In this article, I will discuss high liquidity crypto exchange alternatives that provide fast, safe, and effective trading environments. These exchanges provide deep liquidity, low costs, and worldwide access to numerous cryptocurrencies in a variety of local languages.

Accessibility, seamless transactions, low trading slippage, and responsive support make these exchanges excellent for both novices and professionals in the rapidly changing crypto environment.

What is High-Liquidity Crypto Exchange Alternatives?

High-liquidity crypto exchange alternatives are trading platforms with deep order books, fast transaction execution, and high trading volumes, just like the big exchanges like Binance or Coinbase. Alternatives afford traders competitive pricing and minimal slippage, making large-scale trades smoother.

Examples include Kraken, KuCoin, OKX, and Bitfinex, all of which have excellent liquidity across numerous crypto trading pairs.

These exchanges are suited to institutional investors and high-frequency active traders who need high liquidity to execute trades with better efficiency, predictability, and narrower average price spreads during periods of high volatility in the crypto markets.

Why Use High-Liquidity Crypto Exchange Alternatives

Quicker Trade Completion: High liquidity means bids and offers are filled in a timely manner. There are no annoying waits in the order queue.

Lower Slippage: There are more buyers and sellers, meaning competing price offers. There are lower unexpected losses as orders are filled at anticipated prices.

Stronger Market Stability: High liquidity is the market stabilizing force and range of prices in a market is lower which means smaller price swings. This is valuable in a market with tight price controls.

Increased Trade Volume: Such exchanges are geared to meeting the needs of big customers, both institutional and individuals, and can filled big orders with little delay.

Lower Bid-Ask Spreads: When the market is liquid there is a tight spread, giving better prices.

Predictable Withdraws and Deposits: High liquidity means the exchange has more consistent inflow and outflow of cash and quicker processing of deposits and withdrawals.

Wide Variety of Cryptos: Such exchanges have a lot of trading pairs and a lot of crypto-currencies.

Lower Risk of Abuse: With high liquidity in a market, the probability of price setting abuse is lower which is a sign of market integrity.

Key Point & Best High-Liquidity Crypto Exchange Alternatives List

| Exchange | Key Points |

|---|---|

| Binance | World’s largest exchange by volume; supports 350+ cryptocurrencies, low fees, and advanced trading tools. |

| Coinbase Pro | Regulated U.S. exchange with strong security, transparent fees, and easy fiat-to-crypto conversion. |

| Kraken | Trusted global platform known for high liquidity, margin trading, and robust security features. |

| Bybit | Derivatives-focused exchange offering high leverage, fast execution, and low latency trading. |

| OKX | All-in-one platform with deep liquidity, futures, options, and a powerful mobile trading app. |

| Gate.io | Offers a vast range of altcoins, strong liquidity pools, and competitive spot and futures trading. |

| KuCoin | Popular for diverse altcoin listings, user-friendly interface, and excellent liquidity for small-cap coins. |

| Bitget | Known for copy trading, high liquidity in futures markets, and low trading fees. |

| MEXC | Rapid-growing exchange with deep liquidity, numerous tokens, and strong global trading volume. |

| HTX (formerly Huobi) | Established exchange with strong Asian market presence, solid liquidity, and multiple trading products. |

