What Is Crypto Airdrop?

A crypto airdrop is a marketing strategy used by blockchain-based companies or projects to distribute their cryptocurrency tokens or coins to a large number of users for free or as a reward for performing certain actions, such as completing a survey, joining a Telegram group, or sharing their project on social media.

Airdrops are carried out for a number of purposes, such as raising awareness, creating a community, and rewarding current token owners. Individuals that possess a certain cryptocurrency in their wallets or fulfill specified requirements established by the project, such active involvement in forums, social media engagement, or other promotional activities, are usually eligible to participate in a cryptocurrency airdrop.

The way a cryptocurrency airdrop works is that the project sets aside a specific quantity of its native tokens or coins to be given to the intended recipients. The distribution can happen automatically or necessitate that participants perform certain duties, such signing up for a platform, finishing assignments, or posting project details on social media. The ultimate objectives are to raise awareness of the project, draw in new members, and develop a community that is supportive of the coin.

What Is DBOE Airdrop?

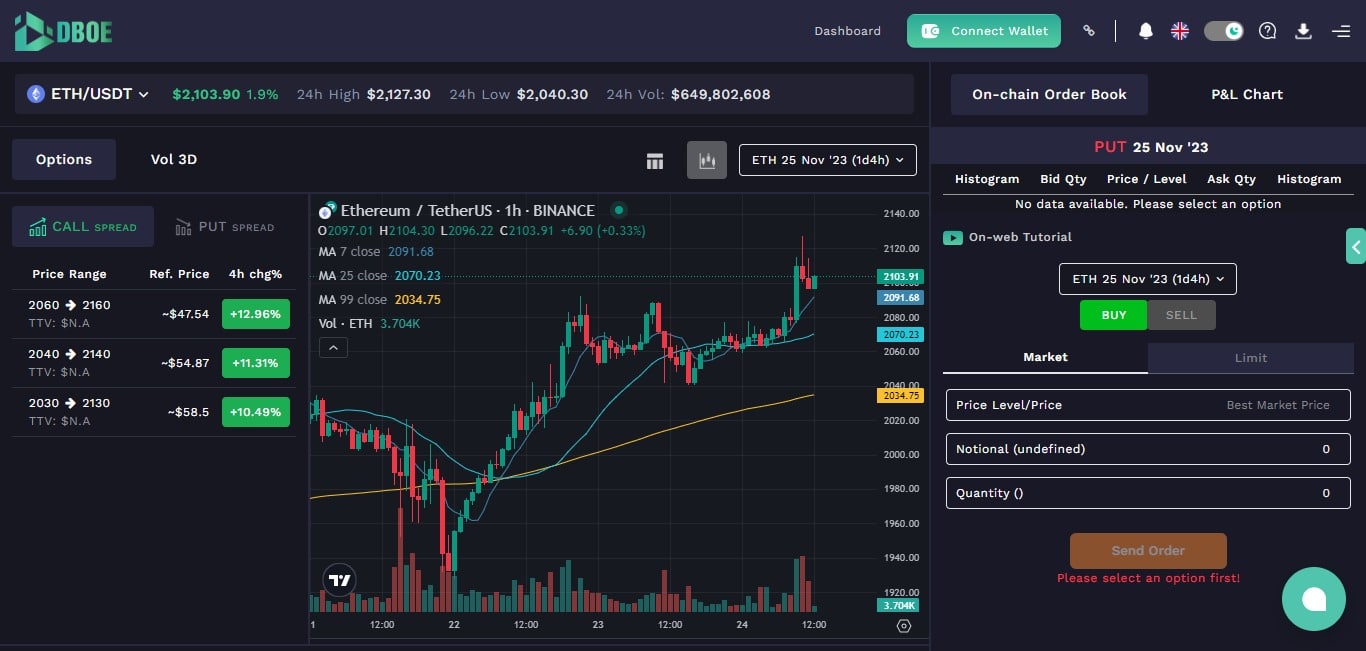

DBOE Airdrop is an Option DEX project that provides a secure and capital efficient platform for decentralised option trading, ensuring the safety of both buyers and sellers without the need for custodial services. DBOE was established in 2022 with the goal of solving the complex over-collateralisation issue in the Decentralisation Finance (DeFi) space to be more capital efficient and driving the higher adoption of DeFi in every day.

DBOE is airdropping a total of 500,000 DBOE to users who sign up. Visit the airdrop page, connect your wallet and sign up to receive up to 50 DBOE.

Basic DBOE Airdrop Points

| Basic | Details |

|---|---|

| Token Name | DBOE Airdrop |

| Platform | Binance Smart Chain |

| Support | 24/7 |

| Total value | N/A |

| KYC | KYC Is Not Requirement |

| Whitepaper | Click Here To View |

| Max. Participants | Unlimited |

| Collect Airdrop | Click Here To Collect Free Airdrop |

How To Claim DBOE Airdrop Step-by-Step Guide:

- Visit the DBOE airdrop page.

