What Is Crypto Airdrop?

A cryptocurrency airdrop is a marketing or promotional approach used by blockchain projects and cryptocurrency organizations to deliver free tokens or coins to a select set of people, often to boost awareness of their project or to reward existing token holders.

The word “airdrop” is derived from the concept of dropping something from the air, as these free tokens are typically dispersed to a large audience, often as a surprise or with little work required on the recipients’ side.

The project advertises the next airdrop and details the eligibility requirements. These requirements may include owning a particular number of the project’s tokens, following the project on social media, signing up for their newsletter, or fulfilling other defined tasks.

What Is Orbiter Finance Airdrop?

Orbiter Finance is a decentralized cross-rollup bridge with smart contracts only on the destination side and is Ethereum’s future multi-rollup infrastructure.

Orbiter Finance doesn’t have an own token yet but could launch an own token in the future. Using the bridge to transfer assets between chains may make you eligible for airdrop if they launch an own token.

Basic Orbiter Finance Airdrop Points

| Basic | Details |

|---|---|

| Token Name | Orbiter Finance Airdrop |

| Platform | ETH |

| Support | 24/7 |

| Total value | N/A |

| KYC | KYC Is Not Requirement |

| Whitepaper | Click Here To View |

| Max. Participants | Unlimited |

| Collect Airdrop | Click Here To Collect Free Airdrop |

How To Claim Orbiter Finance Airdrop Step-by-Step Guide:

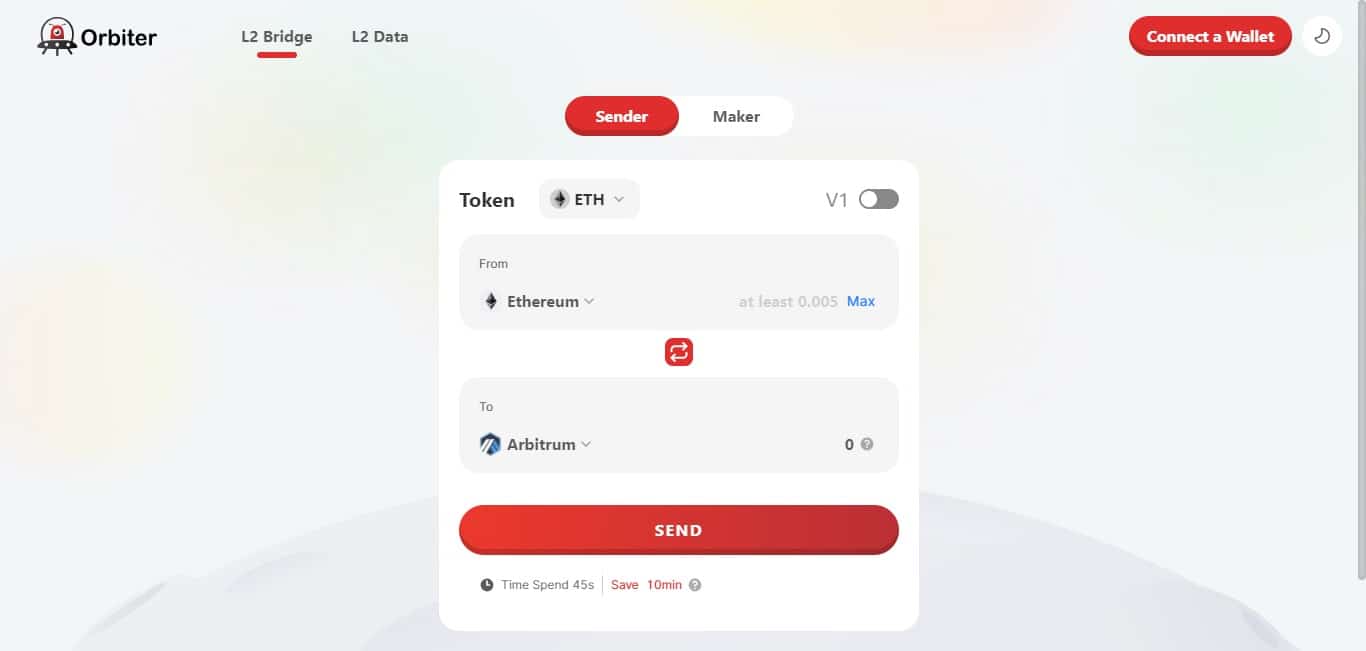

- Visit the Orbiter Finance dashboard.

- Connect your Ethereum, zkSync, Polygon or Arbitrum wallet.

