I will analyze the Best Crypto and Fiat Payment Gateways in Sweden. The growing phenomenon of digital payments necessitates the need of Sweden’s businesses to acquire solutions that deal with both crypto and fiat currency.

These gateways provide quick and safe flexible transactions, allowing merchants to efficiently service both local and international clients while minimizing costs and making financial management easier.

What is Payment Gateways?

A payment gateway represents secure technology that performs seamless online transactions between a buyer and a seller. It serves as a connector among websites/apps and payment-accepting institutions by facilitating the encoding and secure sending of sensitive data such as credit cards and digital wallet credentials.

Transferring payment and receiving money are gateways’ means of verifying transactions. Functioning as a digital bank, debit card, and cash for websites, payment gateways enable quick transactions that online businesses and their clients appreciate. Transacting through payment gateways is quick, secure, and easy.

Why Use Crypto and Fiat Payment Gateways in Sweden

Range of Payment Methods – With a crypto and fiat gateway, businesses can accept both traditional payment methods. i.e., SEK (Swedish Krona), and crypto assets like Bitcoin and Ethereum, which enhances their reach to various customers.

Quick Payment Processing – Fund transfers from international customers through crypto gateways are processed faster than traditional means which helps in reducing the idle cash waiting time.

Reduced Processing Costs – Payments made through crypto, as compared to other alternatives like credit cards, bank deposits, and transfers, have a much lighter processing fee which assists businesses in saving large amounts on every transaction.

Improved Fraud Safety – Advanced payment gateways come with many layers of encryption and authentication to safeguard both the merchant and the merchant’s customer from data and identity theft.

International Benefits – With the absence of borders in crypto payments, Swedish businesses can focus on servicing international customers without the hassle of currency conversions and banking barriers.

User-Friendly Payment Methods – Having the alternative of multiple payment methods enhances customer journeys by offering them convenience. This strategy draws in customers who are friendly and fluent with technology, along with those who are friendly and fluent with crypto currency.

Key Point & Best Crypto and Fiat Payment Gateways in Sweden

| Payment Gateway | Key Points / Features |

|---|---|

| CoinGate | Supports multiple cryptocurrencies, easy integration, real-time settlement. |

| CoinPayments | Wide crypto support, multi-currency wallets, robust security features. |

| B2BinPay | Crypto and fiat support, high-volume transactions, customizable APIs. |

| Adyen | Global fiat payments, multi-channel support, advanced fraud detection. |

| Revolut Business | Multi-currency accounts, instant transfers, integrated business tools. |

| Wise | Low-cost international transfers, multi-currency support, transparent fees. |

| CoinRemitter | Lightweight crypto gateway, simple API, supports multiple blockchain networks. |

| OxaPay | Crypto payments for e-commerce, instant settlement, easy integration. |

| NOWPayments | Accepts many cryptocurrencies, auto-conversion to fiat, no KYC for small merchants. |

