In this article, I will discuss the Best money exchange apps of today. These apps allow you to transfer money internationally with ease and efficiency as they have very low service charges as well as fast delivery services.

Be it sending money to loved ones or dealing with finances for business, these apps make the handling of worldwide monetary issues easy and manageable for all.

Key Point & Best money exchange apps List

| Service | Key Point |

|---|---|

| Western Union | Global network, fast transfers |

| Remitly | Affordable pricing, mobile-focused |

| Revolut | Multi-currency accounts, crypto support |

| MoneyGram | Fast cash transfers, worldwide locations |

| WorldRemit | Competitive exchange rates, online services |

| Paysend | Flat fee transfers, instant to cards |

| OFX | Low fees, 24/7 support |

| TorFX | No fees for large transfers, personal manager |

| BookMyForex | Competitive forex rates, doorstep delivery |

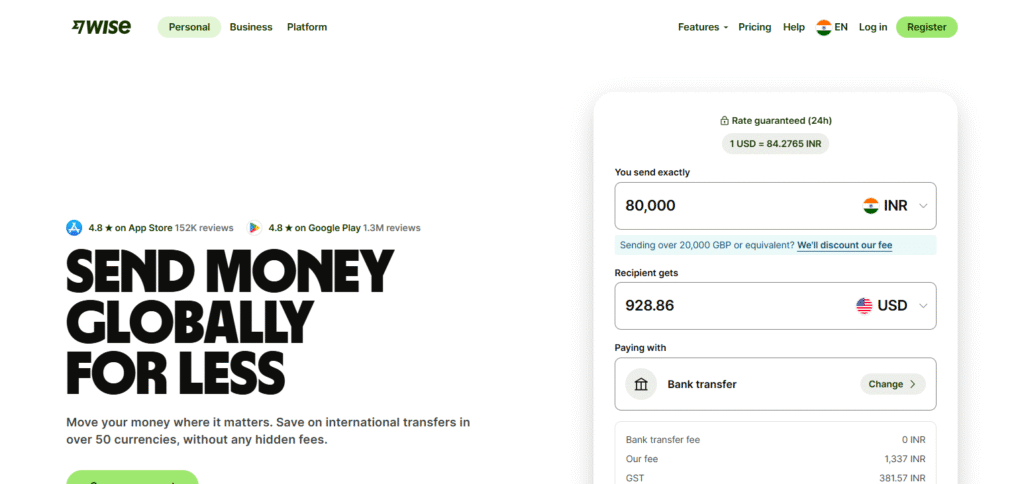

1.Wise

Wise is a money exchange application that is noticed for its low commission fees. Unlike traditional exchanges, Wise offers users real-time exchange rates which enables international money transfers at a comparatively cheaper fee than banks.

Its user-friendliness, speed of transactions, and maintained multi-currency accounts makes Wise favorable to a lot of people who want a cheaper and dependable service for global currency exchange.

Pros & Cons Wise

Pros:

- Low fees Wise does not charge more than what is necessary, with no hidden fees or extra costs in the fine print.

- Live exchange rates You receive the proper exchange rate; there aren’t any extra fees on top of it.

- Multi-currency accounts Best suited for holdings that require multiple currencies.

Cons:

- Limited availability in some countries Not all nations can use Wise.

- Slower transfers Services may take longer than fast ones.

- No cash pick-up option Transfers can only be made through the bank or card payments.

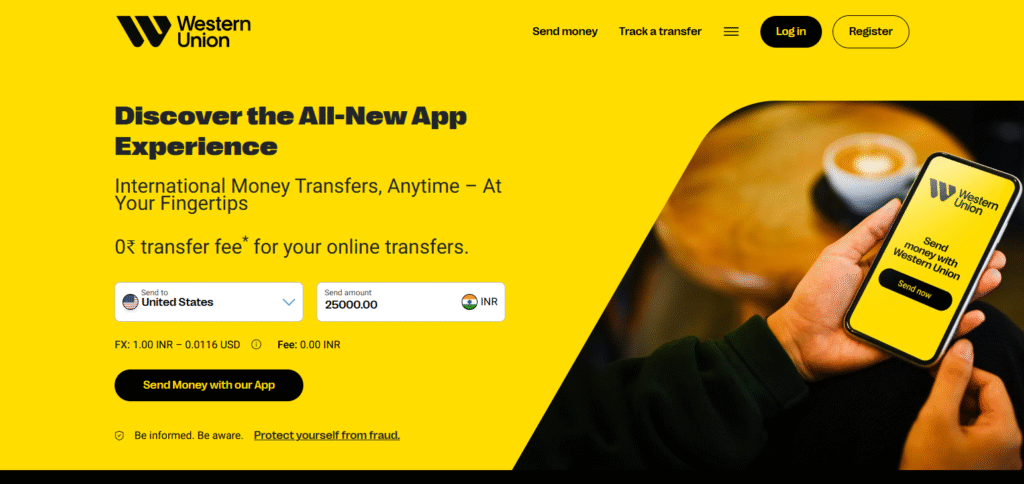

2.Western Union

Western Union is one of the best money exchanger apps since it operates in more than 200 countries. Users can choose different methods of transfer like cash, bank deposits, and mobile wallet transfers.