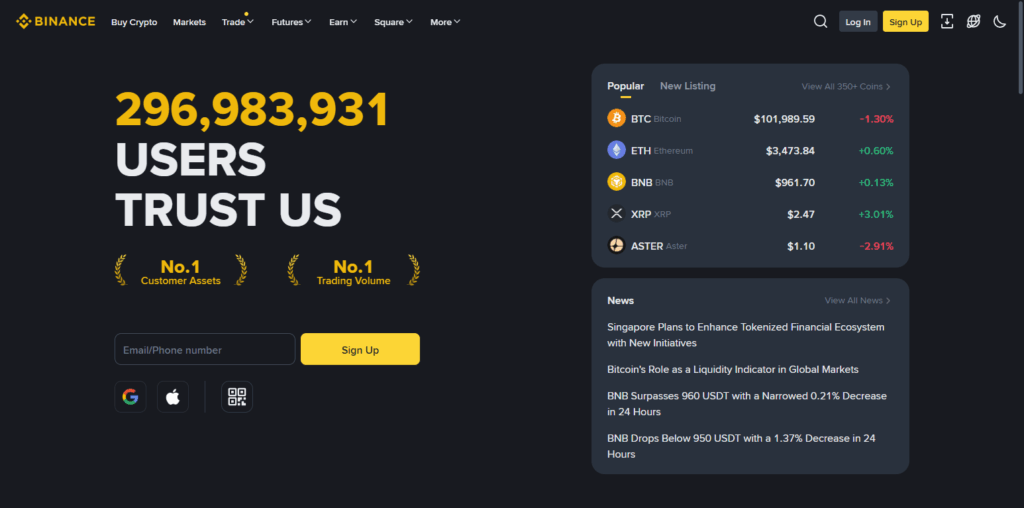

1. Binance

Established in 2012, Coinbase Pro has gained recognition as one of the fastest growing, high-liquidity crypto exchanges, particularly because it meets all legal obligations in the markets it operates in and has built trust with its clients.

The platform supports several local languages and offers a variety of cryptocurrencies at a competitive fee. Coinbase Pro offers the highest level of security with cold storage, two-factor authentication, and digital assets insurance.

Coinbase Pro has a user-friendly platform with Coinbase Pro very rapid trade execution and these features attract retail and institutional clients. Because of the outstanding 24/7 customer support, users can also expect efficient and transparent services. This makes Coinbase Pro a very reliable crypto exchange.

| Feature | Details |

|---|---|

| Exchange Name | Binance |

| Established Year | 2017 |

| Headquarters | Global (Originally founded in China) |

| KYC Requirement | Minimal for small trades; full KYC for higher limits |

| Supported Cryptocurrencies | 350+ |

| Trading Options | Spot, Futures, Margin, P2P, Staking |

| Security | Two-Factor Authentication (2FA), Cold Wallet Storage, SAFU Insurance Fund |

| Supported Languages | 30+ Local Languages |

| Trading Fees | From 0.1% (Reduced with BNB) |

| Customer Support | 24/7 Live Chat and Email Support |

| Mobile App Availability | Yes (iOS & Android) |

2. Coinbase Pro

Founded in 2011, Kraken is one of the most reliable high-liquidity crypto exchange options, serving global traders with greatest trust.

It provides services in different local dialects and offers trading in numerous different cryptos, including prominent and developing coins.

To protect the funds of the user, Kraken takes numerous security measures and employs cold storage, encryption and 2-step verification.

It is recognized for its high liquidity which allows it to make effective and speedy trades even in market fluctuations. With a clear pricing plan alongside a responsive customer service, Kraken offers a secure and professional trading atmosphere for novice and professional traders.

| Feature | Details |

|---|---|

| Exchange Name | Coinbase Pro |

| Established Year | 2012 |

| Headquarters | United States |

| KYC Requirement | Mandatory for all users (ID verification required) |

| Supported Cryptocurrencies | 250+ |

| Trading Options | Spot, Advanced Trade, API Trading |

| Security | Cold Wallet Storage, Two-Factor Authentication (2FA), Insurance Protection |

| Supported Languages | English and major global languages |

| Trading Fees | 0.00%–0.60% (based on volume) |

| Customer Support | 24/7 Live Chat and Email Support |

| Mobile App Availability | Yes (iOS & Android) |

3. Kraken

Bybit came into existence as a crypto exchange in 2018 and has been successfully providing a high-liquidity trading and exchange platform.

Users enjoy fast trading and a seamless experience because of the platform’s multiple tailored features designed for various segments of the user base.

Offering support in different local and native languages for various clients around the world, Bybit has expanded offering a huge variety of different cryptocurrencies, holder of both established and emerging polygon.

