This article focuses on the Best Cross-Border Crypto Remittance Platforms Revolut, PayPal, Stellar, and RippleNet, making international money transfer seamless and quick, using blockchain technology and cryptocurrency, ensuring the transaction is secure and affordable.

These platforms provide cross-border services featuring instant conversion, multi-currency support, and regulatory compliance. These platforms are instant, reliable, cheap, and more seamless than ever.

What is Cross-Border Crypto Remittance Platforms?

Cross-border crypto remittance platforms are modern financial technologies that allow users to send and receive payments across borders utilizing cryptocurrencies. These platforms use blockchain technology to decrease remittance fees and transfer times as opposed to traditional methods which involve multiple intermediaries.

These platforms allow users to change their local fiat currency to their cryptocurrency of choice and back to their currency of choice at the destination of their remittance.

These services integrate with financial institutions and payment processing services to increase the efficiency of international payment services and provide transparency to the end users. This is particularly helpful to migrant workers and international business as well as users from regions with poor banking infrastructures.

Key Point & Best Cross-Border Crypto Remittance Platforms List

| Platform | Key Points / Features |

|---|---|

| Stellar (MoneyGram Access) | Fast cross-border transfers, low fees, integrated with MoneyGram for fiat-to-crypto and remittances. |

| BitPay | Crypto payment gateway for merchants, supports Bitcoin & stablecoins, invoicing, and settlement in local currency. |

| CoinGate | Merchant-focused crypto payments, supports multiple cryptocurrencies, payment buttons, API integration, and POS solutions. |

| B2BinPay | Institutional and merchant crypto payment platform, multi-crypto support, API & wallet management, compliance-ready. |

| PayPal | Supports crypto buying, selling, and payments, easy integration for merchants, limited crypto transfer outside platform. |

| Wise (TransferWise + Crypto) | Low-cost international transfers, crypto-to-fiat options via integration, fast conversion rates, transparent fees. |

| Revolut | Multi-currency account with crypto support, instant crypto purchases & payments, debit card integration. |

| OxaPay | Crypto-to-fiat payment gateway, merchant support, multi-asset wallet, secure transactions. |

| RelayPay | Focus on seamless crypto payments for businesses, supports multiple coins, easy API integration, fast settlements. |

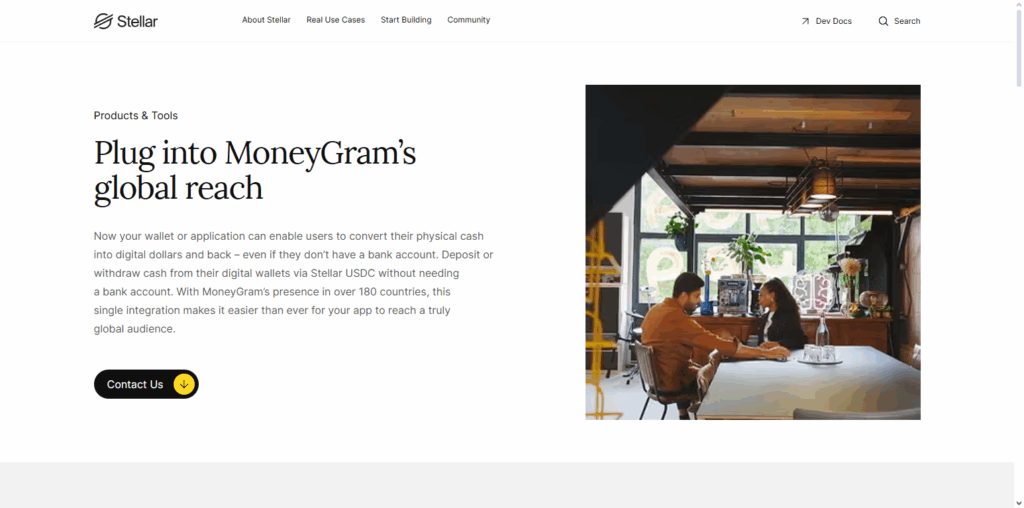

1. Stellar (MoneyGram Access)

Stellar (MoneyGram Access) provides excellent cross-border crypto remittance services due to its speed, low cost, and convenient access. Stellar facilitates near-instant transfers across borders with low fees using blockchain technology.

