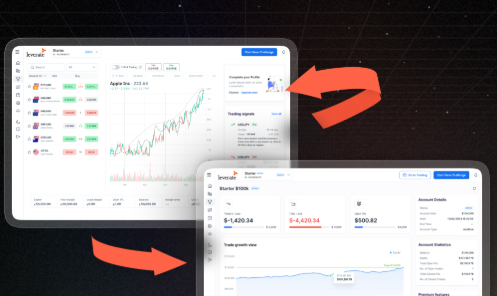

The Top Prop Firm Dashboards for Real-Time Risk Tracking will be covered in this post. For traders to rapidly monitor equity, drawdowns, and account health, these dashboards are crucial.

Traders can successfully manage risk, adhere to strict regulations, and make well-informed decisions with the use of real-time analytics. We’ll look at leading prop companies that provide sophisticated dashboards for novice and expert traders.

What Are Prop Firm Dashboards?

Prop firm dashboards are customized internet interfaces that traders can use to keep an eye on their funded accounts in real time. They are offered by proprietary trading businesses.

Important parameters like equity, open trades, margin usage, daily and maximum drawdowns, and profit development are shown on these dashboards.

They assist traders in making well-informed decisions, adhering to strict regulations, and successfully managing risk by combining performance metrics and risk indicators in one location.

For both novice and experienced traders looking for disciplined and lucrative trading, modern dashboards are vital tools because they frequently include configurable displays, notifications, and mobile access.

Key Features of the Best Prop Firm Dashboards

Equity and Drawdown Tracking in Real-Time

- Track balance, equity, and real-time drawdown to avoid surprises.

Performance Tracking

- Gain access to win and loss rates, risk/reward ratios, and consistency metrics.

Alerts and Notifications

- Get real-time alerts when you get close to your daily loss, max drawdown, or when you are rule-breaking.

Adjustable Dashboards

- Customize views to highlight the data most important to your trading.

Access from Any Device

- Get mobile access to real-time account status and risk metrics.

Indicators of Progress and Scaling

- Get visual milestones to help you know when you’re ready to scale your account.

Reporting and Trade History

- Analyze your trade patterns and histories to sharpen your trading strategies.

Key Point & Best Prop Firm Dashboards for Real-Time Risk Tracking List

| Prop Firm Name | Key Point (Unique & Important) |

|---|---|

| Blueberry Funded | Offers broker-backed execution with institutional-grade spreads, helping traders track slippage and real-time risk exposure accurately. |

| FunderPro | Provides a real-time risk dashboard with live drawdown alerts and performance analytics for better capital protection. |

| FundedNext | Features customizable risk metrics and trader-level KPIs to monitor consistency and daily loss limits in one view. |

| TradersYard | Emphasizes transparency with a clean dashboard showing equity curve, max risk per trade, and real-time margin usage. |

| E8 Funding | Includes advanced analytics with trade tagging and risk-reward tracking to refine strategy performance. |

| Finotive Funding | Supports dynamic drawdown models and real-time account health indicators for disciplined risk management. |

| Alpha Capital Group | Delivers institutional-style dashboards with portfolio-level risk exposure and correlation monitoring. |

| Smart Prop Trader | Offers instant performance scoring and risk snapshots to help traders stay within firm rules. |

| Lux Trading Firm | Provides professional-grade analytics focused on long-term risk profiles and capital efficiency. |

| Blue Guardian | Features a simplified, mobile-friendly risk panel with live alerts for drawdown and rule compliance. |

1. Blueberry Funded

Blueberry Funded, established in the early 2020s, stands as a pioneer broker-backed proprietary trading firm. Blueberry Funded is tailored for traders who appreciate transparency, spread, and execution reliability.

Blueberry Funded has accounts that range in size from small starter accounts to scalable six-figure funded capital options. Throughout the trading experience, traders have access to one of the Best Prop Firm Dashboards for Real-Time Risk Tracking that provides real-time updates for drawdown, equity additions, and compliance to the rules.

As traders progress through the account tier and performance milestones, profit split increases, with a maximum of 80%.