Also, known for derivatives and extensive spot trading capabilities, Bybit’s service delivery as regards security and customer support in described in this paragraph attests to the deep to commitment to care and responsibility for customer welfare and ensured security, both emotional and psychological.

| Feature | Details |

|---|---|

| Exchange Name | Kraken |

| Established Year | 2011 |

| Headquarters | United States |

| KYC Requirement | Basic KYC for small trades; full KYC for higher limits and fiat withdrawals |

| Supported Cryptocurrencies | 250+ |

| Trading Options | Spot, Futures, Margin, Staking |

| Security | Cold Wallet Storage, Two-Factor Authentication (2FA), PGP Email Encryption |

| Supported Languages | English and major global languages |

| Trading Fees | 0.00%–0.26% (based on volume) |

| Customer Support | 24/7 Live Chat and Email Support |

| Mobile App Availability | Yes (iOS & Android) |

4. Bybit

Established in 2017, OKX is one of the top alternatives to high liquidity crypto exchanges, high comprehensive exchanges reachable to the global clientele.

OKX provides traders in multiple countries with the ability to trade Spot, Futures, and Options on a considerable amount of cryptocurrencies to choose from. OKX provides high liquidity which permits quick and reliable transactions to be executed even with rapid market changes.

OKX is a trustworthy choice for professional and retail crypto traders due to its focused innovation, reliability, and robust security in which all of its cold storage wallets, encrypted and multi signature protected wallets, and assets stored in cold wallets are consistently protected.

Automated customer support systems are useful, however, they are of lowest priority when employees are online and helping provided is customer support.

| Feature | Details |

|---|---|

| Exchange Name | Bybit |

| Established Year | 2018 |

| Headquarters | Dubai, UAE |

| KYC Requirement | Optional for basic trading; required for withdrawals and higher limits |

| Supported Cryptocurrencies | 400+ |

| Trading Options | Spot, Futures, Options, Copy Trading |

| Security | Cold Wallet Storage, Multi-Signature Protection, 2FA |

| Supported Languages | 20+ Local Languages |

| Trading Fees | 0.1% (Spot) / 0.01%–0.06% (Derivatives) |

| Customer Support | 24/7 Live Chat and Email Support |

| Mobile App Availability | Yes (iOS & Android) |

5. OKX

Gate.io is among the best high-liquidity crypto exchange alternatives. Founded in 2013, Gate.io offers a large selection of crypto assets to all traders worldwide. The platform is localizable in multiple languages, making it even more user-friendly.

Gate.io is known for rapid and seamless trading all due to its robust market liquidity. It offers spot, futures, and margin trading.

Gate.io facilitates trading around the clock and is designed to keep user assets safe via cold-storage wallets, two-factor authentication, and military-grade encryption.

With 24/7 customer support, Gate.io is able to quickly respond to user requests and guarantee confidence in the trading process. All things considered, Gate.io is an ideal platform for beginners and experienced crypto traders alike.

| Feature | Details |

|---|---|

| Exchange Name | OKX |

| Established Year | 2017 |

| Headquarters | Seychelles |

| KYC Requirement | Minimal for crypto deposits and trading; full KYC for fiat and higher limits |

| Supported Cryptocurrencies | 350+ |

| Trading Options | Spot, Futures, Options, Margin, DeFi, Earn |

| Security | Cold Wallet Storage, 2FA, Anti-Phishing Codes, Proof of Reserves |

| Supported Languages | 20+ Local Languages |

| Trading Fees | 0.08%–0.1% (Spot) / Lower with OKB token |

| Customer Support | 24/7 Live Chat and Email Support |

| Mobile App Availability | Yes (iOS & Android) |

6. Gate.io

Established in 2017, KuCoin is among the best alternatives to high liquidity crypto exchanges and attends to millions of users across the world.

The platform is configured to work in many languages and allows trading in more than 700 cryptocurrencies, including newly emerging altcoins. KuCoin is recognized not only for its strong liquidity but also for the simplicity of its interface, which guarantees customers rapid and efficient trading.

