What Is Blur Finance(BLR)?

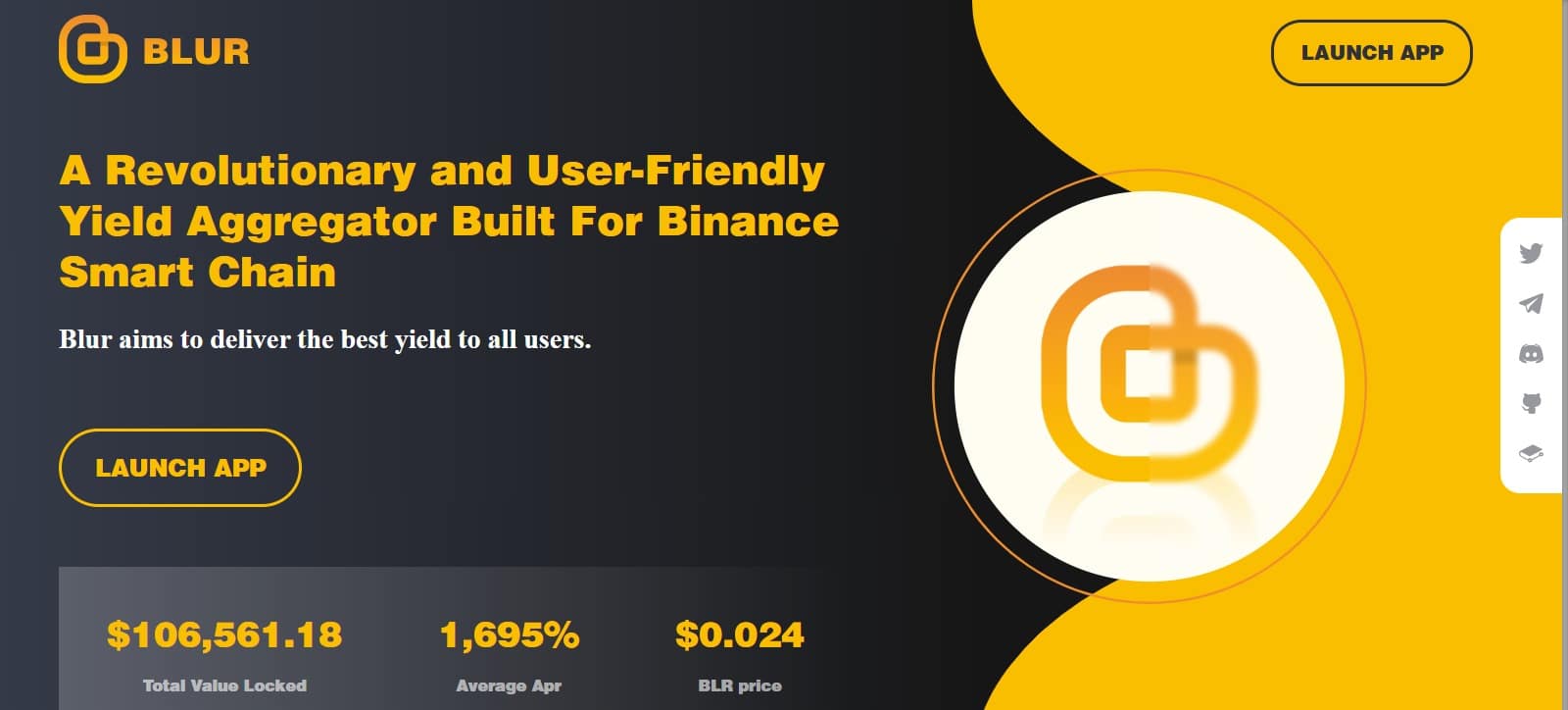

Blur Finance is a Yield Aggregator (Vault) that provides optimized yield for users. The protocol is developed by Blur team and will be governed by BLR holders. This automatically maximizes the user rewards from various liquidity pools (LPs), automated market making (AMM) projects, and other yield farming opportunities in the DeFi ecosystem. This provides a huge advantage over manual operation. Blurred up those yields! From all of the vaults deployed, It has its native governance token $BLR at its core.

