The Best AI Systems for Crypto Customer Segmentation will be covered in this article, with an emphasis on cutting-edge systems that make use of risk profiling, sentiment analysis, behavioral intelligence, and on-chain analytics.

These AI-powered technologies assist cryptocurrency companies in comprehending user behavior, tailoring interactions, improving security, and promoting data-driven expansion throughout DeFi platforms, Web3 ecosystems, and exchanges.

Why Use AI Systems for Crypto Customer Segmentation

Accurate User Insights: Users’ behavioral data is derived and analyzed through the AI which processes on-chain data.

Personalized Engagement: Each user segment can receive customized engagement through specific and tailored communication, target promotions, and features.

Improved User Retention: Reducing churn is achieved by early identification of loss within high-value segments and those who are at risk.

Enhanced Security & Risk Control: Fraud and other undesirable behaviors are mitigated by allocating users based on varying degrees of risk.

Data-Driven Marketing: Behavior-based segmentation of customers allows for the optimization of marketing activities.

Scalable Analysis: In a timely manner, it processes large amounts of data related to the blockchain.

Better Product Decisions: Features are enhanced based on the usage patterns of diverse user segments.

Regulatory & Compliance Support: User categorization is supported for anti-money laundering (AML) and related compliance processes.

Key Point & Best AI Systems for Crypto Customer Segmentation List

| AI Tool | Key Points |

|---|---|

| Chainsight AI | On-chain data automation platform enabling real-time monitoring, custom analytics pipelines, and smart contract data extraction for DeFi and Web3 apps. |

| Alethio AI (ConsenSys) | Enterprise-grade blockchain analytics offering Ethereum transaction intelligence, behavioral insights, and network health metrics for compliance and research. |

| Covalent AI | Unified blockchain data API providing structured, historical, and real-time on-chain data across multiple networks for analytics and AI modeling. |

| Flipside Crypto AI | Data science platform delivering curated on-chain datasets, SQL analytics, and AI-driven insights for DAO governance and crypto growth analysis. |

| Dune AI (Analytics) | Community-powered blockchain analytics tool allowing AI-assisted SQL queries, dashboards, and real-time visualization of on-chain activity. |

| CryptoQuant AI | AI-enhanced on-chain and market analytics platform focusing on exchange flows, miner data, and predictive indicators for trading decisions. |

| Elliptic Navigator | Blockchain intelligence and AI-driven risk analysis tool designed for crypto compliance, transaction tracing, and illicit activity detection. |

| CertiK Skynet AI | Real-time Web3 security monitoring system using AI to detect smart contract exploits, rug pulls, and abnormal on-chain behavior. |

| Santiment AI | Market intelligence platform combining on-chain data, social sentiment analysis, and AI metrics to identify crypto market trends early. |

| PeckShield AI | AI-powered blockchain security solution specializing in threat detection, exploit analysis, and continuous monitoring of DeFi protocols. |

1. Chainsight AI

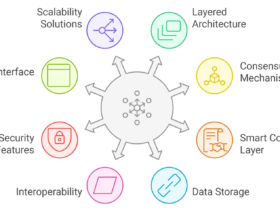

Chainsight AI is an on-chain data intelligence tool that captures and assess blockchain activities. It provides adjustable data streams, smart contract analytics, and real-time tracking across different protocols, assisting teams in interpreting wallet activities and transaction analytics.

Regarding Best AI Systems for Crypto Customer Segmentation – Chainsight AI, user on-chain transaction, engagement, and DeFi activity clustering and pattern recognition makes user engagement segmentation agile.

For projects aimed at understanding nuanced user cohorts at scale, enhancing user experience, and increasing retention, it is indispensable for tailoring product strategies and optimizing the offering to the users.

Chainsight AI Features, Pros & Cons

Features

- Monitoring of on-chain data as it happens.

- Tailored dashboards and analytics pipeline.

- Extraction of smart contract event data.

- Groups of similar wallets.

- Integrations for alerts and API.

Pros

- Insight data is accurate and is time sensitive.

- Models for segmentation are adaptable.

- Extensive data sets are manageable.

- Analysis of user behavior in DeFi is great.

- Alerts are customizable for significant user groups.

Cons

- Knowledge of advanced technical setup is a must.

- Small teams may find it to be expensive.