What makes it unique is that money can be sent both online and offline which provides flexibility to users globally.

Because of its speedy transfer services, good reputation, and wide accessibility through local agents it remains one of the popular choices for international money transfers.

Pros & Cons Western Union

Pros:

- Extensive network More than 200 countries use this service, and there are many agents.

- Cash transfer You can send school fees, cash, and mobile wallets to your bank.

- Fast Transfers Most transfers can be done instantly, within minutes.

Cons:

- High fees If someone uses the app for smaller transfers or faster services, it becomes painfully expensive.

- Variable exchange rates Rates may continuously fluctuate and not be as low as other apps.

- Limited online services Not all options may be done in person selction.

3.Remitly

Remitly is ranked as a leading app for exchanging money because of thier international transfers that are cheap and quick, especially for mobile device users.

The application is tailored for clients sending money to relatives and friends, offering both economic and express delivery services.

Its lower rates, favorable terms of exchange for different currencies, and many other payment methods make it a preferred option for sending money across different parts of the world, especially for users trying to send money in an easy way.

Pros & Cons Remitly

Pros:

- Affordable pricing options – Offers economy and express options for sending money.

- Wide reach – Available in over fifty countries.

- Mobile focused – User friendly mobile transfers with an app.

Cons:

- Higher fees for express transfers – Premium faster transfers.

- Limited countries for express services – Limited countries offer express transfers.

- Exchange rate markups – Slight added costs to transfers due to higher exchange rates.

4.Revolut

The Revolut app is one of the best money exchange apps because of its unique functionality, inclusive services like multi-currency accounts, and cords that can be held, exchanged, and transferred at favorable rates.

Spending alerts and budget management alongside cryptocurrency trading give users everything they require on a singular platform. The app’s interface and inexpensive transfer rates appeal to people who require simple and flexible monetary management worldwide.

Pros & Cons Revolut

Pros:

- Multi Currency accounts – Hold, exchange, send more than 30 currencies.

- Cryptocurrency support – Allows trading and holding Bitcoin and other cryptocurrencies.

- Advanced budgeting tools – Helps in tracking and managing spending in real time.

Cons:

- Fee structure for non-premium users – Free accounts come with restrictions for currency exchange.

- Not available in all countries – Some regions don’t have access to revolut.

- No cash withdrawal option – The account is solely online.

5.MoneyGram

MoneyGram stands out among other apps in the money exchange sector due to its unrivaled global branch network.

The app enables users to send money seamlessly to over 200 countries and provides several methods such as cash pick-up, bank transfer, and mobile wallet deposits. In times of emergency, most people turn to the app because of how fast and easily it can be accessed.

Customers globally appreciate and trust the company’s advanced and innovative technologies, allowing them to conveniently transfer money with different delivery options, thus simplifying their operations.

Pros & Cons MoneyGram

Pros:

- Global Network – Over 200 countries supported and uses agents from other locations.

- Fast registered transfers – Many transfers can now be made snacks or in a matter of minutes.

- Flexible options – Picking up cash, moving from one bank to another, or through a mobile wallet.

Cons:

- High fees for smaller transfers – Transfers of smaller amounts may cost more.

- Exchange rate markups – MoneyGram may be less competitive than other services for the payments given.

- Limited app features – Some services can only be accessed through a physical outlet.