Advanced security techniques are deployed to safeguard customer assets, including encryption, two-step authentication, and a dedicated insurance fund. KuCoin is a go-to exchange for crypto traders and investors around the world for its 24/7 reliable customer support and smooth trading environment.

| Feature | Details |

|---|---|

| Exchange Name | Gate.io |

| Established Year | 2013 |

| Headquarters | Seychelles |

| KYC Requirement | Minimal for crypto deposits and small withdrawals; full KYC for higher limits |

| Supported Cryptocurrencies | 1,700+ |

| Trading Options | Spot, Futures, Margin, Copy Trading, Earn |

| Security | Cold Wallet Storage, 2FA, Anti-Phishing Codes, Encrypted Transactions |

| Supported Languages | 15+ Local Languages |

| Trading Fees | 0.2% (Spot) / Discounts with GT Token |

| Customer Support | 24/7 Live Chat and Ticket Support |

| Mobile App Availability | Yes (iOS & Android) |

7. KuCoin

KuCoin has quickly become one of the best alternatives for high-liquidity crypto exchanges since opening in 2017. With over 700 cryptos available for trading to users around the globe, the exchange has grown to support many local languages.

This diverse support allows all users to navigate the exchange with ease. The platforms spot, futures, and margin markets all offer fast executing trades due to the exchange’s deep liquidity. The exchange’s security is robust, using multi-layered encryption, two-factor authentication, and an insurance fund that covers all assets.

The insurance fund covers all assets and the exchange’s 24/7 customer support and low trading fees of 0.1% make it perfect for crypto traders, beginners and professional, affordability and advanced features.

| Feature | Details |

|---|---|

| Exchange Name | KuCoin |

| Established Year | 2017 |

| Headquarters | Seychelles |

| KYC Requirement | Optional for basic trading; required for higher withdrawal limits |

| Supported Cryptocurrencies | 700+ |

| Trading Options | Spot, Futures, Margin, Trading Bots, Earn |

| Security | Cold Wallet Storage, 2FA, Anti-Phishing Codes, Insurance Fund |

| Supported Languages | 20+ Local Languages |

| Trading Fees | 0.1% (Spot) / Discounts with KCS Token |

| Customer Support | 24/7 Live Chat and Ticket Support |

| Mobile App Availability | Yes (iOS & Android) |

8. Bitget

Bitget is also recognized as one of the best high-liquidity crypto exchange alternatives since it was founded in 2018 as an advanced copy trading and derivatives platform.

Bitget facilitates trading a variety of cryptocurrencies for users across the globe and offers trading in several local dialects. With high liquidity and effortless order execution, the exchange is ideal for novices and experts alike.

For users’ peace of mind, on top of two-factor authentication and transparent proof-of-reserves, cold wallets are used for storing users’ cryptocurrencies. With trading fees starting from 0.1% and 24/7 customer service, Bitget is recognized for its reliability and innovations offered at a low cost.

| Feature | Details |

|---|---|

| Exchange Name | Bitget |

| Established Year | 2018 |

| Headquarters | Seychelles |

| KYC Requirement | Optional for basic trading; required for large withdrawals and fiat use |

| Supported Cryptocurrencies | 500+ |

| Trading Options | Spot, Futures, Copy Trading, Earn |

| Security | Cold Wallet Storage, 2FA, Proof of Reserves, Multi-Signature Protection |

| Supported Languages | 15+ Local Languages |

| Trading Fees | 0.1% (Spot) / 0.02%–0.06% (Futures) |

| Customer Support | 24/7 Live Chat and Email Support |

| Mobile App Availability | Yes (iOS & Android) |

9. MEXC

MEXC was created in 2018, and since then it has been one of the most reliable and fastest high-liquidity alternatives crypto exchanges.

MEXC is available in different local languages, which allows it to provide services to people in 170 different countries. MEXC also has spot, ETF, and futures markets which allow an ultra-fast trade execution.

Users also enjoy high security with advanced encryption, cold wallet storage, and multi-signature protection in addition to the 24/7 support.

MEXC is easy to use, and the low trading fees starting at 0.1% allows it to be accessible to efficient trading. MEXC is great for amateurs and seasoned crypto traders alike.

| Feature | Details |

|---|---|

| Exchange Name | MEXC |

| Established Year | 2018 |

| Headquarters | Seychelles |

| KYC Requirement | Optional for trading; required for higher withdrawal and fiat transactions |

| Supported Cryptocurrencies | 1,600+ |

| Trading Options | Spot, Futures, Margin, ETF, Staking |

| Security | Cold Wallet Storage, 2FA, Anti-Phishing Codes, Proof of Reserves |

| Supported Languages | 20+ Local Languages |

| Trading Fees | 0.1% (Spot) / 0.01% (Futures) |

| Customer Support | 24/7 Live Chat and Ticket Support |

| Mobile App Availability | Yes (iOS & Android) |

10. HTX

HTX, which was established in 2013, is one of the best high-liquidity alternatives to crypto exchanges and boasts a strong platform for traders all around the world. Available in various local languages, HTX access hundreds of high-liquidity and fast-execution cryptocurrencies.

