This article will look at some of the best copy-trading exchange alternatives. Copy-trading exchange allows the active replication of trades by unskilled users.

Hence the unskilled users and the active traders can take advantage of the same platform.

There is support for multiple assets which offers users a variety of options to choose while allowing users to save hours of valuable time while trading. Users can understand market dynamics while effectively minimizing trading risks.

What is Copy-Trading Exchang?

Copy-trading exchanges are platforms for trading cryptocurrency or other financial instruments which let users automate the copy-and-paste function of the trades of the most established traders on the platform.

For novice traders or traders with less experience, Copy-trading offers the opportunity to tactically follow the trades of the most successful traders in real time and save time on completing the learning process, all while increasing the profitability of the trade.

Since professional traders are the ones initiating the trade, users won’t have to be involved in the trade decision-making process.

Copy-trading exchanges also have various risk management mechanisms which are further enhanced by customizable settings for the amount to be invested or the risk to be taken. This makes it even more user friendly for newcomers.

Why Use Copy-Trading Exchange Alternatives

Learn from Seasoned Traders: Users are able to follow the strategies of successful traders and either replicate them or adapt them for their own success without needing extensive market knowledge.

Less Time-Wasting: Users are able to spend or invest passively without the need for constant market monitoring.

Loss Mitigation: Users will be able to better manage losses with the provided tools and limits, preset investment amounts, and diversified portfolios.

Being There to Observe: Moving and taking losing or unprofitable trades will be less of a problem for people trying to learn the most effective market strategies because they will get to observe.

Having to Option to Adjust: Users have a balance of full automation and personal control due to the ability to select which traders to follow, adjust how much of their investment will be used, and stop copying the trader’s actions at any moment.

Key Point & Best Copy-Trading Exchange Alternatives

| Platform | Key Features |

|---|---|

| eToro | User-friendly interface, social trading network, wide range of assets, strong regulatory compliance. |

| ZuluTrade | Connects traders with investors globally, automated copying, performance ranking of traders. |

| NAGA | Social investing platform, copy trading across stocks, crypto, and forex, beginner-friendly. |

| AvaTrade | Regulated broker, multiple trading platforms, automated copy trading, competitive spreads. |

| FXTM Invest | Copy expert FXTM traders, flexible investment amounts, real-time performance tracking. |

| IC Markets + Myfxbook | Advanced analytics, performance tracking, automated strategy copying, low-latency execution. |

| DupliTrade | Seamless copy trading integration, automated strategies, risk management tools. |

| Zignaly | Crypto-focused copy trading, low fees, bot integration, unlimited trader following. |

| Pionex | Built-in trading bots, automated strategy copying, low trading fees, crypto-focused. |

| Pepperstone | High-speed execution, multiple platforms, social trading via third-party tools, regulated broker. |

1. eToro

eToro is loved as the best copy-trading exchange because of the unique combination of social networking and trading. For new traders and passive investors, eToro is ideal, as it lets you copy the real time strategies of top traders.

You can effectively supervise and manage your investments because of the simple interface, of which the performance feedback is clear, and tools for monitoring and risk management. eToro has many different types of assets, including currencies, stocks, and cryptocurrency, so you can diversify your portfolio.

The system offers social trading networks so you can learn from other traders while earning money, which makes it a one of the most innovative, dependably, and easily copy-trading network.

| Feature | Details |

|---|---|

| Platform Name | eToro |

| Type | Copy-Trading / Social Trading |

| Assets Supported | Stocks, Cryptocurrencies, Forex, ETFs |

| KYC Requirement | Basic KYC verification (ID + proof of residence) |

| User Level | Beginner to Advanced |

| Trade Copying | Automatic copying of top traders in real time |

| Risk Management Tools | Stop-loss, take-profit, portfolio diversification |

| Unique Point | Social trading network with transparent trader performance metrics |

| Platform Access | Web, Mobile App (iOS & Android) |

2. ZuluTrade

ZuluTrade is considered one of the top options for copy-trading because it connects automated traders and investors seamlessly and efficiently. Unlike others, ZuluTrade ranks traders by their performance, which allows users to filter experts based on stats and risk scores.

Investors have the most customizable options for their copy settings–trade size, stop-loss limits, and the ability to choose how much risk is applied to their account by assigning different weightings to multiple traders..

