For traders searching for dependable prop firms with more profit payments, adaptable trading regulations, and a variety of platform possibilities, I will go over the Best OneFunded Alternatives in this post.

These options are perfect for both novice and seasoned traders looking for reliable financed trading possibilities since they provide competitive financing models, quick withdrawals, and scalable accounts.

What is OneFunded Alternatives?

Proprietary trading companies that provide traders funded accounts akin to OneFunded but with distinct assessment processes, profit-sharing arrangements, payout schedules, and trading platforms are known as OneFunded alternatives.

With a portion of the earnings they make, these options enable traders to trade firm capital after passing an evaluation or through rapid funding schemes.

OneFunded alternatives are appropriate for traders with different levels of experience and tactics since they frequently provide advantages like bigger profit splits, quicker payouts, flexible trading rules, several platform options like MT4, MT5, and cTrader, and expandable account sizes.

Benefits Of OneFunded Alternatives

Access to Funded Capital – Traders can access an additional level of firm capital to trade without financial risk.

Increased Profit Potential – Alternatives present the opportunity for different profit share splits (generally 80–100%) allowing traders to retain more of their profit.

Flexible Trading Policies – Varying from firm to firm, some policies are more flexible for day trading, position trading (with the ability to set overnight trades), and even strategies that involve taking trades in both directions (i.e., for or against a position).

Multiple platform supported – They’re available on MT4, and MT5, cTrader, DXtrade, and TradeLocker.

Faster and more frequent payouts – Compared to the competitors, some firms even offer weekly, bi-weekly, or same-day payouts instead of a more traditional monthly schedule.

Scalable Capital Growth – Funded accounts can be built through positive performance (i.e., meeting profit goals) on a consistent basis.

Low Cost Evaluation Options – Firms have lowered the barrier of entry for their services through the ability to access challenges and even a subscription-based model to offset the challenge fee.

Risk Management Training – A more disciplined trader will have better long-term sustainable performance.

Key Point & Best OneFunded Alternatives List

| Prop Firm | Key Points / Highlights |

|---|---|

| FTMO | Offers up to $400k funding, flexible account sizes, advanced risk management tools. |

| BluFX | Fast account approval, low entry cost, supports multiple trading platforms. |

| E8 Funding | Simple evaluation process, profit split up to 80%, worldwide trader support. |

| Funded Trading Plus | Instant funding option, competitive profit share, low-risk challenge models. |

| Funding Pips | Quick evaluation, daily withdrawal options, suitable for forex and crypto traders. |

| Smart Prop Trader | Offers both evaluation and instant funding, personalized support, multiple account sizes. |

| RebelsFunding | Low-cost evaluation, high-profit split, risk-friendly rules for consistent traders. |

| TradeDay | Transparent rules, fast scaling options, supports various trading instruments. |

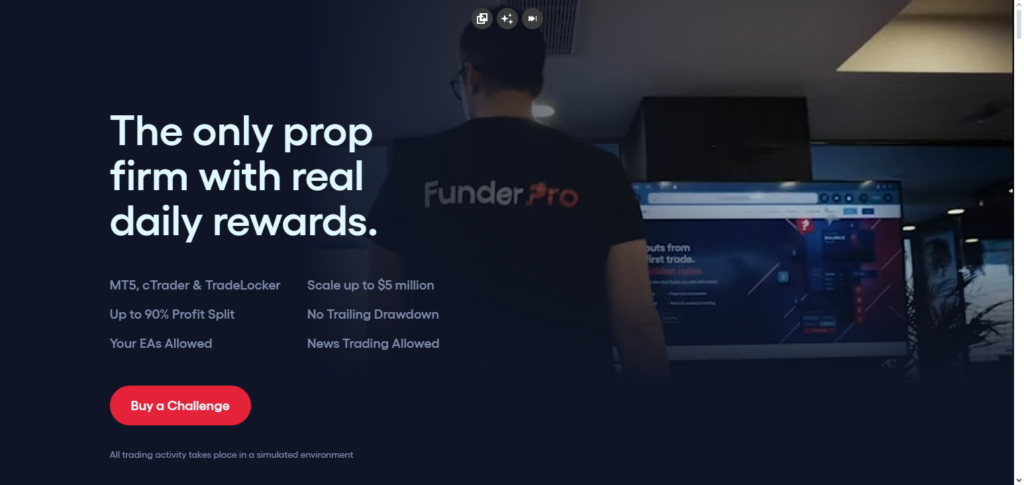

| FunderPro | Flexible funding plans, beginner-friendly, provides mentoring and trader support. |

| The5%ers | Focus on consistent trading, instant funding after trial, global trader accessibility. |

1. FTMO

One of the oldest proprietary trading companies, FTMO is well-known in the sector for its two-step assessment. To obtain a funded account, traders must pass a challenge and verification process. Typically, profit splits range from 80% to 90%, and payouts are made either on demand or every two weeks if profit targets are met.

