In this article, i will discuss the Best Aggregator For Bridging Wrapped Bitcoin Variants.

Out of the many available options, selecting the right one impacts the effectiveness, security, and cost of a cross-chain transfer.

They feature the top cross-chain wrapped Bitcoin bridging aggregators and emphasize their performance on the very critical factors of speed, liquidity, fees, ease of use, and overall customer experience so that you can make an informed decision.

Key Point & Best Aggregator For Bridging Wrapped Bitcoin Variants List

| Platform | Key Point |

|---|---|

| 1inch | Aggregates liquidity from multiple DEXs for best token swaps. |

| OpenOcean | Cross-chain DEX aggregator with deep liquidity and low fees. |

| Matcha | User-friendly DEX aggregator built on 0x protocol. |

| ParaSwap | Optimizes swaps across multiple decentralized exchanges. |

| Portal Bridge | Enables fast and secure asset transfers across blockchains. |

| Across Protocol | Focuses on fast, low-cost cross-chain transfers with fraud proofs. |

| Stargate Finance | Universal liquidity network bridging multiple Layer 1 and 2s. |

| Hop Protocol | Layer 2 scaling bridge for quick token transfers between rollups. |

| Synapse Bridge | Cross-chain protocol enabling fast and inexpensive transfers. |

| Arbitrum Bridge | Official bridge to move assets between Ethereum and Arbitrum L2. |

1.1inch

1inch emerges as the best aggregator for bridging wrapped Bitcoin variants owing to its advanced liquidity aggregation and smart routing technology.

It integrates a multitude of decentralized exchanges and bridges so that users can hold wrapped Bitcoin on different blockchains at the least possible cost and effort.

Its capability to divide transactions done through its interface into many paths reduces slippage and fees; these features make 1inch exceptionally dependable for dynamic transferring of intricate wrapped Bitcoin transactions.

1inch Features

- Smart Routing – Strives a unique Pathfinder algorithm to determine the best route for swaps out of many DEXs.

- Liquidity Aggregation – Pulls liquidity from multiple sources to reduce slippage during wrapped Bitcoin swaps.

- Multi Chain Support – Supports cross-chain transfers along with efficient bridging options.

2.OpenOcean

OpenOcean is the best aggregator for bridging wrapped Bitcoin variants due to its extensive support for all cross-chain operations and its having rich liquidity pools.

Its centralized and decentralized hybrid model provides optimal price and fee conditions for users bridging wrapped Bitcoin on different blockchains.

OpenOcean’s cross-platform interface makes transfers faster and cheaper than with competitors, and its multi-chain swaps are powerful yet easy to use. No other platform combines such sophisticated features with simple-to-use interfaces.

OpenOcean Features

- CEX + DEX Integration – Uses both centralized and decentralized exchange markets to improve trading value.

- Cross-Chain Swaps – Allows wrapped Bitcoin to be bridged on major chains such as Ethereum and BNB Chain.

- Gas Fee Optimization** – Automatically chooses the route with lower transaction costs.

3.Matcha

Matcha stands out unrivaled as the best aggregator for wrapped Bitcoin derivatives because it prioritizes transparency and execution quality.

Matcha is powered by the 0x protocol which aggregates liquidity from several DEXs and bridges, meaning that users obtain the best rates with no additional costs.

Cross-chain swap interfaces are often complicated, but wrapped Bitcoin bridging is seamless thanks to Matcha’s simplified design. User-focused stripped interface together with smart routing enables users to efficiently and reliably swap wrapped Bitcoin on Matcha.

Matcha Features

- Powered by 0x Protocol – Uses 0x’s liquidity network to guarantee accurate wrapped BTC swap execution.

- Transparent Pricing – Shows all fees and slippage before executing trades so users pay what was advertised.

- Simple UI – Makes bridging for beginners straightforward and seamless.