Stellar is also very good at micropayments. Stellar is very crypto-friendly and partnered with MoneyGram, which helps users change crypto quickly to local fiat money. You can use MoneyGram’s global payout locations.

Stellar also has a decentralized network that is secure and transparent. Because their infrastructure is scalable, they can handle large transaction volumes. Stellar is a great option for people and businesses that need to send money overseas.

| Feature | Details |

|---|---|

| Platform Name | Stellar (MoneyGram Access) |

| Primary Use | Cross-border crypto remittances and international payments |

| Supported Assets | Stellar Lumens (XLM) and fiat currency integration via MoneyGram |

| Speed | Near-instant transfers across borders |

| Transaction Fees | Very low, minimal network fees |

| KYC Requirement | Minimal KYC for small transfers; full KYC for larger amounts |

| Unique Advantage | Partnership with MoneyGram enables seamless crypto-to-fiat conversions and global payout network |

| Security | Blockchain-based transparency, secure transactions, regulatory compliance |

| Best For | Individuals and businesses sending low-cost, fast international remittances |

2. BitPay

BitPay has been providing cross-border crypto remittances since 2015 and is also known for its secure and reliable global transactions now and for its revolutionary digital jobs marketplace. BitPay users (both senders and receivers) can remit, receive, and convert payments to BTC and/or other crypto.

The processors also remit to remitters’ local fiat to mitigate economic exposure and other crypto settlement risks. BitPay’s own compliance and crypto payment processors’ global control of cross-border transactions give BitPay both a strong competitive and regulatory advantage.

The cross-border transactions also possess unique security and transparency features unique in the remittance processor market. BitPay’s unique transparency and security, and global crypto payment network, cross-border remittance opportunity make BitPay the front runner choice.

| Feature | Details |

|---|---|

| Platform Name | BitPay |

| Primary Use | Cross-border crypto payments and merchant remittances |

| Supported Assets | Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), and stablecoins |

| Speed | Fast transactions with optional instant settlement in local fiat |

| Transaction Fees | Low processing fees; optional network fees depending on crypto |

| KYC Requirement | Minimal KYC for small transfers; full verification for higher limits |

| Unique Advantage | Combines merchant invoicing, crypto-to-fiat settlement, and payment tracking in one platform |

| Security | Multi-signature wallets, encrypted transactions, regulatory compliance |

| Best For | Businesses and individuals seeking secure, efficient, and compliant global crypto payments |

3. CoinGate

CoinGate provides excellent technology in the facilitation of cross-border crypto remittances. Users on the platform are on the receiving end of fast, secure, and flexible payment solutions and offerings. CoinGate sophisticated offerings are applicable to both the individual as well as merchant businesses.

The platform offers multiple types of cryptocurrencies and allows users the ability to send and receive money internationally without the delays and high fees. The platform offers proprietary users customizable merchant services including payment buttons, point of sale integration, and application programming interface (API) tools.

This allows customers to convert to and receive instant local currency, making the platform more user friendly. Finally, CoinGate combines great velocity, security, and low cost. It’s perfect for crypto transfers.

| Feature | Details |

|---|---|

| Platform Name | CoinGate |

| Primary Use | Cross-border crypto payments and global remittances |

| Supported Assets | BTC, ETH, USDC, and many other cryptocurrencies |

| Speed | Fast crypto transactions; instant or near-instant conversion to fiat |

| Transaction Fees | Transparent fees; around 1% for conversions |

| KYC Requirement | Simplified KYC for low-volume traders (up to €1,000/month) using ID + selfie via Onfido |

| Unique Advantage | Tiered verification — you can start cross-border payments with minimal identity checks, scaling up compliance only as volume grows |

| Security | Onfido ID verification, encrypted data, AML/KYC compliance |

| Best For | Small to medium users and businesses wanting fast, low-barrier crypto outgoing payments globally |

4. B2BinPay

B2BinPay caters to businesses and institutional clients needing efficient and prompt solutions for cross-border crypto remittance. Supported by various crypto assets, the platform offers cost-effective and instant international transfers while eliminating the hassles associated with traditional remittance.