- Now select your destination chain and the asset you want to send and complete the transaction.

- Orbiter Finance doesn’t have an own token yet so using the bridge may make you eligible for an airdrop if they launch an own token.

- You could also become eligible for the zkSync and Arbitrum speculative retroactive airdrops by using Orbiter Finance to transfer assets from L1 to zkSync or Arbitrum or vice versa.

- Please note that there is no guarantee that they will do an airdrop and that they will launch their own token. It’s only speculation.

How To Check Orbiter Finance Airdrop Is Real Or Fake

Checking the legitimacy of a crypto airdrop can be a bit tricky, as scammers often use sophisticated techniques to create fraudulent airdrop campaigns that appear to be legitimate. Here are some steps you can take to verify the authenticity of a crypto airdrop:

- Official Website and Social Media: Begin by visiting Orbiter Finance’s official website. Keep an eye out for any announcements or information about airdrops. Check their official social media channels (Twitter, Telegram, Reddit, etc.) for airdrop updates and announcements.

- Check the Source: If you come across an airdrop notification on social media or a forum, be sure it comes from an official Orbiter Finance account. Scammers frequently build false profiles to impersonate legitimate accounts, so look for verified badges or links to the official website.

- Examine the Airdrop Details: Legitimate airdrops normally give detailed information on the distribution, eligibility requirements, and the number of tokens to be delivered. Be wary if the airdrop lacks clarity or requests sensitive information such as secret keys or passwords.

- Contact the Team : If you have any issues regarding the legitimacy of an airdrop, try contacting the Orbiter Finance team directly using their proper methods. Request that they authenticate the validity of the airdrop or provide instructions on how to participate securely.

- Check the Credentials and Backgrounds of the Team Members: Check the credentials and backgrounds of the team members listed on the Orbiter Finance website. To validate their identities, look for LinkedIn pages or other professional profiles.

- In summary, it’s important to conduct thorough research, verify the source and instructions, look for feedback from other users, and trust your instincts when evaluating the legitimacy of a crypto airdrop. By taking these steps, you can minimize the risk of falling for a fraudulent airdrop and protect your assets and personal information.

What are the risks of participating in an airdrop?

Participating in an airdrop, in which a cryptocurrency or blockchain project gives free tokens to individuals, might pose a number of dangers and concerns. While airdrops can be a fun approach to potentially acquire free tokens, the following concerns should be avoided:

Airdrop scams are prevalent, in which criminal actors manufacture bogus airdrops in order to steal personal information or finances. Take precautions and only take part in airdrops from recognized projects.

Orbiter Finance Airdrop Pros Or Cons

Pros of participating in an airdrop:

- Decentralization: Because Orbiter Finance is a decentralized cross-rollup bridge, it does not rely on a centralized authority. This can improve security and limit the possibility of censorship.

- Multi-Rollup architecture: It is intended to be Ethereum’s future multi-rollup architecture, which can improve the Ethereum network’s scalability and efficiency while resolving some of its current restrictions.

- Airdrops: If Orbiter Finance decides to introduce its own token in the future, users who utilize the bridge to transfer assets between chains may be eligible for airdrops. This can provide additional value and incentives for users to use the platform.

Cons of participating in an airdrop:

- Lack of an Own Token: Orbiter Finance does not currently have its own token. This may limit its utility and the possibilities for user rewards or incentives. The platform’s success may be determined by whether or not it eventually publishes its own coin.

- Uncertainty: The future possibility of getting an airdrop is uncertain. It is dependent on Orbiter Finance’s decision to create its own coin as well as the eligibility criteria. Users should exercise caution and not rely exclusively on the prospect of receiving an airdrop as an incentive.

- Nascent Technology: As with any nascent blockchain technology, adopting Orbiter Finance may involve risks and uncertainties, including as potential flaws, security issues, and regulatory challenges. Before using the platform, users should take caution and conduct extensive research.

Orbiter Finance Airdrop Final Verdicts

Finally, Orbiter Finance represents an interesting advancement in the field of decentralized cross-rollup bridges, with a particular emphasis on smart contracts located just on the destination side. As the blockchain landscape evolves and expands, solutions like Orbiter Finance become increasingly important for bridging the gap between multiple chains, providing smooth interoperability, and facilitating asset transfer across ecosystems.

One thing to bear in mind is that, at the time of this review, Orbiter Finance had not yet launched its own native token. However, it is critical to monitor future developments because the project may contemplate introducing its own coin in the future. This may present chances for users that use the bridge for asset transfers, as they may be eligible for an airdrop of the native token once it is launched.