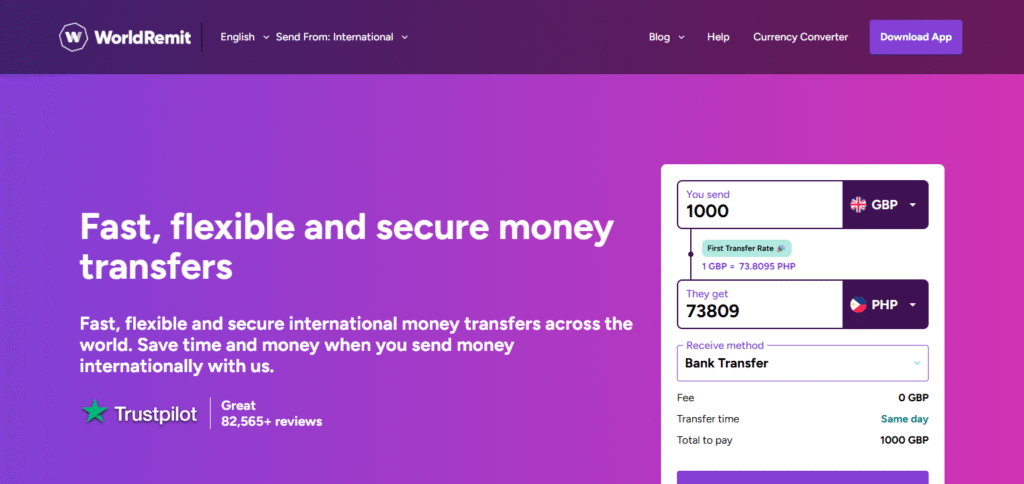

6.WorldRemit

WorldRemit is regarded as one of the best money exchange apps because of its emphasis on affordable and quick international transfers. Users can send money to bank accounts, mobile wallets, and cash pick-up centers in over 130 countries.

The app has an advantageous exchange rate and offers free transparent fee outlines with no disguised fees. Its simple interface and real-time notifications enhances efficiency when sending money across borders, making it an optimal choice for cost-effective international transactions.

Pros & Cons WorldRemit

Pros:

- Affordable fees – There are cheap lower international transfer fees when compared to other services.

- Quick transfers – Transfers are done in minutes.

- Variety of transfer options – From cash pick up to mobile wallets to bank deposits.

Cons:

- Limited availability in certain countries – Not all countries are supported for all services.

- Limited options for large transfers – For high value transactions, this might not be the most ideal service available.

- Exchange rate markups – Rate might to be charged upon the exchanged currency thereby bringing up the costs slightly.

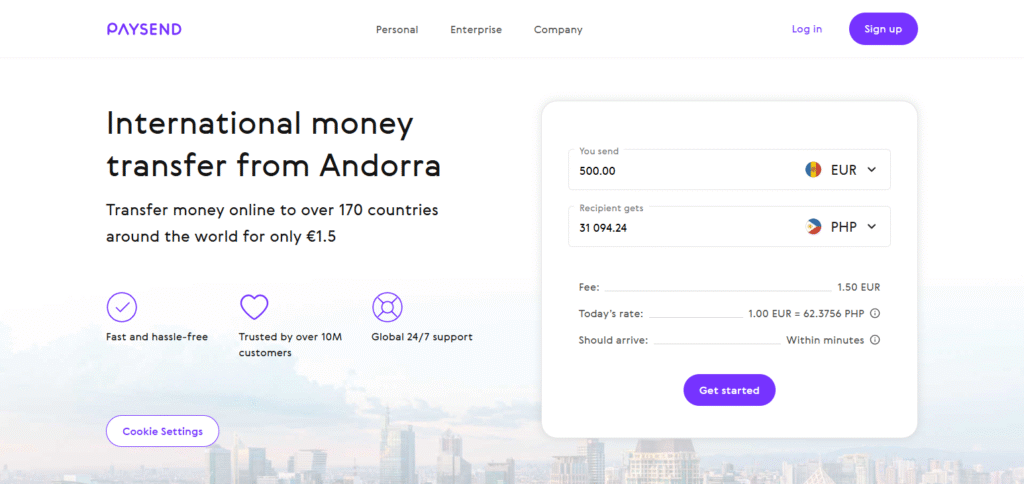

7.Paysend

Among the various apps for currency exchange, Paysend stands out for its simple yet economical strategy for international transfers. The application permits users to send money to more than ninety countries at a flat fee.

The distinctive aspect of Paysend is that funds may be transferred directly to the recipient’s card which speeds up the transaction process. Paysend makes it easy to send or receive money anywhere in the world as it has no hidden fees, comes with a simple user interface, and offers reliable rates.

Pros & Cons Paysend

Pros:

- Flat fee structure – There is transparency of charge made for each transfer.

- Instant card transfers – Money can be sent to the cards of recipients in a matter of seconds.

- Send to over 90 countries – Comes in handy for both business transfers and personal.

Cons:

- Minimal withdrawal choices – Receives money directly through cards which can limit cash withdrawals.

- Exchange margin fees – Forex service is less competitive when compared to other services.

- Large transfers limited services – Not suitable for professional business or other high value transactions.