- Compared to other suppliers, native UI is limited.

- Focus on the on-chain data is limited. There is no data on user sentiment.

- Learning the system may take more time than is normal.

2. Alethio AI (ConsenSys)

Alethio AI is part of ConsenSys, providing enterprise-level blockchain analytics, especially for Ethereum and EVM-based systems. Customers combine sophisticated on-chain data analytics and processing, with customized dashboards, data visualization, and analytics research tools.

Customers can analyze transaction flows and trends, as well as network health, with varying degrees of insight, in wallets and contracts. Highlighted as one of the Best AI Systems for Crypto Customer Segmentation Alethio AI (ConsenSys), its segmentation analytics classify users based on behavioral activities, asset ownership, and types of transactions.

Such analytics help pencil, and provide design, teams with precise compliance, marketing, and product outreach adjustments, optimize user onboarding, and provide insights for competitive analysis from complex, decentralized ecosystems.

Alethio AI (ConsenSys) Features, Pros & Cons

Features

- Firm level analytics of the Ethereum Blockchain.

- Metrics and trends on the health of the network.

- Visualization of the flow of transactions.

- Insights on the behavior of individual addresses.

- Research and tools for data exporting.

Pros

- For depth analysis on a Blockchain, it is impressive.

- For analysis at the institutional level, it is excellent.

- There is an impressive level of accuracy of the data.

- Visualization tools are impressive.

- Reliable as it is backed by ConsenSys.

Cons

- Most of the focus is on Ethereum.

- Market segmentation is not optimized at all.

- Beginners find the interface to be complicated.

- Analysis at the multi-chain level is limited.

- Cost is high.

3. Covalent AI

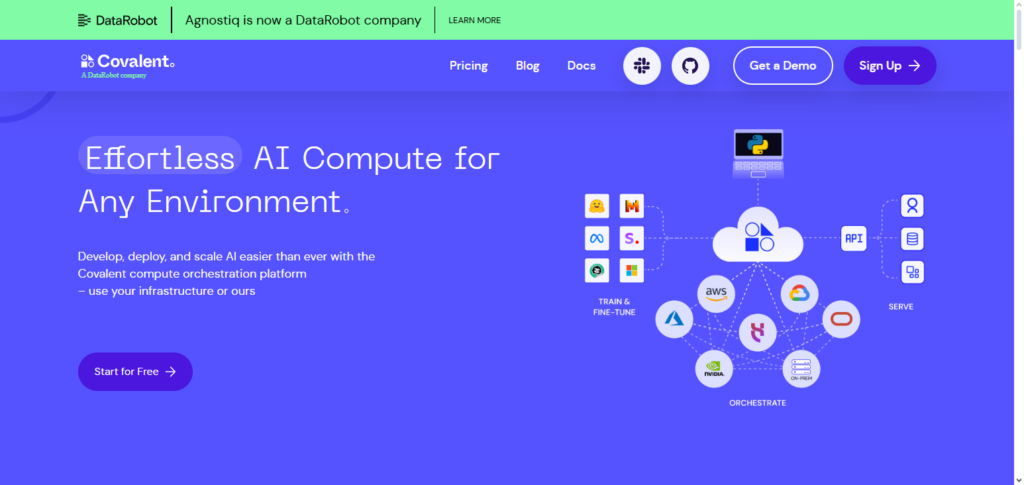

Covalent AI collects, organizes, and standardizes blockchain data across multiple networks and provides users with structured datasets that can be used for analytics, AI modeling, and dashboards, without users having to compute and understand the data directly from the blockchains.

Covalent AI’s data indexing also includes token balances, transactional histories, and recorded event histories of smart contracts, which helps in building advanced analytics. In the Best AI Systems for Crypto Customer Segmentation Covalent AI, the data that Covalent AI possesses helps to analyze users and classify them based on their crypto holdings, their cross-chain activities, and their behavioral activities in certain timeframes.

This is useful for businesses to analyze their customers, refine their engagement activities, and empower AI models that predict churn, adoption, or profile customers who would be considered to be of high value.

Covalent AI Features, Pros & Cons

Features

- An API for unified data across all blockchains.

