What Is Crypto Airdrop?

A crypto airdrop is a distribution of free cryptocurrency tokens or coins to a large number of wallet addresses, typically as a promotional strategy employed by blockchain projects. The term “airdrop” is derived from the idea of “dropping” free tokens to users, much like an airdrop of supplies or information.

These distributions can take various forms, ranging from simple giveaways to more complex reward mechanisms. Airdrops are often used by new or existing blockchain projects to increase awareness, attract a user base, and stimulate community engagement.

Participants in a crypto airdrop are usually required to meet certain criteria, such as holding a specific amount of a particular cryptocurrency or participating in social media activities related to the project. Airdrops can be a mutually beneficial strategy, providing users with the opportunity to receive free tokens while allowing projects to bootstrap their communities and create a broader user base.

What Is Scallop Airdrop?

Scallop Airdrop is the pioneering Next Generation peer-to-peer Money Market for the Sui ecosystem and is also the first DeFi protocol to receive an official grant from the Sui Foundation. By emphasizing institutional-grade quality, enhanced composability, and robust security, they’re dedicated to building a dynamic money market that offers high-interest lending, low-fee borrowing, AMM, and digital asset self-administration tool on a unified platform and offering an SDK for professional traders.

Scallop has confirmed to launch the SCA token and do an airdrop for early users. Users who do lending and borrowing on the platform will get free SCA tokens when the tokens go live.

Basic Scallop Airdrop Points

| Basic | Details |

|---|---|

| Token Name | Scallop Airdrop |

| Platform | Sui |

| Support | 24/7 |

| Total value | N/A |

| KYC | KYC Is Not Requirement |

| Whitepaper | Click Here To View |

| Max. Participants | Unlimited |

| Collect Airdrop | Click Here To Collect Free Airdrop |

How To Claim Scallop Airdrop Step-by-Step Guide:

- Visit the Scallop website.

- Connect your Sui wallet.

- You will need some SUI and/or other tokens. You can get them on Binance.

- Now go to lending and supply tokens.

- Also, try borrowing some tokens by providing collateral.

- Apart from the mentioned APY, participants will also earn SUI tokens from the Scallop Incentive Program which is expected to continue for the duration of the next quarter.

- They’ve confirmed the launch of the SCA token and have confirmed to airdrop it to early lenders and borrowers.

How To Check Scallop Airdrop Is Real Or Fake

Checking the legitimacy of a crypto airdrop can be a bit tricky, as scammers often use sophisticated techniques to create fraudulent airdrop campaigns that appear to be legitimate. Here are some steps you can take to verify the authenticity of a crypto airdrop:

- Official Website and Social Media: Visit the official website of Scallop and check for any announcements or information about the airdrop. Verify the information on official social media channels such as Twitter, Telegram, or Reddit. Legitimate projects often make official announcements on these platforms.

- Whitepaper and Project Details: Review the project’s whitepaper to understand its goals, technology, and tokenomics. Legitimate projects usually provide detailed information about their vision and plans. Be skeptical of airdrops that require you to send funds or disclose private keys. Legitimate airdrops typically do not ask for sensitive information or any form of payment.

- Community Reputation: Check community forums and discussions to see what others are saying about the airdrop. If there are reports of scams or suspicious activities, it’s a red flag.

- Team Information: Look into the team behind the project. Legitimate projects have a transparent and well-documented team. Verify team members’ identities and backgrounds through LinkedIn or other professional profiles.

- Smart Contract Address: If the airdrop involves sending funds or interacting with a smart contract, verify the smart contract address on the official website or from trusted sources. Scammers may create fake smart contracts to trick users.

- In summary, it’s important to conduct thorough research, verify the source and instructions, look for feedback from other users, and trust your instincts when evaluating the legitimacy of a crypto airdrop. By taking these steps, you can minimize the risk of falling for a fraudulent airdrop and protect your assets and personal information.

What are the risks of participating in an airdrop?

Participating in an airdrop, where cryptocurrency tokens are distributed for free to a large number of wallet holders, carries several risks that individuals should be aware of. Firstly, there’s the potential for scams and fraudulent activities, as malicious actors may use fake airdrop campaigns to trick participants into revealing sensitive information or downloading malware.

