About Bonq Euro Coin

Bonq Euro Coin users can access the liquidity of their own digital assets by locking them up in a trove, which is a smart contract controlled only by the users, and mint a low volatility payment coin BEUR, pegged to the Euro. Users can always swap 1 BEUR for 1 EUR worth of collateral (minus fees) directly on the Bonq platform. This will create a floor for BEUR price.

Bonq Euro Coin Point Table

| Coin Basic | Information |

|---|---|

| Coin Name | Bonq Euro Coin |

| Short Name | BEUR |

| Circulating Supply | 1,160,000 BEUR |

| Max Supply | 1,160,000 |

| Source Code | Click Here To View Source Code |

| Explorers | Click Here To View Explorers |

| Twitter Page | Click Here To Visit Twitter Group |

| Whitepaper | Click Here To View |

| Support | 24/7 |

| Official Project Website | Click Here To Visit Project Website |

Fees

Bonq is an interest-free protocol that has two one-time fees that help with the price stabilization mechanism of BEUR. Those fees directly impact the supply and demand of BEUR and protect the platform from front running. One fee is issued when BEUR is borrowed and another one when BEUR is redeemed.

Borrowers pay an issuance fee on each loan opened. The fee is paid in BEUR, added to the loan right from the beginning and is calculated between 0.5% and 5% by the smart contract, depending on the current market demand for BEUR. Most of the time the issuance fee is expected to be 0.5%

Redeemers are charged a redemption fee paid when exchanging BEUR for trove collateral. The fee is paid in BEUR and depends on the trove collateral ratio. Troves with high collateral ratios require higher redemption fees than troves with low collateral ratios. The fees cannot become smaller than 0.5% to protect the redemption facility from being misused by arbitrageurs front-running the price feed.

Liquidation

The Bonq system regularly updates the collateral asset prices via a decentralized data feed. When a Trove falls below the minimum collateralization ratio, it is considered under-collateralized and is getting automatically liquidated.

Risks

There are two scenarios under which users may lose part of their funds:

- Trove liquidation – if a trove gets liquidated, the borrower can still keep their borrowed BEUR, but the Trove will be closed and the collateral will be used to compensate Stability Pool depositors.

- Stability Pool depositors may have their BEUR used to repay debt from liquidated borrowers. Since liquidations are triggered any time trove collateral drops below the minimum collateral ratio (MCR), Stability Pool participants will receive up to 20% additional digital assets to compensate for the BEUR burned. However, in very volatile markets if the digital assets continue to drop in price before selling them, the Stability Pool depositors may lose value in their total pool deposits.

Governance

Bonq protocol is governed by the Bonq DAO. The members of the DAO include the initial founding members and the projects/entities that have their native tokens whitelisted. Governance decisions are made by the DAO directors, the DAO members and BNQ token holders who stake BNQ.

Lending

Bonq allows users to borrow against their assets without selling them. Users deposit their digital assets, (for example ETH) as collateral to a smart contract called Trove to mint and withdraw BEUR low volatility payment coin. The minimum trove collateral ratio (MCR) depends on the overall collateral risk and varies between 105% and 400%.

A Trove consists of two balances. One for the collateral asset and the other one for the debt which is denominated in BEUR. There is no minimum debt and there is no deadline to repay the debt as long as the minimum collateralization ratio per asset is maintained. Users can close Troves upon repaying their debts.

Why Choose Bonq Euro Coin?

Stability Pool

The Stability Pool is funded by other borrowers who deposit BEUR into the Stability Pool to gain from liquidations and earn BNQ rewards. Since the liquidations are triggered automatically once a Trove Collateral Ratio (TCR) falls under the MCR level, the Stability Providers are likely to gain a significant premium on the liquidated collateral asset, which is a strong incentive to back up the platform and be part of the Stability Pool.

If a user borrows against their own ETH tokens, and decides to deposit some of the borrowed BEUR into the Stability Pool they will participate in all the ETH liquidation. However, they will also receive liquidations from other assets. The users who do not wish to get exposed to certain assets, can swap those assets in the DEX immidiately after the liquidation.