- Historical and current data

- Token balances and event logs

- Coverage across multiple chains

- Data pipelines that are ready to use

Pros

- Simple for developers to access the API

- Support for data across multiple chains

- Quick to integrate into applications

- Data sets are well organized

- Suitable for segmentation models

Cons

- The free tier has limits on the number of queries

- Dashboards require outside tools

- No artificial intelligence analytics tools

- Risk and sentiment are not prioritized

- Data is not processed and requires additional work

4. Flipside Crypto AI

A mix of community-based analytics, on-chain datasets, and SQL query ability, Flipside Crypto AI, allows users to create custom metrics.

By translating raw blockchain data into more digestible data sets, that showcase metrics of economic activity, governance participation, and engagement in various DeFi, they provide blockchain data and analytics services.

One of the Best AI Systems for Crypto Customer Segmentation Flipside Crypto AI, focuses user segmentation by the specific transactional behaviors, governance participation, and token related loyalty of users.

These user segmentations, which are focused on end user behaviors, provide key insights to marketers and product teams around the design of focused promotions, the structure of multiple tier reward systems, and the developmental contibution of various user segments to the growth of the ecosystem to increase competitive advantage in crypto markets.

Flipside Crypto AI Features, Pros & Cons

Features

- Jira of on-chain data sets

- Workbench for analytics using SQL

- Metrics for DAO and governance

- Dashboards built by the community

- AI model segment exports

Pros

- Dashboards that are adjustable

- Tiers for access that are free and open

- Community support that is strong

- Appropriate for cohort analysis

- Excellent for research units

Cons

- Geek speak required for SQL

- Not suitable for users lacking technical knowhow

- Limited predictive functionality in AI

- Data is always delayed by batch processing

- Manual segmentation for output

5. Dune AI (Analytics)

Dune AI adds another layer of innovation to the leading community-powered analytics tool by embedding AI into SQL queries. Dune AI also helps users construct dashboards to facilitate deep dives into on-chain datasets.

Users also have the ability to spot trends, report on them, and collaborate with others to share their findings. Dune AI has been recognized as a leader in the category of Best AI Systems for Crypto Customer Segmentation – Dune AI (Analytics), a category in which a flexible query system for detailed segmentation of users with respect to their wallets, their interaction with various protocols, and time patterns is a key differentiator.

With this, analysts can categorize users into various groups such as early adopters, frequent or large volume traders, and liquidity providers. This data-driven segmentation allows for better tailored product attribute and feature marketing to the varying needs and behavioral patterns of the targeted segments.

Dune AI (Analytics) Features, Pros & Cons

Features

- SQL querying supported by AI

- Dashboards that show data in real-time

- Tools for visualizing data

- Templates created by the community

- Sharing and collaboration

Pros

- Simple to publish dashboards

- Templates created by the community enhance insights

- AI assists in creating queries

- Streams of real-time data

- Extensive support across multiple chains.

Cons

- The amount of queries is limited in the free tier.

- Some dashboards need optimization.

- Not focused on customer segmentation straight away.

- Power users may need to be comfortable with SQL.

- Support can be slow.

6. CryptoQuant AI

In order to provide predictive insights into price changes, exchange flows, and miner behavior, CryptoQuant AI specializes in combining market indications with on-chain data. It provides sophisticated analytics that researchers, traders, and institutional teams utilize to comprehend sentiment signals and supply pressures.

CryptoQuant AI is one of the Best AI Systems for Crypto Customer Segmentation. Its data streams can help discover participant clusters whose trading behavior correlates with particular market conditions.

This kind of consumer segmentation makes it possible to provide customized advisory services, individualized alerts, and strategic portfolio suggestions based on measurable behavioral categories that influence market dynamics.

CryptoQuant AI Features, Pros & Cons

Features

- Analytics for market indicators.

- Metrics for exchange flow.

- Signals from miner behavior.

- Insights for liquidity and supply pressure.

- Analytics on predicted trends.

Pros

- Very good for market timing.

- Helpful in trader segmentation.

- Analytics predict metrics clearly.

- Detailed data on exchanges.

- Alerts on market key triggers.

Cons

- Not as much focus on user segmentation.

- There is a steep learning curve with the dashboards.

- There may be a cost to it.

- Not recommended for marketing teams.

- There is a lack of sentiment analysis.

