I’ll talk about the Best Autonomous AI Agents for Crypto Trading in this post, emphasizing how sophisticated automation, AI-driven tactics, and clever risk management tools are revolutionizing how traders function in erratic cryptocurrency markets.

For both novice and expert cryptocurrency traders, these systems facilitate consistent decision-making, increase efficiency, and lessen emotional trading.

Why It Is Autonomous AI Agents for Crypto Trading Matter

Non-stop Market Supervision: Autonomous AI agents can monitor the market for as long as you want! With AI agents, you can trade at any volatility.

Impartial Trading Choices: AI agents remove the panic from the market. They trade based on data, logic, preset functions, and panic won’t even slow you down.

Quicker Trading from AI Agents: With very little market signal, AI agents trade right away. They trade to position you perfectly to gaps in the market.

Risk Management from AI Agents: Autonomous AI agents can place a stop-loss whenever you need it. They also position the size to make sure you don’t lose a lot.

Strategy Improvement in AI Agents: AI agents “learn” using data. They can improve market strategies and keep you on top of the game.

Reliability in Trading AI Agents: AI agents from pharma and other industries trade the market as long as there are rules.

Improved Comprehensiveness: AI agents can trade on any number of exchanges. They can also trade on customizable parameters.

Equity for Autonomous AI in Crypto Agents: Traders at both ends of the spectrum can use autonomous AI agents and benefit from the increased workload.

Effortless Time Decrease from AI Agents: With the use of AI agents, traders will not need to watch the charts as much and the focus can shift to building a strategy.

Flexibility in response to market fluctuations: Self-driving AI agents thrive in dynamic market conditions, embodying the volatility of the crypto world.

Key Point & Best Autonomous AI Agents for Crypto Trading List

| AI Trading Bot | Key Point |

|---|---|

| Gunbot | Highly customizable self-hosted crypto trading bot offering advanced strategies, backtesting, and full control without recurring fees. |

| Maneki AI | AI-driven automated trading system focused on adaptive market analysis and risk-optimized strategy execution for crypto traders. |

| Kryll.io | Visual strategy builder that allows users to create, test, and deploy automated crypto strategies without coding knowledge. |

| Gauntlet AI | Uses advanced simulations and stress testing to optimize DeFi and crypto portfolio strategies under real market conditions. |

| 3Commas | Popular cloud-based trading bot platform with smart trading terminals, DCA bots, and portfolio automation features. |

| Bitsgap | All-in-one crypto trading platform offering grid bots, arbitrage tools, and multi-exchange portfolio management. |

| Cryptohopper | AI-powered crypto bot supporting strategy marketplace, signal integrations, and automated trading across major exchanges. |

| AlgoBot | Automated trading bot designed for hands-free trading with preset strategies and built-in risk management controls. |

| Coinrule | Rule-based crypto trading automation platform enabling users to set “if-this-then-that” strategies without coding. |

| Pionex | Exchange-integrated crypto trading platform offering free built-in grid and DCA bots with low trading fees. |

1. Gunbot

Gunbot provides a comprehensive, self-hosted crypto trading solution for traders who want to manage the control of their strategies and infrastructure. It integrates with several trading platforms and offers customizable trading logic, providing users with a range of options for automated trading, from basic to advanced.

In contrast to cloud-based trading bots, Gunbot prioritizes privacy and security, as it executes its trading logic on the user’s local environment.

It provides a flexible one-time licensing trade automation model, which is why it is commonly cited as one of the Best Autonomous AI Agents for Crypto Trading. It offers backtesting features and community-developed trading strategies. In addition, Gunbot is known for its long-term automation and advanced market adaptability.

Gunbot Features, Pros & Cons

Features

- Highly personalized and configurable trading methods.

- Local self-hosted execution.

- Tools for simulations and back-testing.

- Support for multiple trading exchanges.

- Library of strategies that the community has developed.

Pros

- Comprehensive control of the trading bots and the data.

- Purchase of a license means no recurring subscription fees.

- A lot of flexibility with the trading strategies.

- Offline operation with minimal lag.

- There is a strong community of active users.

Cons

- There is a greater degree of difficulty involved with learning the system.

- There is a need for self-hosting.

- There is an absence of AI predictive modeling.

- The user interface is outdated.

- There is no provision for the average user.