Blueberry Funded Features

- Real-Time Risk Metrics – Supervising risk parameters, including drawdown limits, equity, and open positions, is done in real-time.

- Tight Execution – Minimizing drawdown and slippage are executed accurately with broker-backed pricing.

- Dashboards – Individualized views for rules compliance and performance.

- Scalable Accounts – Different funding levels ranging from starter to big money.

- Real-time Performance Alerts – Performance alerts for breaching daily or overall max loss caps are done in real-time.

Blueberry Funded Advantage & Disadvantage

| Advantage | Disadvantage |

|---|---|

| Real‑time risk and equity tracking helps traders stay within limits. | Dashboards can feel complex for beginners unfamiliar with analytics tools. |

| Broker‑backed pricing reduces slippage and improves trade execution. | Smaller community and support resources compared to larger firms. |

| Customizable dashboards allow tailored monitoring. | Advanced features may require a learning curve. |

| Scalable accounts from small to large capital. | Higher capital tiers may have stricter evaluation criteria. |

| Instant alerts for drawdown or rule triggers. | Frequent alerts can overwhelm new traders. |

2. FunderPro

FunderPro launched in the early 2020s and specializes in modern evaluation models and analytics for active and professional traders. Its accounts have varying challenge-based and instant funding options. These accounts have different capital levels that scale from entry-level accounts to large professional trading balances.

The platform includes the Best Prop Firm Dashboards for Real-Time Risk Tracking. This feature helps traders track their daily loss limit, trailing drawdowns, and open risk exposure in real-time.

FunderPro is reputed for providing traders a deal for profit-sharing, where they get to keep 80%-90% of the profits they generate based on their account level and consistency performance. Traders get more as they progress up their account levels.

FunderPro Features

- Real-Time Drawdown Alerts – Risk parameters drawdown alerts are executed in real-time.

- Analytics – Win rate, risk ratio, and performance history.

- User Friendly – Metrics can be navigated quickly through a streamlined interface.

- Flexible Challenge Models – Quite a few avenues to funding are available with extensive progress tracking.

- Profit Metrics – There are visual metrics for profit goals and profit split.

FunderPro Advantage & Disadvantage

| Advantage | Disadvantage |

|---|---|

| Detailed analytics provide deeper performance insights. | Advanced metrics may be confusing for casual traders. |

| Real‑time drawdown alerts prevent rule violations. | Some tools focused on stats over simplicity. |

| User‑friendly UI makes navigation easy. | May lack certain advanced charting features. |

| Flexible challenge models fit different skill levels. | Faster evaluation models sometimes have tighter limits. |

| Clear profit tracking improves goal clarity. | Profit goals can feel aggressive for some traders. |

3. FundedNext

Established in the early 2020s, FundedNext quickly gained and continues to receive attention for its innovative funding models and trader-centered policies. It provides evaluation and express funding accounts marketing a range of capital, from entry level to upper professional trading accounts.

FundedNext provides traders with access to Best Prop Firm Dashboards for Real-Time Risk Tracking, allowing them to view trade analytics, risk parameters, and daily loss limits, all from a single platform. FundedNext’s profit splits are extremely competitive and range from 80% to 90% depending on performance and scaling, allowing both short- and long-term trading strategies to be successfully utilized.

FundedNext Features

- Continuation Risk Metrics – Tracking is ongoing for account risk and exposure.

- Analytics – Performance consistency and trade analytics.

- Instant Funding Options – Access to instant funding is available through a real-time evaluation.

- Daily Limit Monitoring – There is an automatic display of the drawdown remaining.

- Progress Indicators – Visual markers that show progress towards profit target.

FundedNext Advantage & Disadvantage

| Advantage | Disadvantage |

|---|---|

| Continual risk monitoring enhances discipline. | Busy dashboards may appear cluttered. |

| Consistency metrics help refine trading behavior. | New traders may misinterpret scoring systems. |

| Instant funding options speed access to capital. | Faster paths can have stricter controls. |

| Daily limit visibility prevents unexpected losses. | Alerts sometimes lack customization options. |

| Progress indicators motivate traders toward goals. | Fewer educational tools integrated into the dashboard. |

4. TradersYard

TradersYard began offering services as a proprietary trading firm in 2020. They claim to be the most honest firm in the industry. All traders start with the same assumptions about the firm, unlike most firms that give a random range of starting balances. They show evaluations as hurdles to be jumped over.

