In this article , I will cover the Best Money Exchange Platform, concentrating on those that provide quick access, speedy transfers, and competitive rates.

The right platform is crucial if you are sending money overseas, as well as for multi currency management, to ensure savings and dependable transactions. I will assess the available platforms, summarizing their primary attributes.

Key Point & Best Money Exchange Platform List

| Service | Key Point |

|---|---|

| PayPal | Widely used for online payments; fast transfers between PayPal accounts. |

| Revolut | Offers multi-currency accounts and low exchange fees for global transfers. |

| Western Union | Global reach with cash pickup options in remote areas. |

| Remitly | Fast delivery and multiple payout options, including mobile wallets. |

| OFX | Competitive exchange rates with no transfer fees for large transfers. |

| MoneyGram | Extensive global agent network with cash pickup options. |

| Xoom | A PayPal service offering fast transfers to bank accounts and cash pickup. |

| CurrencyFair | Peer-to-peer exchange model offering competitive rates. |

| WorldRemit | Convenient mobile-based transfers with various payout methods. |

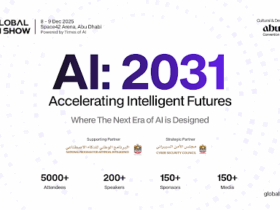

1.Wise

Wise excels as the most optimal money exchange platform because of its payment transparency and how they handle exchanges. Unlike services that conceal costs in exchange rate markups, Wise offers users the mid-market rate which guarantees more money will reach its destination.

Besides, Wise supports dozens of currencies through its user friendly interface; making international transfers easy and low-cost.

The clarity, speed, and reliability it offers makes Wise a suitable platform for individuals and businesses in need of swift, fair, and flexible currency exchange solutions.

Wise Features

- Transparent Fees: Relying on the real exchange rate, Wise’s fees are very low and cost-effective for users.

- Multi-Currency Accounts: Users are able to hold and manipulate balances in more than 50 currencies which simplifies international transactions.

- Fast Transfers: Transfers, depending on the destination, are processed quickly, usually within a day.

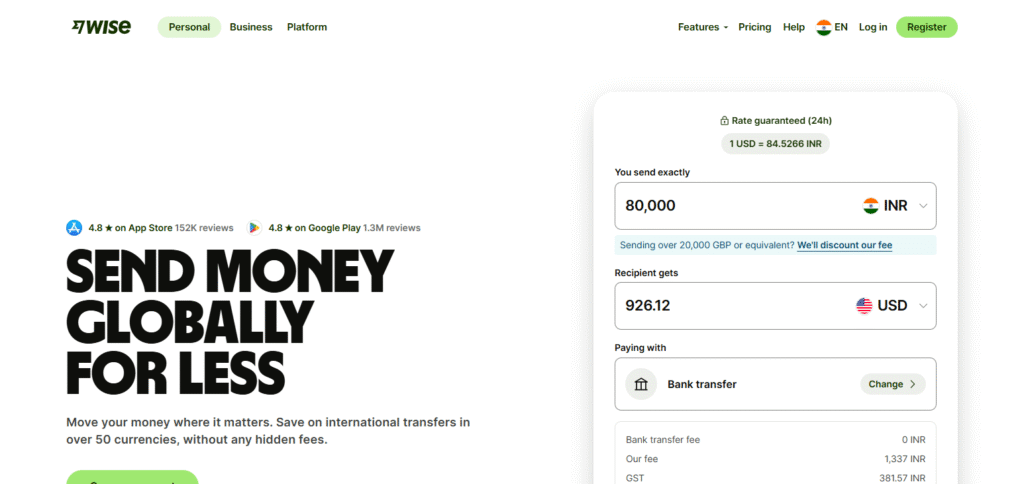

2.PayPal

PayPal is regarded as one of the best money exchange platforms due to its global reach and ease of use.

The service’s primary advantage is its effortless integration with various online services and e-commerce sites, which enables the user to send or receive money in different currencies easily. The platform supports millions of users worldwide, allowing users to transact without revealing bank information.

Payment flexibility can be enjoyed through the digital wallet functions, while the buyer protection system ensures the safety of funds; thus, the platform is a convenient environment for international financial transactions.

PayPal Features

- Global Network: An online payment and money transfer system operated and owned by PayPal services Inc.