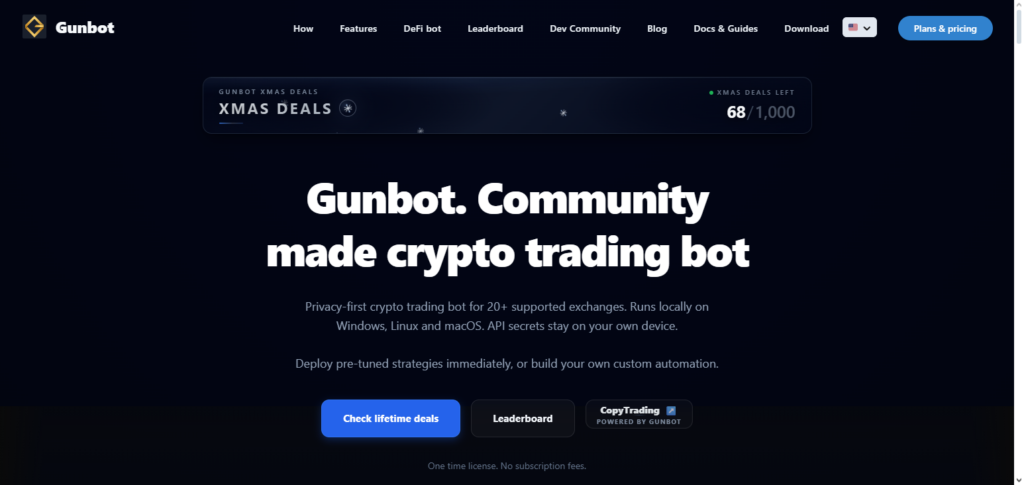

2. Maneki AI

Maneki AI is a new AI driven platform for crypto trading that roams the many potentials of adaptive decision making and automated portfolio optimization. Machine learning models assist in the analysis of market trends, volatility, and risk in real-time.

Best described as one of the Best Autonomous AI Agents for Crypto Trading, Maneki AI sets an emphasis on automated trading with risk management. The platform is built with features that study market conditions and improve in strategy recommendation to the user over time. The platform is simple to use and great for traders who want to automate their trading using AI without the need to have in-depth technical trading knowledge.

Maneki AI Features, Pros & Cons

Features

- Adaptive trading models powered by artificial intelligence.

- The ability to adjust in real-time.

- Portfolio rebalancing that is automated.

- Updates that are powered by continuous Machine Learning.

- A dashboard with all the analytics.

Pros

- Smart automation of the trading process.

- The system adapts in response to changing market conditions.

- Automation of the trading process is a hands-free operation.

- Stronger loss mitigation.

- There are constant incremental adjustments to performance.

Cons

- This is a more recent platform and has a lower number of users.

- Compared to more traditional bots, there is a lesser degree of customization.

- The subscription fees are more expensive.

- There is less manual control over the trading strategies.

- The documentation is in the process of being expanded.

3. Kryll.io

Kryll.io is an automation platform that works in crypto to help users create, evaluate, and execute trading strategies on crypto using a visual editor, and requires no coding. Kryll.io is the sole platform that has the best reviews as one of the Best Autonomous AI Agents for Crypto Trading for novices, and also for those who do not know how to code.

The platform offers users the features of back testing in history, strategy optimization, and also offers a marketplace.

This platform has support for the top exchanges and offers cloud execution. The platform combines a simple and user friendly interface with a lot of long term potential for users interested in systematic crypto trading.

Kryll.io Features, Pros & Cons

Features

- A Strategy builder using drag and drop functionality.

- Fireside trading backtesting with historical data.

- A marketplace for strategies.

- The ability to connect with multiple exchanges.

- Execution in the cloud.

Pros

- A user-friendly interface.

- A sufficient amount of coding is not needed.

- Active marketplace

- Good analytics tools

Cons

- Strategy building can be complex

- Costs increase with usage

- Not fully AI-automated

- Occasional execution delays

- Fewer advanced risk tools

4. Gauntlet AI

Gauntlet AI assists customers in understanding financial risk and simulations, and is applied in decentralized finance (DeFi) along with sophisticated crypto markets.

Rather than engaging in basic trading activities, it analyzes and stress tests portfolios, as well as other financial instruments through varying catastrophic market circumstances, and is even awarded as one of the Best Autonomous AI Agents for Crypto Trading.