They say that once you ‘pass’ the ‘evaluation’, you’ll receive a ‘funded’ account. They integrate with their own version of the Best Prop Firm Dashboards for Real-Time Risk Tracking to view their account balances, equity, and drawdown levels. They also offer the industry standard profit share of 80+% to traders that make consistent profits. Meaning, they don’t promote trader scaling, which increases starting balances.

TradersYard Features

- Equity Curve Visualization – Graphs displaying performance over time.

- Real‑Time Risk Stats – Daily loss, max drawdown, and trade risk visibility.

- Clean Layout – Simple interface that allows for rapid decision making.

- Alerts & Notifications – In-platform and audible alerts for key risk events.

- Account Progress Tracking – Visual markers for goals and scaling readiness.

TradersYard Advantage & Disadvantage

| Advantage | Disadvantage |

|---|---|

| Equity curve visuals simplify performance review. | May not offer as many advanced analytics as pro platforms. |

| Real‑time risk stats improve accountability. | Traders new to risk metrics may need guidance. |

| Clean layout prioritizes core metrics. | Simpler functionality might feel basic for advanced traders. |

| Integrated alert system improves awareness. | Alerts may require fine‑tuning to avoid noise. |

| Clear account progress visualization. | Less customization for personal dashboards. |

5. E8 Funding

E8 Funding was established in the early 2020s and offers traders flexible trading and modified conditions with advanced analytics at their performance. They offer a variety of accounts, which include standard challenges and different models of evaluations that can be funded from entry level to high-cap professional accounts.

E8 Funding also offers some of the Best Prop Firm Dashboards for Real-Time Risk Tracking to track metrics such as winning percentage, risk reward ratio, and drawdown. E8 Funding even offers profit sharing, starting at 80% as traders become consistently profitable and exhibit long-term performance.

E8 Funding Features

- Advanced Trade Metrics – Metrics such as risk-reward ratio, win/loss distribution, and heat maps.

- Live Equity Monitoring – View your real account balance and active drawdown at any time.

- Detailed Performance Reports – Analytics for each performance report daily, weekly, and monthly.

- Trail Drawdown Tracking – View plot for drawdown relative to peak crossings in real time.

- Custom Filters – Modify settings to filter by specific metrics or sets of trades.

E8 Funding Advantage & Disadvantage

| Advantage | Disadvantage |

|---|---|

| Advanced trade analytics support strategy refinement. | High volume of metrics can overwhelm beginners. |

| Live equity view keeps traders updated. | Interface may feel technical for casual users. |

| Detailed performance reports guide improvement. | Reporting tools may require time to master. |

| Trail drawdown tracking adapts to performance changes. | Not all traders need deep drill‑downs. |

| Custom filters allow focused analysis. | Too many options can distract from core metrics. |

6. Finotive Funding

Finotive Funding began its operations in the early 2020s and is known for innovative drawdown policies and evaluation processes that are friendly to traders. It has a variety of account tiers, enabling traders to start with lower capital and progressively scale up to six-figure funding.

One of the platforms Dasboards for Real-Time Risk Tracking, traders receive real-time updates on account status, margin, and performance. Profit splits are enticing and increase as traders move up the ranks with a common start of 80% and lower margins on risk and consistent trading performance over time.

Finotive Funding Features

- Dynamic Drawdown Concepts – Track drawdown limits that flex with your performance.

- Risk Dashboard – Overview of exposure, what’s left on the equity, and the margin.

- Performance History Tools – Analytics on past trades.

- Live Alerts – Rule violation alerts that send emails and show on the dashboard.

- Daily/Lifetime Stats – Performance metrics in the short term and long term.

