In this article, I will discuss the Best Money Exchange Service Online. It is important to choose a proper service because there are many options available, and for many businesses, time is money.

I will concentrate on such features as low fees and fast transfers, safety and accessibility around the globe, and more. This guide is created to help you choose the most reliable and efficient service whether for personal or business use.

Key Point & Best Money Exchange Service Online List

| Service | Key Point |

|---|---|

| Regency FX | Offers tailored foreign exchange services with competitive rates for businesses. |

| Wise | Known for low fees and mid-market exchange rates with transparent pricing. |

| Remitly | Fast transfers with multiple delivery options, especially for remittances. |

| Western Union | Global presence with thousands of physical agent locations for cash pickup. |

| Revolut | App-based platform offering international transfers, budgeting, and FX tools. |

| OFX | No transfer fees and better exchange rates for large international transfers. |

| WorldRemit | Convenient mobile transfers with delivery to bank, cash pickup, or mobile wallet. |

| MoneyGram | Extensive global network and fast cash transfers worldwide. |

| Ria Money Transfer | Affordable remittance service with wide agent coverage and cash pickup options. |

| Currencies Direct | Personalized service with dedicated account managers for large transfers. |

1.Regency FX

Regency FX shines the most as an online money exchanger because of its defined methods of dealing with clients and there understanding of the customer’s needs.

Unlike many other systems, it provides personalized currency services to both business and clients, ensuring that each transaction meets the requirements of the market.

Strong customer service, coupled with competitive rates, fast execution, and dependability makes it convenient for everyone who needs foreign currency. Its promise of openness, no intermediaries, and involvement with customers is unique among companies dealing with foreign exchange.

| Feature | Details |

|---|---|

| Service Type | Online Money Exchange & International Payments |

| KYC Requirement | Minimal KYC, streamlined verification process |

| Supported Currencies | Wide range of fiat currencies for global transactions |

| Privacy | Emphasizes secure and private transactions |

| Transaction Fees | Competitive rates with low transfer fees |

| Platform Accessibility | Web-based platform with a user-friendly interface |

| Speed of Transactions | Fast processing for global transfers |

| Regulatory Compliance | Operates under relevant financial regulations |

| Customer Support | Dedicated team with live chat and email support |

| Additional Features | Currency conversion tools, rate alerts, and personalized solutions |

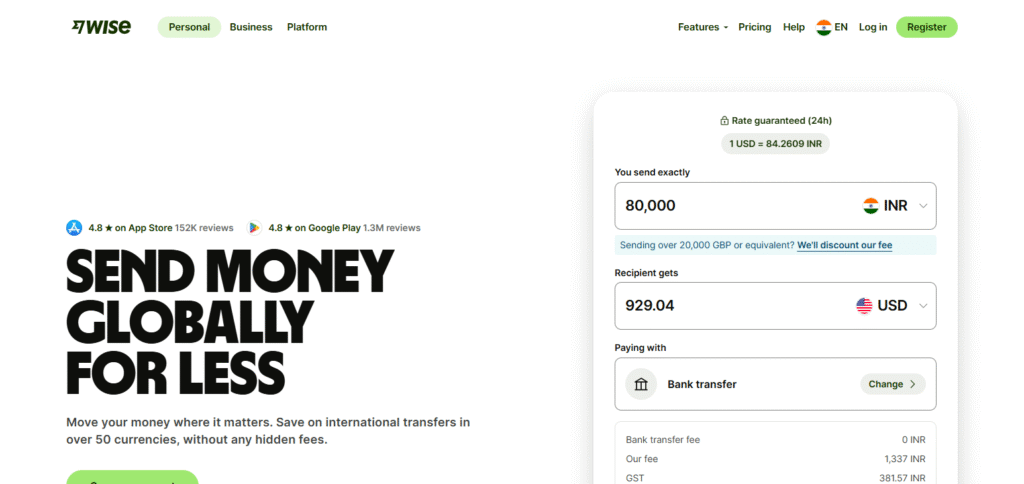

2.Wise

Wise is renowned for being the most reliable online money exchange service, due to the fact that it offers users “real” exchange rates, with no hidden service fees.