ZuluTrade is versatile, supporting different asset classes such as forex, cryptocurrencies, and commodites. ZuluTrade is reliable due to its automated trade execution and prioritization of platform security. For beginners and seasoned traders, ZuluTrade is an intelligent platform.

| Feature | Details |

|---|---|

| Platform Name | ZuluTrade |

| Type | Copy‑Trading / Signal Provider Marketplace |

| KYC Requirement | Requires government‑ID and address proof for live account verification. |

| Assets Supported | Forex, commodities, indices (varies by connected broker) |

| Trade Copying | Investors can select Traders or “Combos+” portfolios and auto‑copy. |

| Risk Controls | Features like “ZuluGuard™ Capital Protection” to limit drawdowns. |

| Unique Point | Transparent performance ranking of Strategy Providers + configurable copy settings |

| Platform Access | Web interface + integration with supported brokers |

3. NAGA

NAGA is one of the most innovative and integrated copy-trading exchanges because of its unique combination of social networking and trading. It enables users to copy top traders in real time within a variety of markets (cryptocurrencies, stocks, and forex).

The platform communities are built around user-generated insights, and members invite, interact, and learn from watching each other’s trading. In addition to social engagement, automation and multi-asset support,

NAGA boasts unique versatility within the platform offered by advanced and custom options in real-time risk control, transparent performance metrics, and risk safe trading. All of these social aspects and automation to a versatile platform built around copy trading enhances NAGA’s appeal to copy trading users.

| Feature | Details |

|---|---|

| Platform Name | NAGA |

| Type | Copy‑Trading / Social Investing Platform |

| KYC Requirement | Requires upload of government‑issued ID and Proof of Address (issued within last 6 months). |

| Assets Supported | Stocks, cryptocurrencies, forex, and other financial instruments |

| Trade Copying | Automatic copying of selected traders’ portfolios via social interface |

| Risk Controls | Performance metrics, stop‑loss options, full access to portfolio history |

| Unique Point | Combines social feed of traders + copy‑trading + simplified access |

| Platform Access | Web and mobile apps (iOS & Android) |

4. AvaTrade

AvaTrade is one of the best copy-trading alternatives as it effectively balances adherence to regulations with comprehensive automated trading solutions.

AvaTrade is also distinguished by its effortless integration with various copy trading facilities. Users can copy the trading strategies of professionals in the trading of forex, crypto, commodities, and indices.

For traders’ peace of mind, AvaTrade implements risk management safeguards as well as stop-loss, take-profit, and leverage control systems, which gives the trader authority over their investment and retrieval of their capital.

Additionally, AvaTrade offers MT4 and MT5 which enhances its popularity among traders. The blend of risk management, automation, and diverse trading options confirms that AvaTrade is the best copy trading option.

| Feature | Details |

|---|---|

| Platform Name | AvaTrade |

| Type | Copy‑Trading / Automated Strategy & CFD Broker |

| KYC Requirement | Requires a valid government‑issued ID plus proof of address (issued within last 6 months) for full verification. |

| Assets Supported | Forex, CFDs on commodities, indices, stocks, cryptocurrencies |

| Trade Copying | Supports integration with copy‑trading tools like DupliTrade and ZuluTrade via registered brokers |

| Unique Point | Fully regulated broker with automatic strategy replication and multi‑platform support (MT4/MT5 + proprietary) |

| Platform Access | Web platform, mobile apps (iOS & Android), desktop MT4/MT5 |

5. FXTM Invest

Another of the best copy trading exchange alternatives is FXTM Invest, providing an easy and organized way of tracking expert traders. What sets it apart is in letting you pick from verified strategy managers based on in-depth performance metrics, risk-differentials, and trading records.

This allows investors to understand and choose accordingly. Users can assign any amount to an investment, diversify across multiple traders, and configure their risk, which makes it great in flexibility, and control.

FXTM Invest features real-time trade copying and secure execution across a range of financial instruments, including forex and commodities. For transparency, customization, and dependable automation, FXTM Invest is great for novice and seasoned investors.

| Feature | Details |

|---|---|

| Platform Name | FXTM Invest |

| Type | Copy‑Trading / Strategy‑Manager Marketplace |

| KYC Requirement | Requires colour scan of government‑issued ID + proof of residence (utility bill/bank statement issued within last 3‑6 months) for full verification. |

| Assets Supported | Forex, CFDs, Strategy Manager trades available via the copy‑trading module |

| Trade Copying | Investors select strategy managers and auto‑invest based on set protection levels. |

| Unique Point | Allows investors to set a “Protection Level” (e.g., close all positions if equity falls below threshold) offering controlled risk. |

| Platform Access | Online dashboard “MyFXTM” and account integration for investors and strategy managers |