Finotive Funding Advantage & Disadvantage

| Advantage | Disadvantage |

|---|---|

| Dynamic drawdown system rewards disciplined traders. | Complex drawdown logic may confuse newcomers. |

| Full risk dashboard consolidates key stats. | May lack some advanced customization features. |

| Robust performance history review. | Traders may rely too much on historical data. |

| Live alerts ensure timely responses. | Too frequent notifications for some. |

| Detailed daily and lifetime stats boost insights. | Analytics may feel overwhelming without guidance. |

7. Alpha Capital Group

Alpha Capital Group is relatively new in the industry, founded in 2020, and aims to provide a top-tier professional trading experience with the risk management systems of large scale institutions.

There are several account programs with sizes that cater to both evaluation-based funding and direct capital access for intermediates and advanced account programs. Users also get the Best Prop Firm Dashboards for Real-Time Risk Tracking in their systems which break down portfolio exposure, drawdown, performance of a trade, and other analytics in real-time.

Profit splits also tend to start around 80% and as traders remain consistent, they tend to increase, making this attractive to serious traders, especially for those who wish to scale over time.

Alpha Capital Group Features

- Portfolio Risk Exposure – Analyze risk across numerous instruments at the same time.

- Professional‑Grade Charts – Visualization of performance at a granular level.

- Real‑Time Alerts – Warnings of risk and drawdown in real-time.

- Comprehensive Risk Panels – Check equity, margin, and drawdown on a single screen.

- Account Growth Metrics – Track progress toward profit goals with specific milestones.

Alpha Capital Group Advantage & Disadvantage

| Advantage | Disadvantage |

|---|---|

| Portfolio risk tools benefit multi‑instrument traders. | May be more than needed for simple strategies. |

| Professional‑grade charts support analysis. | Interface depth can intimidate newbies. |

| Real‑time alerts keep traders informed. | Alerts may require manual filtering. |

| Comprehensive risk panels collect all key data. | Some metrics may not apply to all traders. |

| Account growth tracking shows scaling readiness. | Progress metrics may be slow for short‑term traders. |

8. Smart Prop Trader

Smart Prop Trader was established in the early 2020s. It caters to fans of simplicity and advanced performance insights. Their business model includes tiered capital funding, so traders can choose from various evaluation challenges and funded accounts, from beginner to high-tier professional funding.

Using the Best Prop Firm Dashboard for Real-Time Risk Tracking, traders can see and track compliance with firm rules, daily loss limits, open positions, and more, in real-time. As traders scale their accounts with consistent results, profit-sharing models become more competitive, typically starting around 80% and offering splits that can increase.

Smart Prop Trader Features

- Instant Performance Scoring – Get real‑time scoring feedback for your last trades.

- Live Risk Snapshots – Overview of daily loss and the current remaining allowance.

- Intuitive Layout – Simple yet powerful for quick insights.

- Rule Compliance Indicators – Approaching limits triggers color-coded alerts.

- Profit Split Viewer – Visually displays split percentages and profit earned.

Smart Prop Trader Advantage & Disadvantage

| Advantage | Disadvantage |

|---|---|

| Instant performance scoring helps quick assessment. | Simplified scoring may overlook nuance. |

| Live risk snapshots give at‑a‑glance insight. | May lack deep analytics compared to pro dashboards. |

| Intuitive interface suits beginners. | Limited advanced settings for pros. |

| Rule compliance indicators improve discipline. | Notifications may lack customization. |

| Profit split viewer clarifies earnings. | Dashboard may feel basic for expert traders. |

9. Lux Trading Firm

Lux Trading Firm opened in the early 2020s. It caters to advanced traders looking for a more corporate, professional and sustainable, long-term trading partnership. Its platforms span across various funded accounts with customized capital allocations prioritizing sustainable growth. As a firm, they believe in long-term challenges.

They also utilize the Best Prop Firm Dashboard for Real-Time Risk Tracking to enable traders to see their performance analytics, risk, and capital efficiency in real-time. Most profit splits are 80% to over 90% which leaves room for consistent risk, discipline, and long-term profit over high aggressive trading.

Lux Trading Firm Features

- Professional‑Level Risk Analytics – Understand long-term risk metrics deeply.

- Equity & Drawdown Dashboards – Keep your account health continuously visible.