Marked as its main feature is the multi-currency account that allows to hold, convert and spend in several currencies with ease.

Designed as a transparent platform, showing customers no hidden fees before each transaction, Wise constantly delivers a predetermined level of trust.

Combined with its easy to use interface and high speed of transfers, Wise provides the best service for individuals and businesses dealing with cross-border payments.

| Feature | Details |

|---|---|

| Service Type | Online Money Exchange & International Transfers |

| KYC Requirement | Minimal KYC for lower transaction amounts; enhanced verification for higher limits |

| Supported Currencies | Supports a wide range of fiat currencies with competitive exchange rates |

| Privacy | Secure transactions with a focus on transparency |

| Transaction Fees | Low fees, clear pricing without hidden charges |

| Platform Accessibility | Web-based platform and mobile app for seamless transactions |

| Speed of Transactions | Fast transfers, with real-time tracking available |

| Regulatory Compliance | Operates under financial regulations in multiple jurisdictions |

| Customer Support | Dedicated team available via live chat and email support |

| Additional Features | Multi-currency accounts, real exchange rates, and business solutions |

3.Remitly

Remitly is one of the top online money exchange services due to their speed and flexibility while dealing with international transfers.

An industry first is its dual delivery option—Express and Economy—which allows users to prioritize speed or cost as per their needs. This feature greatly helps when sending money to relatives living overseas.

In tandem with real-time tracking, secure finances, and extensive service in developing areas, Remitly provides a user experience crafted for urgent and frequent cross border payments.

| Feature | Details |

|---|---|

| Service Type | Online Money Transfer & Currency Exchange |

| KYC Requirement | Minimal KYC for lower transaction amounts; additional verification for higher limits |

| Supported Currencies | Supports major fiat currencies for international transfers |

| Privacy | Secure transactions with encryption and fraud protection |

| Transaction Fees | Competitive rates with transparent pricing |

| Platform Accessibility | Web-based platform and mobile app for convenient transfers |

| Speed of Transactions | Fast processing, including express and economy options |

| Regulatory Compliance | Operates under financial regulations in multiple countries |

| Customer Support | 24/7 customer support via chat, phone, and email |

| Additional Features | Guaranteed delivery times, tracking, and special promotions |

4.Western Union

Western Union is still among the leaders in online money exchange due to its unrivaled scope and ease of use around the globe.

Most distinguishing is the enormous agent network available which permits cash collection by the recipients even in the remotest of places.

This is combined with a digital presence and services that closes the gap between modern and traditional approaches to money transfers.

With access to various payment options, multi-currency capabilities, and reliable security protocols, Western Union offers a practical solution for urgent needs anywhere in the world.

| Feature | Details |

|---|---|

| Service Type | Online & In-Person Money Transfers |

| KYC Requirement | Minimal KYC for lower transaction limits; additional verification for higher amounts |

| Supported Currencies | Wide range of fiat currencies for global transactions |

| Privacy | Secure transactions with encryption and fraud protection |

| Transaction Fees | Varies by transfer method and destination, with competitive rates |

| Platform Accessibility | Web-based platform, mobile app, and physical locations for transactions |

| Speed of Transactions | Fast processing, including instant transfers for eligible destinations |

| Regulatory Compliance | Operates under strict financial regulations worldwide |

| Customer Support | 24/7 support via chat, phone, and email |

| Additional Features | Transfer tracking, loyalty rewards, and different payment options |

5.Revolut

Revolut is one of the best online money exchange services due to its multifunctional financial application which combines a currency exchange with budgeting tools.

Its biggest advantage is the ability to convert currencies in real time at interbank rates straight from the app. This feature is perfect for tourists and digital nomads for who frequent travel.

