In this article, I will discuss the Best Aggregator For Bridging With Minimal KYC. With the rise of cross-chain transactions, having platforms that allow fast and secure transfer of assets without elaborate identity verification becomes important.

This guide focuses on the most important protocols that respect user privacy and centralization, making bridging easier and safer for users with little to no KYC requirements.

Key Point & Best Aggregator For Bridging With Minimal KYC List

| Protocol | Key Point |

|---|---|

| Synapse Protocol | Enables fast, low-cost cross-chain asset transfers with generalized messaging. |

| THORChain | Supports native asset swaps across major blockchains without wrapped tokens. |

| Across Protocol | Optimized for fast, secure bridging using optimistic relays and bonded relayers. |

| Orbiter Finance | Lightweight and gas-efficient bridge focused on Ethereum L2s. |

| LI.FI | Aggregates multiple bridges and DEXs to offer optimal cross-chain routing. |

| Bungee (Socket) | Provides customizable cross-chain liquidity routing via modular infrastructure. |

| Rango Exchange | Multi-chain DEX and bridge aggregator for complex cross-chain swaps. |

| Squid Router | Built on Axelar, allows seamless token and function calls across chains. |

| Stargate Finance | Fully composable bridge using LayerZero for native asset swaps. |

| Hop Protocol | Offers fast bridging between Ethereum and its L2s using liquidity pools. |

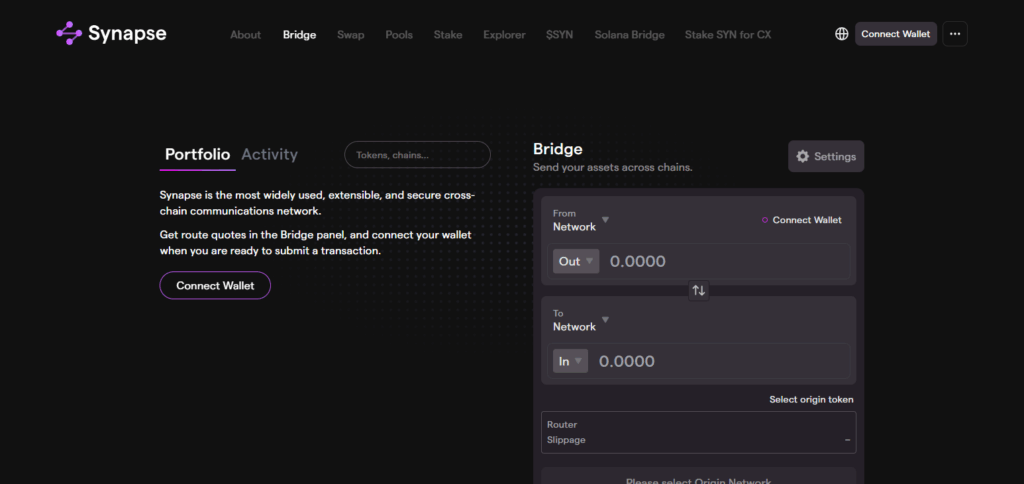

1.Synapse Protocol

Synapse serves as the best bridging aggregator with low KYC restrictions due to its non-centralized nature and fluid support for both EVM and non-EVM chains. As opposed to centralized bridges, Synapse doesn’t funnel users through a mandatory streamlined onboarding process which is great for privacy-sensitive users.

Its primary competitive advantage is providing users with self-custodial control seamless cross-chain transfers that are affordable and quick. While not using wrapped assets in many situations enabling generalized messaging, Synapse provides versatile cross-chain operability flexibly without user branding compromise.

Synapse Protocol Features

- Decentralized Cross-Chain Transfers: Permits the transferring of assets across multiple blockchains without any central authority.

- Generalized Messaging: Encompasses more than just moving tokens between blockchains; Systems are capable of advanced interactions.

- Minimal KYC Requirements: Users maintain anonymity by not having to go through extensive verification processes.

