What Is Crypto Airdrop?

A crypto airdrop is a marketing strategy used by blockchain-based companies or projects to distribute their cryptocurrency tokens or coins to a large number of users for free or as a reward for performing certain actions, such as completing a survey, joining a Telegram group, or sharing their project on social media.

Airdrops are usually conducted to generate awareness and interest in a new project, to increase the token’s liquidity and trading volume, or to reward early adopters and supporters of a project. Airdropped tokens are often distributed through Ethereum-based smart contracts and are automatically sent to the wallets of eligible participants.

While some airdrops can be legitimate opportunities for users to acquire new cryptocurrency tokens, others may be scams or fraudulent schemes aimed at tricking users into giving away their private keys or personal information. Therefore, it is important to carefully research and verify the legitimacy of an airdrop before participating.

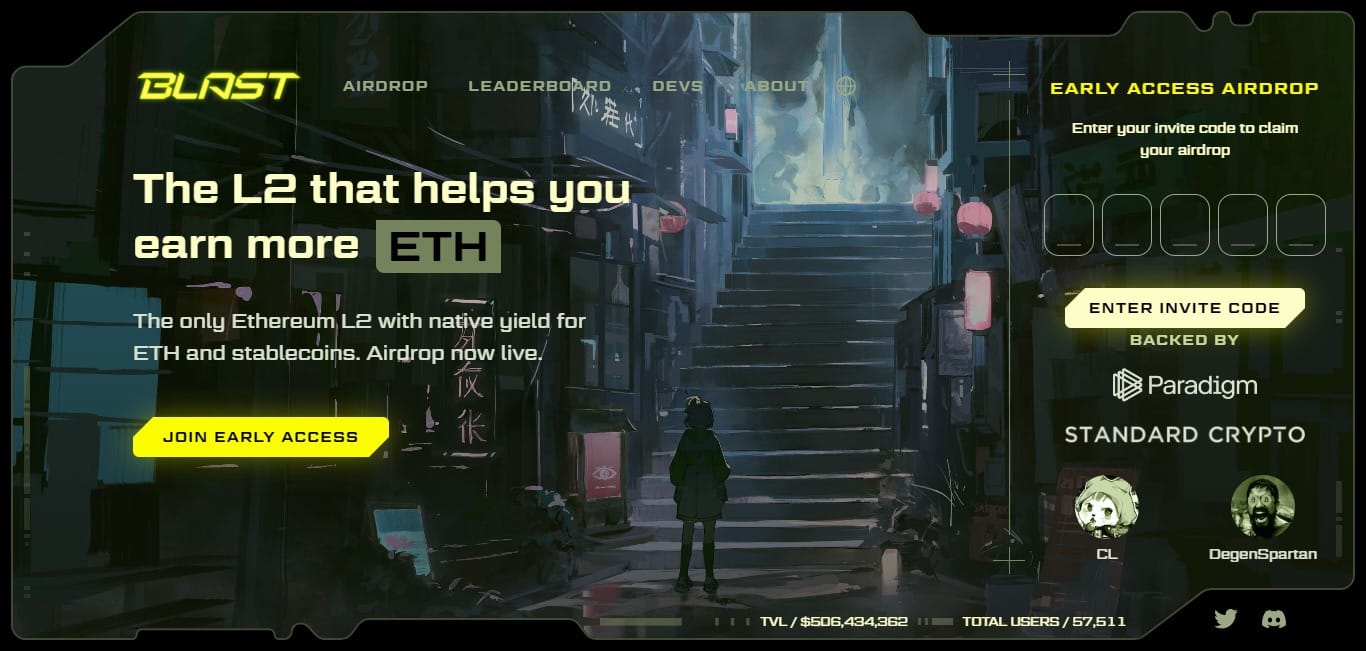

What Is Blast Airdrop?

Blast Airdrop is an L2 with native yield for ETH and stablecoins. Yield makes it possible to create new revenue streams and provide novel rewards for end-users. Users transact in ETH. Dapps are built around ETH. Blast was designed from the ground up so that ETH itself is natively rebasing on the L2. Blast has raised $20 million from investors like Paradigm and Standard Crypto and has confirmed that it will do an airdrop for early users. Users who sign up with an invite code, bridge ETH and invite friends will get airdrop points. Airdrop points will be convertible to Blast tokens in May.

Basic Blast Airdrop Points

| Basic | Details |

|---|---|

| Token Name | Blast Airdrop |

| Platform | Own chain |

| Support | 24/7 |

| Total value | N/A |

| KYC | KYC Is Not Requirement |

| Whitepaper | Click Here To View |

| Max. Participants | Unlimited |

| Collect Airdrop | Click Here To Collect Free Airdrop |

How To Claim Blast Airdrop Step-by-Step Guide:

- Visit the Blast website.

- Click on “Join Early Access”.

- You will need an invite code to access the platform. You can get invite codes from their Discord channel.

- Enter the invite code and access the platform.

- Follow them on Twitter and Discord and click on “check your airdrop”.

- Now, connect your wallet.

- Head over to the Bridge section and transfer ETH or other tokens from Ethereum to Blast L2.

