In this article I will analyze the Best Alternatives to Funding Pips. I will analyze the Best Prop Trading Firms that offer… funded accounts, flexible evaluation processes and low KYC.

These Alternatives offer faster funding, better profit shares and diversified access to Forex, commodities and crypto.

They increase possibilities for growth and the amount you can trade for more than Funding Pips. These are great Funding Pips Alternatives for both newbies and experienced traders.

What is FundingPips Alternatives?

Proprietary (prop) trading firms like FundingPips are compared based on the different options they provide. The other firms provide different funding options and a different set of rules and trading conditions.

The other firms provide evaluation programs to get funded accounts. The other firms provide different account sizes, profit shares, protection against losing capital, and different tradable financial instruments.

Alternative ones and FundingPips loosen the KYC formalities, fasten the transaction to the account of the trader, and provide elastic trading conditions. Alternative ones and FundingPips lessen the KYC formalities, fasten the transaction to the account of the trader, and provide elastic trading conditions.

Alternative ones and FundingPips lessen the KYC formalities, fasten the transaction to the account of the trader, and provide elastic trading conditions.

Why Use Best FundingPips Alternatives

More Capital: Get larger funded accounts to trade which means no risk to personal accounts.

More Flexible Trading Rules: Some have looser options on drawdowns, trade sizes, and more markets to choose.

Low KYC: Reduced documentation for faster onboarding on many.

Quick Payouts: Enjoy quicker profit withdrawals than what typical prop firms offer.

Universal Access: Available to traders from many countries including those not fully supported by FundingPips.

Wide Market Trading: Depending on the alternative, trade Forex, stock, crypto, commodities, and energy markets.

Greater Profit Splits: Some have profit-sharing ratios that are better than those of FundingPips.

Flexible Evaluation: Different evaluation programs let traders pick the one that best suits their trading style.

Key Point & Best FundingPips Alternative List

| Prop Firm Name | Key Points / Highlights |

|---|---|

| FunderPro | Fast funding, flexible evaluation, multiple account sizes |

| Funded Trading Plus | High profit splits, minimal KYC, Forex & crypto support |

| FTUK | UK-based, low fees, global trader access |

| Traders With Edge | Advanced risk management, fast payouts, supportive community |

| The Funded Trader | Multiple evaluation options, low drawdown limits, instant funding |

| SurgeTrader | Forex & commodities trading, instant account scaling, transparent rules |

| MyForexFunds (MFFX) | Flexible programs, fast withdrawals, worldwide availability |

| The5ers | Low-risk programs, long-term growth funding, scalable accounts |

| E8 Funding | Global access, multi-market support, fast evaluation completion |

| Lux Trading Firm | Minimal KYC, competitive profit splits, strong trader support |

1. FunderPro

FunderPro distinctively excels as one of the best alternatives to FundingPips because of its prompt funding and adaptable evaluation options for novice and seasoned traders. In contrast to a multitude of prop firms, FunderPro’s provision of varying account sizes lets traders adjust and control the scales of their strategies while risk management is in effect.

FunderPro’s unwavering and discernible policies are too attractive for steady traders because of their minimal charges, reasonable profit statistics, and the division of profit-split ratios.

FunderPro’s backing of numerous markets like Forex, commodities, and even crypto reinforces the multitude of options FunderPro offers its traders. These characteristics are the reason FundingPips clients consider FunderPro a viable alternative.

FunderPro Features

- Fast Funding: Traders get access to capital within days of completing the evaluation programs.

- Flexible Account Sizes: Traders can scale their strategies with the wild choices of account sizes.

- Diverse Markets: Open to trading Forex, commodities, and crypto.