B2BinPay’s competitive advantage comes from features such as automated conversion to local fiat, seamless international transactions with API integrations, multi-wallet management, and instant crypto transfers with settlement.

B2BinPay is also crypto-transaction compliant with the KYC/AML framework and offers a high degree of transactional security. Speed, advanced features, and integration are key strengths that make the platform stand out in delivering advanced cross-border crypto payment solutions.

| Feature | Details |

|---|---|

| Platform Name | B2BinPay |

| Primary Use | Cross-border crypto payments and remittances for businesses and individuals |

| Supported Assets | 36+ cryptocurrencies including BTC, ETH, XRP, stablecoins |

| Verification Speed / KYC | Quick verification using SumSub, completed in 2–3 minutes for their centralized wallet |

| KYC Requirement | Identity verification via trusted providers; risk-based checks with AML screening |

| Extra Security Checks | Option to enable additional AML provider (Crystal or Chainalysis) for enhanced checks |

| Unique Advantage | Fast wallet onboarding + multi‑crypto support + strong but streamlined compliance |

| Best For | Users needing fast, flexible, and compliant global crypto payments with moderate KYC burden |

5. PayPal

PayPal’s global payment network has integrated the ability to support cross border crypt remittances. The service allows clients to purchase, transact and hold various digital currencies and instantaneously convert to local fiat currencies.

PayPal’s predominant market strength is its highly trusted and recognizable company infrastructure. Unlike competitors which require users to create digital wallets or crypto currency exchanges, PayPal, supports remittances to and from traditional bank accounts. PayPal’s offers security, regulation and transaction encryption.

Their UX is to simple and efficient for business and individual users. All this results in PayPal’s market position as the most favorable segment provider.

| Feature | Details |

|---|---|

| Platform Name | PayPal Cryptocurrencies Hub |

| Primary Use | Cross‑border crypto transfers, P2P payments with crypto |

| Supported Assets | Bitcoin (BTC), Ethereum (ETH), LiteCoin, Bitcoin Cash, and PayPal’s PYUSD stablecoin |

| Speed | Near‑instant transfers within PayPal / Venmo ecosystem; fast on-ramps and off-ramps to fiat |

| Transaction Fees | PayPal applies a spread + transaction fees on crypto buys/sells |

| KYC Requirement | Required: name, address, DOB, taxpayer ID; may also need photo ID, proof of address, and even selfie/biometrics |

| Unique Advantage | Leverages PayPal’s massive global user base + familiar interface; P2P crypto payments via email or PayPal account |

| Security & Compliance | Custodial crypto held via licensed provider (Paxos), full KYC/AML checks, transaction limits, and regulatory compliance |

| Best For | Users who want to send or receive crypto cross-border using a trusted payments provider without switching to a dedicated crypto exchange |