| RelayPay | RelayPay allows users to pay or receive money |

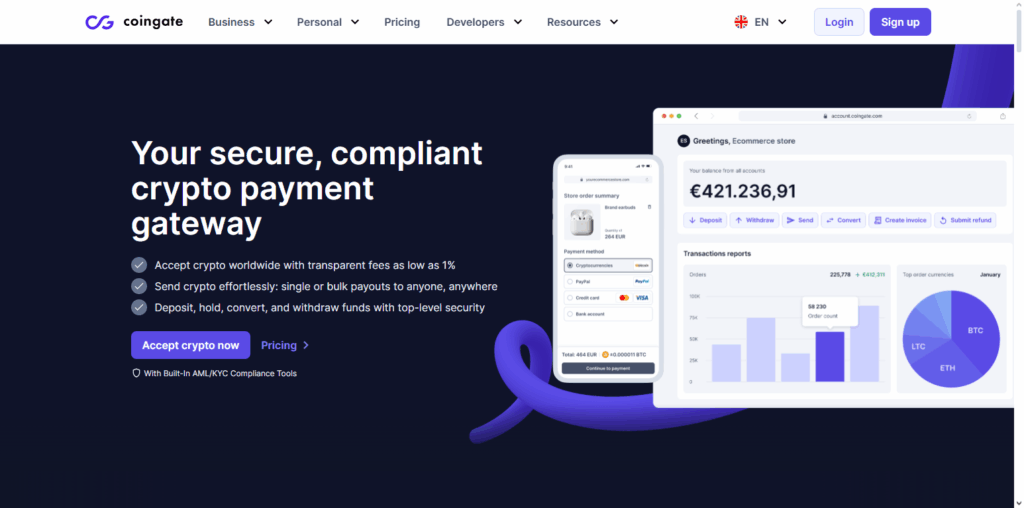

1. CoinGate

CoinGate has become one of the most reputable crypto and fiat payment processors in Sweden thanks to its reliable and versatile payment options. It enables Swedish companies to receive payments in various cryptocurrencies such as Bitcoin and Ethereum alongside traditional fiat currencies allowing access to a broader audience.

Incorporating real-time settlement, secured fraud protection, and protective measures for all parties involved in a transaction, fast and safe payments are always guaranteed.

For e-commerce platforms, automated invoicing, and multi-currency wallets, CoinGate facilitates simple and efficient financial management through its API integrations. Due to its flexibility, fast pace, and solid regional assistance, CoinGate is one of the most recommendable platforms for Swedish merchants.

CoinGate Features

- Volatility Filtering via Instant Crypto-to-Fiat Transaction: Users are enabled to convert crypto-in payments to fiat (EUR, USD, GBP) to elude volatility risks, or auto convert from crypto to fiat.

- Easy Implementation: A wide range of plugins are provided along with a complete REST API, SDKs, and billing in installments, and additional POS centered features

- Excellent crypto treasury management: Users are provided fine features to manage crypto treasury like, dashboards with balance monitoring in real time and division of team permissions, mass payouts, return payments, and reporting.

2. CoinPayments

Among the many provided crypto and fiat payment gateways in Sweden, CoinPayments shines the most, considering the customers’ needs and values. Swedish merchants can accept more than 2000 crypto assets, in addition to fiat currencies.

Customers hold extreme payment flexibility. Users can access instantaneous transactions, and merchants protect themselves by control cal to secured multi-currency wallets with fraud protected systems.

Furthermore, no other provided payment gateway have such easy link to e-commerce services with automatic invoicing tools and dashboards to facilitate payment oversee. CoinPayments have best crypto pairings as well as the best safety and usability, thus became first choice among the Sweden payment gateways.

CoinPayments Features

- Support and wallet: There are over 100 cryptocurrencies, and a multi-coin custodial wallet to enable merchants store, send or to receive several tokens.

- Custom Invoicing: Merchants have the ability to generate real time tracking invoices, payment link QR codes, and “Buy Now” buttons at their choosing

- Merchant Control: Merchants have the ability to convert their assets from crypto to fiat, also there are permissions available on transaction fee batching