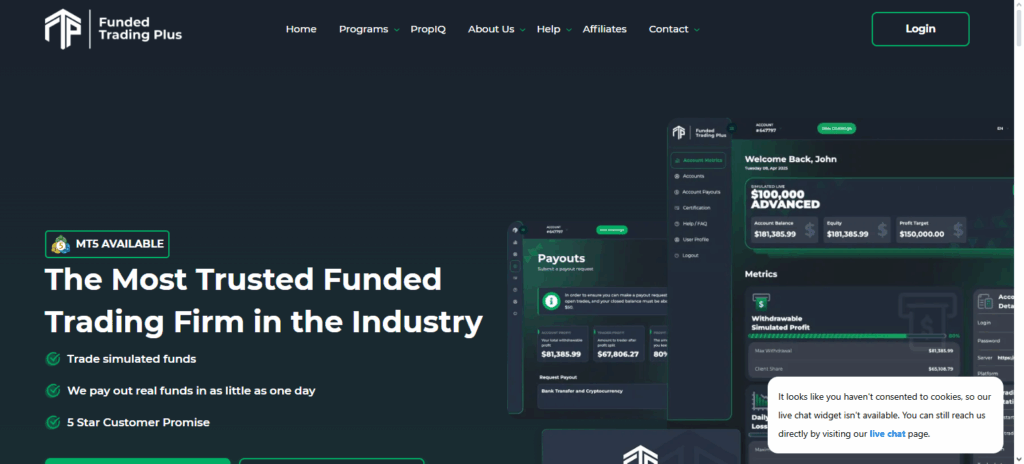

2. Funded Trading Plus

Funded Trading Plus presents one of the best alternatives to FundingPips. The company focuses on creating seamless transitions to funded accounts. Funded Trading Plus’s unique and flexible evaluation programs boost profit split ratios to generously reward traders.

The company also has a wide range of asset classes including Forex, crypto, and indices which gives traders multiple options to grow their accounts.

With low KYC thresholds, fast payouts, and clear operational guidelines, Funded Trading Plus is also reliable and efficient for traders around the world. With the profit protection system, they reduce the risk traders take, creating one of the best alternatives to FundingPips.

Funded Trading Plus Features

- High Profit Splits: For consistent traders, earned profits are split at a very favorable ratio.

- Minimal KYC Requirements: Traders from all over the world can onboard within minutes.

- Multiple Asset Classes: Trade Forex, crypto, and indices with very loose trading rules.

3. FTUK

FTUK stands out as a great FundingPips alternative, especially for traders looking for a UK-based prop firm that’s accessible globally. Its distinctive advantage is that it has low fees, making it easy for traders to get funded accounts in no time, as FTUK also has easy evaluation processes.

FTUK offers several options for traders, as the firm gives people the opportunity to trade on Forex, commodities, and indices. FTUK has minimalistic but well-structured trading rules and puts the emphasis on responsible account management to ensure that traders get to account growth in a sustainable manner.

Considering the rapid payouts and the quick responsiveness of the firm’s customer support, FTUK is a great alternative to FundingPips in the UK and helps traders capitalize on opportunities without added friction.

FTUK Features

- Low Fees: Access to cheap evaluations, trading, and general services.

- Global Access: Traders of all regions are welcome.

- Transparent Rules: Rules are clear and foster growth in a constructive manner.

4. Traders With Edge

Traders With Edge is another leading alternative to FundingPips due to its trader focused philosophy and sophisticated risk management systems. The key benefit is that it provides flexible evaluation systems with clear and uncomplicated conditions, meaning that traders can shift their focus to actual performance rather than assessing a myriad of complicated conditions.

Evaluation covers Forex, commodities and indices, allowing for a balance of diverse and flexible strategies. Traders With Edge provides fast turnaround to Payouts as well as competitive profit splits, making it financially rewarding especially for traders who are consistent.

To assist with overall understanding and profitable trading, a community is in place to provide insights and mentorship. Traders With Edge implements little KYC policies and offers scalable accounts, enabling traders to develop with self-assurance which differentiates Them from FundingPips.

Traders With Edge Features

- Advanced Risk Management: Account protection and growth consistency.

- Supportive Community: Good to have guidance and others with the same goals.