Users can spend worldwide with one card and without paying exorbitant charges. The effortless combination of personal finance management and international transfers is what distinguishes Revolut from other digital banks.

| Feature | Details |

|---|---|

| Service Type | Online Money Exchange & Multi-Currency Accounts |

| KYC Requirement | Minimal KYC for basic transactions; additional verification for higher limits |

| Supported Currencies | Supports a wide range of fiat currencies and cryptocurrency exchange |

| Privacy | Secure transactions with strong encryption protocols |

| Transaction Fees | Low fees with transparent pricing, depending on exchange method |

| Platform Accessibility | Web-based platform and mobile app with an intuitive interface |

| Speed of Transactions | Instant currency exchanges and fast international transfers |

| Regulatory Compliance | Operates under financial regulations in multiple jurisdictions |

| Customer Support | Live chat and email support with a dedicated help center |

| Additional Features | Virtual cards, budgeting tools, stock and crypto trading options |

6.OFX

OFX achieves its standing as an industry-leading online money exchange service by facilitating large international transfers with no “fine print” fees.

Having expert currency support through dedicated dealers, which adds a personal touch, is a critical strength.

This is especially convenient for businesses and individuals who handle large amounts of money because it ensures better planning and execution. The platform gives users support anytime and anywhere, and thus, users can control the currency market on their terms.

| Feature | Details |

|---|---|

| Service Type | Online Money Exchange & International Transfers |

| KYC Requirement | Minimal KYC for lower transaction amounts; additional verification for higher limits |

| Supported Currencies | Wide range of fiat currencies for global transactions |

| Privacy | Secure transactions with encryption and fraud protection |

| Transaction Fees | Competitive rates with no hidden fees; lower costs for large transfers |

| Platform Accessibility | Web-based platform and mobile app for easy transactions |

| Speed of Transactions | Fast processing, typically within 24-48 hours |

| Regulatory Compliance | Operates under strict financial regulations worldwide |

| Customer Support | 24/7 support via phone, email, and chat |

| Additional Features | Currency exchange rate alerts, business solutions, and hedging tools |

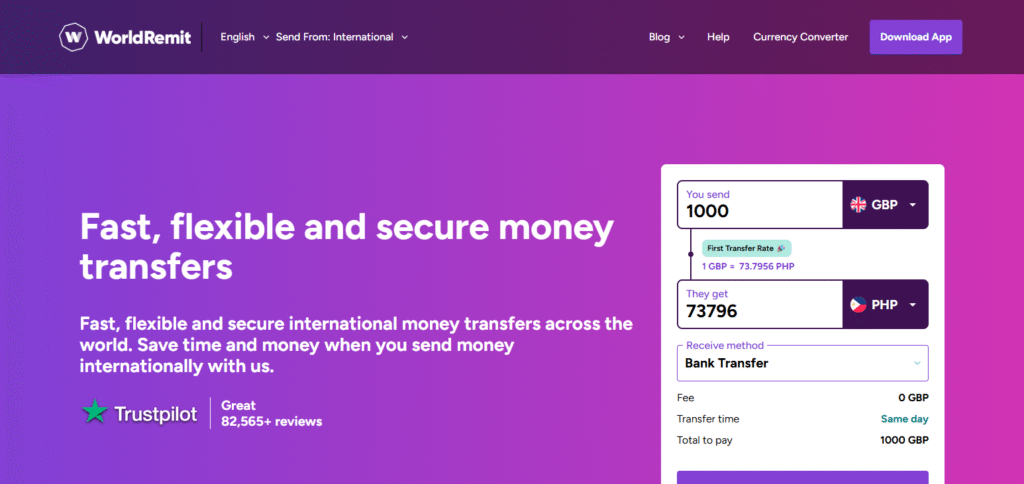

7.WorldRemit

WorldRemit stands out as an efficient online money transfer service by streamlining international transfers and making them mobile-friendly.

Its distinct strength lies in offering varied methods of payout such as bank deposits, cash pickup, mobile money, and even airtime top-ups which adds flexibility for the recipient.