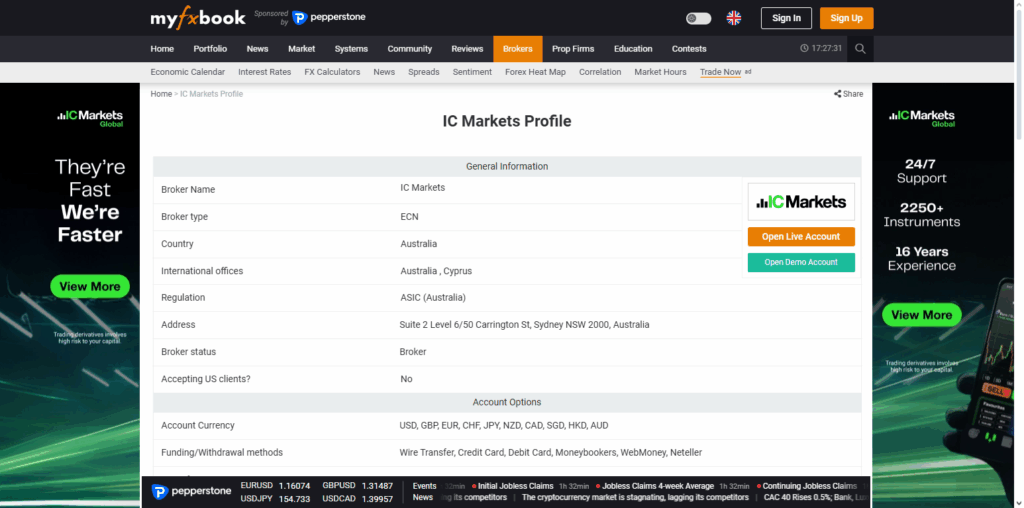

6. IC Markets + Myfxbook

IC Markets paired with Myfxbook stands out among copy-trading exchange alternatives because of its combination of low-latency trading and detailed analytics. Myfxbook enhances transparency by tracking performance, success rates and risk metrics in real time, while IC Markets offers ultra-fast trade execution with tight spreads.

This integration permits investors to automatically copy top-performing strategies after assessing performance and historical drawdowns. Users can switch between a number of traders, define risk parameters and track changes with ease.

The combination of high-quality trading infrastructure and advanced analytical tools offers clients peace of mind and makes Myfxbook + IC Markets a smart choice for copy-trading.

| Feature | Details |

|---|---|

| Platform Name | IC Markets + Myfxbook |

| Type | Copy‑trading / Auto‑trade service (via Myfxbook Autotrade) |

| KYC Requirement | Requires government‑issued ID and proof of residence (dated within last 90–180 days) for account approval. |

| Trade Copying | Use Myfxbook Autotrade to connect your IC Markets account to signal providers; includes risk tolerance settings. |

| Unique Point | Deep integration of IC Markets’ ECN infrastructure with Myfxbook’s transparent signal tracking and auto‑copy capabilities. |

| Platform Access | Supports MetaTrader 4, MetaTrader 5, cTrader via IC Markets; Myfxbook connects for auto‑copy funtionality. |

7. DupliTrade

DupliTrade is one of the leading options in the copy-trading exchange space due to its completely automated and transparent trading system designed for novice and advanced investors alike.

What makes DupliTrade particularly unique is its ability to connect with regulated brokers so customers can copy professional strategy providers’ trades in real time and completely autonomously. DupliTrade focuses on the proactive management of trading risk with custom settings including trade size, customizable stop-loss limits, and trade allocations to multiple traders for risk distribution.

The platform also provides strategy performance metrics and real-time performance-based strategy rankings for customers to construct well-informed trading plans. The blend of automation with persistent security makes DupliTrade particularly unique in the copy-trading space.

| Feature | Details |

|---|---|

| Platform Name | DupliTrade |

| Type | Copy‑Trading / Strategy Provider Marketplace |

| KYC Requirement | Requires signed Limited Power of Attorney (LPOA) and identity verification via broker. |

| Trade Copying | Automated replication of selected strategy providers’ trades in real‑time. |

| Unique Point | Provides thorough strategy auditing for providers (e.g., live tracked history, drawdown limits) and offers transparent performance metrics of the strategies. |

| Platform Access | Linked via compatible regulated brokers (MT4/MT5) for integration with DupliTrade service. |

8. Zignaly

Zignaly is one of the best copy-trading exchange options, especially for cryptocurrency traders, due to its creative combination of automated trading bots with professional signal providers.

The best part is being able to follow several expert traders at the same time while still having complete command over trade sizes, risk thresholds, and the overall composition of your portfolio. Zignaly is partnered with the best crypto exchanges, which leads to quick trade executions and safe management of your funds.

