This article will cover the Top Rated Crypto Swap Aggregators for the Cheapest Fees. Crypto swap aggregators optimize and streamline the transaction process by determining the most effective multi-route swap and minimizing transaction costs and slippage.

These services connect several decentralized exchanges, allowing the user to trade at the most favorable exchange rate available and the most effective gas fees. These aggregators are great for all levels of cryptocurrency investors, as they enhance the overall user experience.

What is Crypto Swap Aggregators?

Cryptocurrency swap aggregators enable users to instantly trade single tokens across several decentralized exchanges (DEXs) in one transaction, optimizing the trading process (and helping users avoid having to do manual comparisons).

They automatically determine the best trading strategies in terms of cost and efficiency and avoid fragmentation of liquidity across multiple exchanges to reduce slippage trade and maximize efficiency.

They allow trades users to swap tokens and integrate directly to crypto wallets to facilitate trades across multiple cryptocurrencies. They are best characterized as integrators of value in the DeFi space.

How Do Crypto Swap Aggregators for Lowest Fees work?

Routing Across Multiple Exchanges: Crypto swap aggregators do not execute a swap in a single decentralized exchange (DEX); rather, they look over numerous DEXs, liquidity pools, and competitors of the user’s DEX to determine the best route with the lowest fees and slippage in comparison to all decentralized exchanges. Furthermore, the software used to execute the trade optimally splits the trade to minimize costs and slippage.

Smart Price Comparison: Crypto swap aggregators do not work one by one on the DEXs. As they execute numerous trades simultaneously, they quickly compare token prices, liquidity, and fees on different DEXs, and compute the best route and optimal trade execution.

Optimizing Gas and Slippage: Most aggregators optimize transactions for Ethereum gas fees or network transactions costs. They also reduce slippage (trades price impact) by smartly splitting the whole trade into portions and deciding to use a pool of high liquidity.

Single Transaction Convenience: Users do not have to browse the multiple decentralized exchanges to swap their tokens. The aggregator streamlines all the forex routing and fees optimizations in one transaction. They designed the aggregator with user convenience in mind, and to save the user’s time and money.

Integration With Wallets: A majority of the aggregators integrate with MetaMask, Trust Wallet, and Ledger wallets. This ensures that the trades are performed directly from the users’ wallets, and funds are secured while gaining the advantage of lower fees.

Key Point & Best Crypto Swap Aggregators for Lowest Fees List

| Crypto Swap Aggregator | Key Features / Highlights |

|---|---|

| 1inch | Aggregates liquidity from multiple DEXs, splits trades to reduce slippage, supports Ethereum, BSC, Polygon, Optimism, and Arbitrum. |

| Matcha (by 0x) | User-friendly interface, finds best prices across DEXs, integrates with wallets like MetaMask, supports limit orders. |

| OpenOcean | Multi-chain aggregator, cross-chain swaps, low slippage, deep liquidity from various DEXs. |

| KyberSwap | On-chain aggregator, optimized routing, supports multiple chains, staking and rewards options. |

| Rubic Exchange | Cross-chain swaps, multi-chain DeFi support, fast transaction execution, liquidity aggregation. |

| Slingshot | Gas-efficient swaps, decentralized routing, focuses on minimal slippage and secure transactions. |

| Zerion Swap | Part of the Zerion DeFi dashboard, simple interface, aggregates DEX liquidity, portfolio tracking included. |

| Symbiosis Finance | Cross-chain liquidity aggregator, supports multiple blockchains, focuses on interoperability and low fees. |

| LI.FI | Multi-chain routing aggregator, bridges + swaps in one transaction, reduces cross-chain complexity. |

