This article focuses on the Best Aggregators for Bridging Short-Term trades. I will assess platforms based on the speed, security, and cost-effectiveness of their cross-chain transfers.

These routes, fees, and slippage are optimized, which makes them great for trades that need to be executed quickly. I will help you understand these top aggregators, which will help improve your short-term trading, no matter your experience level.

What is Bridging Aggregators?

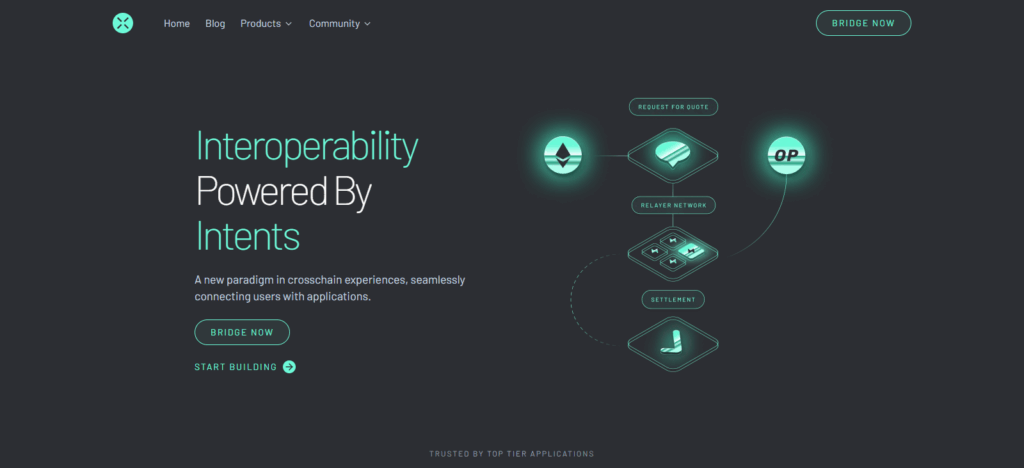

Bridging aggregators are specialized platforms linking disparate blockchains together to enable users to transfer assets easily across different networks.

These aggregators significantly improve the efficiency of cross-chain transfers by looking for the quickest, cheapest, and safest transaction routes across various bridges, mitigating the risks of transaction failures, lowering costs, and enhancing liquidity.

Optimum liquidity seamless movement and positioning of assets across several blockchains are vital for traders and users in the DeFi space. Bridging aggregators provide reliable and efficient tools for these users.

Why Use Aggregators for Bridging Short-Term

Cost Efficiency: Aggregators track and pick the cheapest crossing fees for multiple bridges to minimize the cost for quick trades.

Time Efficiency: Aggregators pick the fastest available bridges so you can take the short-term trades without delays.

Lowered Risk: Aggregators evaluate multiple bridges, thus lowering the chances of a transaction failing or getting stuck.

Access to Liquidity: Aggregators utilize cross-beam liquid platforms that make transferring large or volatile trades easier.

Simplicity: The user can handle cross-chain transfers through one aggregation interface as opposed to running different bridges.

Key Point & Best Aggregators for Bridging Short-Term List

| Aggregator | Key Point / Unique Feature |

|---|---|

| Rango Exchange | Multi-chain support with fast and low-fee bridging solutions. |

| Squid Router | Optimizes cross-chain routes to ensure minimal slippage and quick transfers. |

| XY Finance | Combines DEX and bridge aggregation for seamless asset swaps across chains. |

| ChainHop | Focused on instant cross-chain transfers with high liquidity availability. |

| Orbiter Finance | Efficient and secure bridging with support for multiple token types. |

| OpenOcean | Aggregates DEXs and bridges to provide best rates for trades and transfers. |

| Router Protocol | Uses smart routing to reduce gas fees and improve cross-chain transaction speed. |

| deBridge | Offers cross-chain interoperability with decentralized governance and high security. |

| ChainPort | Supports token migration and bridging across multiple networks easily. |

| Across Protocol | Provides fast, low-cost bridging with a focus on secure liquidity pools. |

1. Rango Exchange

Rango Exchange is among the best aggregators for bridging short-term trades due to its outstanding speed, efficiency, and multi-chain support.

Built for traders who want to transfer assets quickly, Rango employs simultaneous searches for multiple bridges to pinpoint the fastest and lowest cost option, reducing fees and time.

Its intelligent routing minimizes slippage and maximizes liquidity, facilitating effortless large transfers. Also, Rango’s intuitive design enables trading to perform cross-chain transactions in a few clicks with no manual comparison of bridges required.