Users receive a complete set of performance metrics, real-time updates, and adaptable subscription options. Zignaly’s combination of automated tactics, advanced analytics, and crypto-centric environment delivers a complete copy-trading solution that is efficient, reliable, and remarkably adaptable for copy traders of any level.

| Feature | Details |

|---|---|

| Platform Name | Zignaly |

| Type | Copy‑Trading / Profit‑Sharing for Crypto Markets |

| KYC Requirement | Simplified onboarding; funds remain in your exchange account (via API) — platform states no subscription fees, only performance‑based charges. |

| Assets Supported | Cryptocurrency pairs, integrated with major exchanges like Binance & KuCoin |

| Trade Copying | Copy expert traders or join pooled accounts where you share profit and follow identical results |

| Unique Point | Performance‑based model — you only pay when profits are made; funds stay in your account, avoiding full custody transfer |

| Platform Access | Web‑based platform; connect your existing exchange account via API to enable copy or pooled strategies |

9. Pionex

Pionex is one of the best alternatives to copy trading exchanges, especially for cryptocurrency hobbyists, due to its automated strategy tools and built-in trading bots. Its distinct advantage is the combination of the automation and copy trading functionalities, where users get to use smart, pre-configured bots that trade non-stop, allowing users to take advantage of opportunities without being present.

Investors can track leading traders and use advance automated strategies at the same time. This allows a trading experience that is adaptive to one’s changing needs. With low trading fees and high security, a variety of crypto pairs, automation, copy trading, and cost effective features, Pionex is a trade automation copy platform that is exceptional at providing automated trading services in the cryptocurrency space.

| Feature | Details |

|---|---|

| Platform Name | Pionex |

| Type | Crypto copy‑trading & automated trading bots |

| KYC Requirement | Two levels: For basic use (Level 1) only country/region + legal full name; full ID + selfie for Level 2. |

| Trade Copying | Supports “CopyBot” function—users can copy bots created by professional/provided traders. |

| Unique Point | Low‑barrier entry: basic account setup with limited KYC suffices for crypto trading & bot use; funds remain in your account, and you opt‑in to bots you follow. |

| Platform Access | Web and mobile (iOS & Android) platform supporting crypto paired trading, bots and strategy copy functions. |

10. Pepperstone

Pepperstone is highly recommended for copy-trading for its fast execution, great trading interfaces, and good adherence to regulations. Its social trading and copy trading functionality is enhanced by third party integrations, notably Myfxbook and DupliTrade, which makes expert strategy replication effortless.

Traders are able to enjoy tight spreads and low latency across several asset classes, including forex, indices, commodities and crypto.

The emphasis on the user’s ability to control and diversify their strategies within copy-trading is a strong feature for risk management. The combination of reliability, technology, and copy-trading functionality makes Pepperstone great for beginners and advanced traders alike.

| Feature | Details |

|---|---|

| Platform Name | Pepperstone |

| Type | Copy‑Trading / Social Trading via third‑party tools + Broker services |

| KYC Requirement | Requires government‑issued photo ID + proof of address (utility bill/bank statement) to open live account. |

| Trade Copying | Supports integration with external copy‑trading / social trading platforms; offers reliable execution infrastructure. |

| Unique Point | Combines deep regulation (multi‑jurisdictional licensing), low latency execution, and strong broker‑side infrastructure — ideal for copying strategies with performance transparency. |

| Platform Access | MetaTrader 4, MetaTrader 5, cTrader via Pepperstone; compatible with social/copy‑trade add‑ons. |

Conclusion

To summarize, all the recommended platforms provide a harmonious mix these days. What makes trading easier for newcomers and even for seasoned investors quite a lot are the levels of automation, transparency, and accessibility.

eToro, ZuluTrade, NAGA, AvaTrade, FXTM Invest, IC Markets + Myfxbook, DupliTrade, Zignaly, Pionex, and Pepperstone are the platforms which provide the most innovative features such as real-time trade copying, active risk management, multi-asset trading, and performance reporting and analytics.

These platforms help users obtain great profits and valuable insights while minimizing risks. Most importantly, the users are the ones controlling their investments while leveling trading with seasoned professionals. The choice of the platform can be based on goals, preferred assets, and risk appetite.

FAQ

A copy-trading exchange is a platform that allows users to automatically replicate the trades of experienced traders in real time, helping beginners or busy investors benefit from professional strategies.

Both beginners and experienced traders can use copy-trading platforms. Beginners gain exposure to professional strategies, while experienced traders can diversify or automate part of their trading.

Most reputable copy-trading platforms are regulated and provide risk management tools, but investors should carefully choose verified traders and manage their investment amounts.