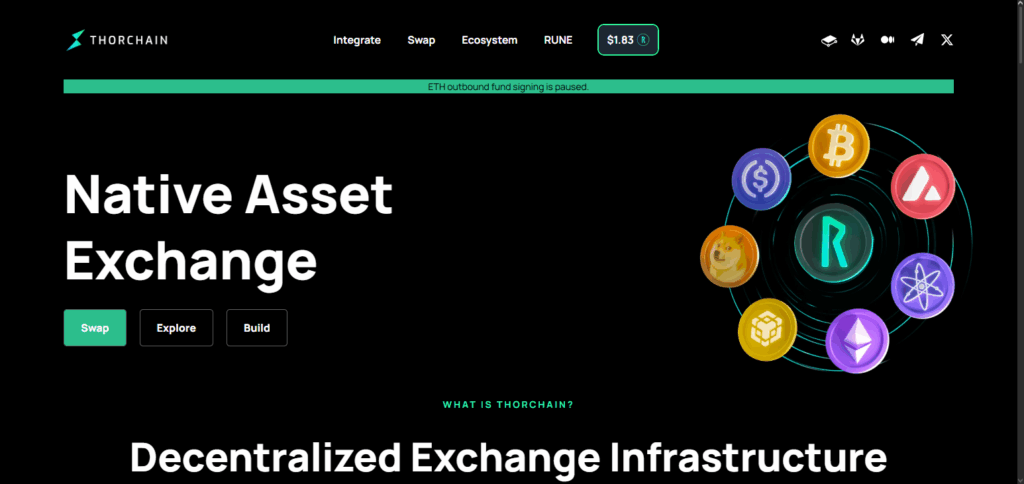

2.THORChain

THORChain serves as the most optimal aggregator for bridging with the least KYC requirements since it allows the traditional swaps of native coins for direct transactions across several blockchains and does not require wrapped tokens or centralized intermediaries.

Its holistic decentralized liquidity model allows users manage their funds without any form of identity verification. The removal of custodial risks coupled with KYC barriers grants users true cross-chain autonomy, which privacy-conscious individuals seeking asset transfers would find THORChain appealing.

THORChain Features

- Native Asset Swaps: Facilitates the exchange of native tokens directly for one another as opposed to using wrapped versions; thereby mitigating counterparty risks.

- Decentralized Liquidity Pools: Custodial risks are eliminated as users have complete control over their funds through non-custodial pools.

- KYC-Free Transactions: Transfers value in the form of bridges where one does not require verification of identity documents.

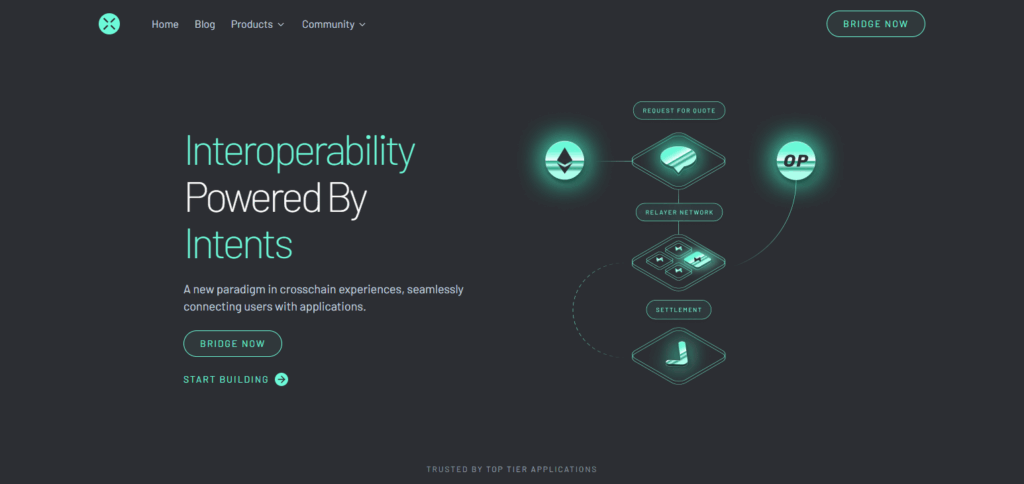

3.Across Protocol

Across Protocol is the best aggregator for bridging with minimal KYC because of its use of the optimistic relayer model which avoids centralization and user identification processes. It stands out with the use of bonded relayers and single liquidity pools which makes cross-chain transfer fast and cheap.