Platform revenue is generated from a small percentage of all the vault profits and distributed back to those who stake $BLR. As a decentralized project with a deeply ingrained crypto-mindset, there is also a robust governance system in place to put the decision-making power in the hands of those invested in the project by governance mechanisms build around $BLR.

| Coin Basic | Information |

|---|---|

| Coin Name | Blur Finance |

| Short Name | PIFI |

| Max Supply | 100,000,000 |

| Total Supply | 100,000,000 |

| Source Code | Click Here To View Source Code |

| Explorers | Click Here To View Explorers |

| Twitter Page | Click Here To Visit Twitter Group |

| Whitepaper | Click Here To View |

| Support | 24/7 |

| Official Project Website | Click Here To Visit Project Website |

Composition of Blur Vaults

Ⅰ. Vaults targeting Venus pools

All single-assets users deposit into Blur vaults will be auto-compounded on Venus lending pools. The interests earned from Venus will be exchanged for more single-assets for next turn of auto-compounding.

Ⅱ.Vaults targeting PancakeSwap pools

All liquidity pairs users deposit into Blur vaults will be auto-compounded on PancakeSwap farms. The rewards (Cake) earned from PancakeSwap will be exchanged for more LP for next turn of auto-compounding.

Blur Vault Fee Structure

5% Performance Fee:

Deducted from yield earned every time a vault harvests a strategy. The fee is extracted by minting new shares of the vault, thereby diluting vault participants. This is done at the time of harvest, and calculated based off of time since the previous harvest. On the Blur finance user interface, yield is displayed as net APY. This means that both fees and compounding returns are taken into consideration in the rates presented. Since harvests don’t occur on a set basis, yield is estimated based off of historical data.

Tokenomics

The Blur Finance is a decentralized protocol governed by the Blur team (Blur DAO in the future). The Blur Governance Token (“BLR”) will be used to make decisions about the future of the protocol. The only way to obtain BLR is by staking ; There will be no ICO or PRESALE for BLR.

Total Supply of $BLR:100,000,000

Initial Liquidity: 10%

Liquidity staking rewards: 60%

Seed Round investment: 12% (Release 2% monthly after 6 months)

Community Reserve:8%(Release 2% monthly after 3 months)

Development Reserve & Team Reserve:10% (Release 1% monthly after 6 months)

Emission Schedule

Funds deposited in Blur will automatically start earning $BLR yield after the fair launch.

During the first 20 days of $BLR rewards, 3% of the total supply (=0.15%/day) will be distributed to Blur depositors.

Blur finance During the following 70 days, 7% of the total supply (=0.1%/day) will be distributed, and at the end of this boost period, the emission rate of $BLR will drop to 10,000 per day

Roadmap

2022 Q2

- The founding of Blur team

- Deployment of Blur Finance on Testnet

- Complete Audits with SolidProof

2022 Q3

- Deployment of Blur Finance on Mainnet

- Fair Launch of BLR on PancakeSwap

- BLR, USDT, BUSD and USDC Single-asset Staking Vaults

- Launch six PancakeSwap LP staking vault

- Launch Leveraged Yield Farming with new auto-compounding pools, providing leverage on popular PancakeSwap pools

- Token Value Expansion — add buyback and burn mechanisms to make BLR long-term deflationary (more explained below)

- 50% of the 4.5% performance fee will be used on BLR buyback and burn. This means half of the fees will go towards token holders in the form of burn

- Blur Finance V.1

- Provide ability to add liquidity to pools directly on Blur Finance

- Integrate with more PancakeSwap pools

- List coingecko and coinmarketcap

- Token Value Expansion — add buyback and burn mechanisms to make BLR long-term deflationary (more explained below)

2022 Q4

- Lending Pools

- Complete Audits with PeckShield and Certik

- CEX listing of BLR

- More Marketing Partnerships

2023 Q1

- Modular Development Components

- NFT Utility Integration

- Cross-Chain Expansions

- Synthetic Assets and Derivative Trading

Leave a Reply