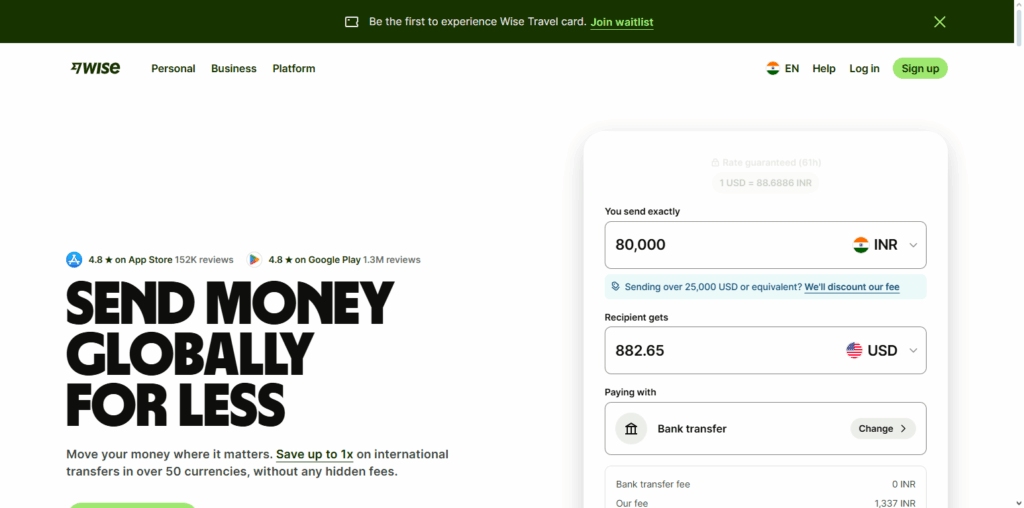

6. Wise (TransferWise + Crypto)

Wise (formerly TransferWise) added crypto features which bolstered it’s already strong reputation for cross-border remittance.

They pioneered the low-cost remittance, transparent pricing model, and fast, inexpensive transfers at the border. Because they incorporate crypto transfers in addition to regular banking transfers, users are able to send money internationally without high banking fees or long processing times.

Wise is the only fintech to offer real exchange rates without the hidden fees, and their service allows for instant crypto to fiat conversions to any user in the world. They are very user friendly and compliant with local laws. They are currently the best option for businesses to send money internationally and trace those funds.

| Feature | Details |

|---|---|

| Platform Name | Wise (TransferWise) |

| Primary Use | Cross‑border money transfers (note: Wise itself doesn’t support sending crypto) |

| Supported Assets | Fiat currencies only (Wise does not support direct crypto transfers) |

| KYC Model | Partner KYC — Wise allows regulated partners to conduct KYC, offloading customer verification. |

| Verification Speed / Difficulty | Standard KYC by Wise or via partners; for many customers, additional verification is not required. |

| Additional Verification | In higher-risk cases (e.g. EU customers), extra documents may be requested, but ~95% don’t need more than initial verification. |

| Unique Advantage | Very seamless integration for businesses — they can rely on existing KYC flow instead of undergoing fresh verification for each user. |

| Best For | Businesses and platforms wanting to embed Wise transfers without enforcing full KYC again on their customers. |

7. Revolut

Revolut has been at the forefront among competitors in the digital banking space and offers instant cross-border cryptocurrency payments among its features. Customers are able to purchase, hold, and send cryptocurrencies which are able to get automatically converted into over 30 different fiat currencies.

The service is streamlined into debit cards and mobile payments which enable users to make payments and send money across to several countries. User data is protected with advanced crypto security, 2FA, and compliance with banking regulations.

Overall, it’s a user friendly service that offers great digital banking, debit card payments, and international money transfers and has the speed and flexibility that is need in a digital service.

| Feature | Details |

|---|---|

| Platform Name | Revolut |

| Primary Use | Cross-border crypto transfers (within Revolut users) & crypto trading |

| Supported Assets | Multiple cryptocurrencies (depends on region) |

| KYC Requirement | Identity verification via ID + selfie, including biometric (facial scan) checks |

| Verification Tools | Uses Jumio for identity + liveness checks |

| Regulatory Compliance | Checks sender/receiver details as per Travel Rule; verifies wallet ownership for high-value crypto transfers |

| Security Features | 2-factor authentication, wealth protection with biometric validation for crypto withdrawals |

| Unique Advantage | Seamless integration of crypto, fiat, and multi-currency accounts in one app with reasonably streamlined KYC |

| Best For | Users who want a unified app for both crypto and traditional finance, with moderate verification burden |