This structure enables users secure KYC-free bridging of assets which makes this protocol perfect for users who need speedy decentralized transactions between Ethereum and its layer-2 solutions whilst maintaining privacy.

Across Protocol Features

- Optimistic Relayer Model: Relayers have a bond of security with their assets with regard to the transfers they make so they do the least possible in the way of intermediaries.

- Single Liquidity Pool: Reduces costs and increases the speed of enabling provided liquidity.

- No KYC Needed: Permits asset transfers without identity verification processes with negligible data collection.

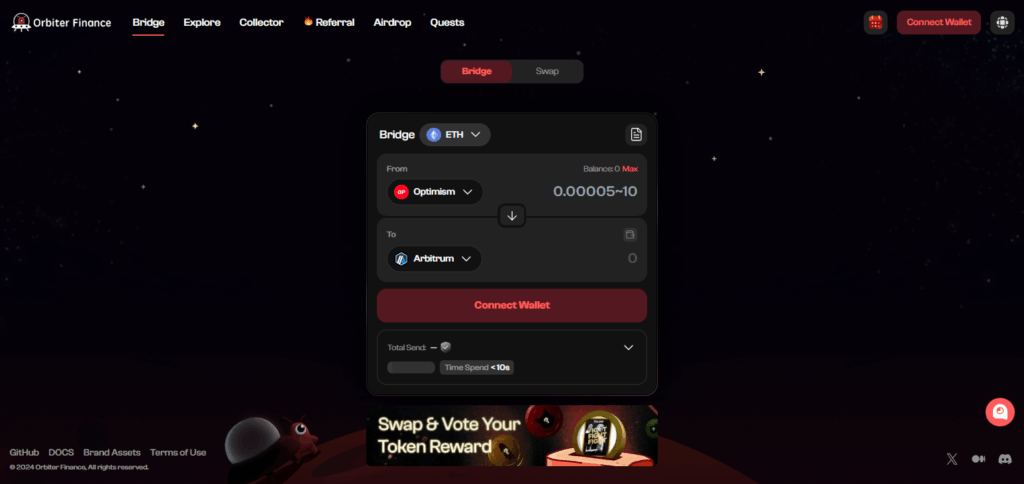

4.Orbiter Finance

Due to Orbiter Finance’s streamlined approach designed for Ethereum Layer 2 ecosystems, it is the best aggregator for bridging with low KYC requirements. Unlike others, it supports direct transfers between rollups with gas and transfer fee efficiency, sidestepping wrapped tokens or asset custodians.

Through its user-controlled P2P settlement model, Orbiter’s users retain full control over their funds and identity verification. This approach makes Orbiter Finance perfect for users looking for fast, secure, no- KYC cross-rollup transfers in the Ethereum framework.

Orbiter Finance Features

- Layer 2 Focused: Focused on cross rollup transfers for the Ethereum rollups.

- Peer-to-Peer Settlement: Removes centralized custodians by enabling direct transfer between users.

- KYC-Free Bridging: Fast and gas efficient bridging of assets with no identity checks required.

5.LI.FI

LI.FI remains the top choice for bridging with minimal KYC due to its integration of various bridges and non-custodial DEXes into a single routing engine. Unlike other services, LI.FI enables users to move assets across different chains without any central control.

What makes LI.FI distinct is that it leverages route optimization while safeguarding user privacy. By granting LI.FI cross-chain access and the ability to integrate with non-custodial wallets, users are positioned to execute efficient and inexpensive transfers; thus, having strong appeal to users looking to bridge without KYC restrictions.

LI.FI Features

- Multi-Bridge Aggregation: Merges several bridges and DEXs for better cross-chain routing.

- Smart Route Selection: Determines the cheapest and fastest transfer methods.

- Non-Custodial & KYC Free: There is no KYC needed during bridging, allowing users to keep their privacy.

6.Bungee (Socket)

Bungee (Socket) has the least amount of KYC requirements out of all the other options because it offers cross-chain transfers using its modular infrastructure which is non-custodial. We could also consider it a smart aggregator.

Its outstanding feature is smart routing and dynamic selection that chooses the best bridge among all available options in real time without any user verification at any step of the process.