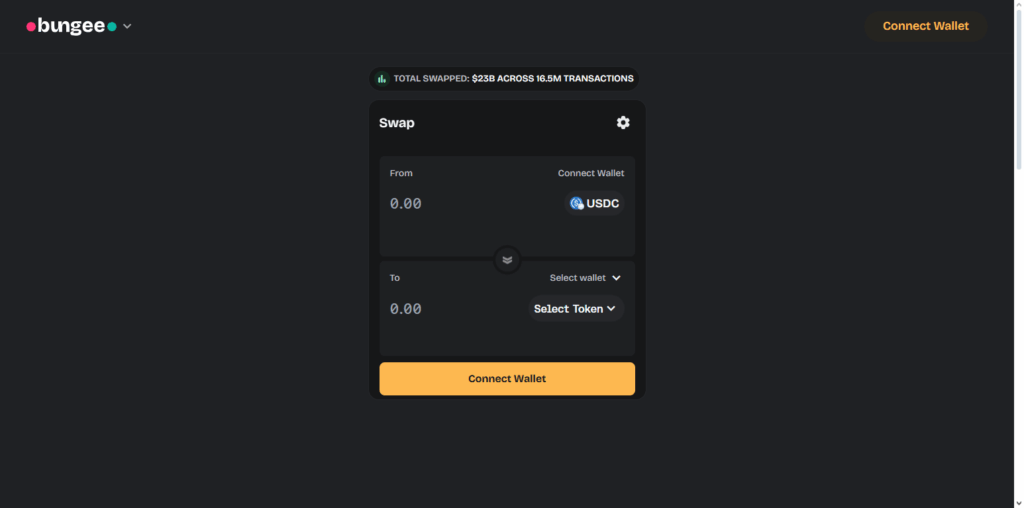

| Socket (Bungee) | Enables cross-chain swaps, bridge aggregation, focuses on secure and fast multi-chain transactions. |

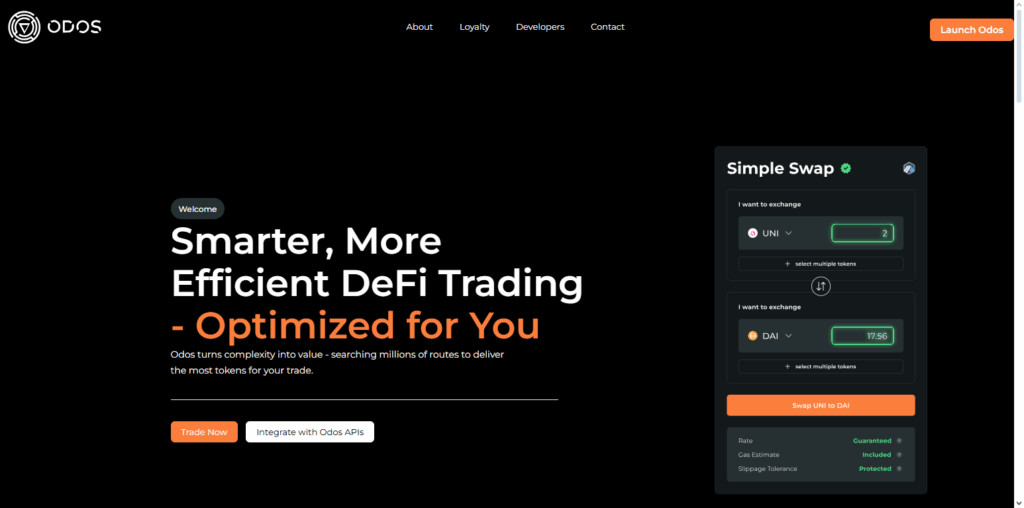

| Odos | Cross-chain swap aggregator, smart routing, high liquidity, low slippage, supports multiple EVM-compatible chains. |

1. 1inch

1inch is the best crypto swap aggregator for low-cost trades thanks to route splitting custom algorithms. Trade splitting allows 1inch aggregators to minimize trade costs. Because 1inch is able to run hundreds of algorithms per second with real human oversight, 1inch can run hundreds of trades per second to minimize trade costs with slippage.

1inch is able to allocate trades to all of the major blockchains like Ethereum, Binance Smart chain, Polygon, Arbitrum and Optimism, allowing real time swaps in every trade.

Cross chain swaps have gas fees, so 1inch algorithms, gas optimization algorithms like pathfinders optimize gas fees. 1inch works with all major wallets and also has a self custodial wallet. 1inch is the best crypto aggregator. 1inch is the best choice for low-cost crypto trades.

| Feature | Details |

|---|---|

| Platform Name | 1inch |

| Type | Decentralized Swap Aggregator |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Optimism, Arbitrum |

| Key Feature | Smart routing algorithm that splits trades across multiple DEXs to minimize slippage and fees |

| Fee Structure | Low trading fees; optimized gas usage via Pathfinder algorithm |

| KYC Requirement | Minimal to none for swaps (standard wallet connection sufficient) |

| Wallet Integration | MetaMask, Trust Wallet, Ledger, and other Web3 wallets |

| Unique Advantage | Real-time price comparison across liquidity sources for best rates |