The exchange employs robust cold storage, strong encryption, and user-friendly risk management measures to secure user assets. HTX is one of the best crypto exchanges to offer 24/7 customer support with fast response times.

HTX crypto exchange has a strong reputation for reliability and presence around the world. Trading fees at HTX crypto exchange are fairly low, and their effective starting point is 0.2%. This assures cheap and efficient transactions for traders all over the world.

| Feature | Details |

|---|---|

| Exchange Name | HTX (formerly Huobi) |

| Established Year | 2013 |

| Headquarters | Seychelles |

| KYC Requirement | Minimal for crypto trading; full KYC required for fiat and large withdrawals |

| Supported Cryptocurrencies | 700+ |

| Trading Options | Spot, Futures, Margin, Staking, Earn |

| Security | Cold Wallet Storage, 2FA, Risk Control System, Proof of Reserves |

| Supported Languages | 20+ Local Languages |

| Trading Fees | 0.2% (Spot) / Discounts with HT Token |

| Customer Support | 24/7 Live Chat and Email Support |

| Mobile App Availability | Yes (iOS & Android) |

Pros & Cons

Pros:

- Swift Order Execution:High liquidity features fewer delays in order matching and reduces waiting time on trades.

- Negligible Price Slippage:The execution of trades occurs at the expected price levels, thereby minimizing losses.

- Consistent Market Prices:Substantial liquidity makes price levels stable, even in periods of extreme market fluctuations.

- Improved Market Functionality:Large volumes in trade provide the market with the ability to absorb large buy/sell orders.

- Narrower Bid-Ask Spread:Increased profitability owing to narrower gaps between buy and sell orders.

- Increased Market Confidence:More liquidity brings in larger players to the market and increases market trust and reliability.

- More Advanced Trading Facilities:Greater liquidity enables the order of several currencies, pairs, and complex order types.

Cons:

- More Traders:Increased liquidity means there will be more market participants, which reduces the ability to capture mispricing.

- Potential for Market Control:Market liquidity is possible to centralized control, which reduces market decentralization.

- Overly Complex Buying and Selling:The use of complex trading tools become a problem, especially for a novice.

- Buggering the Market:Larger market players bring more strict control over a market, which in turns increases control over regulations imposed on a given geo.

- Increased Likelihood for a Cyber-attack:Public servers for order execution on high-volume exchanges will have a market level security which is a guarantee for a cyber-attack.

Conclusion

To sum up, the most favorable alternatives to high liquid crypto exchanges—like Bybit, Binance, Kraken, Coinbase Pro, KuCoin, HTX, and others—provide users trustworthy exchanges with deep liquidity, robust defenses, quick execution, and strong defenses against hacking.

The exchanges provide a wide range of cryptocurrencies and a variety of local languages for a secure and effective global trading experience. Their around the clock automated trading system, cutting edge tools, and minimal commissions make the services attractive for novice users and systematized traders alike.

Picking an exchange with high liquidity guarantees economical, straighforward, and precisely controlled trading, enabling users to sustain a high level of trade activity in a crypto market which is highly dynamic.

FAQ

Yes. Most high-liquidity exchanges invest heavily in security measures like encryption, cold wallet storage, and two-factor authentication to protect users’ funds.

Yes, they support several local languages and serve traders from over 100 countries, offering global accessibility and support.

Fees vary but generally range between 0.1% to 0.2%, making them affordable for frequent traders.

Absolutely. Many of these exchanges offer user-friendly interfaces, educational guides, and demo accounts, making them suitable for both new and experienced traders.

Binance, Kraken, and Bybit are popular among professionals for their advanced trading tools, deep liquidity, and efficient order execution.