FTMO facilitates traders’ access to forex, indices, commodities, and cryptocurrency markets by supporting key trading platforms such as MetaTrader 4, MetaTrader 5, cTrader, and DXtrade. For quicker funding and weekly payouts with comparable or greater profit splits, many traders opt for alternatives like Funded Trading Plus.

FTMO Features, Pros & Cons

Features

- Three-step evaluation challenge

- Up to 80–90% profit splits

- MT4, MT5, cTrader, DXtrade support

- Scheduled or on-demand payouts

- Profit scaling program

Pros

- Solid and reputable brand

- Definite risk management rules

- Ability to use several platforms

- Payout options are flexible

- Established trader network

Cons

- Evaluation can be overly constrictive

- Challenge fees expected

- Limited time evaluation may stress some traders

- Newbies may find rules a little overwhelming

- Profit splits are not the best in the industry

2. BluFX

With BluFX’s subscription-based funding approach, traders pay a regular monthly charge rather than a typical challenge, allowing for early access to funds without drawn-out assessments.

Traders execute on well-known platforms like MetaTrader 4 & 5 with access to forex, indices, commodities, and cryptocurrency, and payout splits usually vary but are intended to be competitive with traditional prop firms.

The5%ers is a good OneFunded competitor that offers scalable funded accounts with up to 100% profit splits and structured rewards every 14 days to help traders develop capital steadily, even though BluFX’s distinctive strategy works best for subscription traders.

BluFX Features, Pros & Cons

Features

- Funding model based on subscriptions

- No standard evaluations

- Forex, indices and crypto access

- MT4/MT5 platform support

- Month to month access flexibility

Pros

- No tedious challenges

- Easily guessable cost model

- Simple for beginners

- Zero risk as funding continues while the subscription is active

- Standard platforms available

Cons

- Cost of the subscription can get high

- Profit splits are not industry best

- Not suited for high volume trading

- Payout terms can be vague

- Less account options

3. E8 Funding

In the forex, futures, and cryptocurrency markets, E8 Funding (doing business as E8 Markets) offers a configurable challenge system with 1-, 2-, or 3-step programs. Depending on the type of account, profit splits might reach 90–100%. Payouts are frequently made on demand following the achievement of goals.

MatchTrader, cTrader, and TradeLocker are among the platforms that are supported; account sizes range from $5K to $500K. FunderPro, which enables daily reward requests with up to 90% profit sharing and quick payout processing, is a viable OneFunded substitute for traders who value speed and payout flexibility.

E8 Funding Features, Pros & Cons

Features

- Adjustable challenge steps (1-3)

- Profit splits between 90 and 100%

- MT4, cTrader, and MatchTrader support

- Payouts on demand

- All sizes of accounts available

Pros

- Adjustable challenge pathways

- Potential for substantial profit sharing

- Access to numerous platforms

- Receives payments quickly after completing targets

- Accounts that grow in size

Cons

- New traders may find it a little puzzling

- Each challenge has different rules

- A few fees can be applied

- Risk parameters are still very rigid

- The platforms have a steep learning curve

4. Funded Trading Plus

Offering 1-step, 2-step, and instant financing challenges with simple rules and quick compensation structures, Funded Trading Plus has rapidly acquired popularity. Once paid, traders are able to withdraw simulated earnings from day one, and profit shares can be as high as 100%.

The majority of trading strategies, including scalping, hedging, and swing trading, are supported by MetaTrader 5, cTrader, DxTrade, and Match Trader. FTMO, which is well-known for its well-established brand and multi-platform support across FX and CFD markets, is a suggested OneFunded substitute offering comparable features with a wider worldwide reach.

Funded Trading Plus Features, Pros & Cons

Features

- Challenges that are one-step, two-step, and instant

- Up to 100% profit splits

- MT5, cTrader, and DXtrade support

- Instant funding and weekly payments

- Allows hedging and scalping

Pros

- Excellent funding instant options

- Splitting profit possibilities is very high

- Diverse trading styles permitted

- Support for several platforms

- Payouts that are regular

Cons

- Some challenges have fees

- Instant funding may be more expensive

- Changes in rules can occur

- Brand is less reputable than FTMO

- Some traders believe that rules are convoluted

5. Funding Pips

With profit percentages between 80 and 100% and accounts scalable up to $2 million, Funding Pips provides low-cost challenges and a variety of evaluation methods, including quick, one-step, and two-step programs. Traders can trade forex, metals, indices, energy, and cryptocurrency using platforms including MetaTrader 5, cTrader, and Match-Trader.