This unique fusion of speed, dependability, and ease makes it perfect for short-term trading purposes.

| Feature | Details |

|---|---|

| Platform Name | Rango Exchange |

| Use Case | Bridging short-term trades across multiple blockchains |

| KYC Requirement | Minimal or no KYC required |

| Supported Chains | Multi-chain support including Ethereum, BSC, Polygon, and more |

| Transaction Speed | Fast execution with optimized routing |

| Fees | Low bridging fees, dynamically selected for efficiency |

| Liquidity | Access to high liquidity across integrated bridges |

| User Interface | Simple and intuitive for quick asset transfers |

| Security | Reliable with secure cross-chain protocols |

| Unique Advantage | Combines speed, low cost, and minimal KYC for short-term traders |

2. Squid Router

Squid Router stands out as the primary aggregator for bridging short-term trades with exceptional efficiency and optimized cross-chain routing.

It swiftly and accurately traverses various blockchain networks and determines the quickest and most economical routes, allowing traders to conduct fast trades and minimize costs.

It employs algorithms that enhance dependability by lowering slippage and delays, ensuring fast and precise transactions, even in the most unstable market periods.

Supporting a diverse selection of chains and tokens, Squid Router broadens the market of transferable assets.

Complex cross-chain routings are simplified by real-time data and an easy-to-use system, designed for fast and precise short-term trading, in which traders value speed, safety, and accuracy.

| Feature | Details |

|---|---|

| Platform Name | Squid Router |

| Use Case | Optimized cross-chain bridging for short-term trades |

| KYC Requirement | Minimal or no KYC required |

| Supported Chains | Multi-chain support including Ethereum, BSC, Polygon, Avalanche |

| Transaction Speed | Fast execution with smart routing |

| Fees | Low and optimized fees for short-term transfers |

| Liquidity | Access to high liquidity for smooth asset movement |

| User Interface | Intuitive and easy to navigate |

| Security | Secure bridging protocols to protect transactions |

| Unique Advantage | Dynamic route optimization ensures speed and minimal slippage |

3. XY Finance

XY Finance is an industry leader in bridging short-term trades. It has decentralized exchanges (DEX) and unmanaged cross-chain transfers.

Its liability is the smart aggregation of multiple liquidity sources and bridges to track the quickest and cheapest pathways. The system’s efficiency captures no slippage, instant execution, and low fees.

XY Finance short-term trading strategies offer flexibility and efficiency in net management with their broad spectrum of networks and tokens.

XY Finance real-time analytics and transaction processing was the reason for XY Finance’s adoption by traders. It clean and minimal interface for confident and efficient cross-chain trading distinguishes XY stakeholders.

| Feature | Details |

|---|---|

| Platform Name | XY Finance |

| Use Case | Fast and efficient cross-chain bridging for short-term trades |

| KYC Requirement | Minimal or no KYC required |

| Supported Chains | Multi-chain support including Ethereum, BSC, Polygon, Avalanche |

| Transaction Speed | Quick execution with smart aggregation of bridges |

| Fees | Low fees optimized for short-term trades |

| Liquidity | Access to deep liquidity pools across multiple chains |

| User Interface | Simple and user-friendly for seamless transfers |

| Security | Robust protocols to ensure safe cross-chain transactions |

| Unique Advantage | Combines DEX aggregation with bridging for fast, efficient transfers |

4. ChainHop

ChainHop is an aggregator that is bridging short-term trades in the most efficient manner. One of the primary reasons that are most traders interested in this aggregator is because of its speed, trustworthiness, and capable of liquidity management.

The instant access to most cost-effective cross chain options minimize transaction fees and provides quick execution for the transition.

Supports a wide range blockchains and versatile tokens which means a lot of different casing trading patterns can be implemented.

The sophisticated routing techniques will make sure that slippage and failed transactions are minimized.

The real-time transaction monitoring system and the overall outstanding user experience will make sure that cross-chain transfers will be minimized. All of the stated features of ChainHop make it a outstanding choice for short-term trading.

| Feature | Details |

|---|---|

| Platform Name | ChainHop |

| Use Case | Fast and reliable cross-chain bridging for short-term trades |

| KYC Requirement | Minimal or no KYC required |

| Supported Chains | Multi-chain support including Ethereum, BSC, Polygon, Avalanche |

| Transaction Speed | Instant execution with optimized routing |

| Fees | Low fees for time-sensitive transfers |

| Liquidity | High liquidity across integrated bridges |

| User Interface | Simple and intuitive for efficient use |

| Security | Secure protocols to prevent failed or stuck transactions |

| Unique Advantage | Focused on speed and reliability, ideal for short-term trading |

5. Orbiter Finance

The best bridge short-term trades aggregators is Orbiter Finance includes efficient cross-chain transfers that are fast and dependable.

A special highlight is the ability to choose the shortest and most affordable cross-bridge options for any trades, that are also low in slippage.