4.ParaSwap

Ellipal is one of the leading aggregators of wrapped Bitcoin variant bridging due to its sophisticated optimization algorithms that multi decentralized exchanges and bridges for the fastest Bitcoin wrapped cross bridging and cheapest path for the transaction.

Due to its advanced algorithms for parallel execution of many transactions at once with different sources of liquidity, slippage and gas fees are minimized.

With the help of numerous blockchains the entire process of moving wrapped Bitcoin is risk free and quick. This makes ParaSwap Bitcoin cross bridgers stand out who need efficiency and low priced options in multichain bridging.

ParaSwap Features

- Advanced Transaction Splitting – Enhances price determination by dividing large swaps into smaller chunks.

- Gas Token Integration – Enables the use of gas tokens to further lower the cost of bridging.

- Multi-Dex Aggregation – Optimizing wrapped Bitcoin liquidity.

5.Portal Bridge

Portal Bridge remains one of the best contending aggregators for bridging different versions of wrapped Bitcoin due to its emphasis on security and decentralization.

With over two decades of experience in advanced cryptographic methodologies, Portal Bridge ensures swift, trustless, and fraud-resistant transfers across multiple blockchains. Is uniquely reliable with regard to maintaining efficient bridging while safeguarding assets.

Moreover, wrapped Bitcoin bridging briskly expands the user’s assets and Portal Bridge’s tailored interface allows anyone, crypto-enthusiasts and beginners alike, to perform complex cross-chain transactions easily and swiftly.

Portal Bridge Features

- Cross-Chain Security – Verifiable cryptographic proofs are used for enforcing security on wrapped Bitcoin transfers.

- Decentralized Architecture – A structure without middle entities lowers trust expenses.

- High Throughput – Fast bridging of significant volumes of wrapped Bitcoin is facilitated.

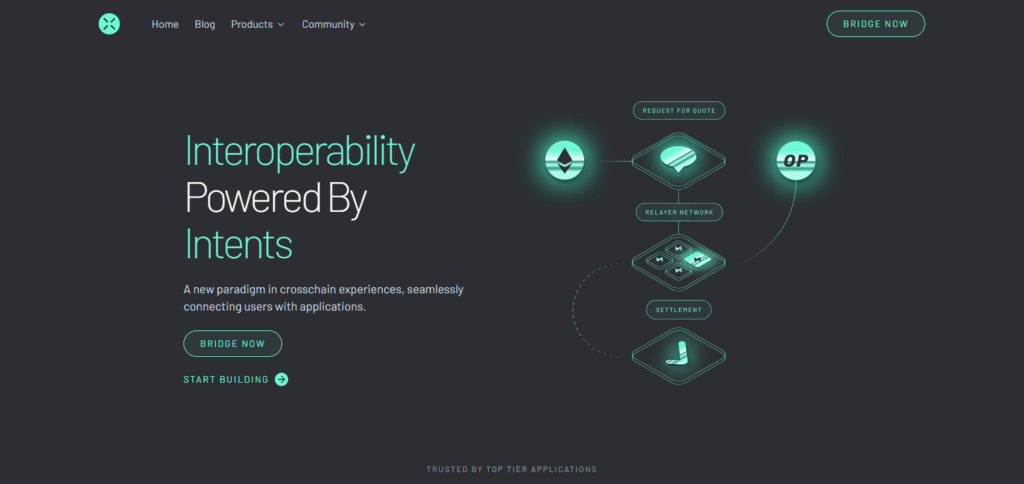

6.Across Protocol

Across Protocol is the foremost aggregated provider for bridging wrapped Bitcoin variants because of its use of optimistic rollup technology for cross-chain transfer.

Wrapped Bitcoin bridging stands to gain significantly from Across Protocol’s emphasis on rapid, low-cost transactions, along with its unique fraud-proof mechanism which minimizes risks during asset transfer.

The combination of these elements–advanced technology protecting users and low bridging fees–set Across Protocol apart as the best option for seamless wrapped Bitcoin bridging.

