About Shorter Finance Coin

Shorter Finance Coin consensus algorithm underpinning the blockchain network, has given rise to opportunities to create autonomous, transparent, and efficient financial products. Blockchain-based exchanges and infrastructures have ushered in the next major era of the open world. The future of senior trading tutoring is open, far more evenly distributed, and plenty of arbitrage chances not only for a few entitled ones, but for all who can connect high throughput blockchains.

Most notably, continuously low-barrier approvals pertain to behaviors including lending the long-term holding tokens, borrowing from the smart contracts, shorting the tokens to smooth market structural changes in volatility. While it may sound precarious to allow a parcel of codes to take over the position of traditional banks and brokers, the design logic for doing so runs in a publicly investigated mechanism based on an immutable blockchain.

Shorter Finance Coin Point Table

| Coin Basic | Information |

|---|---|

| Coin Name | Shorter Finance Coin |

| Short Name | IPISTR |

| Circulating Supply | 605,301,295 IPISTR |

| Max Supply | 18,533,333,333 |

| Source Code | Click Here To View Source Code |

| Explorers | Click Here To View Explorers |

| Twitter Page | Click Here To Visit Twitter Group |

| Whitepaper | Click Here To View |

| Support | 24/7 |

| Official Project Website | Click Here To Visit Project Website |

How Shorter Works

As traders, brokers even bankers around the globe have been stumbling together for decades, occupants in the DeFi industry were left scrambling to answer a series of questions: why will a smidge of disorganized vibration put the positions held by short-sellers into stunning situations? What should the innovator do to make the whole system stay largely beyond the radar despite market manipulation? Is there a gateway for conservative spot lenders and aggressive traders to neutralize the amassing risk, hereby spare from being busted during peak market hours altogether?

Founding Principles

As with other projects in the DeFi space, Shorter’s governance will emerge from community collaboration and participation. They begin the project with a few simple governance principles:

- Any and all material changes to Shorter products should be proposed in public, with code, with appropriate time for community feedback.

- From a decentralized standpoint, collaboration from the community should take on a significant portion of the responsible on-chain liquidating assurance. Your roadmap for progressive decentralization outlines your strategy for transitioning to fully autonomous and decentralized decision-making.

- A successful governance system should represent taking either minimizing the time or cost necessary into consideration, for an individual or institution to participate in governance. They will explore solutions including gas-efficient methods and blockchains with high throughput to build the DAO mainstay.

Voting

Proposals will require the support of the rulers roughly obtaining 0.1% voting power and a simple majority voting to approve with a quorum of at least 10% of all Committee shares. Besides, there could be another circumstance that could preclude the proposal from getting through if both sides haven’t gained enough support shares until its duration of voting ends.

Why Choose Shorter Finance Coin?

Pool

Pool is an abbreviation for Token loan pool in Shorter. Token loan pools are pools of tokens stored in a smart contract, used to facilitate functions such as liquidity provision, and borrowing/lending of tokens in a decentralized way.

Days to Expiration (DTE)

DTE in Shorter is the live period that a pool or related trading is valid. Once succeed, all open positions in matured pools will be put under liquidation instantly and meticulously.

Margin Locked

The (maintenance) margin represents the amount of equity the investor must maintain in the position after the orders have been made to keep the position open. The locked margin exists to protect providers from traders defaulting on their loans.

Slippage

Slippage refers to the difference between the expected price of a trade and the price at which the trade is executed. Slippage is most prevalent with larger orders and during periods of higher volatility.

Price Impact

Price impact affects the execution price of a swap similarly but is a result of a different dynamic. When using an automated market maker, the relative value of one asset in terms of the other continuously shifts during the execution of a swap, leaving the final execution price somewhere between where the relative price started – and ended.

Farming

Farming, or yield farming, is a practice in the DeFi cryptocurrency world. It is the term that defines the process that stands for obtaining the high yield and a method to earn more cryptocurrency with your cryptocurrency. In addition, it’s a chance to obtain extra yields from the protocol’s governance token.

Where Can You Buy Shorter Finance Coin?

Tokens Can Be Purchased On Most Exchanges. One Choice To Trade Is On Uniswap (V3), As It Has The Highest IPISTR/USDT. e Trading Volume, $8,947 As Of February 2021. Next is OKEx, With A Trading Volume Of $6,180,82. Other option To Trade Include IPISTR/USDT And Huobi Global. Of Course, It Is Important To Note That Investing In Cryptocurrency Comes With A Risk, Just Like Any Other Investment Opportunity.

Market Screenshot

Shorter Finance Coin Supported Wallet

Several Browser And Mobile App Based Wallets Support Shorter Finance Coin. Here Is Example Of Wallet Which Shorter Finance Coin – Trust Wallet For Hardware Ledger Nano.

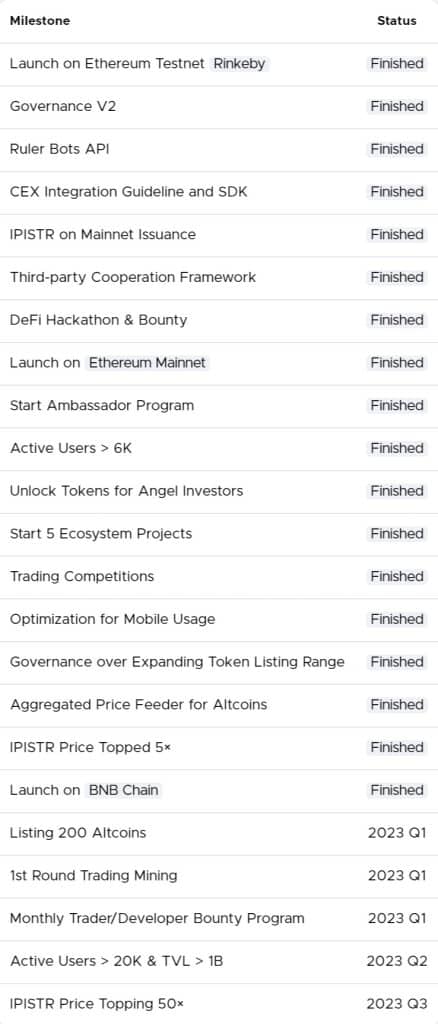

Shorter Finance Roadmaps

Leave a Reply