I will provide a reflection on the Most Trusted Crypto Tax Reporting Tools for Global Users. The complexity of cryptocurrency taxes arises from the different exchanges, wallets.

trading, staking, and NFT transactions. Crypto tax tools automate the tracking of transactions, calculation of gains and losses, and creation of detailed, accurate reports to simplify this process. such tools guarantee compliance for users globally in an effective and reliable way.

What is Crypto Tax?

Taxes on crypto involve how cryptocurrency transactions like Bitcoin, Ethereum, and other digital assets, are taxed. Buying, selling, trading, and even using crypto for purchases can lead to profits, and since all government agencies regard cryptocurrency as property, it may be hit with a capital gain tax or income tax.

Taxes on crypto, however, are also applicable to crypto mining and other income, like staking income and airdrops. If one doesn’t report their crypto income, there may be penalties or even failure of the legal system. So crypto tax pertains to the regulation of digital currency the same way financial laws would regulate other assets.

How Crypto Taxes Reporting Tools Work

Connect Wallets and Exchanges

- Users link their wallets and exchange accounts via API keys or CSV uploads.

- Tools automatically import all transaction histories, including trades, transfers, staking, and mining rewards.

Transaction Categorization

- Each transaction is classified as income, capital gain/loss, staking reward, mining reward, or NFT activity.

- Some platforms also identify DeFi or cross-chain operations separately.

Cost Basis & Gain/Loss Calculations

- Tools calculate the cost basis for each crypto asset using methods like FIFO, LIFO, or HIFO.

- Gains, losses, and taxable income are computed for every taxable event.

Tax Report Generation

- Platforms generate tax-compliant reports tailored to specific countries (e.g. IRS Form 8949 in the U.S.).

- Reports summarize total gains, losses, and crypto income in a ready-to-file format.

Integration with Tax Filing Software

- Many tools allow direct export to software like TurboTax or provide downloadable forms for accountants.

Audit & Compliance Support

- Tracks historical transactions to provide evidence in case of audits.

- Ensures reporting meets local and international tax regulations.

Key Point & Most Trusted Crypto Tax Reporting Tools for Global Users List

| Platform | Key Features / Points |

|---|---|

| Koinly | Automatic portfolio tracking, supports multiple exchanges, generates tax reports. |

| CoinTracker | Syncs wallets/exchanges, calculates capital gains, supports DeFi and NFT tracking. |

| TokenTax | Handles complex trades, global tax reporting, supports margin and futures trading. |

| ZenLedger | Import from multiple sources, generates IRS-compliant reports, integrates with TurboTax. |

| TaxBit | Real-time transaction tracking, IRS-compliant reporting, enterprise-grade solutions. |

| BearTax | Simple interface, connects multiple wallets/exchanges, exports tax forms easily. |

| Blockpit | Multi-platform support, automated compliance, real-time auditing and reporting. |

| CryptoTax | Calculates gains/losses, supports DeFi & NFTs, provides detailed tax summaries. |

| Accointing | Portfolio management, tax reports, analytics dashboard, multi-currency support. |

| CryptoTaxCalculator | Easy-to-use interface, accurate tax calculations, supports a wide range of exchanges. |

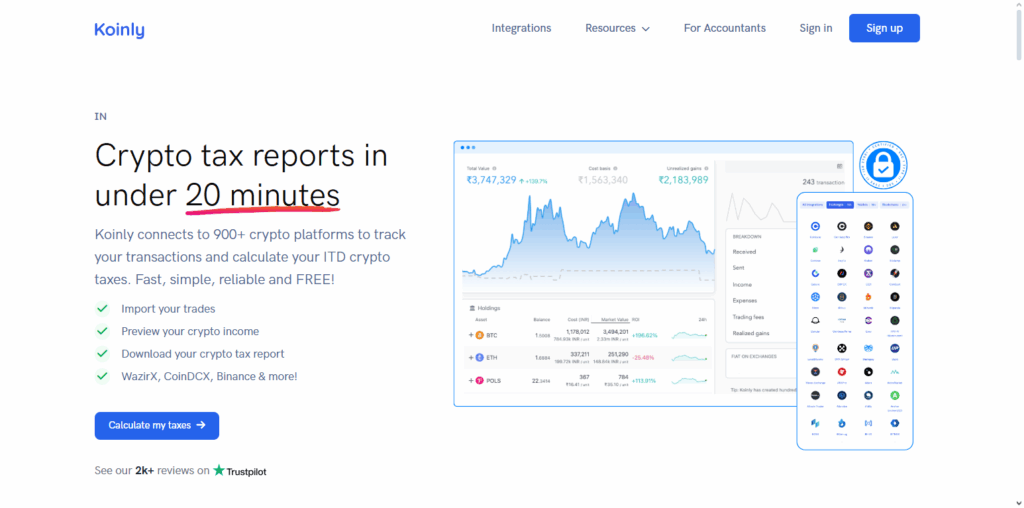

1. Koinly

Koinly is a worldwide crypto tax calculating tool that is accurate, easy to use, and versatile. Because of its extensive range of supported exchanges, blockchains, and wallets, users around the globe are able to auto-sync their transactions.