Across Protocol Features

- Optimistic Transfer Model – Provides rapid wrapped BTC movement with a fraud-proof fallback system.

- Low Bridging Fees – Value-focused approach keeps slippage and fees to a minimum.

- Instant Finality – Using bonded relayers enables faster confirmation times.

7.Stargate Finance

Stargate Finance currently serves as one of the best aggregators for bridging wrapped variations of Bitcoin due to its unified liquidity pool with cross-chain instant transfers. Unlike other bridges, Stargate uses direct inter-chain liquidity provisioning to eliminate time-consuming routing slack, thus cutting down on wait time and slippage.

The relative focus on the liquidity efficiency and cross-chain interoperability makes bridging wrapped Bitcoin easier and more reliable. This combination of speedy access and secure stargate Finance enables users to opt instantly for wrapped Bitcoin bridging.

Stargate Finance Features

- Unified Liquidity Pools – Removes dependence on third-party relayer for instant transfer execution.

- Native Asset Support – Improves wrapped Bitcoin’s transfer speed and usability by supporting it natively.

- Omnichain Compatibility – Bridges the Ethereum, Avalanche, BNB Chain and others.

8.Hop Protocol

With its focus on Layer 2 networks, Hop Protocol stands out as the best aggregator for bridging different flavors of wrapped Bitcoin because it allows for near instantaneous transfers at tiny costs. Its design enables users to transfer wrapped Bitcoin across rollups without being queued for long confirmation times due to its trust-minimized liquidity pools.

This method bypasses and secures the transfer at an incredibly low cost and time, thus it is perfect for those looking to transfer wrapped Bitcoin across different Layer 2 systems with speed and low cost.

Hop Protocol Features

- Layer 2 Specialization – Transfers of wrapped BTC between rollups Optimism and Arbitrum are conducted at rapid pace.

- AMM-Based Liquidity – Automated market makers are utilized for more effective transfer processes.

- Non-Custodial Design – Throughout the bridging process, assets remain in the control of the user.

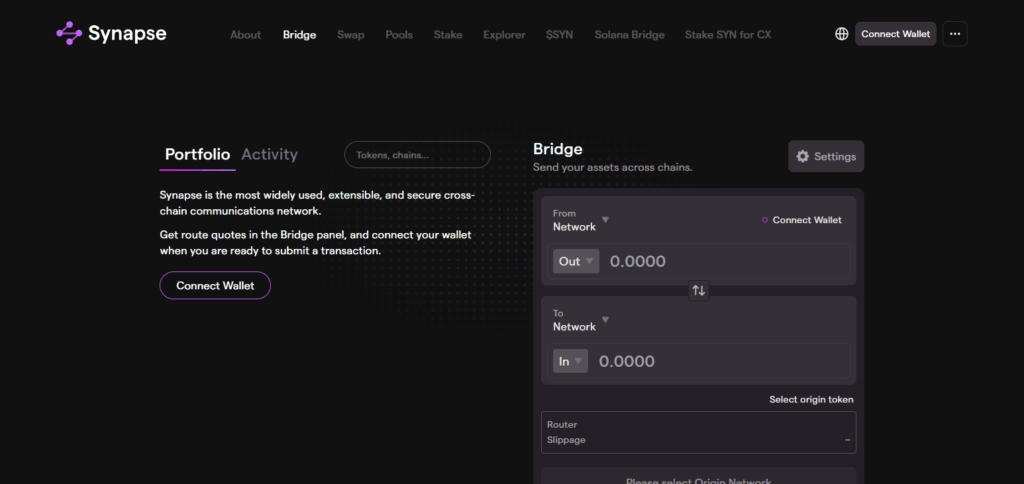

9.Synapse Bridge

Multichain-enabled Synapse Bridge stands out as the top option in bridging and transferring wrapped Bitcoin derivatives because of its speedy and secure transfer features.