Once consistency standards are met, payouts may be made on a weekly, biweekly, or demand basis. A trustworthy OneFunded substitute is E8 Markets, which offers clear payouts and extensive platform assistance for traders looking for consistency. Funding Pips has had conflicting community comments regarding rule enforcement.

Funding Pips Features, Pros & Cons

Features

- Plans for evaluations that are budget-friendly

- Profit sharing that can reach 100%

- MT5, cTrader, and Match-Trader support

- Payouts weekly and bi-weekly

- Scalable capital options

Pros

- Reasonable pricing for challenges

- Significant profit sharing opportunities

- Support for platforms is standard

- Flexible payouts

- Good for scalpers

Cons

- Can be a little more strict

- Not very well known

- Charges you extra

- Response can be a little slow

- Growth can be slow

6. Smart Prop Trader

With several challenge forms, profit shares that are usually around 80%, and a focus on quick funding channels, Smart Prop Trader (also known as Smart Trader Funds) provides traders with a gateway to cash.

Payout cycles often occur every 14 days following funded status, and supported platforms frequently include the MetaTrader series and comparable tools with round-the-clock assistance.

As businesses expand, traders can scale up to higher capital tiers with freedom. Funded Trading Plus is a powerful OneFunded substitute with weekly payout schedules and immediate financing choices for traders seeking a wider worldwide audience and instant reward features.

Smart Prop Trader Features, Pros & Cons

Features

- Multiple evaluation levels

- Profit shares ~80%+

- MT4/MT5 compatibility

- Payouts every two weeks

- Growth capital

Pros

- Good rules

- Good compatibility

- Good for newcomers

- Easy to understand scaling

- Regular payouts

Cons

- Less profit split than a few competitors

- Smaller community feel

- Still need to get evaluated

- Scaling restrictions

- Smaller number of bigger funding options

7. RebelsFunding

RebelsFunding is a prop firm that offers a variety of evaluation programs, from multi-step to rapid funding. Profit percentages normally range from 80% to 90%, and payouts are typically made accessible soon after goals are met.

Traders frequently receive biweekly or on-demand dividends, however exact payout times vary. Depending on the subscription level, RebelsFunding’s programs enable trading on bespoke interfaces or common platforms like MetaTrader.

FunderPro is a powerful OneFunded substitute that stands out for daily reward requests and swift issuance (sometimes in a matter of hours) to assist traders in rapidly compounding profits.

RebelsFunding Features, Pros & Cons

Features

- Instant & staged assessments

- Profit share ~90%

- MetaTrader compatibility

- Immediate payouts

- Risk management rules

Pros

- Flexible funding options

- Payouts can be done quickly

- Good platform options

- Easy to understand rules

- Good for beginners

Cons

- Smaller brand presence

- Fewer options

- Rules can change

- Fewer larger funding options

- Support can be slow

8. TradeDay

TradeDay strives to offer structured funding and training possibilities, although its official material focuses more on community, mentoring, and trader assistance than on specific public payment measures.

Before enrolling in supported programs, traders usually receive education and desk guidance to grow, and specific profit splits and platform information are less obvious on the homepage.

Smart Prop Trader is a useful OneFunded alternative because of its mentorship focus. It provides traders with actionable funded paths with defined payout cycles by offering explicit profit share structures and challenge paths across popular platforms like MT4/MT5.

TradeDay Features, Pros & Cons

Features

- Trader mentoring focus

- Structured programs

- Community support

- Standard platform access

- Funding opportunities

Pros

- Excellent training resources

- Great community support

- Great learning environment

- Real trader mentoring

- Helpful for beginners

Cons

- Less transparent on payout splits

- Funding details often unclear

- Platforms vary

- Not ideal for advanced traders

- Fewer direct funded accounts

9. FunderPro

With configurable financed challenges, a profit share of up to 90%, and special daily prizes that allow traders to request dividends after they have earned more than 1% of their initial account value, FunderPro empowers traders.

Depending on the type of account, traders can request incentives every two weeks, and award issuance is usually fairly quick (usually within eight hours).

TradeLocker and other popular interfaces with leverage up to 1:100 are among the supported platforms. E8 Markets, which provides on-demand payouts and a variety of platform alternatives across major asset classes, is a good OneFunded substitute.

