I’ll go over the top SEBA bank card options for 2026 in this post. Many consumers are searching for dependable cards that provide smooth transactions, cashback incentives, and worldwide acceptance due to the increase in cryptocurrency spending.

These alternatives, which range from Nexo and Coinbase to Crypto.com Visa, offer both regular users and cryptocurrency aficionados cutting-edge functionality, robust security, and flexibility.

Key Point & Best SEBA Bank Card Alternatives List

| Card Name | Key Points / Features |

|---|---|

| Nexo Card | Earn crypto rewards on purchases, no hidden fees, integrates with Nexo wallet. |

| Coinbase Card | Spend crypto directly from Coinbase account, instant conversion to fiat, cashback. |

| Wirex Card | Multi-currency support, crypto cashback, contactless payments, mobile app integration. |

| BitPay Card | Convert crypto to USD for spending, no monthly fees, linked to BitPay wallet. |

| Monolith Card | Ethereum-based, spend DeFi assets, integrates with smart contracts, NFT support. |

| Uphold Card | Multi-asset support, spend crypto & fiat, real-time conversion, secure mobile app. |

| CryptoPay Card | Crypto spending & top-ups, Visa/Mastercard network, multi-crypto support. |

| Plutus Card | Crypto cashback in PLS token, spending limits, contactless payments, rewards program. |

| Shakepay Card | Canadian-focused, cashback in Bitcoin, instant crypto conversion, no monthly fees. |

| Crypto.com Visa Card | Tiered crypto rewards, metal card options, no annual fee, extensive app features. |

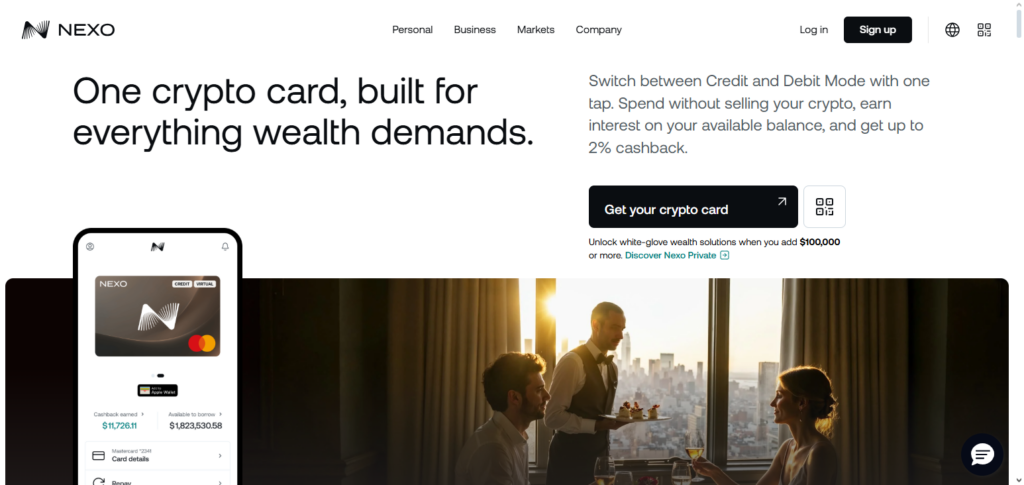

1. Nexo Card

The Nexo Card gives the ability for users to spend their assets through the use of crypto-backed debit cards. Customers of the Nexo Card can spend and access their crypto for daily purchases and transactions.

Not only is the card compatible with several digital currencies, but it can also provide instant cashbacks for users in the form of NEXO tokens. The Nexo Card allows for adjustable credit lines by holding the crypto in the Nexo Wallet. The Nexo card is also one of the best alternatives to SEBA Bank Card due to the card’s overall exceptional and low cost.