A large selection of blockchain networks and tokens is available for trading, while Orbiter Finance robust emphatic security systems engineered for rapid transfers in high frequency trading are built for high dependability as high frequency trading is high constant.

Orbiter Finance adheres to the best emphatic systems allowing rapid high frequency short trades in high safety and high dependability on the trading.

| Feature | Details |

|---|---|

| Platform Name | Orbiter Finance |

| Use Case | Fast and efficient cross-chain bridging for short-term trades |

| KYC Requirement | Minimal or no KYC required |

| Supported Chains | Multi-chain support including Ethereum, BSC, Polygon, Avalanche |

| Transaction Speed | Quick execution with dynamic routing |

| Fees | Low fees optimized for short-term transfers |

| Liquidity | Access to high liquidity across supported bridges |

| User Interface | Intuitive and user-friendly |

| Security | Secure protocols to protect assets during transfers |

| Unique Advantage | Dynamic route optimization ensures minimal slippage and fast transfers |

6. OpenOcean

OpenOcean is at the top when it comes to bridging short-term trades with its integrated solution for trading and cross-chain transfers.

It is able to efficiently cross aggregate several DEXs and bridges in order to determine the most optimal and lowest cost pathways, thus minimizing costs and slippage for time-sensitive trades.

OpenOcean operates across several chains and tokens, thus providing traders with plenty of options to deep liquidity.

For volatile markets, the combination of an EasyToUse interface and real-time data streamlines execution. OpenOcean covers the three most important criteria for traders that execute short-term high-frequency strategies: speed, efficiency, and reliability.

| Feature | Details |

|---|---|

| Platform Name | OpenOcean |

| Use Case | Efficient cross-chain bridging and DEX aggregation for short-term trades |

| KYC Requirement | Minimal or no KYC required |

| Supported Chains | Multi-chain support including Ethereum, BSC, Polygon, Avalanche |

| Transaction Speed | Fast execution with optimized routing |

| Fees | Low fees, optimized for short-term transfers |

| Liquidity | Access to deep liquidity across multiple DEXs and bridges |

| User Interface | Simple, intuitive, and user-friendly |

| Security | Robust protocols to ensure safe transactions |

| Unique Advantage | Combines DEX aggregation with bridging for cost-effective, fast transfers |

7. Router Protocol

Router Protocol offers bridging short-term trades unique efficiency and security spanning multiple blockchains. Its unique distinction is having smart routing technology that identifies and picks the most time-efficient and economical routes for moving assets, decreasing costs and slippage in the process.

Router Protocol supports numerous tokens and chains, providing enough freedom and deep liquidity for high-frequency trading. Its resilient architecture allows for hassle-free cross-chain execution, even under stress, while the sophisticated design enables users to visualize and control activities in the system.

The combination of these features, instantaneity, reliability, comfort, and seamless execution of tasks is Router Protocol’s core value proposition for short-term trading.

| Feature | Details |

|---|---|

| Platform Name | Router Protocol |

| Use Case | Fast and secure cross-chain bridging for short-term trades |

| KYC Requirement | Minimal or no KYC required |

| Supported Chains | Multi-chain support including Ethereum, BSC, Polygon, Avalanche |

| Transaction Speed | Quick execution with smart routing |

| Fees | Low fees optimized for time-sensitive transfers |

| Liquidity | High liquidity across integrated bridges |

| User Interface | Intuitive and easy-to-use |

| Security | Robust protocols to ensure safe transactions |

| Unique Advantage | Smart routing technology reduces slippage and improves transfer speed |

8. deBridge

deBridge excels as an aggregator for short-term trade bridging because of its emphasis on security, speed, and cross-chain interoperability.

Connecting disparate blockchain networks is perhaps deBridge’s most impressive feat, which is done through a secure and decentralized structure providing quick, dependable transfer of assets.

Cutting costs for short trades is critical, so deBridge’s route optimization for low transaction costs and slippage is a game changer.

The diverse range of blockchain networks and tokens available means abundant liquidity. The deBridge platform’s intuitive design allows for quick and safe short-term trading, providing impressive transaction speed and transparency at every step of the way.

| Feature | Details |

|---|---|

| Platform Name | deBridge |

| Use Case | Secure and fast cross-chain bridging for short-term trades |

| KYC Requirement | Minimal or no KYC required |

| Supported Chains | Multi-chain support including Ethereum, BSC, Polygon, Avalanche |

| Transaction Speed | Fast execution with optimized routing |

| Fees | Low fees suitable for quick trades |

| Liquidity | High liquidity across integrated bridges |

| User Interface | Simple and intuitive for seamless transfers |

| Security | Decentralized protocols with strong security measures |

| Unique Advantage | Combines speed, security, and minimal KYC for efficient short-term trades |

9. ChainPort

ChainPort is a leading short-term trade bridge aggregator, quickly and efficiently executing cost-effective cross-chain transfers.