FunderPro Features, Pros & Cons

Features

- Daily reward payouts possible

- Profit splits up to ~90%

- TradeLocker & MT support

- Scalable accounts

- Transparent rules

Pros

- Fast reward processing

- Competitive profit share

- Clear payout terms

- Modern platform options

- Good for active traders

Cons

- Daily payout may tempt over-trading

- Platform options limited vs FTMO

- Fees for some programs

- Rules strict for big accounts

- Newer brand

10. The5%ers

With structured evaluation programs like Bootcamp and High Stakes, The5%ers is an established prop business that focuses on risk management and scalable capital growth. Payouts are normally made every 7–14 days after conditions are met, and profit shares begin lower but can climb up to 100%.

The company enables swing trading and longer-term methods with less time constraint, and traders use the MetaTrader 5 and Match-Trader platforms. FTMO is a powerful OneFunded substitute that provides widespread platform support and well-established worldwide recognition, making it perfect for trading across asset markets.

The5%ers Features, Pros & Cons

Features

- Long-term growth focus

- Up to 100% profit share

- MT5/Match-Trader support

- Weekly/bi-weekly payouts

- Risk-first approach

Pros

- Excellent for swing traders

- High profit share potential

- Longer trade holding allowed

- Supportive risk mindset

- Scaling programs

Cons

- Payouts slower vs daily options

- Evaluations still required

- Limited platform variety

- May suit fewer active scalpers

- Scaling criteria strict

Comparison Table

| Prop Firm | Profit Split | Evaluation Type | Supported Platforms | Payout Frequency | Best For |

|---|---|---|---|---|---|

| FTMO | 80–90% | Two-step challenge | MT4, MT5, cTrader, DXtrade | On demand / bi-weekly | Traders wanting reputable, structured programs |

| BluFX | Varies (subscription model) | Subscription (no challenge) | MT4, MT5 | Monthly / on profit | Subscription-based traders |

| E8 Funding | 80–100% | 1–3 step challenges | MT4, cTrader, MatchTrader | On demand | Flexible challenge paths |

| Funded Trading Plus | Up to 100% | One-step, Instant | MT5, cTrader, DXtrade | Weekly / instant | Fast funding & payouts |

| Funding Pips | Up to 100% | One / two step | MT5, cTrader, MatchTrader | Weekly / bi-weekly | Low-cost challenges |

| Smart Prop Trader | ~~80% | Multi-level challenge | MT4, MT5 | Bi-weekly | Beginner-friendly programs |

| RebelsFunding | ~80–90% | Instant / staged | MetaTrader | On demand | Flexible evaluation choices |

| TradeDay | N/A/Varies | Training + funded pathways | Varies | N/A/Varies | Traders needing mentorship |

| FunderPro | Up to ~90% | Challenge with daily rewards | TradeLocker, MT | Daily / bi-weekly | Frequent payouts & active traders |

| The5%ers | Up to 100% | Bootcamp / high stakes | MT5, MatchTrader | Weekly / bi-weekly | Long-term & swing traders |

Conclusion

Your trading style, payout expectations, and preferred platform will determine which OneFunded option is right for you. For traders looking for dependability, stringent risk management, and international repute, FTMO stands out.

For individuals seeking quick funding, flexible regulations, and faster profit payments, Funded Trading Plus and FunderPro are the best options. Traders that like various challenge alternatives with scalable profit splits might benefit from E8 Funding and Funding Pips.

The5%ers is still a great option for disciplined trading and long-term growth, while TradeDay and BluFX serve niche and subscription-based traders. All things considered, these OneFunded options provide a variety of funding schemes, competitive payouts, and cutting-edge trading platforms, enabling traders to select the most effective route to successful funded trading.

FAQ

Funding Pips and E8 Funding are beginner-friendly with lower-cost evaluation paths, flexible rules, and scalable accounts. Smart Prop Trader also provides supportive structures for new traders.

Most top alternatives support MetaTrader 4/5. Others like E8 Funding and FunderPro also include cTrader, TradeLocker, MatchTrader, and additional execution systems for broader asset access.

Many alternatives offer up to 90–100% profit share when traders meet targets. Firms like Funded Trading Plus, The5%ers, and Funding Pips are known for high-end profit splits.

Top alternatives include FTMO, Funded Trading Plus, FunderPro, E8 Funding, Funding Pips, The5%ers, BluFX, Smart Prop Trader, and TradeDay. Each firm has different evaluation processes, profit shares, and platform support to suit various trader styles.

Evaluate your trading style, risk preferences, payout frequency, supported platforms, and fee structure. For steady growth and reputation, FTMO is strong. For speed and flexible payouts, consider FunderPro or Funded Trading Plus.