About TiTi Protocol Airdrop

TiTi Protocol Airdrop is a decentralized, multi-asset reserve collateral-backed, use-to-earn algorithm stablecoin, aiming to provide diversified and decentralized financial services based on the crypto-native stablecoin system and autonomous monetary policy. TiUSD is the stablecoin issued by TiTi Protocol.

TiTi Protocol has confirmed to launch an own token called “TiTi”. Users who’ve done testnet actions may get an airdrop when they launch an own token.

| Basic | Details |

|---|---|

| Token Name | TiTi Protocol Airdrop |

| Platform | ETH |

| Support | 24/7 |

| Total value | N/A |

| KYC | KYC Is Not Requirement |

| Whitepaper | Click Here To View |

| Max. Participants | Unlimited |

| Collect Airdrop | Click Here To Collect Free Airdrop |

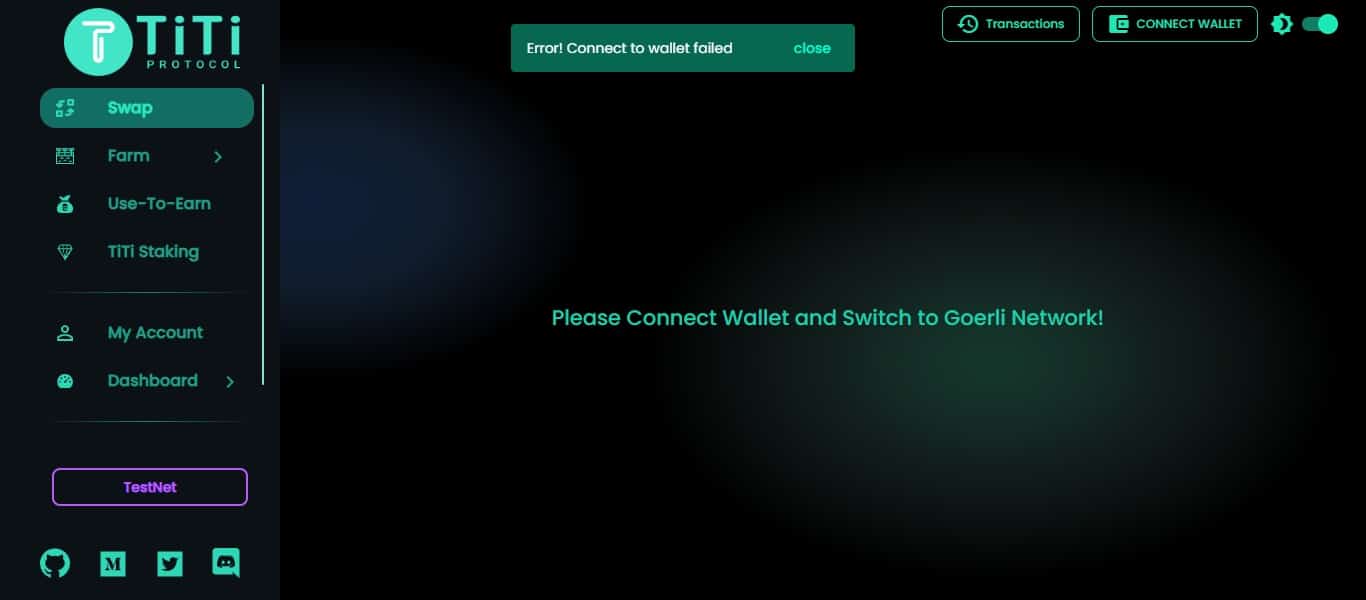

Step-by-Step Guide:

- Visi the TiTi Protocol testnet page.

- Connect your Wallet.

- Change the network to Goerli testnet and get Goerli ETH from here.

- Go back to TiTi Protocol, click on “TestNet” and claim testnet USDC.

- Now make some swaps on the platform.

- Click on “Farm” and stake some USDC and also provide liquidity.

- They’ve confirmed to launch an own token called “TiTi”.

- Early users who’ve done testnet actions may get an airdrop when they launch an own token.

- Please note that there is no guarantee that they will do an airdrop. It’s only speculation.

TiTi Protocol System

TiTi-Protocol is a new type of elastic supply decentralized stablecoin protocol based on decentralized Monopoly Auto Market Maker mechanism (M-AMM) and backed by Multi-Assets-Reserve.

TiUSD Stability Mechanism

The core of reserve assets endorsed decentralized stablecoins hinges on the market circulation shall consistently reflect actual market demand. Besides, as a stablecoin pegging to $1, for the most time, the currency price should stay at $1 enhancing the users’ trust. Therefore, the most straightforward idea occur to us:

One Protocol can issue stable assets at a price of no less than $1 and repurchase stable assets at a price of no more than $1. The whole fund obtained from the issuance or sale of assets will be sent to Protocol Reserve Value. The Protocol Reserve Value bears sufficient funds when users redeem or repurchase assets with issued stablecoin. Thus, the protocol can maintain the price at $1 at any time to increase the user’s sense of trust in the Protocol.

TiTi Key Features

Open and Transparent

TiTi Protocol is fully realized through smart contracts on the chain, and the mechanism is open and transparent;

High capital efficiency

Compared with over-collateralized stablecoins, TiTi Protocol has a higher capital efficiency;

Stronger stable capability:

TiTi Protocol brings a new type of elastic supply decentralized stablecoin solution that incorporates the Multi-Assets-Reserve mechanism. The stabilization mechanism does not rely too much on the decentralized and is more efficient which ensures that there is sufficient value support behind each TiUSD token;

Anti-Volatility risk:

By introducing the multi-assets reserve mechanism, the protocol amortizes the risk of individual asset fluctuations, thereby enhancing the risk resistance of the entire system. At the same time, the protocol introduces financial products such as MMF, which creates new game models, to further guarantees the stability of TiUSDi;

Scalability:

The architecture design of TiTi Protocol is easy to expand by introducing new type of reserve and the governance mechanism can effectively improve the protocol’s risk control ability during expansion process.

Core Terms

M-AMM: Monopoly Auto Market Maker or TiTi’s AMM. The monopoly market maker system means that for certain stocks listed on the exchange, only one designated market maker can be responsible for market making. The typical representative is the expert system of the New York Stock Exchange.

Multi-Assets Reserve: TiUSD is a stablecoin issued backed by asset reserve, ETH, WBTC, DAI etc.

MMF: Market Making Fund, the fund are assets portfolio in contract provide by users for unilateral market making without any limit.

PRV: Protocol Reserve Value, the market Value brought by all TiTi mint. PRV can only be used to buyback TiUSD.

PAV: Protocol Added Value, Protocol accumulated revenue through TiTi trading in all internal TiTi M-AMM.

FR: MMF ratio against TiUSD circulation

RR: PRV ratio against TiUSD circulation

Reorders: An original stabilizing mechanism enables TiUSD peg to $1 effectively

Leave a Reply