Nexo Card — Features

| Feature | Description |

|---|---|

| Crypto‑Backed Spending | Spend crypto without selling your assets. |

| Cashback Rewards | Earn up to 2% cashback in NEXO tokens. |

| Credit Line | Flexible credit backed by your crypto holdings. |

| Multi‑Asset Support | Supports many popular cryptocurrencies. |

| Security | Real‑time alerts and strong asset protection. |

Nexo Card Pros & Cons

Pros

- Spend crypto without selling your assets.

- Earn 2% cashback (NEXO tokens) when you spend using the card.

- Access flexible credit lines backed by crypto.

- Multiple cryptocurrencies supported.

- Strong security and real-time alerts.

Cons

- The card rewards are primarily offered in the platform token (NEXO).

- The card may require KYC verification.

- The card benefits are tied to holding/staking.

- The card is still not as widely accepted as Visa/Mastercard.

- The price volatility of crypto is a reward value risk.

2. Coinbase Card

Coinbase Card is great for spending cryptocurrencies directly from a Coinbase account. It supports multiple cryptocurrencies, making it easy to use for daily transactions. It also offers cash back in the form of cryptocurrencies which gets added to your wallet. It has a mobile app which facilitates tracking transactions, getting notifications, and managing your account.

Coinbase Card is a great alternative for a SEBA Bank Card. It is great for merchants in need of a reliable and legit globally accepted card. Coinbase has partnered with Visa for great merchant acceptance. For added peace of mind, the card also has some security features like quick card freezes and 2FA.

Coinbase Card — Features

| Feature | Description |

|---|---|

| Direct Wallet Use | Spend directly from your Coinbase wallet. |

| Crypto Cashback | Earn rewards in crypto on purchases. |

| Visa Network | Accepted worldwide where Visa is supported. |

| App Control | Manage transactions via mobile app. |

| Regulatory Compliance | Strong compliance with global rules. |

Coinbase Card Pros & Cons

Pros

- You can spend directly without having to sell your crypto assets.

- Cashback (in crypto) when you spend using the card.

- It is widely accepted by merchants as it works through Visa.

- You can manage your card through the app.

- The card is fully compliant and follows the industry regulations, so your money will be safe.

Cons

- Some competitors charge lower fees, but in this case, the fees are too high for the same service.

- You must use only the Coinbase ecosystem; you will get stuck if you use anything else.

- Different rewards apply based on user location.

- The card is not offered in a lot of countries.

- There are fees for converting crypto to cash.

3. Wirex Card

The Wirex card excels in the seamless interaction of crypto and fiat. Customers may spend in 150+ currencies and can convert crypto to fiat in real-time. Customers can also earn WXT token rewards.

They offer contactless payments and virtual cards for online payments. With the emphasis on flexible borderless payments, Wirex is well suited for international travel and digital nomadism.

Customers in search of the best SEBA Bank Card alternatives will find Wirex to offer strong crypto rewards, low conversion costs, and added digital asset insurance. Users also appreciate the security and the large selection of digital wallets, allowing for optimal management of crypto and fiat, making it an ideal debit card alternative.

Wirex Card — Features

| Feature | Description |

|---|---|

| Real‑Time Conversion | Convert crypto to fiat instantly on spend. |

| Token Rewards | Earn rewards in WXT tokens. |

| Multi‑Currency Wallet | Support for many cryptos and fiat. |

| Contactless Payments | Use tap‑to‑pay in stores. |

| Virtual Card | Option for secure online spending. |

Wirex Card Pros & Cons

Pros

- Get crypto converted to fiat instantly, and all real-time.

- WXT tokens earned.

- Many crypto options.

- Get virtual banking and contactless cards.

- The account supports different fiat currencies.

Cons

- Some will see the rewards low, they will want to see higher reward rates.

- Some transaction charges.

- Support for crypto varies by country.

- Needs KYC.

- Some features are behind a paywall.

4. BitPay Card

The BitPay Card is perfect for users wanting to spend cryptocurrencies for everyday expenses. The BitPay Card allows users to spend anywhere Mastercard is accepted, after the card converts crypto balances to USD. The card has easy reloads from the BitPay card wallet, and has features like real-time notifications, and card-blocking.