Its innovative design incorporates cross-chain communication with automated market maker (AMM), which allows wrapped Bitcoin to be exchanged on many blockchains instantaneously and without friction.

Users also benefit from Synapse’s focus on low fees and a seamless user experience as these elements increase cost-effective bridging while maintaining security. Such agility and flexibility, along with robust security measures, enhance Synapse Bridge’s reliability for multi-network wrapped Bitcoin transactions.

Synapse Bridge Features

- Cross-Chain Messaging – Employs messaging protocols for swift wrapped Bitcoin bridge execution.

- Liquidity pools on several chains – Provides extensive liquidity for effortless trades.

- Compatable Tokens – Access a multitude of wrapped Bitcoin standards in various ecosystems.

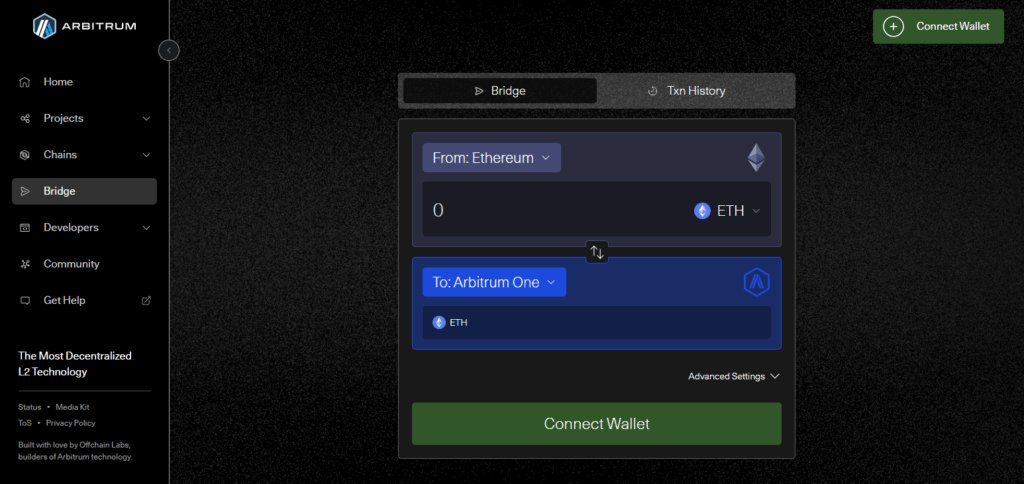

10.Arbitrum Bridge

Arbitrum Bridge is one of the best options for bridging wrapped Bitcoin variants due to its effortless and quick transfer between Ethereum and Arbitrum’s layer two network.

Its competitive edge is in keeping Ethereum-level security while reducing gas fee-calculus, thus, making wrapped Bitcoin bridging easier and cheaper.

The use of optimistic rollup technology on Arbitrum secures fast finality and user experience, thus, making the bridge stand out as the best aggregator for users who wish to transfer wrapped Bitcoin from one chain to another swiftly and at a lower price.

Arbitrum Bridge Features

- Ethereum-Level Security – Takes advantage of Ethereum’s base layer for wrapped BTC transactions.

- Optimistic Rollup Technology – Guarantees efficient, scalable bridging.

- Streamlined Functionality – Facilitates the transfer of funds from Ethereum to Arbitrum or vice versa with ease.

Conclusion

In summary, the optimal Bitcoin wrapped variant bridging aggregator depends upon a user’s unique requirements such as speed, cost, security, or multi-chain functionality.

OpenOcean and Synapse Bridge have broad cross-chain compatibility while 1inch and ParaSwap focus on smart routing and liquidity optimization.

Stargate Finance and Hop Protocol focus on innovative liquidity solutions and Layer 2 respectively, which also makes them stand out. All of these together serve as reliable-efficient on the diversity of blockchain networks in which wrapped Bitcoin bridging is accessed.