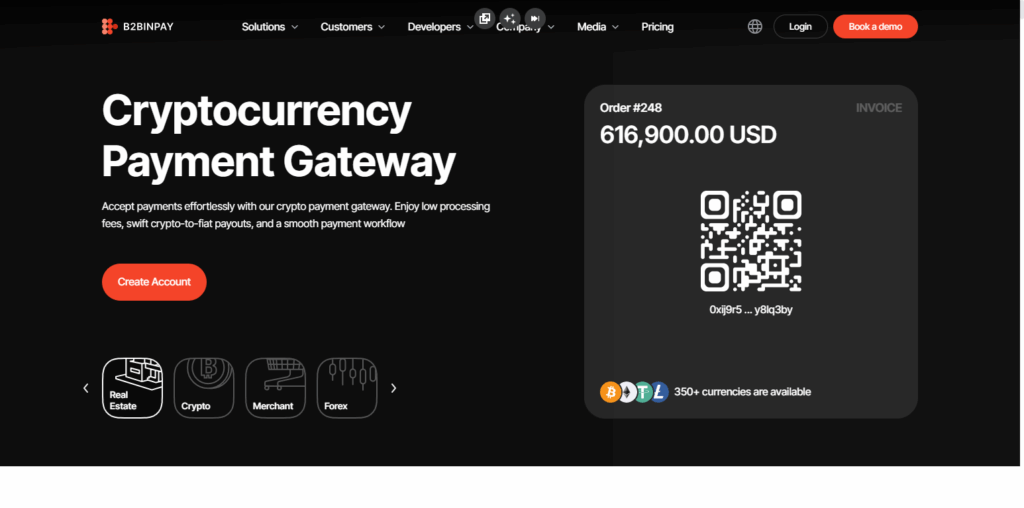

3. B2BinPay

B2BinPay is considered one of the most efficient and secure crypto and fiat payment gateways in Sweden. It allows Swedish enterprises to receive effective crypto and fiat payments instantly.

B2BinPay is designed for businesses and expanding ecommerce because of its ability to handle high volume transactions. B2BinPay’s advanced API makes it easy and effective to integrate custom solutions into web and mobile applications and POS systems.

Multi-currency wallets with advanced fraud protection allow flexibility and high security. Automated invoicing and custom analytics create a payment solution Sweden businesses can depend on. B2BinPay is one of the most reputable payment systems that empowers Swedish enterprises to meet the financial needs of their clients.

B2BinPay Features

- Versatile: More than 350 different currencies are accepted, including the most popular cryptocurrencies, stablecoins, and tokens. The system is extremely adaptable to any requirements for crypto payments.

- Prompt & Changeable Settlements: Payments can be altered into either fiat or stablecoins, and merchants can withdraw funds into either crypto wallets or bank accounts through SEPA/SWIFT.

- Security & Compliance: Security measures implemented through no rolling reserves (unlike traditional high-risk payment processors), and high scalability for growing businesses.

4. Adyen

Adyen is a business with a strong global presence which offers a wide array of payment services, making it one of the most important payment service providers to the Swedish market as well as to the Swedish crypto market.

It allows for swift and secure transactions as well as access for Swedish companies to a variety of different digital payment solutions as well as to numerous different fiat currencies. Adyen is also a very prominent and well regarded processor for the multi channel payment solutions for in store purchases.

It also allows companies to centralize their payment processing. Adyen also allows for in depth tailored reporting, allowing Swedish companies to better optimize their reporting solutions when it comes to digitally driven transactions.

Adyen is also regarded for it fraud prevention measures which benefit the customer and the merchants alike. As such, it can be inferred that Adyen is a professional provider of payment services for Swedish companies and businesses with which they can manage their payment processing in a crypto and fiat agile manner.

Adyen Features

- All-in-one Payments: Provides merchants with the ability to accept payments at any time and from any location via integrated mobile, e-commerce, and physical (POS) payments across different businesses.

- Cross-Border Payment Solutions: Ideal for international enterprises (or businesses operating in Europe) due to 250+ payment methods and 187 supported currencies.

- Cloud Based, Highly Available: Built with multiple data centers (active-active), with competitively low latency, high availability, and robust architecture, ensuring system resilience and constant uptime.

5. Revolut Business

Revolut Business was one of the first crypto and fiat payment gateways in Sweden and is still considered one of the most flexible payment processors in the country. It lets Swedish users accept payments in various fiat and crypto currencies giving them the freedom to use the payment processor for local and global clients.

Revolut Business is also known for its instant transfer capabilities and multi-currency accounts, its financial managment integrations also help users track their income and expenses.

Revolut Business’s payments movement user experience, predictive security, and instant payment notifications make the customers payment experience seamless. Domestic users also benefit from corporate cards, payment automation and custom invoicing, accross the gateways various ecommerce integrations.

Revolut Business Features

- Business Banking + Multi-Currency Accounts: Enables businesses to hold, exchange, and make payments in various fiat currencies (EUR, USD, GBP, etc.), which is advantageous for global business operations.

- Card Payments and Merchant Tools: You can pay suppliers via e-commerce or use its business platform. It also accepts regular card payments.

- Crypto Friendly Features: Revolut allows users to trade and hold cryptocurrencies in the app, and its business offering can employ other crypto payment gateways or digital asset to fiat conversion (when possible legally in the region).