- Connect your wallet.

- Change the network to Binance Smart Chain.

- You will need some BNB to pay for gas fees. You can get BNB from Binance.

- Now go back to the airdrop page and enter your email address and them click on “Airdrop DBOE”.

- Approve the transaction from your wallet.

- Now you will get a confirmation message.

- Eligible users will get up to 50 DBOE when the claim goes live in the future.

How To Check DBOE Airdrop Is Real Or Fake

Checking the legitimacy of a crypto airdrop can be a bit tricky, as scammers often use sophisticated techniques to create fraudulent airdrop campaigns that appear to be legitimate. Here are some steps you can take to verify the authenticity of a crypto airdrop:

- Research the project: Before participating in any airdrop, it’s essential to research the project behind it thoroughly. Check the project’s website, whitepaper, social media profiles, and community forums to learn more about its team, vision, and roadmap. If the project seems sketchy or lacks transparency, it’s best to avoid the airdrop altogether.

- Check the source: Make sure that the airdrop announcement or promotion is coming from an official source, such as the project’s website, social media profiles, or community forums. Be wary of airdrops that are promoted through spam emails, unsolicited private messages, or fake social media accounts.

- Verify the instructions: Legitimate airdrops typically have clear and straightforward instructions for participation. Make sure that the instructions are feasible and reasonable, and that they don’t require you to reveal your private keys, passwords, or sensitive personal information.

- Look for feedback: Check online forums and social media groups to see if other users have participated in the airdrop and whether they received the promised tokens. If there are many complaints or red flags, it’s best to avoid the airdrop altogether.

- Trust your instincts: If an airdrop seems too good to be true or makes unrealistic promises, it’s probably a scam. Use your common sense and trust your instincts when evaluating the legitimacy of a crypto airdrop.

- In summary, it’s important to conduct thorough research, verify the source and instructions, look for feedback from other users, and trust your instincts when evaluating the legitimacy of a crypto airdrop. By taking these steps, you can minimize the risk of falling for a fraudulent airdrop and protect your assets and personal information.

What are the risks of participating in an airdrop?

Participating in an airdrop, where individuals receive free tokens or cryptocurrencies as part of a promotional campaign, carries several inherent risks. One primary concern is the potential for scams and fraudulent activities. Malicious actors may create fake airdrop campaigns to trick participants into divulging sensitive information, such as private keys or personal details, leading to theft or identity fraud. Additionally, the value of airdropped tokens can be highly volatile, subjecting participants to market risks.

The tokens received may lack liquidity or face sudden depreciation, resulting in financial losses. Moreover, regulatory uncertainties surround airdrops, as legal frameworks for these distributions vary across jurisdictions. Participants may inadvertently run afoul of financial regulations, exposing themselves to legal consequences. As with any investment or promotional activity, individuals should exercise caution, thoroughly research the legitimacy of the airdrop, and be mindful of potential pitfalls before deciding to participate.

DBOE Airdrop Pros Or Cons

Pros of participating in an airdrop:

- Security: DBOE prioritizes security in its decentralized option trading platform, ensuring a secure environment for both buyers and sellers. This commitment to security can enhance user trust in the platform.

- Capital Efficiency: The project aims to address the over-collateralization issue in DeFi, making the platform more capital efficient. This could attract users looking for more cost-effective and efficient options for decentralized trading.

- No Custodial Services: DBOE eliminates the need for custodial services, reducing the risk associated with centralized control over user funds. This aligns with the principles of decentralization, giving users more control over their assets.

Cons of participating in an airdrop:

- Limited Track Record: As of now, DBOE is a relatively new project established in 2022. The lack of a proven track record may pose a risk for early adopters who prefer more established platforms with a longer history of successful operations.

- Airdrop Risks: While airdrops can attract initial attention, they may also lead to a concentration of tokens in the hands of speculative users who may not necessarily contribute positively to the ecosystem. This could impact the token’s value and distribution.

- Market Volatility: DeFi markets can be highly volatile, and the success of DBOE may be influenced by broader market trends. Users should be aware of the inherent risks associated with decentralized finance and the potential impact of market fluctuations on their investments.

DBOE Airdrop Final Verdicts

In conclusion, DBOE stands as a pioneering force in the realm of decentralized option trading within the cryptocurrency space. Since its inception in 2022, the project has diligently worked towards resolving the intricate challenges posed by over-collateralization in the Decentralized Finance (DeFi) sector. By providing a secure and capital-efficient platform, DBOE not only ensures the safety of both buyers and sellers but also eliminates the need for custodial services, aligning with the core principles of decentralization.

The project’s commitment to addressing capital efficiency concerns in DeFi reflects a forward-thinking approach, aiming to enhance the overall user experience and drive higher adoption of decentralized finance in everyday transactions. The establishment of DBOE marks a significant step toward bridging the gap between traditional finance and the innovative world of DeFi.