- You will need some ETH or other tokens supported on Blast to be eligible to bridge. You can get them on Binance.

- The tokens that have been bridged can only be withdrawn in February, once the mainnet has launched.

- You will get one spin per ETH deposited per week.

- Each spin unlocks a certain number of airdrop points.

- After you complete your initial bridging, you will receive referral codes. You will only get a certain number of codes in the beginning.

- The more you and your initially invited friends bridge, the more spins you will earn.

- All the earned airdrop points can be converted to Blast tokens in May.

- For more information regarding the airdrop, see this page.

How To Check Blast Airdrop Is Real Or Fake

Checking the legitimacy of a crypto airdrop can be a bit tricky, as scammers often use sophisticated techniques to create fraudulent airdrop campaigns that appear to be legitimate. Here are some steps you can take to verify the authenticity of a crypto airdrop:

- Official Website and Announcement Channels: Check the official website of the project. Legitimate projects will have an official website with detailed information about the airdrop. Verify the information through official communication channels such as the project’s official social media accounts, blog posts, or announcements on platforms like Bitcointalk.

- Verify Team and Advisors: Legitimate projects usually have a team and advisors. Verify the credentials and background of the team members. Look for links to their LinkedIn profiles or other professional profiles.

- Community Engagement: Legitimate projects have an active and engaged community. Check social media channels, forums, and chat groups to see if there is genuine excitement and discussion about the airdrop.

- Whitepaper and Project Information: Legitimate projects often have a whitepaper that outlines their goals, technology, and tokenomics. Review the whitepaper and other project information to ensure it is comprehensive and well-documented.

- Trust your instincts: If an airdrop seems too good to be true or makes unrealistic promises, it’s probably a scam. Use your common sense and trust your instincts when evaluating the legitimacy of a crypto airdrop.

- In summary, it’s important to conduct thorough research, verify the source and instructions, look for feedback from other users, and trust your instincts when evaluating the legitimacy of a crypto airdrop. By taking these steps, you can minimize the risk of falling for a fraudulent airdrop and protect your assets and personal information.

What are the risks of participating in an airdrop?

A participant should carefully examine the dangers involved in taking part in an airdrop, which is a technique used by blockchain and cryptocurrency projects to give away free tokens to a large audience. The possibility of fraud and swindles is one major risk. The popularity of airdrops is abused by certain bad actors who fabricate projects or ask participants for personal information, resulting in identity theft or other financial losses.

In addition, while trying to retrieve airdropped tokens, users could unintentionally download dangerous software or expose themselves to phishing scams. Another danger is that, unlike traditional financial instruments, airdrop initiatives might not be subject to the same level of scrutiny and consumer safeguards due to the absence of regulatory control in the cryptocurrency industry.

Blast Airdrop Pros Or Cons

Pros of participating in an airdrop:

- Native Yield for ETH and Stablecoins: Blast’s integration of native yield for ETH and stablecoins provides users with the opportunity to generate additional revenue streams, enhancing the overall financial experience for participants.

- Innovative Reward System: The inclusion of yield not only benefits users financially but also introduces a novel reward system. This innovation could attract a broader user base, including those seeking unique incentives and rewards.

- ETH-Centric Transactions: Given the prevalence and popularity of ETH in the blockchain ecosystem, having users transact in ETH aligns with existing user preferences and practices. This can contribute to a smoother onboarding process for users already familiar with ETH transactions.

Cons of participating in an airdrop:

- Dependence on ETH: While transacting in ETH has advantages, it also means Blast’s success is closely tied to the performance and stability of the Ethereum network. Any issues or congestion on the Ethereum network could impact Blast’s user experience and performance.

- Market Volatility Risks: The native yield for ETH and stablecoins, while offering opportunities for additional revenue, also exposes users to market volatility. Cryptocurrency markets can be highly unpredictable, and users might face financial risks associated with these fluctuations.

- Competition within the L2 Space: The Layer 2 scaling solution space is becoming increasingly competitive. Blast will need to differentiate itself significantly to stand out among other solutions, and success is not guaranteed in such a dynamic and competitive environment.

Blast Airdrop Final Verdicts

In conclusion, Blast emerges as a promising Layer 2 (L2) solution that seamlessly integrates native yield for both Ethereum (ETH) and stablecoins. The incorporation of yield not only enhances the platform’s functionality but also opens up avenues for the creation of innovative revenue streams and unique rewards for end-users. By facilitating transactions in ETH and building decentralized applications (Dapps) around the Ethereum ecosystem, Blast positions itself at the forefront of blockchain innovation.

One of the key distinguishing features of Blast is its ground-up design, ensuring that ETH itself undergoes native rebasing on the L2. This intrinsic integration enhances the overall efficiency and user experience, aligning the platform with the core principles of decentralized finance. The successful fundraising of $20 million from prominent investors such as Paradigm and Standard Crypto underscores the confidence in Blast’s potential and its ability to make a significant impact in the blockchain space. The commitment of these investors reflects the belief in the project’s vision and its potential to drive positive change within the decentralized finance landscape.