Koinly’s specialty is calculating capital gains, gains from staking, mining, and gains from other DeFi activities as well as accurate tax reporting based on FIFO and LIFO methods.

Koinly is perhaps the only tool that provides crypto tax reports for users from the USA, UK, Canada, and Australia, ensuring global regulatory compliance. The clear analytic information displayed on the easy to use dashboard increases Koinly’s credibility.

Pros & Cons Koinly

Pros:

- Wide Global Support: It is great for global users since its available in 100+ countries. (

- Large Integration Coverage: It integrates with hundreds of exchanges and blockchains and even supports DeFi, staking, lending, NFTs, and more.

- User Friendly & Automated: Internal transfer smart matching, automatic price look ups, and auto classification help reduce the manual work.

Cons:

- Pricing for High Volume: The costs may rack up to a substantial sum for the very active traders since the pricing is per transaction.

- Possible Sync / Classification Errors: Some users report issues with certain APIs or trades being mislabelled.

- Limited Security Features: 2FA may be weaker for some sections of the system.

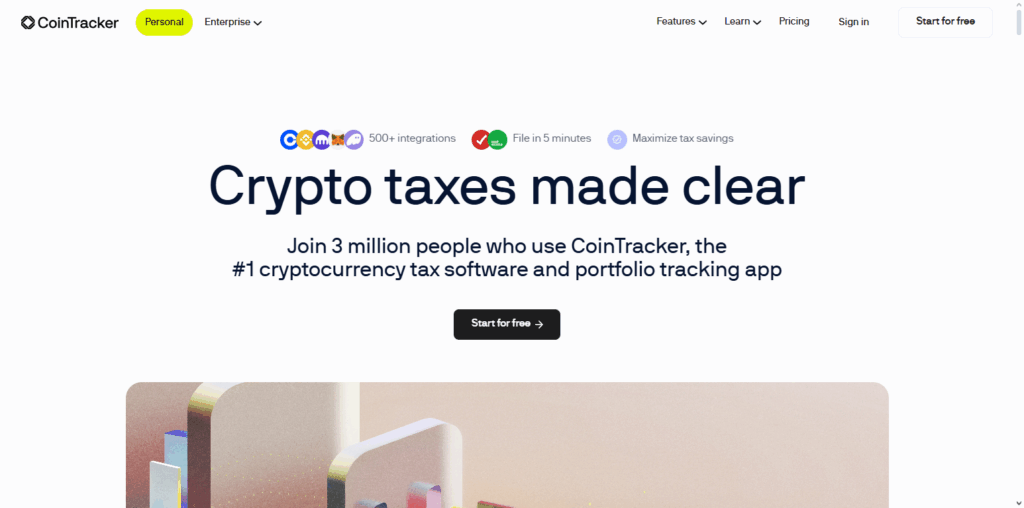

2. CoinTracker

CoinTracker has an unparalleled reputation as a crypto tax reporting tool throughout the world, as it combines comprehensive tracking with unparalleled user-friendliness. CoinTracker’s unique feature is the ability to track all transactions in real time due to the automatic syncing of wallets, exchanges, and DeFi platforms.

CoinTracker calculates capital gains, losses, and crypto income with precision and includes mechanisms for much more sophisticated tools like margin trading and NFTs. Tax reports for the U.S. and Canada, as well as other European countries, are fully tax compliant and Dex and CoinTracker operates tax compliant in all other countries as well.

Overall, CoinTracker is a fully transparent crypto reporting tool with excellent user experience (UX) and seamless experience with tax filing tools. Users of CoinTracker are given transparency and docuemented reporting for all of thier crypto activities.

Pros & Cons CoinTracker

Pros:

- Wide Exchange and Wallet Support: CoinTracker has support for over 500 exchanges and wallets.

- Variable Cost-Basis Methods: CoinTracker offers FIFO, LIFO, and HIFO which provides optimal liability tax support.