- Flexible Evaluation Programs: Variety in programs to suit all trading styles.

5. The Funded Trader

The Funded Trader is another great alternative to FundingPips that stands out for its flexible evaluation programs and options for instant funding.

One of its distinctive features is that traders can choose among various account types and risk limits customized to each account, enabling traders to choose programs that correspond to their trading style.

The firm facilitates trading on Forex, indices, and commodities, enabling traders to access different markets and broaden their trading horizons. Simple guidelines, rapid payout processing, and high profit distribution ratios create a friendly trading atmosphere for both novice and seasoned traders.

The absence of extensive KYC and global accessibility allow for immediate account funding. All of the above features provide sufficient reason for The Funded Trader to be a dependable and high functioning option for anyone wanting to outpace FundingPips in funding options.

The Funded Trader Features

- Multiple Account Types: Programs to line up with different risk profiles for each.

- Instant Funding Options: Access to capital is permitted almost instantly in the evaluations.

- Diverse Markets: Funded Trader permits trading Forex, indices and commodities.

6. SurgeTrader

SurgeTrader is one of the most recognized alternatives to FundingPips. Known because of its instant account scaling and trader-centered initiatives. Its most important strength is flexible evaluation which fits both the conservative and aggressive trading patterns.

This helps traders get to bigger funded accounts quicker. SurgeTrader operates in the forex and commodities markets which means there is a considerable room for diversification.

Well-defined trading policies, competitive profit-sharing, and efficient payout systems help meticulous traders looking for seamlessness in their work.

Also, traders can come from any region of the globe because of very basic KYC criteria. For these reasons, SurgeTrader is a practical choice for traders who need a reliable alternative to FundingPips.

SurgeTrader Features

- Instant Account Scaling: Account scalars access bigger accounts instantaneously.

- Flexible Trading Rules: Rules fit for every trading dynamic.

- Fast Payouts: Withdraw profits as frequently as you trade.

7. MyForexFunds (MFFX)

MyForexFunds (MFFX) stands out as an alternative to FundingPips and offers adaptable programs that cater to traders of varying skill levels.

It offers an advantage to traders with its assortment of accounts, which enables traders to access capital and scale rapidly, including accounts with evaluation periods and accounts with instant funding.

MFFX covers securities like Forex, commodities, and indices which broadens traders’ options. It values client retention with diverse payout options, great profit-sharing ratios, consistent reward for risk, and fair policies on profit withdrawal.

It is also easy for traders all over the world to access MFFX because of its low KYC thresholds and no geographical restrictions. These features make MFFX a worthy alternative to FundingPips.

MyForexFunds (MFFX) Features

- Rapid Funding Programs: Gain access to numerous evaluation types for instant capital.

- Worldwide Access: Traders from every part of the world can trade with minimal KYC.

- Diverse Trading Options: Trade seamlessly across Forex, commodities, and indices.

8. The5ers

The5ers is one of the best alternatives to FundingPips, particularly valued for its long-term, low-risk funding options that assist sustainable growth for traders.

They allow accounts for traders to start small and scale slowly, which is a positive thing for disciplined and patient traders. The5ers also supports trading in Forex and indices, which gives traders a variety of options to choose from.

The5ers provide great and fast services, gives clear and fast pay, and has great profit split for traders. The5ers also has low KYC requirements and is available to traders from everywhere. Because of these positive aspects, The5ers is a good alternative to FundingPips.

The5ers Features

- Sustainable Growth: Low-risk accounts centered around sustainable growth.

- Gradual Scalability: Consistent trading is required to gradually build accounts.

- Multiple Market Access: Trade Forex and indices as well as a variety of other markets.

9. E8 Funding

E8 Funding stands out as one of the best alternatives to FundingPips. It is one of the few globally accessible alternatives. E8 boasts diversification of trading E8 shows versatility with trading options as it includes Forex, commodities, and indices.

This is a huge advantage because traders can easily diversify their strategies. E8 Funding boasts simplistic and flexible evaluation programs where the rules are clear and transparent which allows traders to easily qualify for a funded account.