The card is globally accepted, and users can receive customer support without the card. The card can be managed from the BitPay app, and users can spend USD crypto balances from the BitPay wallet. The card is especially great for spending Ethereum and Bitcoin. It is preferred to the SEBA Bank card for lower fees and higher global customer support.

BitPay Card — Features

| Feature | Description |

|---|---|

| Instant Conversion | Crypto converts to USD at time of spend. |

| Mastercard | Accepted globally via Mastercard network. |

| Wallet Integration | Easy reload from the BitPay wallet. |

| Popular Crypto Support | Works with BTC, ETH, and more. |

| Transparent Fees | Clear fee structure. |

BitPay Card Pros & Cons

Pros

- Converts crypto to USD instantly.

- Accepted worldwide via Mastercard.

- Simple wallet reload.

- Supports major cryptos like BTC, ETH.

- Clear fee policies.

Cons

- Limited incentives for rewards.

- Card balance is USD only.

- Some operations have transaction fees.

- Support for less popular tokens is lacking.

- Not recommended for customers who make frequent significant purchases.

5. Monolith Card

Monolith Card is an example of a DeFi debit card; it enables investors to make payments using Ethereum and ERC-20 tokens directly. The card is a perfect example of innovative blockchain technology and everyday use.

It provides a real-time conversion service and a secure wallet that allows the cardholder to make contactless payments. Card services are available through a smartphone application. Monolith Card is a perfect choice for DeFi enthusiasts because it has low fees, provides a greater amount of cardholder privacy, and allows the cardholder to keep complete custody of their crypto. Monolith Card is one of the best SEBA Bank Card alternatives.

The card services are integrated with a decentralized wallet and notify the cardholder about transactions, which is ideal for people who want to make payments in both crypto and fiat currencies.

Monolith Card — Features

| Feature | Description |

|---|---|

| DeFi Focus | Designed for Ethereum/DeFi users. |

| ERC‑20 Spending | Spend Ethereum and ERC‑20 tokens. |

| Non‑Custodial Wallet | You control your private keys. |

| Instant Conversion | Real‑time crypto to fiat conversion. |

| Blockchain Transparency | Transactions visible on chain. |

Monolith Card Pros & Cons

Pros

- Directly spend Ethereum & ERC‑20 tokens.

- Non-custodial wallet with DeFi focus.

- Conversion in real-time.

- Virtual and contactless card options.

- Transparency through blockchain.

Cons

- Confined to Ethereum ecosystem.

- High gas fees, at times.

- Limited accepting merchants.

- Not beginner friendly.

- Less incentives for rewards.

6. Uphold Card

Uphold Card allows users to spend an integrated account balance consisting of multiple cryptocurrencies, fiat currencies, and even precious metals. Support real-time currency conversion, competitive fees, and worldwide Mastercard acceptance for seamless spendable experience.

The platform’s automatic crypto-to-fiat conversion makes it perfect for everyday spending. As a best SEBA Bank Card alternative, Uphold Card is an ideal option for users looking to optimize their spending with a single card across multiple asset classes.

Uphold’s security measures, which include two-factor authentication and card security controls, provide peace of mind to users. In addition, users can earn spendable rewards, check balances, and manage portfolios through the app.

Uphold Card — Features

| Feature | Description |

|---|---|

| Multi‑Asset | Spend crypto, fiat, or precious metals. |

| Mastercard | Accepted worldwide with Mastercard. |

| Real‑Time Conversion | Immediate conversion at checkout. |

| Strong Security | Two‑factor authentication and alerts. |

| All‑in‑One Wallet | Manage assets and spend from one app. |

Uphold Card Pros & Cons

Pros

- Spend precious metals, fiat, and crypto.

- Good range of assets supported.

- Spend with real-time conversions.

