What Is Crypto Airdrop?

A cryptocurrency airdrop is a marketing method used by cryptocurrency projects to deliver free tokens or coins to a large number of wallet addresses, typically to promote their project, get attention, and establish a community. The name “airdrop” refers to the idea of “dropping” or distributing these tokens to a large audience, similar to an aircraft delivering supplies to people in need.

Airdrops entail the distribution of tokens or coins at no cost to the recipients. These tokens may have real worth, however they are normally distributed in limited quantities. Airdrops are frequently used as a promotional technique to raise awareness about a new cryptocurrency project or to reward existing platform supporters and users.

By releasing tokens to a wide spectrum of people who may be interested in the project, airdrops can help establish a community of users and supporters around a project. To qualify for an airdrop, users may be required to hold a specified amount of a specific cryptocurrency in a specific wallet, join up for a project’s newsletter, or complete other tasks.

What Is Apricot Finance Airdrop?

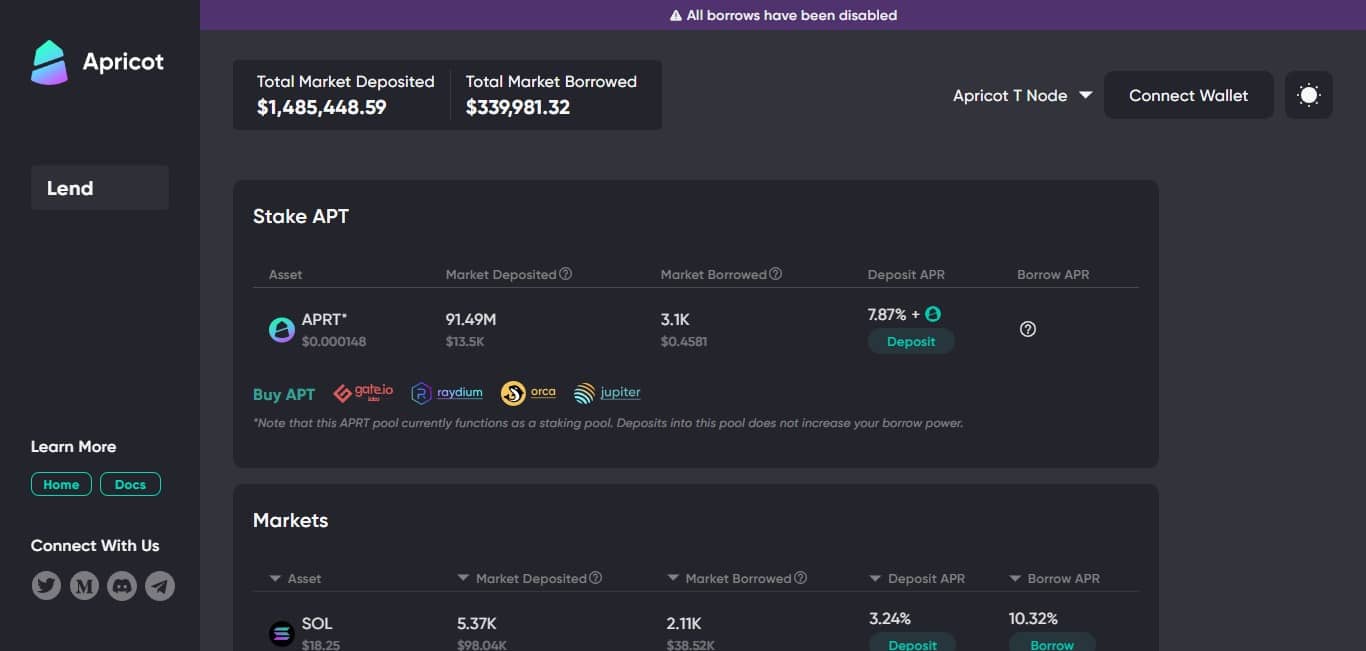

Apricot Finance is a next-gen lending protocol that supports leveraged yield farming on Solana. Its mission is to help users maximize yield while protecting their downsides. It provides standard lending and borrowing services: users deposit assets to earn interests and use their deposited assets as collateral to borrow other assets.

Apricot Finance has announced that they will be airdropping their APR token to early users of the platform. Users that lend or borrow on their platform will make you eligible for the airdrop. The rewards will be distributed after TGE.