It specializes in short-term trading by allowing cross-chain transfers and token migrations over a number of blockchains, all at minimal fees and delays.

ChainPort’s sophisticated routing determines the most efficient and cost-effective route for each trade, guaranteeing minimal slippage and maximum liquidity. It is compatible with a large number of tokens and blockchains, so it is flexible and efficient.

Its sophisticated design allows for real-time trade monitoring and execution, ideal for short-term traders. These features have made it a preferred aggregator for short-term traders.

| Feature | Details |

|---|---|

| Platform Name | ChainPort |

| Use Case | Fast and reliable cross-chain bridging for short-term trades |

| KYC Requirement | Minimal or no KYC required |

| Supported Chains | Multi-chain support including Ethereum, BSC, Polygon, Avalanche |

| Transaction Speed | Quick execution with optimized routing |

| Fees | Low fees optimized for time-sensitive transfers |

| Liquidity | Access to high liquidity across supported bridges |

| User Interface | Intuitive and easy-to-use |

| Security | Secure protocols to prevent failed or stuck transactions |

| Unique Advantage | Focused on seamless token migration with minimal KYC |

10. Across Protocol

Across Protocol prioritizes bridging short-term trades through efficient, safe, and economical cross-chain transfers. Here, bridging time sensitive trades offers fast, hassle-free, safe and economical cross-chain transfers.

Optimized liquidity pools plus intelligent routing help maintain minimal fees and slippage during fast transaction and time sensitive trades.

It offers deep liquidity and offers flexible and broad asset transfers through its various supported chains. Its user-friendly design coupled with fund transfers security allows for simplified monitoring of cross-chain transfers and real-time transaction tracking.

The reliable efficiency and overall speed of service provided establishes Across Protocol as a reliable option for short-term trading.

| Feature | Details |

|---|---|

| Platform Name | Across Protocol |

| Use Case | Fast and secure cross-chain bridging for short-term trades |

| KYC Requirement | Minimal or no KYC required |

| Supported Chains | Multi-chain support including Ethereum, BSC, Polygon, Avalanche |

| Transaction Speed | Quick execution with optimized routing |

| Fees | Low fees suitable for short-term transfers |

| Liquidity | High liquidity across supported bridges |

| User Interface | Simple and intuitive for easy use |

| Security | Robust protocols to ensure safe and reliable transfers |

| Unique Advantage | Combines speed, low cost, and minimal KYC for efficient short-term trades |

Pros & Cons Aggregators for Bridging Short-Term

Pros:

- Fast Execution: Aggregators find the quickest routes for time-sensitive trades.

- Cost Efficiency: Automatically selects bridges with the lowest fees.

- Reduced Slippage: Optimized routing lessens the price impact when transfers are made.

- High Liquidity Access: Connects to multiple bridges to facilitate the transfer of large amounts.

- Convenience: Single platform to manage cross-chain transactions without the need to check multiple bridges.

- Minimal KYC Options: Many aggregators allow fast transfers without going through KYC checks.

Cons:

- Platform Risk: Centralized and poor quality aggregators may remain unprotected from breaches.

- Network Congestion: Major traffic on certain chains can cause delay.

- Limited Token Support: Some aggregators may not provide support on all tokens or chains.

- Fees Can Vary: Due to price volatility, fees can still be higher from designed optimal routes.

- Learning Curve: Beginners may find it difficult to use the interface for cross-chain bridging.

Conclusion

To conclude, top aggregators for bridging short-term trades prioritize speed, efficiency, and flexibility within and across various blockchain networks.

These platforms optimize route efficiency while minimizing fees and slippage, creating reliable and frictionless cross-chain transfers. Rango Exchange, Squid Router, XY Finance, and other enterprises bring liquidity and low KYC restrictions within easy reach, and their intuitive platforms facilitate time-critical trades.

The best solutions available for traders who need rapid, inexpensive, and safe options use these aggregators to move resources swiftly and dynamically, Streamlining short-term trades and decision-making.

FAQ

Aggregators optimize speed, reduce fees, minimize slippage, and provide high liquidity, making them ideal for time-sensitive, short-term trading strategies.

Many top aggregators, like Rango Exchange and Squid Router, require minimal or no KYC, allowing quick access to cross-chain transfers.

Reputable aggregators use secure protocols and audit measures to protect funds, but users should always verify platform credibility and avoid unsupported tokens.

Some of the top options include Rango Exchange, Squid Router, XY Finance, ChainHop, Orbiter Finance, OpenOcean, Router Protocol, deBridge, ChainPort, and Across Protocol.