- Mobile‑Friendly Interface – View your risk metrics from any device.

- Scalability Tools – Metrics for evaluating readiness to progress in capital tiers.

- Historical Performance Filters – Analyze and compare performance across various time frames.

Lux Trading Firm Advantage & Disadvantage

| Advantage | Disadvantage |

|---|---|

| Professional‑level analytics suit serious traders. | May feel too advanced for beginners. |

| Continuous equity and drawdown views enhance control. | Dashboard depth may distract new users. |

| Mobile‑friendly interface supports flexibility. | Mobile version may not show full desktop features. |

| Scalability tools encourage growth planning. | Scaling signals may be slow for aggressive traders. |

| Historical filters enable comprehensive review. | Too many timeframes can confuse focus. |

10. Blue Guardian

Established in the early 2020s, Blue Guardian has become one of the industry’s most user-friendly prop firms, with an interface and account setup designed for traders. Their account options include Evaluation and Funded models with varying tiers of capital, from small Starter accounts to large Professional funding tiers.

Their traders enjoy one of the Best Prop Firm Dashboards for Real-Time Risk Tracking, allowing them to receive real-time notifications on downsize limit breaches, milestones, rule breaches, and 3 other proprietary performance metrics.

Profit splits tend to start around 80% and improve with higher account tiers, making it one of the most attractive options to traders who want to scale and drive robust risk management.

Blue Guardian Features

- Live Drawdown Alerts – Real-time alerts when nearing critical thresholds.

- Simplified Risk Panel – Concentrated layout showcasing crucial risk indicators.

- Rule Compliance Tracker – Captures breaches or potential breaches.

- Mobile Alerts – Notifications concerning risk indicators are sent to your phone.

- Progress Tracking – Dashboard bars indicating completion towards goals.

Blue Guardian Advantage & Disadvantage

| Advantage | Disadvantage |

|---|---|

| Real‑time drawdown alerts boost awareness. | Simpler alert system may miss advanced triggers. |

| Focused risk panel highlights essentials. | May lack some deep analytics for pros. |

| Rule compliance tracker improves discipline. | Interface may feel minimal for some users. |

| Mobile alerts keep traders informed on the go. | Mobile notifications could be too frequent. |

| Progress tracking motivates toward goals. | Progress visuals may lack detail for advanced traders. |

Conclusion

Having access to the Best Prop Firm Dashboards for Real-Time Risk Tracking is crucial for disciplined and successful trading in the fast-paced trading climate of today. These platforms, which include Blueberry Funded and Blue Guardian, give traders real-time information on equity, drawdowns, and risk exposure, which helps them make better decisions and avoid expensive errors. Real-time analytics, comprehensive reporting, and competitive profit splits enable traders to concentrate on strategy while upholding stringent risk control, regardless of whether they are managing six-figure capital or scaling tiny accounts. Selecting the appropriate dashboard can be crucial to long-term trading success.

FAQ

Prop firm dashboards are online platforms provided by proprietary trading firms that allow traders to monitor their account performance, risk metrics, equity curves, and compliance with firm rules in real time. They are designed to give traders transparency and control over their funded accounts.

Real-time risk tracking helps traders prevent significant losses by monitoring drawdowns, daily limits, and margin usage instantly. It allows for smarter decision-making, better trade management, and adherence to firm rules, which is crucial for long-term profitability.

Some of the top prop firms with the Best Prop Firm Dashboards for Real-Time Risk Tracking include Blueberry Funded, FunderPro, FundedNext, TradersYard, E8 Funding, Finotive Funding, Alpha Capital Group, Smart Prop Trader, Lux Trading Firm, and Blue Guardian. These firms provide live analytics, alerts, and intuitive interfaces.

Key features include live drawdown tracking, equity and profit visualization, margin alerts, trade history analytics, performance scoring, and compliance monitoring. Dashboards that combine these features allow traders to track risk efficiently and scale accounts confidently.

Profit splits vary by firm but typically start around 70–80% and can increase as traders demonstrate consistent performance. Dashboards help traders track profitability in real time, ensuring they understand how much they earn and how close they are to targets.