- Effective Portfolio Tracking: CoinTracker provides real-time automated portfolio tracking in addition to tax report real-time tracking, which is very helpful for overall performance management.

Cons:

- Export Restrictions: Exporting tax forms to programs like TurboTax requires being on a paid plan.

- Manual Transaction Adjustments: Some complex transactions (like DeFi) may still require some manual adjustments; support for this may be a little slower.

- High Volume is Costly: If people trade really often; each one of the high-tier plans can get quite expensive.

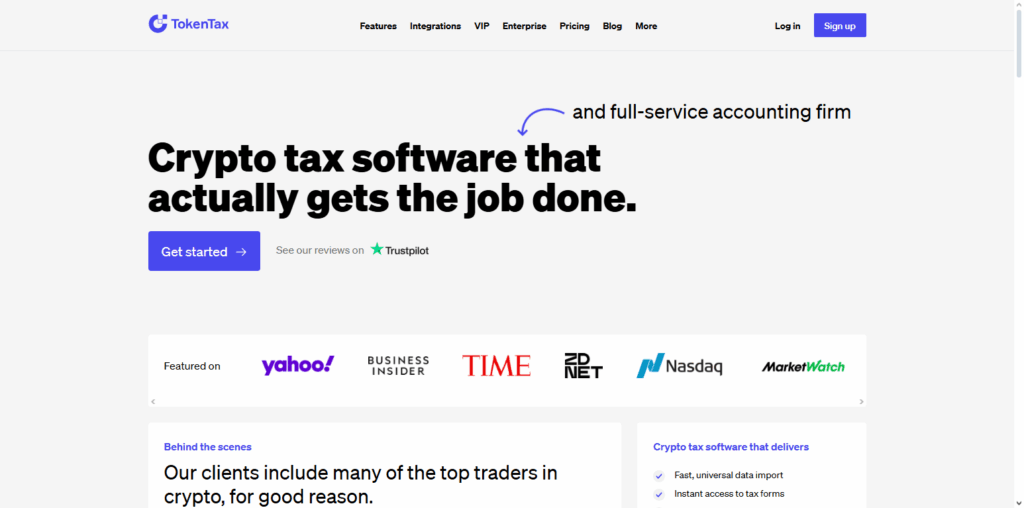

3. TokenTax

One of the most reliable software tools for reporting cryptocurrency taxes and for dealing with complicated cryptocurrency transactions is TokenTax. Regarding crypto-related transactions, most platforms are rigid; however, TokenTax is the only software that is that supports margin trading, futures, and international crypto activities which makes it the most suitable for expert traders.

TokenTax\’s distinct feature of providing fully personalized, IRS-compliant tax documents, and documenting tax obligations for other nations is why it is the most precise tax reporting tool is for crypto users everywhere.

TokenTax connects with exchanges and wallets, sorts activities, and computes gains and losses with various accounting methods. It is the exceptional combination of flexibility, compliance, and reliability, that differentiates TokenTax from other softwares.

Pros & Cons TokenTax

Pros:

- Professional Support Options: For those needing more assistance, they provide a full-service tax support, accomplished, CPA, and more.

- DeFi & NFT-Friendly: Their support of DeFi protocols and NFT transactions is commendable.

- Strong Report Accuracy & Audit Trail: Completed in detail, their templates can help create audit trails, and reports.

Cons:

- No Free Plan: OPS have to pay, and they don’t have a free tier, which is something a lot of their competitors do.

- High Cost for Heavy Users: For those that have a large number of transactions, the premium and VIP plans can get quite costly, even in the tens of thousands.

- Limited Third Party Integrations: Compared to some of their competitors, they have fewer integrations with other tax software.

4. ZenLedger

ZenLedger is one of the most trusted crypto tax reporting tools for global users due to its unique ability to merge the best of both worlds. ZenLedger’s edge is the ability to collate data from numerous exchanges, wallets, and DeFi dashboards into one.

ZenLedger auto-sorts trades, staking rewards, mined income, and NFT transactions. Then, takes these to derive the gain/loss values accurately. Tax-compliant reports for many countries can be created, and the system integrates with tax platforms such as TurboTax for easy filing.

ZenLedger further assists users with real-time portfolio tracking, analytics, and reporting to ensure audit-proof reporting. This stream of features allows ZenLedger to provide its customers with exceptional value and reliability vis-a-vis crypto tax reporting.

Pros & Cons ZenLedger

Pros:

- Broad Protocol Support: They support over 400 exchanges and more than 100 DeFi, and NFT protocols.

- Audit Assistance: If you’re audited, they have documentation for your transactions in detail, which helps a lot.