7. Elliptic Navigator

Elliptic Navigator employs blockchain analytics for compliance and risk management, providing AI-based transaction tracing and the detection of suspicious activities. It helps banks and crypto companies manage counterparty risk, monitor potential losses from money laundering, and track suspicious transactions.

With recognition as one the Best AI Systems for Crypto Customer Segmentation Elliptic Navigator for segmentation, it assigns a particular segment to each user based on their risk, transaction behaviors, and association with flagged accounts.

It helps compliance teams in managing the order of tasks to be prioritized, setting risk management procedures, and adapting the pace of onboarding to the level of regulation while managing the balance between compliance and the protection of legitimate, high-value clients from the high-risk users.

Elliptic Navigator Features, Pros & Cons

Features

- AI scoring of transaction risks.

- Tools for compliance with AML.

- Detection of illicit addresses.

- Risk profiles for wallets.

- Timelines for case investigations.

Pros

- Great for teams dealing with compliance.

- Risk detection with high accuracy.

- Simple segmentation of risks.

- Onboarding for enterprise support.

- Aids in processes for AML.

Cons

- Mainly focused on risk with lack of customer engagement.

- High cost for users with less resources.

- The focus on the product analytics is less.

- There is a need for training in order to understand the scores.

- Risk attributes is the only area for segmentation

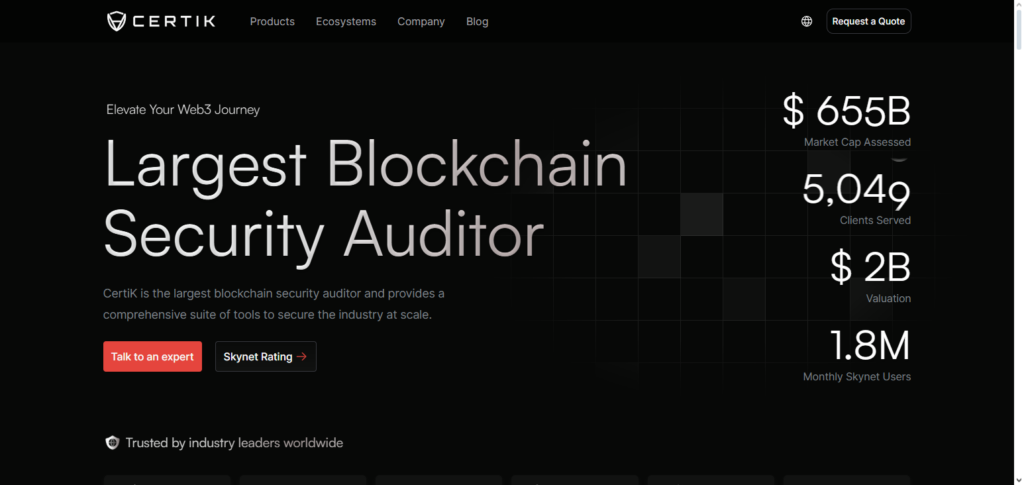

8. CertiK Skynet AI

AI CertiK Skynet is a Web3 security monitoring suite. CertiK Skynet AI monitors changes in blockchain technology due to Artificial Intelligence (AI); it helps in noting changes in potential triggers, may be harmful, and preposterous behaviors.

It monitors and analyzes blockchain smart contracts, transaction lanes and flows, as well as the interactions in the entire ecosystem, and helps in issuing alerts to the ecosystem’s agents before the threats are fully matured.

CertiK AI is one of the Best AI Systems for Crypto Customer Segmentation CertiK Skynet AI. Because of its analytical model, it can be segregated into distinct user by means of interaction behavioral risks, blockchain smart contracts, and security events history.

This ability helps the overall project in segregating the blockchain participants to high and low risks, thus creating a way for target project participation education and the creation of project risk mitigation plans and the granting of support in tiers to the active users of the ecosystem.

CertiK Skynet AI Features, Pros & Cons

Features

- Detecting exploits in real-time.

- Monitoring smart contract security.

- Alerts for behavioral anomalies.

- Dashboards showcasing risk segmentation.

- Scanning on-chain data continuously.

Pros

- Skynet is excellent for security-conscious teams.

- Rapid notification for new security threats.

- Aids in prioritizing different risk segments.

- Dashboards for monitoring is simple.

- APIs for integration are decent.

Cons

- Narrow scope of segmentation beyond security.