Bungee’s wide wallet integration and support of other decentralized protocols guarantees speed and flexibility and ensures privacy during transactions. Users looking for control over their transactions and fast and efficient transfer options while remaining KYC-free are the perfect fit for this service.

Bungee (Socket Features

- Modular Infrastructure: Flexible and adjustable cross-chain liquidity routing for real-time needs.

- Decentralized Execution: Non-custodial bridges done without central entity supervision are safe.

- Minimal KYC: Transfers still private are facilitated through less need for ID verification.

7.Rango Exchange

Bridging with minimal KYC is best done through Rango Exchange as it acts as an aggregator due to the plethora of non EVM and EVM chains it supports, making asset swapping effortless, spanning cross multichain ecosystems.

Its main distinctive feature is the combination of DEX and bridge aggregators into a single interface which facilitates complex cross-chain interoperability while ensuring user privacy.

Rango has revolutionized asset bridging by allowing non custodial execution and no identity verification, thus granting unparalleled privacy protection over personal data.

Rango Exchange Features

- Multi-Chain Support: Assets can be bridged through EVM and non-EVM blockchains.

- DEX and Bridge Aggregator: Provides advanced swaps featuring bridges and decentralized exchanges.

- No KYC Needed: Users enjoy non-custodial, permissionless access without losing privacy.

8.Squid Router

Squid Router stands out as the optimal choice for bridging with minimal KYC thanks to the Axelar network which allows borderless cross-chain swaps and contract calls without needing to identify users.

Its distinguishing feature is the combination of privacy protection with the possibility of consolidating multiple asset transfers and function execution across different chains, all within a single transaction.

Squid provides users with deep KYC-less freedom when migrating assets and engaging with decentralized applications in different ecosystems by connecting to decentralized wallets and avoiding centralized custody.

Squid Router Features

- Axelar Integration: Employs a secure cross-chain communication network to perform seamless transfers.

- Combined Asset and Function Calls: Executes swap and contract functions in a single transaction.

- KYC-Free Transfers: No need for checks of any kind guaranteeing freedoms to users.

9.Stargate Finance

Stargate Finance is the number one aggregator for bridging with minimal KYC because of enabling cross-chain user verificationless native asset transfers through LayerZero’s ultra-secure messaging protocol. It’s most notable feature is instant finality and unified liquidity pools which enables users to directly bridge assets with high efficiency and low slippage.

The fully decentralized and non-custodial design of Stargate ensures privacy and control to users, which makes it ideal for users looking for smooth cross-chain bridging with no KYC hurdles.

Stargate Finance Features

- LayerZero Protocol: Cross-chain native asset swaps in real time and securely are done using instant, cross-chain messaging.

- Unified Liquidity Pools: Bridging is smooth and slippage is minimal.

- Fully Decentralized & KYC-Free: Total user sovereignty is provided with no custodians or KYC on record.

10.Hop Protocol

Aggregating with minimal KYC can be done through the bridging system Hop Protocol which uses liquidity pools on Ethereum and its Layer 2 ecosystems for instant and permissionless transfer of funds without any KYC checks.

It’s most valuable characteristic is the swift, cost-effective, non-custodial smart contract bridging between Ethereum and rollups. Users are guaranteed privacy and control over their assets without the need for centralized control through wrapped tokens.

Hop Protocol Features

- Liquidity Pools on L1 and L2: Facilitates quick and cost-efficient transfers of value between Ethereum and its rollups.

- Non-Custodial Smart Contracts: Users are able to keep control of their assets while bridging with the use of smart contracts.

- Minimal KYC: Enables users to move their assets without any identity checks.

Conclusion

To conclude, the most efficient bridging KYC aggregators practive a blend of decentralization coupled with user control along with stratified cross-chain liquidity. These protocols offer unencumbered movement of assets while preserving privacy.

THORChain, Across Protocol, or Hop Protocol are exemplary as they do not employ centralized custody and do not rely on identity verification. User control is preserved, and instant fast, and secure identity-free bridging is offered.

Using these aggregators enables effortless, frictionless transferring of assets and interactions across blockchains while ensuring full independence and sovereignty with minimal data and personal details shared.