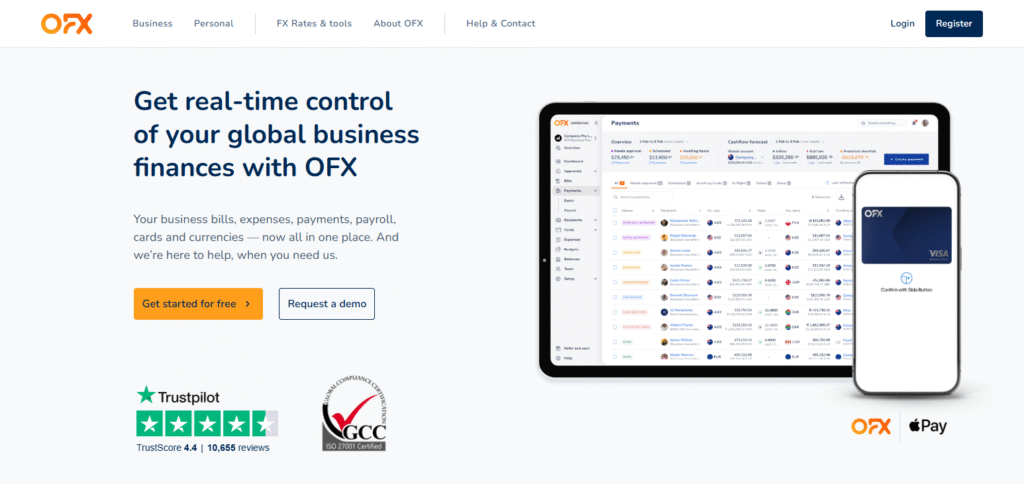

8.OFX

OFX is at the top of money exchange apps because it provides international transfers at lower costs for larger sums.

Businesses and individuals who need to send large amounts of money will appreciate OFX’s no transfer fees and competitive exchange rates.

OFX also offers personalized service with account managers standing by at all hours. It is reliable for global money transfer, especially for high value transactions, due to the advanced security of the platform and quick transfer processing.

Pros & Cons OFX

Pros:

- No transfer fees – Does not deduct fees, which is very beneficial for people who wish to send larger amounts.

- Above market exchange rates – Uses good rates and foreign exchange for transfers that are sent abroad.

- 3-24*7 Customer service – Has dedicated account managers to help guide you.

Cons:

- Above average transfer restrictions – Not great for people wishing to make smaller transactions.

- Long transfer periods – Transfers may take a long duration of days to complete.

- Few currency choices – Not all currencies are accepted, some of which are less popular.

9.TorFX

TorFX is widely recognized as one of the best money exchange app because of its tailor-made service and also lack of fees on big transfers. Its sophisticated exchange rate policies are meant for clients who are required to transfer large amounts of money abroad.

Maybe the best aspect of TorFX is the support of their account managers who guide clients throughout the currency exchange processes.

Results guarantee customer satisfaction by providing attention and around-the-clock assistance coupled with safe and accurate transfer services. Therefore the clients, whether private or corporate, can entrust their accounts with TorFX.

Pros & Cons TorFX

Pros:

- No fees for large scale transfers – Great if you want to send a large amount of money.

- Tailored account services – Gives more specific help to their clients.

- Good exchange rates – Uses acceptable rates on loan currency exchanges.

Cons:

- Not ideal for people wishing to make smaller transfers – There is a limit on the amount that can be sent.

- Very basic payment methods – Only allows person to person bank transfers.

- Not as fast as the rivals – Taking time to process transfers is a problem.

10.BookMyForex

BookMyForex is rated among the top money exchange apps because of their exemplary services for both personal and business transactions.

The money exchange app also provides very good exchange rates for more than 80 currencies. They uniquely deliver forex orders right at the customer’s doorstep. Through the app, users can also purchase foreign currencies, transfer money overseas, and make international payments without much hassle.

It makes the process of managing global money transfers easy by ensuring transparency and customer satisfaction which are the main reasons it stands out as a prime choice.

Pros & Cons BookMyForex

Pros:

- Competitive exchange rates – Uses rates that are more economical than most banks for forex.

- Doorstep delivery – Foreign currency is brought to you wherever you are.

- Wide range of services – Foreign currency exchange, international transfers, and other things are included.

Cons:

- Limited International Transfer Options – Other services may be more comprehensive.

- No Immediate Transfers – Compared to express services, transfers may take longer.

- Limited availability in some regions – Primarily available in India.

Conclusion

Overall, the best apps for money exchange provide low costs, fast transfer speeds, and other appealing attributes.

Companies such as Western Union, Remitly, and Revolut have a wide geographical reach, offer favorable rates for currency exchange, and diverse payment methods which fulfill many requirements.

For individual and corporate transfers or for payments around the world, the selection of the app to perform the operation is based on time efficiency, pricing strategy, and ease of use. To summarize, international finances have become simpler, cheaper, and easier thanks to these applications.