- Tax Planning Tools: They offer some tools to help with tax-loss harvesting, unrealized gains tracking, and next-year planning for taxes.

Cons:

- Cost Rises with Volume: They do have expensive plans, this is a result of increasing volumes of transactions.

- Learning Curve: Especially if they are unfamiliar with DeFi/NFT tax events, it can be a bit dense for beginners.

- Users are Misinformed: Issues with involving reporting/accounting every user.

5. TaxBit

TaxBit is seen as one of the most reliable crypto tax reporting tools by customers around the world because of the company’s emphasis on automation, compliance, and scalability.

It’s competitive advantage is derived from its ability to monitor transactions in real time on various exchanges, wallets and blockchains, giving users the ability to see tax events as they happen.

TaxBit even supports advanced trading activities including DeFi, staking, and NFTs while calculating gains, losses, and income in real time to meet positive accounting.

They produce a tax report in compliance with the requirements of various nations and even partnering with tax professionals. The as a result of automation and international coverage, TaxBit becomes the most preferred solution for crypto users.

Pros & Cons TaxBit

Pros:

- Built by Tax Professionals: The app was developed by tax experts and provides robust support as needed for IRS reporting.

- Good Exchange Integration: The app provides integration with a number of big exchanges that makes the process easy.

- Enterprise Grade: The app is suitable for all users, including individuals and businesses with a large volume of users, and is well-designed for that.

Cons:

- Primarily US-Focused: The app lacks depth of support outside the US and many features are US-centric.

- Limited Manual Flexibility: Some users have reported that manual editing and reconciliation of transactions can be difficult.

- Support Paid Tiers: Better support and some advanced features are only available for a fee at enterprise levels.

6. BearTax

The simplicity, effectiveness, and dependability of BearTax have made it one of the most reputed crypto tax reporting tools amongst users all over the world. The most significant differentiating factor is the ability to seamlessly connect to numerous exchanges and wallets to quickly import transactions with no complicated configurations.

BearTax specializes in producing detailed and precise reports tailored to the specific requirements of each country, which includes reports on capital gains and losses, and crypto income from staking or mining.

For users who manually track their transactions, BearTax is able to process CSVs, and so, is adaptable to all kinds of users. The platform’s design ensures transparency, and that all reports are ready for audits, making it so other users across the world can also handle their crypto tax obligations without any worries.

Pros & Cons BearTax

Pros:

- Simple to Use: The app offers an easy-to-use interface, and the process to import through CSV or API is simple.

- Flexible Cost Methods: The app provides support for FIFO and LIFO, which can be beneficial for different tax strategies.

- Wide Exchange Coverage: There is support for more than 50 exchanges via API or CSV.

Cons:

- Limited Jurisdiction Support: The app is only supported in a handful of countries (e.g., US, Canada, Australia, India) per some reviews.

- Basic Feature Set: There is less comprehensive optimization (tax-loss harvesting, advanced DeFi) compared to more robust tools.

- Less Suitable for Very Complex Portfolios: The app may lack depth for extremely complex or institutional-level crypto activity.

7. Blockpit

Blockpit earned users’ trust worldwide as one of the best crypto tax reporting tools because of its focus on compliance automation and multi-jurisdiction support. Real-time monitoring of transactions from several exchanges wallets and blockchains is Blockpit’s best feature.

Blockpit’s tracking systems guarantee that no taxable events go unreported. Blockpit’s tax reporting systems categorize trade and staking rewards as well as DeFi activities with the use of reputable systems from top accountants to calculate gains and losses.

Revenue procedures and several country specific tax reporting templates simplify tax compliance. Blockpit’s users are fully supported in tax reporting obligations and tax reporting systems with peace of mind. Blockpit tax managed crypto expenses with ease.

Pros & Cons Blockpit

Pros:

- Real-Time Tax Liability: This tool gives you an estimate for your performance and tax liabilities in real time. Should you, for example, integrate with Blockpit, you get estimates right from your crypto portfolio.

- Strong for European Users: Blockpit offers great support for European tax jurisdictions and has compliance-first features.

- Comprehensive Import Options: Lots of wallets and exchanges come with both manual CSV and auto-sync support.

Cons:

- DeFi/NFT Complexity: Specialist tools are better when it comes to complex DeFi or other advanced on-chain activities.

- Pricing Struct: Costs may rise in line with large volumes of transactions.

- Less Known Outside Europe: Compared to US-centric tools, Blockpit has less adoption and less of a community outside Europe.

8. CryptoTax

CryptoTax is one of the most respected crypto tax reporting tools for users across the globe. It has a perfect balance of precision, simplicity, and broad scope of crypto activities.