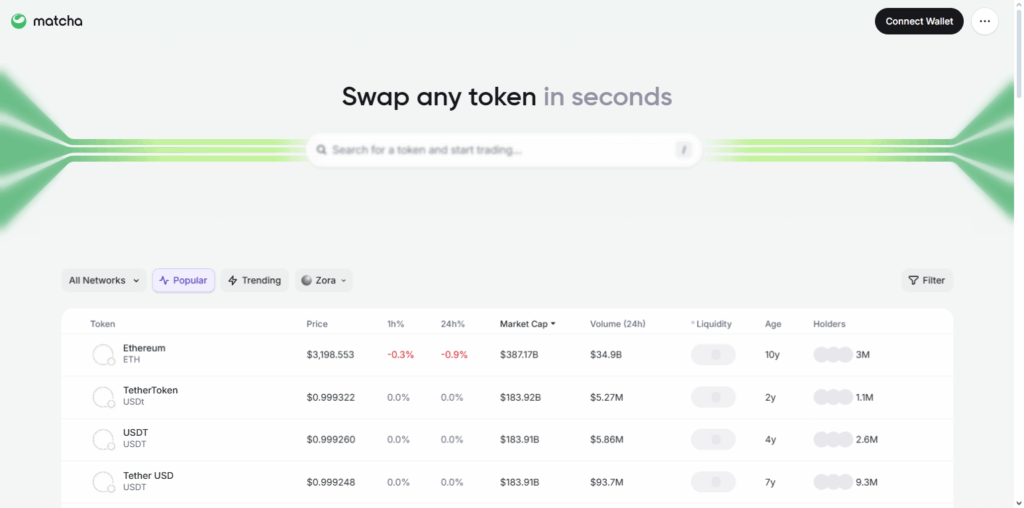

2. Matcha (by 0x)

Matcha (by 0x), one of the best crypto swap aggregators, is known for having the lowest fees due to its price optimization and easy-to-use platform.

Custom Matcha, 0x’s smart order routing, finds the best trades across multiple DEXs, saving slippage and other costly transactions. Clean and modern, the platform is easy for newbies and veterans alike to switch tokens and use limit orders to trade.

Secure transactions are guaranteed because Matcha integrates directly to its users’ MetaMask and Ledger wallets. Matcha’s low fees stem from its deep liquidity, high gas efficiency, and transparent pricing.

| Feature | Details |

|---|---|

| Platform Name | Matcha (by 0x) |

| Type | Decentralized Swap Aggregator |

| Supported Chains | Ethereum, Polygon, Binance Smart Chain, Optimism, Arbitrum |

| Key Feature | Smart order routing across multiple DEXs to find the lowest fees and best rates |

| Fee Structure | Low trading fees; minimal slippage via optimized routing |

| KYC Requirement | Minimal to none for standard swaps; wallet connection sufficient |

| Wallet Integration | MetaMask, Ledger, WalletConnect, and other Web3 wallets |

| Unique Advantage | User-friendly interface with limit orders and real-time price optimization |

3. OpenOcean

OpenOcean stands out as a top cryptocurrency swap aggregator with the lowest fees due to its cross-chain and multi-chain optimization and its ability to get the most efficient rate across a variety of decentralized exchanges.

Its intelligent routing function examines the discrepancies in price and liquidity across the different exchanges and then decides the best route to take. In the event that slippage occurs, it divides the trade to lessen the rate of slippage and to lower the cost associated with the transaction. .

OpenOcean’s multi-cross chain and single chain trade instant swaps asssit instant trades from the top liquidity providing exchanges like as Ethereum, BS, Polygon, Solana and Avalanche. With its Low fees, highly liquify and high multi-chain trading, near instant swaps, it has outperformed the rest and best for those who are trading with tight cost margins.

| Feature | Details |

|---|---|

| Platform Name | OpenOcean |

| Type | Multi-Chain & Cross-Chain Swap Aggregator |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Solana, Avalanche, Fantom, Arbitrum |

| Key Feature | Smart routing across multiple DEXs and liquidity sources to secure lowest fees and minimal slippage |

| Fee Structure | Low trading fees; optimized for gas efficiency across chains |

| KYC Requirement | Minimal to none for standard swaps; wallet connection sufficient |

| Wallet Integration | MetaMask, Trust Wallet, WalletConnect, Ledger, and other Web3 wallets |

| Unique Advantage | Supports both single-chain and cross-chain swaps in a single transaction efficiently |