- Analytics for segmentation is rudimentary.

- The security-oriented vocabulary can be hard for marketers.

- Alerts are hypersensitive.

- Less data from the community.

9. Santiment AI

Santiment AI provides market information that captures both quantitative behavior and community tales by combining social sentiment analysis with on-chain analytics. Its datasets, which feed into prediction indicators utilized by traders and researchers, include development activities, token holdings, whale movements, and social signals.

Santiment AI’s multi-dimensional data facilitates segmentation based on sentiment engagement, trading habits, and impact scores, making it one of the Best AI Systems for Crypto Customer Segmentation. By matching attributes to the tastes and habits of different cohorts, projects can utilize this segmentation to tailor messages, predict changes in user sentiment, and promote communities.

Santiment AI Features, Pros & Cons

Features

- Sentiment signals and on-chain metrics.

- Development activity and whale watching.

- Analysis of social media.

- Indicators of market trends.

- Triggers for custom segmentation.

Pros

- Usage data and sentiment are combined.

- Trend segmentation is done excellently.

- Analysis of community presence is excellent.

- A wide variety of metrics.

- Early signal detection is superb.

Cons

- The user interface has a lot of information.

- The upper tiers of the application are chargeable.

- Signal interpretation is complicated.

- Risk classification was weak.

- There is a delay in data collection.

10. PeckShield AI

With a focus on threat identification, exploit analysis, and ongoing protocol monitoring, PeckShield AI provides proactive blockchain security analytics. Its technologies assist DeFi teams and exchanges in understanding the threat landscape, identifying vulnerabilities, and flagging questionable addresses.

PeckShield AI, one of the Best AI Systems for Crypto Customer Segmentation, is capable of segmenting customers based on anomalous patterns, security risk exposure, and involvement with flagged contracts.

This allows for segmentation that informs risk-adjusted access levels, tailored user education on safe habits, and targeted security alerts. Teams may improve safety and trust for all parties involved by integrating security behavior into customer profiles.

PeckShield AI Features, Pros & Cons

Features

- Recognition of behavioral patterns.

- Anomaly and exploit detection.

- Clustering of addresses.

- Segmentation of risk by wallets.

- Monitoring that is ongoing.

Pros

- Robust threat intelligence.

- Address clustering is done well.

- Alerts help with segmentation.

- Helpful for DeFi security.

- Integrations via API access.

Cons

- Centered on security risk (not product behavior).

- Primarily for security analysts.

- Few marketing segmentation features.

- Some advanced functionalities require payment.

- Needs technical explanation.

Conclusion

For blockchain initiatives, exchanges, and Web3 platforms to gain a deeper understanding of user behavior, the best AI solutions for crypto consumer segmentation are essential. These AI technologies convert unprocessed blockchain data into useful consumer segments by utilizing on-chain analytics, behavioral modeling, sentiment analysis, and risk intelligence.

This makes it possible for companies to provide tailored experiences, increase user retention, bolster security, and enhance marketing and product plans.

AI-driven segmentation is crucial for finding high-value consumers, controlling risk, guaranteeing compliance, and promoting sustainable growth as crypto ecosystems continue to get more complicated. Using the appropriate AI segmentation technologies gives you a competitive edge in the increasingly data-driven cryptocurrency market.

FAQ

AI systems for crypto customer segmentation use artificial intelligence and on-chain analytics to categorize blockchain users based on behavior, transaction patterns, holdings, sentiment, and risk profiles. These systems help crypto businesses better understand and engage their users.

Customer segmentation enables crypto platforms to deliver personalized experiences, improve user retention, enhance security, and comply with regulations. It helps identify high-value users, risky wallets, and different engagement levels across decentralized ecosystems.

Unlike traditional systems, AI crypto tools analyze transparent on-chain data in real time, including wallet activity, smart contract interactions, and cross-chain behavior. This allows for more accurate, dynamic, and behavior-based segmentation.

AI systems use on-chain transaction data, token holdings, DeFi activity, exchange flows, social sentiment, governance participation, and security risk indicators to create detailed user segments.

Crypto exchanges, DeFi protocols, NFT platforms, DAOs, Web3 startups, compliance teams, and institutional investors benefit from AI-powered customer segmentation to improve decision-making and growth strategies.