Additionally, the value of airdropped tokens can be highly volatile, and there’s no guarantee that they will appreciate in the future. Participants may find themselves holding worthless or low-value tokens, especially if the project behind the airdrop fails to gain traction. Moreover, regulatory uncertainty surrounds many airdrop projects, and participants could inadvertently find themselves on the wrong side of legal issues if the distribution violates any financial regulations. It’s crucial for individuals to exercise caution, thoroughly research airdrop projects, and be skeptical of requests for private keys or personal information to mitigate these risks.

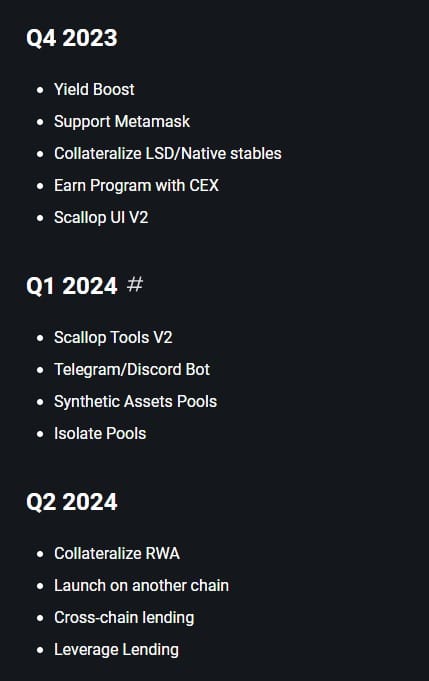

Scallop Airdrop RoadMap

Scallop Airdrop Pros Or Cons

Pros of participating in an airdrop:

- Innovation in the Sui Ecosystem: Scallop is positioned as the pioneering Next Generation peer-to-peer Money Market for the Sui ecosystem. This suggests a commitment to innovation within the blockchain space, potentially bringing new and advanced features to users.

- Official Grant from the Sui Foundation: Being the first DeFi protocol to receive an official grant from the Sui Foundation adds credibility and support to Scallop’s development. This financial backing could contribute to the project’s stability and long-term success.

- Institutional-Grade Quality: The emphasis on institutional-grade quality implies a focus on reliability, security, and professional standards. This can attract institutional investors who prioritize these aspects when participating in decentralized finance.

Cons of participating in an airdrop:

- Early Stage Risks: As a pioneering project, Scallop may face uncertainties and risks associated with being at an early stage of development. Users should be cautious about potential issues such as bugs, smart contract vulnerabilities, or unforeseen challenges.

- Dependency on Sui Ecosystem: While being part of the Sui ecosystem can provide advantages, it also means that Scallop’s success may be closely tied to the overall success and stability of the Sui ecosystem. Any issues affecting Sui could have a cascading impact on Scallop.

- Competition in DeFi Space: The decentralized finance space is highly competitive, with numerous projects vying for users and market share. Scallop may face challenges in standing out among the multitude of DeFi platforms offering similar services.

Scallop Airdrop Final Verdicts

In conclusion, Scallop emerges as a trailblazer in the realm of decentralized finance, standing as the pioneering Next Generation peer-to-peer Money Market within the Sui ecosystem. Notably, it holds the distinction of being the first DeFi protocol to receive an official grant from the esteemed Sui Foundation, underscoring its significance in the decentralized finance landscape.

Scallop’s commitment to institutional-grade quality, heightened composability, and unwavering security sets it apart, as it strives to construct a dynamic money market that seamlessly integrates high-interest lending, low-fee borrowing, Automated Market Making (AMM), and a digital asset self-administration tool, all within a unified platform. The provision of a Software Development Kit (SDK) for professional traders further solidifies its commitment to fostering a diverse and thriving ecosystem.

A notable feature of Scallop’s upcoming initiatives is the launch of the SCA token, accompanied by an airdrop for early users. This strategic move not only enhances user engagement but also serves as a gesture of appreciation for the early adopters who contribute to the platform’s growth. The symbiotic relationship between users and the platform is further emphasized by the promise of free SCA tokens for those engaging in lending and borrowing activities when the tokens go live.