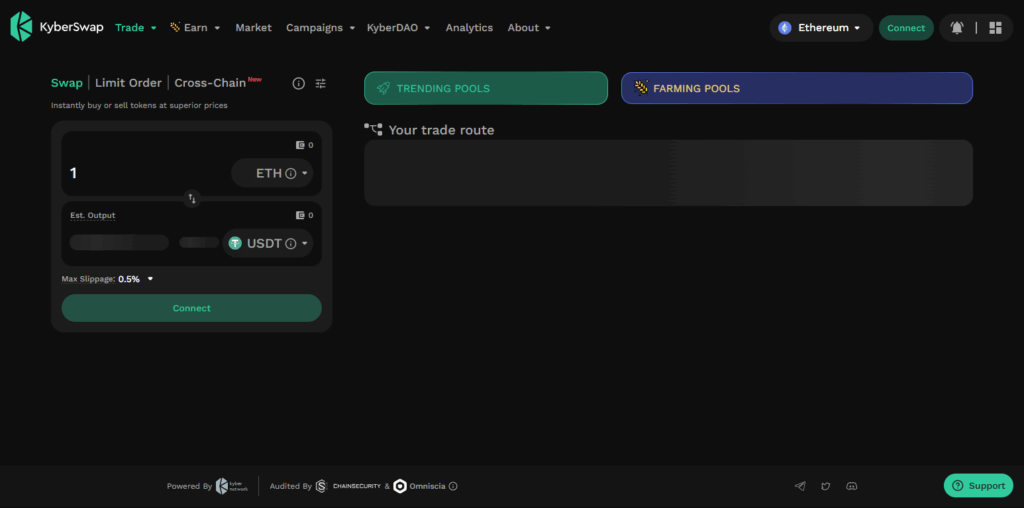

4. KyberSwap

KyberSwap is an best aggregator for crypto swaps with the lowest fees due to being an on-chain liquidity aggregator with optimized routes for trades. KyberSwap is connected to many different decentralized exchanges and sources of liquidity to identify the cheapest path for a swap and, thus. avoids high slippage and costs from unnecessary transactions.

KyberSwap is also active on several different blockchains which allows cross-chain and multi-token swaps. KyberSwap is also unique as it has a dynamic fee optimization model which changes the route of a swap to to reduce gas costs when network congestion is high. With a great platform and wallet integrations, KyberSwap has a great platform for trading.

| Feature | Details |

|---|---|

| Platform Name | KyberSwap |

| Type | Decentralized Swap Aggregator |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Fantom, Arbitrum |

| Key Feature | On-chain liquidity aggregation with optimized routing to minimize slippage and fees |

| Fee Structure | Low trading fees; dynamic fee optimization for gas efficiency |

| KYC Requirement | Minimal to none; wallet connection sufficient for swaps |

| Wallet Integration | MetaMask, WalletConnect, Ledger, and other Web3 wallets |

| Unique Advantage | Real-time multi-DEX routing and staking options for additional benefits |

5. Rubic Exchange

Due to cross-chain aggregation and multi-chain routing capabilities, Rubic Exchange is one of the most reputable providers of low-cost crypto swaps. Users can swap tokens seamlessly and efficiently across different blockchains.

Rubic’s smart routing algorithm optimizes decentralized exchanges, routing to the most advantageous liquidity pools to maximize swap liquidity and minimize slippage and gas fees.

Rubic quickly clears the cross-chain swap, streamlining multi-chain trading and reducing its costs. Designed to provide unparalleled value to customers while maintaining user-friendly integrations alongside opaque fee structures, Rubic is a top execution provider for value-focused crypto traders.

| Feature | Details |

|---|---|

| Platform Name | Rubic Exchange |

| Type | Multi-Chain & Cross-Chain Swap Aggregator |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Fantom, Arbitrum |

| Key Feature | Cross-chain swaps with smart routing to minimize slippage and trading fees |

| Fee Structure | Low trading fees; optimized gas usage for cross-chain transactions |

| KYC Requirement | Minimal to none; wallet connection sufficient for standard swaps |

| Wallet Integration | MetaMask, Trust Wallet, WalletConnect, Ledger |

| Unique Advantage | Enables fast, single-transaction cross-chain swaps efficiently |

6. Slingshot

A key reason why Slingshot is the best crypto swap aggregator is the gas efficient, optimized trade routing, which ultimately results in the lowest fees in the market. By connecting to many DEXs and sources of liquidity, Slingshot identifies the lowest liquidity paths for token swaps and reduces slippage and transaction costs.