This flexibility is especially useful in areas where the banking infrastructure is lacking. WorldRemit addresses the problem geographically by prioritizing speed, flexible user control, and ease of use through a simplified app interface, aiding users all across the globe.

| Feature | Details |

|---|---|

| Service Type | Online Money Transfers & Currency Exchange |

| KYC Requirement | Minimal KYC for small transfers; additional verification for higher limits |

| Supported Currencies | Supports a wide range of fiat currencies for global transfers |

| Privacy | Secure transactions with encryption and fraud protection |

| Transaction Fees | Transparent pricing with competitive fees |

| Platform Accessibility | Web-based platform and mobile app for convenient transfers |

| Speed of Transactions | Fast transfers, including instant options for select destinations |

| Regulatory Compliance | Operates under financial regulations in multiple jurisdictions |

| Customer Support | 24/7 support via chat, phone, and email |

| Additional Features | Transfer tracking, multiple payment options, and flexible payout methods |

8.MoneyGram

MoneyGram is one of the best online money exchange service companies due to its combination of online and offline transfer services.

What sets it apart the most is that users can initiate a transaction digitally and complete it with cash at thousands of pickup locations around the world.

This flexibility accommodates both users with technological proficiency and those from regions reliant on cash.

MoneyGram’s multilingual customer service, strong fraud protection, and high-security technology also ensure safety in cross-border transfers for everyone.

| Feature | Details |

|---|---|

| Service Type | Online & In-Person Money Transfers |

| KYC Requirement | Minimal KYC for lower transaction limits; additional verification for larger amounts |

| Supported Currencies | Wide range of fiat currencies for global transactions |

| Privacy | Secure transactions with encryption and fraud prevention measures |

| Transaction Fees | Competitive rates, varies by transfer method and destination |

| Platform Accessibility | Web-based platform, mobile app, and physical locations worldwide |

| Speed of Transactions | Fast processing, with instant transfer options for select regions |

| Regulatory Compliance | Operates under strict financial regulations globally |

| Customer Support | 24/7 support via phone, chat, and email |

| Additional Features | Transfer tracking, multiple payout options, and loyalty rewards |

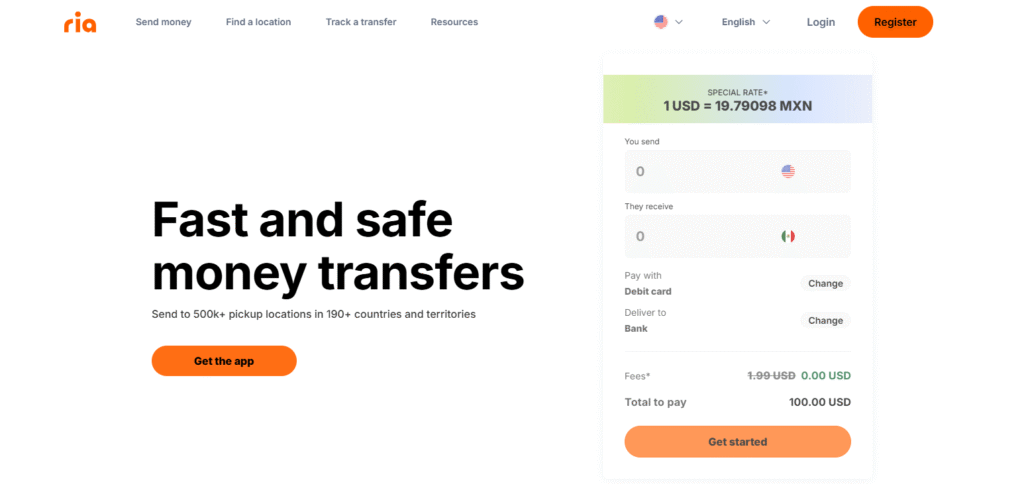

9.Ria Money Transfer

Ria Money Transfer has remained one of the best online money transferring services because of its focus on cost-effectiveness and accessibility around the world.

Of note, is the payout network it offers which stretches over a lot of countries and both rural and urban places. This coverage enables users to send funds to difficult places rapidly and dependably.