E8 provides scalable accounts which along with rapid account growth, accounts are rewarded scalable accounts which rapid payouts is E8’s way of acknowledging consistent trading performance.

E8’s easy and smooth KYC and account registration is a huge advantage for traders globally, This is what sets E8 Funding apart from the competition and Speed as well as value is E8’s biggest advantage as one of the best alternatives to FundingPips.

E8 Funding Features

- Trader Support: No complex and restrictive processes to access trading.

- Diverse Market Options: Trade Forex, commodities and indices.

- Hassle Free Funding: Speedy evaluation for funding, and quick access to profit withdrawal.

10. Lux Trading Firm

Lux Trading Firm is a notable alternative to FundingPips because of how little KYC is required and how little KYC is REQUIRED and how little KYC is required hello.

Its greatest advantage is flexible funding and profit split offerings that make it easier and less risky for traders to earn more. Lux Trading Firm handles Forex, commodities and index trading, so there is more than enough market offer to meet traders’ needs.

Account scalability, quick payouts, and clear rules make it a no-brainer for new and experienced traders globally. Because of all of the above, it is no surprise that the Lux Trading Firm alternative to FundingPips remains available and seamless.

Lux Trading Firm Features

- Minimal KYC: Easy and quick for international traders to onboard.

- Profitable Retention: Keep and trade the most profits from your payout.

- Flexible and Complex Accounts: Wide array across Forex, commodities and indices.

Pros & Cons

Pros

- Multiple Evaluation Models: Alternatives provide several evaluation models, such as one-step, two-step, and instant funding, which suit traders of different risk profiles and strategies.

- Higher Profit Splits Offered :Some firms’ profit split policies allow traders to keep more of what they earn, as they offer profit splits of up to 100%.

- More Relaxed Trading Rules: Drawdown limits and rules around trading during news events, which can be more strict, are more relaxed and provide the trader more control of their trading.

- Greater Market Range: The range and type of markets traders can access, including Forex, commodities, indices, and cryptocurrencies, allow traders to expand the diversification of their portfolios.

- Wider Availability: Alternatives have relaxed KYC policies and are available to traders from all over the world, which increases the opportunities available to global traders.

Cons

- Higher Evaluation Fees: Some firms have evaluation fees that can be considered expensive which can be seen as a barrier to entry for traders that have little capital.

- Fewer Trading Platforms: Some alternatives provide less trading platforms to use which can be restrictive for traders that are used to specific platforms and tools.

- Lower Maximum Account Sizes :When firms have lower maximum account sizes, it, more often than not, limits scaling opportunities for successful traders.

- Inconsistent Rule Enforcement: Inconsistent enforcement of rules, especially during evaluations, can derail traders moving to live accounts.

Conclusion

Ultimately, the best FundingPips alternatives allow traders to enjoy greater flexibility, different markets, quicker access to funded accounts, reduced risk, and less KYC hassle.

FunderPro, Funded Trading Plus, FTUK, SurgeTrader, MyForexFunds, and The5ers are especially notable for their transparent policies, reasonable profit sharing, scalable accounts, and access from anywhere in the world.

When alternative accounts are tailored to traders’ personal strategies, risk appetites, and objectives for scaling, the accounts are far more valuable to the traders.

In summary, the available alternatives enable traders to increase their profit prospects and enjoy a much better funded trading experience.

FAQ

Yes, most platforms allow account scaling as traders demonstrate consistent performance, enabling access to larger funded accounts over time.

Funding speed varies by firm. Some offer instant or rapid funding programs, while others require evaluation completion before releasing capital.

Most alternatives support Forex, commodities, indices, and sometimes cryptocurrencies. Some firms offer specialized markets depending on their platform.

Alternatives may offer higher profit splits, faster funding, flexible evaluation programs, minimal KYC, and access to more markets. They help traders find conditions that suit their trading style better than FundingPips.