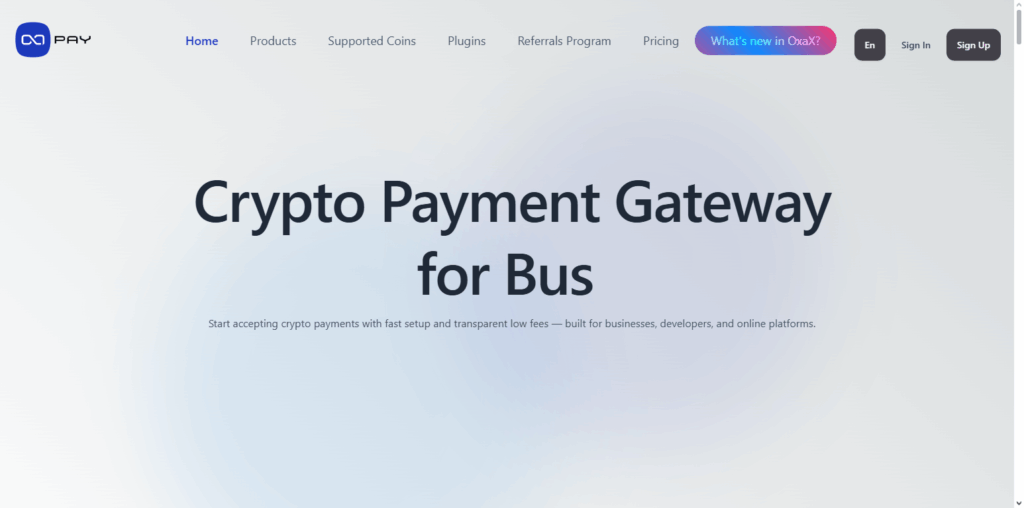

8. OxaPay

OxaPay has real-time cross-border crypto payment capabilities and enables the efficient moving of money around the world at the speed and ease of how money should move around the globe, and how individual and corporate customers should be able to send and receive global money transfers.

Clients are able to transfer bitcoin, bitcoin cash, ether, tether, and other digital currencies, and can instantly convert to and withdraw in their local country’s fiat, thereby removing the delays and volatility risks normally encountered.

Merchant and wallet payment automation services are also offered to clients via the company’s own, highly customizable API. Like all market leaders, OxaPay has market-leading compliance, data security, and advanced technology, safe encrypted and transparent transactions are completed in real-time, and utilize real-time fraud detection and prevention.

OxaPay is the market leader in speed, and balance of price and functionality. Flexibility, reliability, and security strongly reinforce OxaPay is the number one choice in the market for global payments using digital currencies.

| Feature | Details |

|---|---|

| Platform Name | OxaPay |

| Primary Use | Crypto payment gateway for global remittances and merchant payments |

| Supported Assets | Major cryptocurrencies: BTC, ETH, USDT (ERC20/TRC20), USDC, BNB, TON, and more |

| Transaction Fees | Very low — around 0.4% per transaction |

| KYC Requirement | No KYC or KYB required — users (merchants) can onboard with just an email |

| Unique Advantage | Instant setup, full API or “no-code” invoice links, anonymous payments, and auto-conversion to stablecoins to reduce volatility |

| Security | Uses SSL encryption, 2FA, and secure wallet integrations; optional fraud‑detection mechanisms |

| Best For | Businesses and individuals seeking a privacy‑focused, developer-friendly gateway for global crypto payments without identity verification burdens |