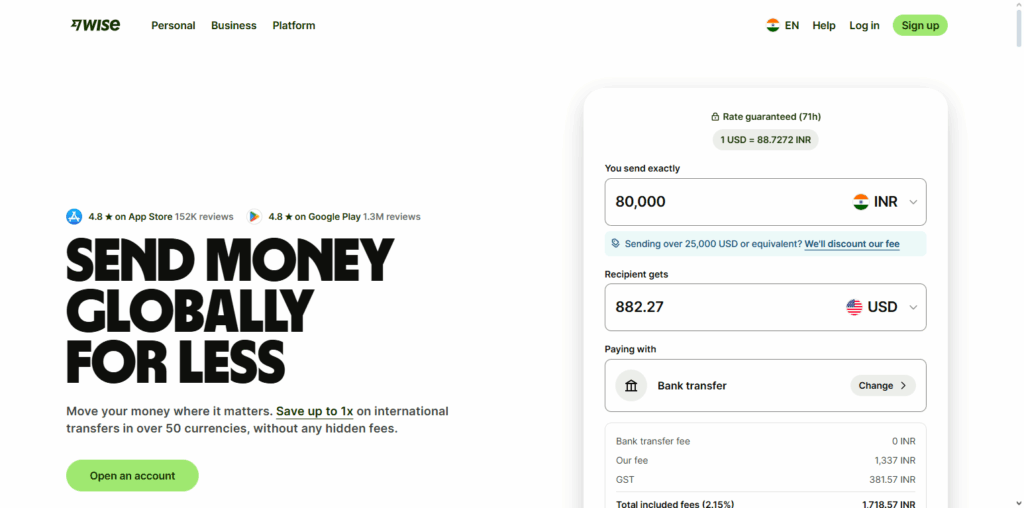

6. Wise

Wise has cheap and open international payment solutions and as a result, has one of the best crypto and fiat payment gateways in Sweden. It permits users from Sweden, both firms and individuals, to make, receive and accept payments in various fiat euros at minimal costs and with real exchange rates to reduce the loss of money at conversion.

They have a good reputation for their reliability, transparency, speed, and ease of use of their transfer and account management platform. They instantly transfer money and provide easy account management.

They even have a multi-currency accounts for their users. They ease international payment made from their accounts and have integrated business tools to create a user friendly experience with the help of their strong and multi-currency security measures. For these reasons, their their efficiency, low costs, and worldwide availability make them perfect for businesses.

Wise (formerly TransferWise) Features

- Low Cost Cross-Border Payments: Wise has gain repute for very low and transparent fees for sending money across borders.

- Multi-Currency Holding: Businesses can hold and manage balances in different currencies, thus it is easier to one place to manage payments from different geographies.

- Integration Capabilities: Can use alongside payment gateways to receive fiat payouts, especially when crypto is converted to fiat and transferred to a bank account.

7. CoinRemitter

CoinRemitter is among the most effective crypto and fiat payment gateways in Sweden that integrates effortlessly into companies’ workflows.

Swedish merchants can receive payments in multiple cryptocurrencies and receive automated invoices, and immediate settlements, and can manage multi-assets in crypto and fiat in the same wallet. Low-cost, self-hosted, and full control of the transactions as an API add an extra layer of efficiency.

He attributes his decision to a great reputation determined by solid security, easy integration into platforms, and reliable crypto-to-fiat conversion. Without a doubt, the gateway of choice among Swedish businesses for cryptocurrency payments has to be CoinRemitter.

CoinRemitter Features

- Ultra-Low Processing Fees: CoinRemitter charges 0.23% in transaction processing fees. This is much lower than the fees charged by other crypto and traditional payment processors.

- Flexible Widgets & APIs: Their services are suited for Software as a Service (SaaS), Initial Coin Offerings (ICOs), and web applications since they offer payment integration through widgets (pricing, presale, and button) and REST APIs.

- Auto-Withdrawal & Gas Optimization: Their ‘Gas Station’ feature lowers the transaction (gas) costs for certain coins and the service enables customers to configure external wallets to receive automated withdrawals.