- Buyer Protection: Offers payment options with buyer protection, ensuring secure transactions.

- Ease of Use: User-friendly and easy-to-navigate for personal and business transactions.

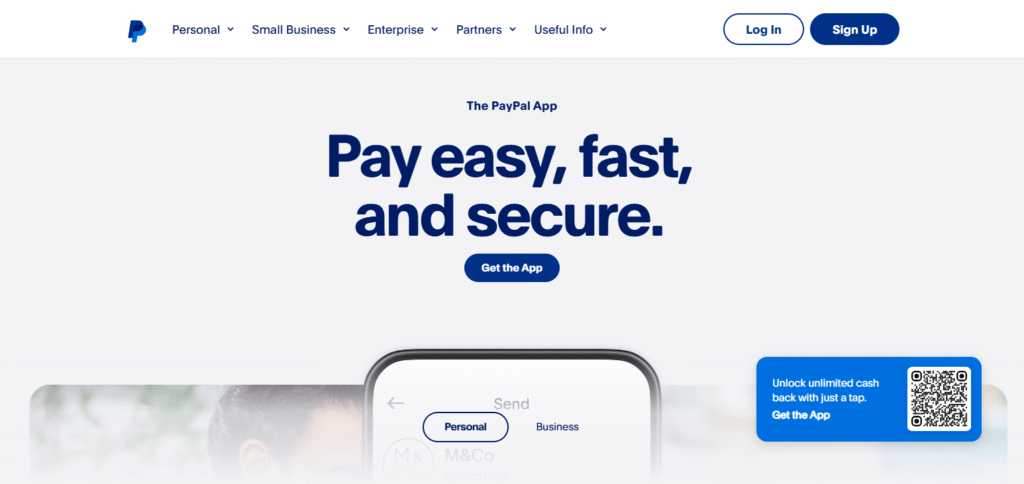

3.Revolut

Revolut ranks among the best money exchange platforms because of its real-time currency conversion coupled with multi-currency wallet features.

What sets it apart is the ability to hold, exchange and spend in more than 30 currencies directly from one app using interbank rates.

Users can instantly switch between currencies, track spending and even set budgets. Its digital-first approach combined with modern tools like virtual cards and crypto access makes Revolut a smart choice for travelers and global users with complex financial needs.

Revolut Features

- Multi-Currency Wallet: Offers the option to buy, sell, and hold cryptocurrencies directly within the app.

- Real-Time Currency Exchange: Available exchange rates can be compared in real time and currencies can be converted instantly without hidden fees.

- Cryptocurrency Access: Customers can manage cryptocurrencies through the application effortlessly.

4.Western Union

Western Union has secured its place as one of the leading money exchange platforms because of their unmatched global reach and access on a local level. Its remarkable feature of being the best is the enormous network of agent locations which allows cash collection in the remotest areas.

This form of physical presence is suitable for people without any banking services. The company accepts different methods of transfers such as offline, online and even through mobile applications. This flexibility makes it easier for both the senders and receivers, especially for international transfer of funds.

Western Union Features

- Global Network: With over 500,000 agent locations, Western Union ensures a wide global reach for pickup locations.

- Variety of Payment Methods: Funds can be sent via bank transfer, debit/credit cards, or cash in the office.

- Transfer Speed: Transfers are quick, with same-day delivery services available in various countries.

5.Remitly

Remitly has made a name for itself as a money exchange platform by prioritizing speed and convenience for recipients.

Its standout feature is the range of delivery options provided which go beyond simple bank deposits and cash pick-ups to include mobile wallets and home delivery in select areas.

Such flexibility means users are able to customize each transfer based on the recipient’s preferences. Coupled with live tracking, detailed milestones, and clarity regarding delivery windows, Remitly offers efficient solutions for cross-border money transfers that are fast, secure, and accessible.

Remitly Features

- Various Delivery Methods: Allows cash pick-up and mobile wallet transfers. Funds can also be deposited directly into a bank account.

- Quick Transfers: Some funds can be accessed within a few minutes after transactions, facilitating quick access to money.

- Tracking: Users are able to track where their money is during the transfer, keeping them informed as to when they will receive the funds.

6.OFX

OFX has established itself as a money exchange service platform of high repute owing to its offering of favorable exchange rates with no additional fees.