Slingshot’s unique advantage is, even for extremely complicated trades, streamlined single transaction execution that avoids unnecessary overhead, especially in transaction costs.

Slingshot provides even more convenience with trade routing and wallet integrations such as MetaMask and Trust Wallet. Low fees, access to rich liquidity, optimized trade routing, and affordable swaps are the most efficient trade routing in the market.

| Feature | Details |

|---|---|

| Platform Name | Slingshot |

| Type | Decentralized Swap Aggregator |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Arbitrum |

| Key Feature | Gas-efficient swap routing that minimizes slippage and transaction fees |

| Fee Structure | Low trading fees; optimized for minimal gas usage |

| KYC Requirement | Minimal to none; wallet connection sufficient for standard swaps |

| Wallet Integration | MetaMask, Trust Wallet, WalletConnect, Ledger |

| Unique Advantage | Streamlined single-transaction execution for fast, cost-effective swaps |

7. Zerion Swap

Zerion Swap is one of the best crypto swap aggregators because of the unique approach to combining liquidity aggregation with portfolio management for the best pricing. Users receive a cost-efficient overview of their assets.

It is one of the only aggregators that queries a number of decentralized exchanges to identify the best trade routes in terms of slippage and transaction costs.

Integrating with the Company’s unique DeFi dashboard is the ultimate in ease of use, investment management, and executions. Convenient trade execution in a wallet, with fee transparency and ease of access is ideal for crypto users who value efficiency and security.

| Feature | Details |

|---|---|

| Platform Name | Zerion Swap |

| Type | Decentralized Swap Aggregator integrated with DeFi Dashboard |

| Supported Chains | Ethereum, Polygon, Binance Smart Chain, Avalanche, Arbitrum |

| Key Feature | Aggregates liquidity from multiple DEXs to minimize slippage and fees while providing portfolio management |

| Fee Structure | Low trading fees; optimized routing reduces gas costs |

| KYC Requirement | Minimal to none; wallet connection sufficient for swaps |

| Wallet Integration | MetaMask, Ledger, WalletConnect, Trust Wallet |

| Unique Advantage | Combines cost-effective swaps with portfolio tracking in a single platform |

8. Symbiosis Finance

Since cross-chain liquidity optimization & multi-chain routing results in low-cost fee aggregation, Symbiosis Finance stands out from other crypto swap aggregators. It allows users to swap coins in one transaction, eliminating multi-step transactions.

The platform\’s algorithm evaluates liquidity from multiple DEX to identify the least expensive route for trade, reducing slippage and gas payments.

Symbiosis Finance focuses on interoperability, as its produced wallets facilitate trade for many coins on various blockchains. If users prioritize low-cost fees and cross-chain efficiency other aggregators on the market cannot meet Symbiosis Finance\’s liquidity.

| Feature | Details |

|---|---|

| Platform Name | Symbiosis Finance |

| Type | Cross-Chain Swap Aggregator |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Fantom, Arbitrum |

| Key Feature | Cross-chain swaps with optimized routing to minimize slippage and trading fees |

| Fee Structure | Low trading fees; smart routing reduces gas costs across chains |

| KYC Requirement | Minimal to none; wallet connection sufficient for standard swaps |

| Wallet Integration | MetaMask, WalletConnect, Ledger, Trust Wallet |

| Unique Advantage | Efficient multi-chain swaps in a single transaction, reducing complexity and fees |

9. LI.FI

LI.FI is noted as one of the top crypto swap aggregators with the lowest fees due to their unique offering of cross-chain bridging in a single optimized token swap. Rather than going through tedious steps across various platforms, LI.FI routes trades to lower slippage and reduce gas expenditures.

Their smart aggregation algorithm filters through a wide range of decentralized exchanges and other liquidity outlets in order to find the optimal routes for all cross-chain and single-chain swaps.