8. OxaPay

In Sweden, OxaPay is one of the best providers of crypto and fiat payment solutions, catering to all types of businesses. OxaPay is the only one catering to the e-commerce space, allowing merchants to accept payments seamlessly and quickly with no hassle. OxaPay allows merchants to accept payments in various cryptocurrencies and automatically converts crypto to fiat.

Merchants have the option of choosing the currency in which they wish to receive payments. The service is suitable for both small and large businesses, having integrated APIs, real time transaction monitoring, and high service security.

OxaPay provides an advanced payments solution which allows merchants to better their customer service and grow their businesses across borders.

OxaPay Features

- Dynamic Invoicing & Static Addresses: For periodic payments, subscriptions, or unique user tracking, OxaPay creates cryptocurrency invoices dynamically and assigns each user a fixed wallet address.

- Automatic Conversion to Stablecoins: The service automatically converts crypto to a stable currency (like USDT) to counter the fluctuating value of crypto and protect the merchant.

- Advanced Payment Management Tools: The service provides tools for auto-withdrawal, a webhook callback for the user to handle underpaid payments, and a white-label checkout to facilitate the control of the payment’s appearance.

9. NOWPayments

NowPayments has established itself as one of the top-rated services to accept cryptocurrencies and digital currency (fiat) in Sweden. It provides customers with an impeccable experience by offering a highly versatile solution offering the conversion of 70 + digital currencies.

Customers can elect to receive payments in the Swedish Krona (SEK) and other currencies as they process payments from all over the world. It is one of the few payment services where the customer can elect the currency to receive payment in and at the same time the merchant is insured against price fluctuations of the volatile currencies.

Customers appreciate the seamless API integration and low fees that NowPayments provides. No KYC approvals gives it a great advantage to smaller token payments. Money is received in real time and range of services is growing constantly.

NowPayments is enabling Swedish businesses to once again become world leaders and greatly streamlining the services of their customers that they want to provide.

NOWPayments Features

- Wide Support for Cryptocurrencies: Accepts more than 200 cryptocurrencies (altcoins and stablecoins included) so the customers can choose how to pay.

- Easy Cash Out & Currency Conversion: Merchants can change the crypto payments they receive to fiat and withdraw straight to a bank account, closing the gap between crypto and traditional finance.

- Transparent and Low Cost: Service fees start at 0.5% with no extra fees for setup, plus a multitude of integration options (API, plugins, payment links) to facilitate onboarding.

10. RelayPay

RelayPay is regarded as one of Sweden s top crypto/fiat payment gateways due to the ease of bridging the gap between digital assets and banking seamlessly without the complexities most gateways present.

Their number one strength is the instant conversion of crypto to fiat and the ability to make everyday bill payments, online payments and merchant payments.

RelayPay is dependable on the individual level as well as the business level because of rapid processing, reasonable pricing and reliable safety. For Sweden, RelayPay is as fast and effective as they come, and the multi-service support with the easy to use interface simplifies the payment gateway.

RelayPay Features

- Immediate Exchange of Cryptocurrency & Fiat – Instantaneous digital currency conversion to a local currency for payment purposes.

- Multiples of Service Provision – Facilitates payment of bills, online shopping, and transactions with other business.

- Transparent and Secure – Process assured with no challenges- strong security and rational prices.

Conclusion

To summarize, Sweden’s top crypto and fiat payment processors give companies a safe, adaptable, and effective method to manage both conventional money and crypto.

CoinGate, CoinPayments, B2BinPay, Adyen, Revolut Business, Wise, CoinRemitter, OxaPay, RelayPay, and NOWPayments, keep improving their unique offerings, including rapid transaction completion, minimal fee structures, and watertight security.

The incorporation of these payment processors by companies in Sweden will improve customer engagement, and ease operational and financial process. The fast growing digital economy in Sweden will benefit further as businesses automate payment processes.

FAQ

Yes — crypto-asset service providers are regulated in Sweden under the EU’s MiCA framework and local AML laws.

They must comply with anti‑money laundering (AML) and KYC (know your customer) regulations. Also, many providers must register with the Swedish Financial Supervisory Authority (SFSA).

Gains from crypto are generally treated as capital gains. If a business receives crypto and then converts or sells it, the profit may be taxed similarly to other financial assets