- Mastercard accepted globally.

- Good management and security features.

Cons

- High spread fees.

- Varying rewards programs.

- Some asset classes restricted by country.

- Some actions incur fees.

- For newcomers, it’s a bit complicated.

7. CryptoPay Card

With CryptoPay Card, users spend Bitcoin, Ethereum, and Litecoin via a prepaid debit card. They provide online purchases, contactless payments, and crypto-to-fiat instantaneous conversions.

The card is great for users wanting to spend crypto without going through an exchange. As a best SEBA Bank Card alternative, CryptoPay Card has low fees, worldwide acceptance, and real-time transaction alerts.

Customers use the CryptoPay app for easy account management, and enjoy multiple crypto options, transaction security, and swift crypto-to-fiat conversions. The card’s popularity and acceptance make it an excellent choice for users wanting a decent crypto debit card.

CryptoPay Card — Features

| Feature | Description |

|---|---|

| Multi‑Crypto Support | Spend BTC, ETH, LTC, etc. |

| Instant Conversion | Crypto to fiat in real time. |

| Contactless Payments | Tap‑to‑pay enabled. |

| Simple Reloading | Easy top‑ups from wallet. |

| Mobile Management | Full control via CryptoPay app. |

CryptoPay Card Pros & Cons

Pros

- Spend Bitcoin, Ethereum, and Litecoin.

- Instant conversion of crypto to fiat.

- Contactless payments available.

- Easy process to reload your card.

- Notifications for transactions in real time.

Cons

- Some regions have geographical limitations.

- Compared to the competition, they offer less rewards.

- Charges for card issuance and ATM withdrawals.

- They support a small number of tokens.

- Features are very limited.

8. Plutus Card

The Plutus Card provides a unique way to earn crypto rewards and spend crypto. Using a Plutus Card allows you to earn cash back with Plutus (PLU) tokens. You can pay bills, make purchases, and top up your card with either cash (fiat) or crypto.

Other perks are contactless payments and partner discounts. Plutus creates a secure and integrated wallet system. For those considering best SEBA Bank Card alternatives Plutus Card prioritizes rewards, low spending balance, and flexible spending.

Users can access their card to top it instant with an app, receive notifications, and the card works globally. Also, Plutus provides an ideal opportunity to spend crypto with a card and earn cash back like a traditional debit card.

Plutus Card — Features

| Feature | Description |

|---|---|

| Crypto Cashback | Earn PLU token rewards on spend. |

| Merchant Discounts | Partner offers and benefits. |

| Contactless | Tap to pay at stores. |

| Flexible Funding | Top up with crypto or fiat. |

| Community Perks | Special benefits for Plutus users. |

Plutus Card Pros & Cons

Pros

- Receive cashback in PLU tokens.

- Discounts with partner merchants.

- Virtual and contactless cards.

- Crypto and fiat top-ups are flexible.

- Additional perks for community members.

Cons

- Cashback only in their native token.

- Rewards are affected by the token value.

- Premium perks are only available if you stake or hold the coin.

- Not universally accepted everywhere.

- Some transactions incur fees.

9. Shakepay Card

The Shakepay Card is designed for Canadian residents and lets users spend Ethereum and Bitcoin with instant conversion to CAD. It has no monthly fees, a simple app-first design, and customers receive Bitcoin cashback.

Users conveniently monitor spending, transfer money, and manage wallets directly in the app. Shakepay Card has strong Canadian regulatory adherence, low-cost transactions, and is easy to use, making it the best SEBA Bank Card alternative.

Users appreciate the no-fee structure and the everyday use potential. With the addition of two-factor authentication and secure wallets, Shakepay is a reliable option for Canadians who want to use crypto for everyday purchases.