CryptoTax’s biggest differentiating factor is the support for various transactions: trading, staking, mining, and transfer of NFTs, and calculating realized gains, losses, and taxable income automatically.

CryptoTax syncs with numerous wallets and exchanges which streamlines the processes eliminating manual interventions.

It drafts tax-compliant documents for a multitude of national jurisdictions, guaranteeing cross-border compliance. Cryptotax is a world leader in technology for cryptocurrency tax reporting for users and is able to meet and excel in the highest expectations of clients.

Pros & Cons CryptoTax

Pros

- Covers a wide range of transaction types — trades, staking, mining, NFTs.

- Good import support for many wallets/exchanges.

- Generates detailed, audit-ready tax summaries.

Cons

May not have very advanced integrations for institutional / pro users.

- Pricing might not be optimal for very high transaction volumes.

- Less-known brand: smaller community/support compared to big players.

9. Accointing

Accointing has become one of the most respected crypto tax reporting tools for worldwide users due to the consolidation of tax compliance and portfolio management features.

Offering a one of a kind service, Accointing tracks all crypto transactions across exchanges, wallets, and DeFi platforms while concurrently computing all gains, losses, and other taxable income. Accointing provides country-specific tax reports and several accounting methods, thus accommodating users from all over the world.

Accointing has made tax reporting on crypto as easy as possible for users and allows them to manage and invest in their crypto all over the world, with the peace of mind that comes from worldwide portfolio insights.

Pros:

- Combines portfolio tracking + tax reporting in one platform.

- Supports many accounting methods (FIFO, LIFO, etc.).

- Generates country-specific tax reports, useful for global users.

Cons

- Interface may feel clunky when reconciling many transactions.

- Some features (like tax-loss harvesting) may be limited or paid.

- Customer support may not be as robust for very advanced DeFi users.

10. CryptoTaxCalculator

Global users consider CryptoTaxCalculator as one of the most reliable crypto tax reporting tools due to the degree of automation and accuracy it achieves in performing and customzing tax solutions for all crypto activities.

CryptoTaxCalculator’s main selling points are the variety of exchanges, wallets and blockchains the software supports, as well as the automated calculations of capital gains and losses, and unlocking the taxable income streams from crypto activities such as trading, staking, mining, or NFTs.

Users receive tax reports that are audit-ready, tailored to the user’s country of residence, and can select accounting methods of their preference, FIFO or LIFO. CryptoTaxCalculator provides users the ability, confidence, and ease to report their crypto taxes thanks to user-friendly software, precise reporting, and aid in global compliance.

Pros & Cons Accointing

Pros:

- Tax Tracking and Portfolio Tracking: It aids in simultaneous tracking of taxes and portfolio.

- Easy to Use: It has a user friendly dashboard and does not have a complicated user interface .

- Supports Several Countries: It has a good multi-country support, primarily in EU-countries .

Cons:

- Risks Related to Acquisitions: It has been noted that more features like HIFO and mobile support have been added, though Blockpit acquiring Accointing is a concern to some users ([Reddit][16]).

- Tax Optimization is Less Advanced: Lacks more advanced tax optimization .

- Transaction Limits in Free Tier: Inactive traders face limitations with very cheap or free plans capped at 5 transactions and thus, have less room to operate, especially, day traders.

Conclusion

In summary, worldwide users can fully trust the crypto tax report tools, which include Koinly, CoinTracker, TokenTax, ZenLedger, TaxBit, BearTax, Blockpit, CryptoTax, Accointing, and CryptoTaxCalculator, to provide an effortless, tax-compliant, and efficient worldwide cryptocurrency tax management service.

These service providers mainly differentiate with auto wallet and exchange syncing, smart categorizations and transactional splitting, loss and gain calculation and report generation with the required tax documentation for a variety of countries.

From beginners to seasoned crypto tax and portfolio management service users, these providers foster crypto tax compliance confidence and ease with tools such as thorough documentation, real-time portfolio management and audit-ready features.

FAQ

It is a software platform that helps you aggregate your cryptocurrency transactions from multiple wallets and exchanges, categorize them (trades, staking, mining, etc.), and calculate your capital gains, losses, and crypto income. These tools then generate tax‑compliant reports for filing.

Even a small number of trades can lead to taxable events. These tools save time and reduce the risk of errors in manual calculations, helping you stay compliant across jurisdictions.

Most tools support multiple accounting methods, like FIFO, LIFO, and specific identification, to calculate how much you originally paid for the assets and therefore determine your gains or losses.