Users are provided with digital tools by Ria that make sending, tracking, and receiving funds effortless. Thus, aiding in frequent remittances to different locations around the world.

| Feature | Details |

|---|---|

| Service Type | Online & In-Person Money Transfers |

| KYC Requirement | Minimal KYC for lower transaction amounts; additional verification for larger transfers |

| Supported Currencies | Wide range of fiat currencies for global transactions |

| Privacy | Secure transactions with encryption and fraud prevention measures |

| Transaction Fees | Competitive rates with transparent pricing |

| Platform Accessibility | Web-based platform, mobile app, and physical locations worldwide |

| Speed of Transactions | Fast processing, including instant transfer options for select countries |

| Regulatory Compliance | Operates under financial regulations in multiple jurisdictions |

| Customer Support | 24/7 support via phone, email, and chat |

| Additional Features | Transfer tracking, multiple payout options, and promotions for frequent users |

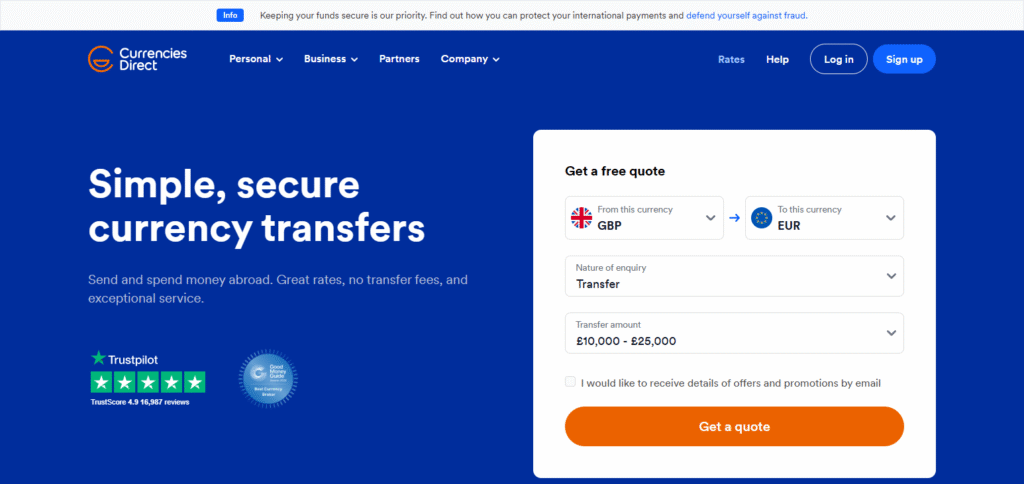

10.Currencies Direct

Currencies Direct stands out as one of the primary online money exchange services that offers individualized attention when it comes to foreign currency dealings.

The company’s strong points are in the provision of bespoke solutions to optimize high value business transfers, backed by dedicated account managers.

With industry low service fees and competitively priced exchange rates, Currencies Direct guarantees that its customers’ experts will always attend to their needs and offer pertinent guidance.

This accessible form of tailored assistance, coupled with fee reduction makes the business highly recommendable for international payments and currency manipulations.

| Feature | Details |

|---|---|

| Service Type | Online & In-Person Money Transfers |

| KYC Requirement | Minimal KYC for basic transactions; additional verification for higher amounts |

| Supported Currencies | Wide range of fiat currencies for global transactions |

| Privacy | Secure transactions with encryption and fraud prevention measures |

| Transaction Fees | Competitive rates with no hidden fees |

| Platform Accessibility | Web-based platform, mobile app, and dedicated account managers |

| Speed of Transactions | Fast processing with same-day transfers for select currencies |

| Regulatory Compliance | Operates under financial regulations in multiple jurisdictions |

| Customer Support | Dedicated support via phone, chat, and email |

| Additional Features | Rate alerts, forward contracts, and tailored business solutions |

Conclusion

In summary, choosing the appropriate online money exchange service varies from person to person due to specific requirements like how fast the money needs to be transferred, the fee applicable, how user-friendly the interface is, and how secure the platform is.

Wise, Remitly, and Western Union offer numerous services, including but not limited to low fees, real-time tracking, personalized aid, and extensive networks worldwide.

Taking into account factors such as user-friendliness, transfer options, and customer service, users can make informed decisions enables international money transfers to be seamless, simple, and inexpensive.