Shakepay Card — Features

| Feature | Description |

|---|---|

| Bitcoin Rewards | Earn Bitcoin on purchases. |

| No Monthly Fees | Free card usage. |

| Simple App | Easy mobile experience. |

| Instant Fuel | Fast conversion to CAD. |

| Canadian Focus | Strong local support and compliance. |

Shakepay Card Pros & Cons

Pros

- Bitcoin cashback offered.

- No fees monthly.

- Mobile app interface is simple.

- Crypto is converted to CAD instantly.

- Compliance with regulations in Canada is strong.

Cons

- This card is for Canadians only.

- Supporting just Bitcoin and Ethereum is a limitation.

- No option for countries in fiat currency.

- Not ideal rewards outside of Canada.

- Rewards available are limited.

10. Crypto.com Visa Card

The Crypto.com Visa card provides the opportunity to earn CRO tokens while spending the crypto. There are many tiers available that offer benefits such as cash back, airport lounge access, and subscription discounts.

It also integrates easily to the Crypto.com App and supports many cryptocurrencies. The Crypto.com Visa Card provides the best alternatives to the SEBA Bank Card due to the global access Visa provides and the additional levels of benefits.

The card can also be locked instantly, and integrates two factor authentication and real time spend alerts to assist with user security. The additional features, alongside the benefits from the Crypto.com app, makes the Visa card a good option for most casual and professional crypto users.

Crypto.com Visa Card — Features

| Feature | Description |

|---|---|

| Tiered Rewards | Higher tiers = better cashback. |

| Subscription Rebates | Rebates on streaming services. |

| Visa Acceptance | Works globally on Visa network. |

| Multi‑Crypto Support | Spend a wide range of tokens. |

| App Ecosystem | Integrated suite of financial tools. |

Crypto.com Visa Card Pros & Cons

Pros

- They offer a lot of different card tiers and cashback options.

- You get a rebate on subscriptions to Netflix, Spotify, and other services.

- A lot of different countries accept the card.

- You can hold a lot of different types of crypto.

- They have a really strong app with good features.

Cons

- To qualify for the best tiers, CRO staking is a must.

- Token lock‑ups influence reward amounts.

- Elevated minimums for some tiers.

- Rewards system is somewhat intricate.

- Withdrawals may incur fees.

Conclusion

In conclusion, consumers looking for alternatives to SEBA Bank Cards have a lot of possibilities thanks to the market for cryptocurrency debit and prepaid cards.

Nexo, Coinbase, Wirex, BitPay, Monolith, Uphold, CryptoPay, Plutus, Shakepay, and Crypto.com cards Visa offers special benefits including cheap costs, fast crypto-to-fiat conversion, cashback rewards, and worldwide acceptance.

Each card ensures strong security and simple wallet management while meeting a variety of user needs, from casual spenders to DeFi fanatics.

These options are useful and adaptable solutions in the developing crypto environment since they allow consumers to keep control over their digital assets, earn rewards, and have seamless spending experiences.

FAQ

The best alternatives include Nexo Card, Coinbase Card, Wirex Card, BitPay Card, Monolith Card, Uphold Card, CryptoPay Card, Plutus Card, Shakepay Card, and Crypto.com Visa Card. These offer features like crypto spending, cashback rewards, low fees, and broad merchant acceptance.

Crypto cards convert your digital assets into fiat currency at the point of sale, enabling you to spend crypto like regular money. They often include mobile apps for easy management, transaction alerts, and security features like two‑factor authentication.

Most alternatives (like Coinbase, Crypto.com Visa, BitPay, and Uphold) are accepted globally through Visa or Mastercard networks. Some region‑specific cards, like Shakepay, may be limited to certain countries but still provide strong local support.

Yes! Many alternatives include rewards such as cashback in crypto (e.g., CRO on Crypto.com Visa Card or PLU on Plutus Card), interest earnings, or partner benefits. Reward rates vary by card and user tier.

Yes, several support multiple coins. Cards like Wirex, Uphold, and Coinbase allow spending or converting a variety of cryptocurrencies directly through their apps before purchase.