Basic Apricot Finance Airdrop Points

| Basic | Details |

|---|---|

| Token Name | Apricot Finance Airdrop |

| Platform | Solana |

| Support | 24/7 |

| Total value | N/A |

| KYC | KYC Is Not Requirement |

| Whitepaper | Click Here To View |

| Max. Participants | Unlimited |

| Collect Airdrop | Click Here To Collect Free Airdrop |

How To Claim Apricot Finance Airdrop Step-by-Step Guide:

- Visit the Apricot Finance dashboard.

- Connect your Solana wallet.

- Now lend or borrow or provide liquidity on the platform.

- Also try to bridge UST from Terra to Solana using Wormhole and deposit UST to Apricot.

- Apricot has already announced that they will be airdropping their APR token to early mainnet users.

How To Check Apricot Finance Airdrop Is Real Or Fake

Checking the legitimacy of a crypto airdrop can be a bit tricky, as scammers often use sophisticated techniques to create fraudulent airdrop campaigns that appear to be legitimate. Here are some steps you can take to verify the authenticity of a crypto airdrop:

- Examine the following official channels: Begin by visiting Apricot Finance’s official website as well as its social media outlets (Twitter, Telegram, Discord, and so on). Watch for announcements or blog postings on the airdrop. Legitimate projects frequently use official means to disseminate information regarding airdrops.

- Verify Information: Make certain that the information you have corresponds to the official announcements. Take note of the dates, terms, and any participation requirements. Scammers frequently use identical names or logos to trick users, so double-check the information.

- Unsolicited Messages: Be wary of unsolicited messages, particularly those requesting personal information, private keys, or money. Legitimate airdrops normally do not necessitate the sending of cryptocurrencies or the provision of sensitive information up front.

- Investigate the Team: Look into the Apricot Finance team’s background. Examine their LinkedIn profiles, GitHub contributions, and other reliable sources. Scammers frequently operate anonymously or under false names.

- Verify the Contract Address: If the airdrop involves sending or receiving tokens, make sure the contract address is correct. Please use the official contract address given by Apricot Finance. Scammers may establish bogus websites with bogus contract addresses.

- In summary, it’s important to conduct thorough research, verify the source and instructions, look for feedback from other users, and trust your instincts when evaluating the legitimacy of a crypto airdrop. By taking these steps, you can minimize the risk of falling for a fraudulent airdrop and protect your assets and personal information.

What are the risks of participating in an airdrop?

Airdrop frauds are common in the bitcoin world. Fraudsters may set up bogus airdrop campaigns in order to obtain personal information such as private keys or wallet addresses, thereby jeopardizing your security.

Scammers may set up websites or social media profiles that look exactly like authentic airdrop notifications. They have the ability to dupe you into supplying sensitive information or downloading hazardous software.

Apricot Finance Airdrop Pros Or Cons

Pros of participating in an airdrop:

- High Yield Opportunities: Apricot Finance provides leveraged yield farming, allowing users to potentially earn larger yields than standard loan and borrowing platforms.

- Risk Mitigation: The platform’s purpose to safeguard users from negative outcomes suggests an emphasis on risk management. This may appeal to users who are concerned about the volatility and danger connected with DeFi platforms.

- Incentives for Airdrop: The distribution of APR tokens to early users provides an incentive for involvement and interaction with the network. As these tokens gain value, users may benefit from them.

Cons of participating in an airdrop:

- High Risk: Leveraged yield farming is inherently dangerous, with huge losses possible if the market goes against users. Users should proceed with caution and only join if they are completely aware of the hazards involved.

- Uncertain Token Value: While the APR token airdrop is a tempting inducement, the future value of these tokens is unknown and subject to market swings. The airdrop may not provide significant benefit to users.

- Lack of Regulation: Decentralized finance (DeFi) networks frequently operate in a regulatory gray area, exposing users to legal and security issues.

Apricot Finance Airdrop Final Verdicts

Finally, Apricot Finance is a promising new development in the decentralized finance (DeFi) arena, notably on the Solana blockchain. Apricot Finance has set out to fulfill the dual objectives of boosting income and protecting its users from potential drawbacks by focusing on next-generation lending methods.

Apricot Finance’s support for leveraged yield farming is one of its core features, allowing customers to maximize their profits on their cryptocurrency investments. This innovation is consistent with the broader DeFi trend of pushing yield generating boundaries while preserving risk management.