Gauntlet AI employs sophisticated optimization strategies to evenly distribute and allocate capital, as well as manage risk.

Because of its predictive capability concerning market inefficiencies and failures, it is mostly used by institutional participants and DeFi protocols, as opposed to retail.

By operating in such unstructured and conflicting conditions, Gauntlet AI streamlines autonomous decision-making and sustains core principles in frozen volatile crypto ecosystems.

Gauntlet AI Features, Pros & Cons

Features

- Advanced market simulations

- Stress testing for strategies

- Risk modeling and forecasting

- Quantitative optimization

- DeFi & institutional focus

Pros

- Industry-grade analytics

- Improved risk forecasting

- Optimizes portfolios vs volatility

- Great for institutional strategies

- Reduces blind spots in models

Cons

- Not designed for casual traders

- Requires technical knowledge

- Higher cost structure

- Limited broker/exchange integration

- Slow learning curve

5. 3Commas

3Commas is one of the many instances of cloud-based crypto trading, and is one of the widely used platforms.

It is equipped with several features that include DCA (Dollar Cost Averaging) bots, smart trading terminals, and other forms of portfolio automation, and is compatible with multiple centralized exchanges (CEXs).

Risk management, as well as profit optimization is built into the system, and is one of the reasons for his recognition as one of the Best Autonomous AI Agents for Crypto Trading. Using signal automation, stop-losses, and take profit systems, traders are in a position to fully automate their trading strategies.

3Commas Features, Pros & Cons

Features

- Smart trading terminal

- DCA & grid bots

- Trailing stop & take-profit

- Multi-exchange support

- Mobile app

Pros

- Easy automation setup

- Works with many exchanges

- Good UI & tools

- Great mobile experience

- Strong risk tools

Cons

- Subscription required

- No built-in AI learning

- Bot performance varies

- Can be overwhelming

- Extra cost for advanced features

6. Bitsgap

Bitsgap is a comprehensive crypto trading and portfolio management solution that specializes in grid trading and arbitrage. Traders can control multiple exchange accounts from one interface and use automated trading bots.

Bitsgap is ranked among the Best Autonomous AI Agents for Crypto Trading because of its market-neutral strategy that excels in sideways price movement. The platform is equipped with real-time analytics, a demo mode, and backtesting features to perfect trading strategies.

The platform’s automation features allow traders to enhance their trading strategies and avoid emotional trading in a very volatile crypto ecosystem.

Bitsgap Features, Pros & Cons

Features

- Grid trading bots

- Arbitrage opportunities

- Portfolio overview across exchanges

- Analytics and back testing

- Demo mode

Pros

- Automation of arbitrage

- Simplified tracking across multiple exchanges

- Great for grid strategies

- Handy demo mode

- Strong interface

Cons

- Subscription required

- AI trading features are limited

- Only specific types of bots

- Not good for complicated logic

- Execution latency

7. Cryptohopper

Cryptohopper is one of the platforms that offer the most automated crypto trading bots powered by artificial intelligence. The platform has a marketplace for strategies, and offers automated execution, signal integration, and strategy automation.

The users can select from settings that allow manual, semi-automated, or fully automated trading. In the middle of this is where most users, who consider Cryptohopper to be one of the Best Autonomous AI Agents for Crypto Trading, value the platform’s AI strategy designer and the extensiveness of the customization features.

Users can test strategies, trade without using real money, and trade on multiple exchanges. The marketplace / community strategies paired with AI execution offers a solution that most traders want, which explains why it is popular.

Cryptohopper Features, Pros & Cons

Features

- AI-assisted design of strategies

- Market for signal providers

- Tools for backtesting

- Ability to paper trade

- Support for Multiple Exchanges

Pros

- Suitable to beginners and advanced traders

- Marketplace for community strategies

- Hybrid AI bots

- Ability to simulate trades before real live trading

- Adjustable risk parameters

Cons

- Monthly subscription

- Variations in marketplace quality

- Can be too much for some users

- Performance of bots can be inconsistent

- Cannot be done in a few minutes, there are many steps needed for configuration

8. AlgoBot

AlgoBot is an entirely hands-off automated crypto trading solution aimed at the simplification of algorithmic trading to the daily trader. AlgoBot usually offers preset strategies with built-in risk controls, so manual configurations are unnecessary.