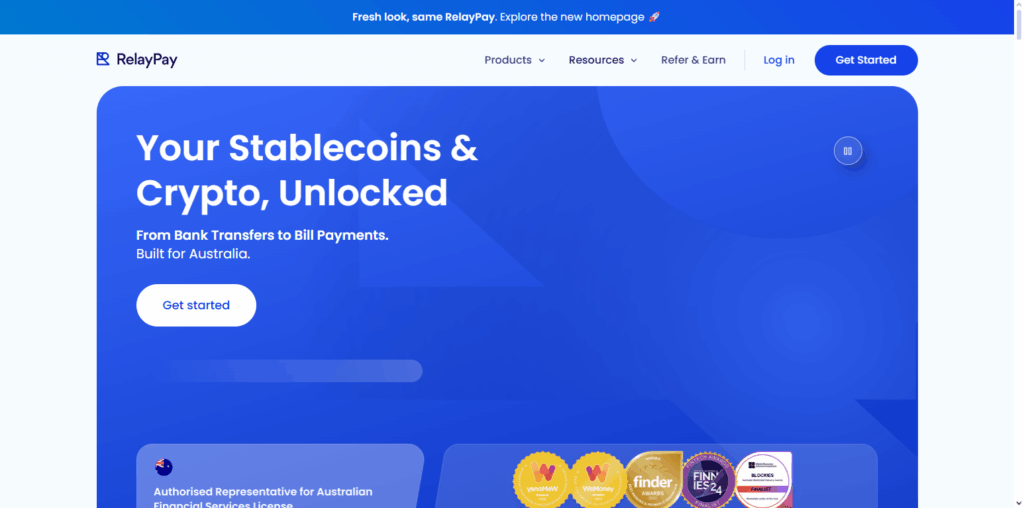

9. RelayPay

RelayPay is one of the top players in providing cross-border crypto remittance service processing and seamless transactions of crypto to local fiat currencies on every international remittance.

RelayPay is the only crypto transaction service that provides real-time conversion and transfers. RelayPay’s transaction processing is the fastest in the industry. RelayPay’s Integration of it’s API is one of it’s biggest competitive advantages.

RelayPay lets it’s customers, financial institutions and merchants automate and manage their global transactions while providing real-time transparency to all the processed transactions.

RelayPay’s KYC, AML and transaction processing protocols guarantee they are one of the safest crypto remittance players today. Overall, RelayPay is the fastest, most accessible and safest crypto remittance service available today.

| Feature | Details |

|---|---|

| Platform Name | RelayPay |

| Primary Use | Cross-border crypto payments; converting crypto to AUD for merchants or individuals |

| Supported Assets | BTC, ETH, USDT, USDC, SOL, XRP, and more |

| Transaction Speed / Cost | Uses Layer-2 networks (like Polygon, Arbitrum, Solana) to reduce network fees; shows rates upfront and locks rate quote for 10 minutes |

| KYC Requirement | Mandatory ID verification for users. RelayPay requires KYC due to AUSTRAC regulation. For merchants, KYB (Know Your Business) verification is required via their dashboard. |

| Regulatory Compliance | Registered with AUSTRAC as a Digital Currency Exchange & Independent Remittance Dealer. |

| Security Features | Fully self-custodial wallet, optionally 2‑step authentication; transaction monitoring via Merkle Science. |

| Unique Advantage | Converts crypto payments to AUD same-day; offers merchant API / checkout link; no chargebacks for merchants. |

| Best For | Australian businesses & users who want to pay or be paid in crypto, but settle in fiat (AUD) without crypto volatility risk. |

Conclusion

To sum up, the leading cross border crypto-remittance platforms including, RippleNet, Stellar (MoneyGram Access), BitPay, CoinGate, B2BinPay, PayPal, Wise, Revolut, OxaPay and RelayPay, are revolutionizing the ease, security, and affordability of international money transfers, Each of these platforms has real-time settlement and low-cost transfers,

seamless conversions of crypto to fiat, high security and accessibility, and they utilize blockchain and crypto assets to eliminate many of the costly inefficiencies of international remittance.

These platforms focus on making international transfers efficient and user friendly through improved transparency and reliability. All of them combined provide a glimpse of the future of international transactions.

FAQ

Cross-border crypto remittance platforms are digital services that allow individuals and businesses to send and receive money internationally using cryptocurrencies. They provide faster, cheaper, and more secure transfers compared to traditional banking systems.

Crypto remittance platforms reduce fees, eliminate delays caused by intermediaries, offer near-instant transfers, and allow conversion between crypto and local currencies seamlessly. They also provide enhanced transparency and tracking of transactions.

Leading platforms include RippleNet (via partners), Stellar (MoneyGram Access), BitPay, CoinGate, B2BinPay, PayPal, Wise, Revolut, OxaPay, and RelayPay. Each offers unique features such as real-time settlement, multi-currency support, API integration, and merchant tools.

Yes, top platforms implement strong encryption, KYC/AML compliance, and fraud protection measures. Most also follow international financial regulations, ensuring that cross-border transactions are safe and legally compliant.