Businesses and individuals dealing with high-value transactions find OFX especially useful because of its exceptional feature of servicing international transfer of large sums and its personalized service with access to currency specialists.

Users are able to complete complicated transfers with peace of mind. Navigating complex transfers is effortless with this combination of support, global access, and OFX’s low rates, making it perfect for international money transfer users.

OFX Features

- Better Exchange Rates: Provides more attractive exchange rates compared to big banks, especially on larger deals.

- Free Transfers on Larger Deals: Free transfers above a certain threshold, benefiting both individuals and businesses.

- Currency Specialists: Clients have access to personalized aid from currency specialists at OFX, ensuring ease during difficult transfers.

7.MoneyGram

MoneyGram is cited for its thorough attention on convenience and accessibility. It stands out as one of the top money exchange platforms due to its unique combination of a strong digital presence and a vast physical network consisting of thousands of agent locations worldwide.

With the ability to send money digitally or in person, users can address deposits into bank accounts, mobile wallets, or cash pick up for the recipients. The flexible MoneyGram service helps users residing in urban or rural areas.

MoneyGram Features

- Large Agent Base: MoneyGram conduct business at more than 350,000 outlets globally, serving the unbanked population.

- Multiple Payment Channels: Payments using bank accounts, debit/credit cards, and cash at the agents’ outlets are acceptable.

- Fast Transfers: Urgent money transfers can be accomplished in minutes using many of their transfer services.

8.Xoom (a PayPal service)

Xoom sets itself apart as a money exchange platform by market reach and speed of transfer servicing a vast number of countries.

Its unique strength lies in the ability to send money directly to bank accounts, cash pickup locations, and even pay utility bills abroad—all from one app.

Xoom’s integration into digital wallets provides seamless transactions while real-time tracking ensures speed and transparency simultaneously. For users in need of fast and flexible options for transferring money internationally, Xoom serves as a reliable solution.

Xoom (a PayPal service) Features

- PayPal Integration: PayPal users can extract cash straight from their accounts through Xoom. This addition has streamlined transactions for Xoom users that already use PayPal.

- Multiple Payout Options: Offers superior international bank deposits, cash pickups, and mobile wallet transfers.

- Real-Time Tracking: Not only does Xoom deliver notifications, users are also informed on the progression of the transaction.

9.CurrencyFair

CurrencyFair’s greatest advantage stems from their unique peer-to-peer money transfer system. Users can set their own desired exchange rates, which might leave them better off than conventional forex service providers.

This model greatly spurs transparency and helps users price their currency more competitively. Along with an intuitive platform, support for a wide range of currencies makes CurrencyFair an affordable and adaptable international money exchange service.

CurrencyFair Features

- Peer-to-Peer Currency Exchange: Through CurrencyFair’s platform, users are the ones to set the exchange rates. Other traders can accept and trade with them directly.

- Low Transfer Fees: Currency transfer fee structures highly prevail over traditional servi ces.

- Multi-Currency Support: Their services enable managing over 20 currencies from a single account.

10.WorldRemit

WorldRemit is a leading provider in international transfers for its affordability and quick send/receive processes.

Its main benefit is being able to send money to 130 countries, as well as offering bank deposits, mobile wallet payments, and cash pickup.

WorldRemit keeps its focus on low fee structures and competitve exchange rates, making it ideal for users seeking cost effective options. It’s mobile app allows transactions to be tracked effortlessly, providing a stellar experience when sending money internationally.

WorldRemit Features

- Wide Payment Options: Remit offers mobile transactions, bank deposits, and cash pickup, providing an all-inclusive mobile wallet platform.

- Low-Cost Transfers: International transfers are known to be low, thanks to WorldRemit; this is true for senders and recipients.

- Instant Transfers: The option to issue transfers instantly is available and this enables users to use WorldRemit for any time critical transactions.

Conclusion

In summary, the priorities determining the best money exchanging platforms include speed, cost, accessibility, and geographical reach.

Wise, PayPal, and Revolut each have their pros, whether is it pricing, coverage, or pricing, and easy to use services. In the end, what is the best will depend on your requirements, low fees, flexible payment options, or unrestricted international accessibility.

Think about what matters the most to you, then you can decide which platform can help with your financial transfers goals.