Being part of the Best Autonomous AI Agents for Crypto Trading, AlgoBot offers consistency, discipline, and emotionless-analytics. The platform caters to users who want less active engagement with the trading platform, as the service is designed to foster the trader’s automation priorities.

With automatic market-analysis and defined entry-exit strategies, AlgoBot encourages users to adopt disciplined trading behavior, even in the face of unpredictable swings in the crypto market.

AlgoBot Features, Pros & Cons

Features

- Pre-set strategies

- Counters for irrational trading

- Automated scanning of the market

- Built-in risk parameters

- User-friendly design

Pros

- Good for traders who like hands-off trading

- Setup only takes a few minutes

- Emotional factor is eliminated

- Built-in risk management features

- Trading execution is consistent

Cons

- Not very deep in strategy

- Can be over-simplified

- Limited advanced analytics

- Fewer integrated exchanges

- Not suited to professional traders

9. Coinrule

Coinrule is a crypto automation platform based on the logic of automation where users build their own “if-this-then-that” trading logic.

It is compatible with numerous exchanges and has a collection of already built strategies for users to apply to different market conditions. Amongst the rest of the automation that is offered, Coinrule is rated as one of the Best Autonomous AI Agents for Crypto trading due to the strategy-driven nature.

Coinrule is best for users who want automation based on explainable reasoning as opposed to a black-box solution that AI offers. It offers automation with logic, risk control, and action-based triggers.

Coinrule Features, Pros & Cons

Features

- Trading bots that are rules based

- Logic of the If-This-Then-That type

- Collections of templates

- Support for multiple exchanges

- Ability to back test strategies

Pros

- Not programming is required

- Reasonable control over rules

- Speedy strategy formation

- Suitable for event-driven trading

- Friendly for beginners

Cons

- Logic of rules constrains sophistication

- Subscription fees recur

- Not entirely AI autonomous

- Less complex bots

- Limited strategy assessment

10. Pionex

Pionex has integrated trading bots into their crypto exchange, allowing customers to trade without buying additional software. New traders appreciate Pionex because of their low trading fees, DCA, and grid bots.

With Pionex being awarded one of the Best Autonomous AI Agents for Crypto Trading, they continue to offer users the full trading automation experience by providing the bots right at the exchange level. Users get to enjoy quick trade execution, and low lag trading.

Pionex has a simple platform and is a great option for traders who want to automate their trading strategies without having to spend a large amount of time keeping track of their trades.

Pionex Features, Pros & Cons

Features

- Integrated grid and DCA bots

- Exchange with reduced trading costs

- In-exchange auto execution

- Mobile application and dashboard

- Immediate deployment

Pros

- Free bots

- Affordable overall fees

- Quickly processed

- Simple plug-and-play

- Great for novices

Cons

- Few bot varieties available

- Danger of centralized exchange

- Less sophisticated analysis

- No external bots

- Low level of AI learning

Conclusion

The emergence of autonomous AI agents has revolutionized cryptocurrency trading by facilitating disciplined execution, quicker decision-making, and ongoing market monitoring. While technologies like Gauntlet AI and Maneki AI offer sophisticated risk modeling and adaptive intelligence, platforms like Gunbot, 3Commas, Cryptohopper, and Bitsgap provide traders with customisable automation.

These Top Autonomous AI Agents for Crypto Trading lessen emotional bias, increase productivity, and assist traders in using systematic tactics to handle erratic markets. Selecting the appropriate AI agent may greatly improve consistency, risk management, and long-term trading performance in the dynamic cryptocurrency environment, regardless of your level of experience.

FAQ

Absolutely. Platforms like 3Commas, Coinrule, and Pionex are beginner-friendly, offering pre-built strategies and simple interfaces. These tools allow new traders to automate trades without coding or deep technical knowledge.

No AI trading agent can guarantee profits. Crypto markets are highly volatile, and performance depends on market conditions, strategy selection, and risk controls. AI agents improve consistency and discipline but do not eliminate risk.

Advanced traders often prefer Gunbot, Cryptohopper, or Gauntlet AI due to their deep customization, backtesting, and quantitative modeling capabilities. These platforms offer greater control over strategy logic and execution.

Cloud-based agents offer convenience and ease of access, while self-hosted agents provide more control and privacy. The best choice depends on your technical skills, security preferences, and trading goals.

There is no fixed minimum. Some platforms allow small starting balances, while others perform better with higher capital for diversification. Always start with an amount you can afford to risk.