Automated Liquidation Mechanism

The Trove needs to maintain a Minimum trove Collateral Ratio (MCR) which depends on the overall risk level computed by the Bonq Risk Model here . If the Trove has insufficient collateralized debt positions, there is an instant liquidation mechanism. Liquidated borrowers keep their BEUR, and all their collateral is distributed to the Stability Pool or, in the case of insufficient Stability Pool liquidity, distributed to the other troves with the same collateral.

Stability Pool Liquidation

When Troves are liquidated, BEUR tokens are burned from the Stability Pool in an equal amount to the liquidated debt to ensure that the total BEUR supply remains backed. In return, the collateral of the liquidated Troves is added to the Stability Pool and distributed to the Stability Providers. Both the burning of BEUR and the redistribution of liquidated collateral take place on a pro-rata basis.

Community Liquidation

In the event that the Stability Pool runs out of funds, both the collateral and the debt of the liquidated trove are distributed over the remaining troves with the same collateral. Pro rata to their collateral amount. Additionally, Community Liquidation is used for every trove with CR <100%, even if the SP has not been depleted.

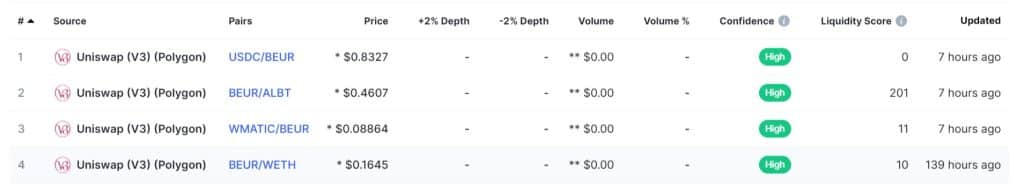

Where Can You Buy Bonq Euro Coin?

Tokens Can Be Purchased On Most Exchanges. One Choice To Trade Is On Uniswap (V3) (Polygon), As It Has The Highest USDC/BEUR. e Trading Volume, $8,947 As Of February 2021. Next is OKEx, With A Trading Volume Of $6,180,82. Other option To Trade Include USDC/BEUR And Huobi Global. Of Course, It Is Important To Note That Investing In Cryptocurrency Comes With A Risk, Just Like Any Other Investment Opportunity.

Market Screenshot

Bonq Euro Coin Supported Wallet

Several Browser And Mobile App Based Wallets Support Bonq Euro Coin. Here Is Example Of Wallet Which Bonq Euro Coin – Trust Wallet For Hardware Ledger Nano.

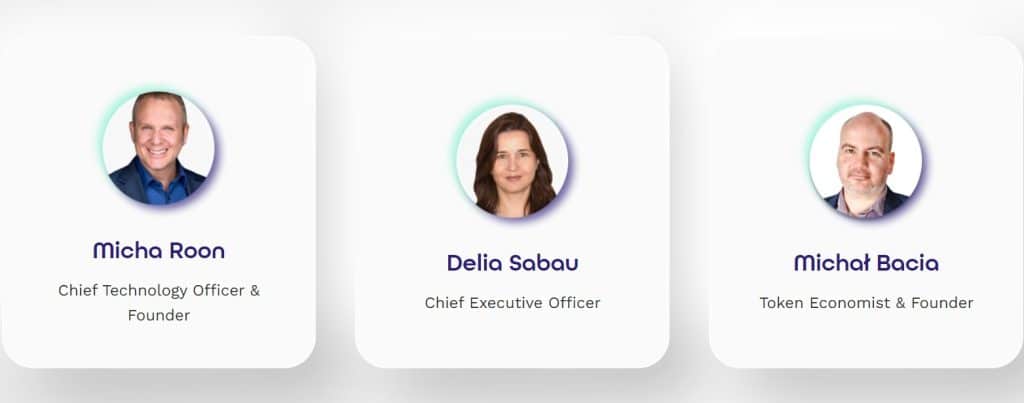

Bonq Euro Team

Leave a Reply