LI.FI’s built in wallet and ease of use across multiple chains gives customers peace of mind as transactions are executed quickly and securely. Their dedication to making multi-chain trades as seamless and affordable as possible makes their platform highly popular in the crypto space.

| Feature | Details |

|---|---|

| Platform Name | LI.FI |

| Type | Multi-Chain & Cross-Chain Swap Aggregator |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Fantom, Arbitrum, Solana |

| Key Feature | Combines cross-chain bridging and token swaps in a single optimized transaction to minimize fees and slippage |

| Fee Structure | Low trading fees; efficient gas usage for both single-chain and cross-chain swaps |

| KYC Requirement | Minimal to none; standard wallet connection sufficient |

| Wallet Integration | MetaMask, WalletConnect, Ledger, Trust Wallet |

| Unique Advantage | Simplifies multi-chain trades while optimizing fees, allowing cost-effective cross-chain swaps in one step |

10. Socket (Bungee)

Socket (Bungee) holds the top position as a crypto swap aggregator with a unique capability to be the most cost-effective in the market because of its cross-chain interoperability and bridge routing.

Customers can exchange tokens and coins in a unified transaction. Its sophisticated routing algorithm considers cost-effective and efficient multi-liquidity sources and hates gas fees to whittle down the trade.

Socket (Bungee) guarantees the safety and speed of complex cross-chain swap transactions. Supported by dozens of tokens and popular wallets, traders can store their assets, as well as experience market liquidity, which is ideal when looking to minimize fees.

| Feature | Details |

|---|---|

| Platform Name | Socket (Bungee) |

| Type | Cross-Chain Swap Aggregator |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Fantom, Arbitrum, Solana |

| Key Feature | Aggregates liquidity and bridges assets across chains in a single optimized transaction to minimize fees and slippage |

| Fee Structure | Low trading fees; gas-efficient routing for cross-chain swaps |

| KYC Requirement | Minimal to none; wallet connection sufficient for standard swaps |

| Wallet Integration | MetaMask, WalletConnect, Ledger, Trust Wallet |

| Unique Advantage | Enables fast and secure cross-chain swaps with minimal cost and simplified user experience |

11. Odos

One of the key reasons why Odos has gained recognition as one of the best crypto swap aggregators is low fees and intelligent multi-chain and single-chain routing which optimizes every trade.

After evaluating the gas fees and the slippage, Odos is able to split the transactions across different DEXes to help the users save the most value on their swaps.

Odos single-chain and mulit-chain routing is the best on the blockchain by iteratively evaluating the best route and gas cost of the DEXes in the market. The aggregator’s focus on rlxc-chan efficiency, high liquidity access, and clear and transparent fees makes Odos one of the best in the market.

| Feature | Details |

|---|---|

| Platform Name | Odos |

| Type | Multi-Chain & Single-Chain Swap Aggregator |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Fantom, Arbitrum |

| Key Feature | Smart routing across multiple DEXs and chains to minimize slippage and reduce trading fees |

| Fee Structure | Low trading fees; optimized gas usage for both single-chain and cross-chain swaps |

| KYC Requirement | Minimal to none; wallet connection sufficient for swaps |

| Wallet Integration | MetaMask, WalletConnect, Ledger, Trust Wallet |

| Unique Advantage | Efficient and cost-effective swaps with high liquidity access and simplified multi-chain execution |

Conclusion

To sum up, the best crypto swap aggregators in terms of lowest fees, like 1inch, Matcha, OpenOcean, KyberSwap, Rubic Exchange, Slingshot, Zerion Swap, Symbiosis Finance, LI.FI, Socket (Bungee), and Odos, give users an incredible opportunity to maximize their value and minimize their costs.

These platforms utilize smart routing, multi-chain flexibility, and liquidity aggregation in order to minimize slippage and achieve optimal gas fees. By streamlining complex swaps and offering easy wallet connect features, they improve the entire crypto trading experience.

These aggregators, most especially, enhance the entire DeFi experience. For the affordable swap, with enough liquidity and reliability, these aggregators provide the most value in the experience of DeFi.

FAQ

They automatically compare prices across multiple DEXs, optimize trade routes, and sometimes split trades across platforms. This ensures users get the highest output while paying the least in transaction costs and gas fees.

Some of the top aggregators include 1inch, Matcha (by 0x), OpenOcean, KyberSwap, Rubic Exchange, Slingshot, Zerion Swap, Symbiosis Finance, LI.FI, Socket (Bungee), and Odos.

They use smart routing algorithms that split large trades across multiple liquidity pools and DEXs, ensuring minimal price impact and optimal execution.