In this piece, I will cover the Best Bridging aggregators for Real-Time Quotes, outlining those Teleport aggregators that provide accurate, blockchain-wide, real-time pricing.

These aggregators enable real-time cross-chain swap execution by fetching the most favorable pricing, achieving low slippage, and expediting order fulfillment.

Traders and investors alike would appreciate these Teleport tools for performing effortless token transfers on their preferred blockchain network.

Key Point & Top Bridging Aggregator For Real-Time Quotes List

| Platform | Keypoint |

|---|---|

| Portal Bridge | Cross-chain bridge enabling secure asset transfers. |

| Across Protocol | Fast and low-cost cross-chain token transfers. |

| Stargate Finance | Unified liquidity layer for cross-chain swaps. |

| Hop Protocol | Scalable rollup-to-rollup bridge for quick transfers. |

| Synapse Bridge | Decentralized bridge supporting multiple chains. |

| Arbitrum Bridge | Bridge connecting Ethereum and Arbitrum Layer 2 network. |

| 1inch | Aggregator optimizing trades across multiple DEXs. |

| OpenOcean | Cross-chain DEX aggregator for best swap rates. |

| Matcha | User-friendly DEX aggregator focusing on best prices. |

| ParaSwap | Aggregator offering optimized trading routes and low fees. |

1. Portal Bridge

Portal Bridge excels as a bridging aggregator by offering real-time quotes with unmatched speed and accuracy. Its key differentiating capability is the instant aggregation of liquidity from different sources while automatically cross-chain streamlining numerous blockchain networks.

This allows users to get the most recent information and optimum swap rates instantly. With an emphasis on data precision, on-time payment, and real-time data cross-chain execution, Portal Bridge stands out as the best option for seamless transparency and low fees during token transfers.

Portal Bridge Features

- Multi-Chain Compatibility – Allows for smooth transfers from and to major blockchains such as Ethereum, Solana and BNB Chain.

- Real-Time Token Quotes – Helps customers make more optimum bridging decisions by real time display of token exchange rates.

- Security via Guardian Network – Validates x-chain transfers through decentralized guardians (validators) within guardian networks.

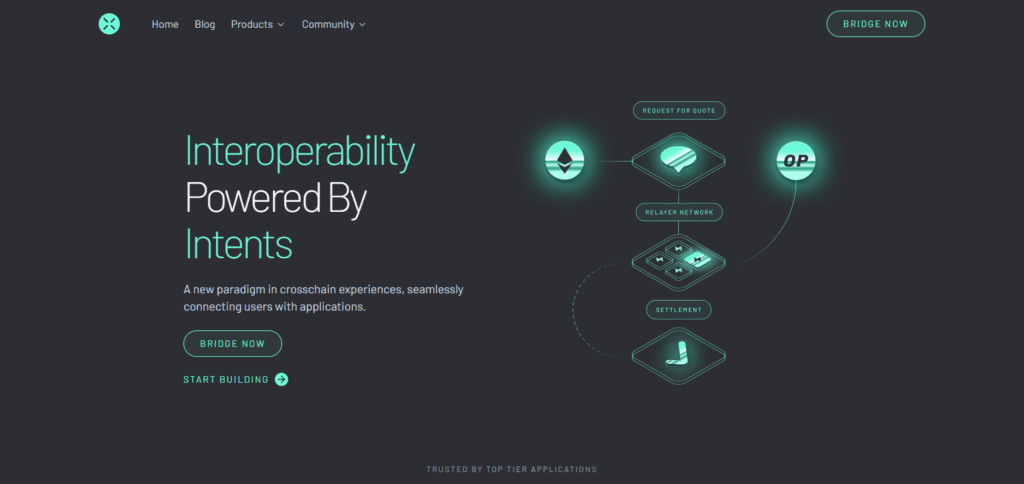

2. Across Protocol

Across Protocol stands out as a leading bridging aggregator, offering on-the-spot quotes with low latency and fees.

Its standout feature is its optimized messaging layer that guarantees fast and secure cross-chain transfers without compromising on price accuracy.

Leveraging multiple sources of liquidity together with sophisticated routing algorithms, Across Protocol provides guaranteed real-time pricing updates. This blend of speed, accurate quote aggregation, and cost efficiency is what makes Across Protocol preferred by users seeking dependable real-time cross-chain swaps.

Across Protocol Features

- Instant Bridging – Best for quick movement of assets from and to Arbitrum and Optimism L2s.

- Low Slippage & Fees – Offers optimized liquidity to minimize costs.

- Data Transparency – Real-time quoting and comprehensive analytics offer open access to all bridge quote APIs.

3. Stargate Finance

Stargate Finance is recognized as a leading bridging aggregator, thanks to its real-time quotes and unified liquidity across chains.

Its strongest features are native liquidity pools, which enable guaranteed and instant settlement without the need for third-party liquidity providers. This minimizes slippage and guarantees consistent pricing, delivering users timely quotes.

Stargate Finance’s swapes can be accessed through diverse cross-chain interfaces, which make them fast, reliable, cost-efficient, and easy to use, thus making Stargate Finance a prominent cross-chain bridging service.

Stargate Finance Features

- Unified Liquidity Pools – Integrated asset cross-chain limit liquidity pools are provided using native assets on Layer Zero.

- Guaranteed Finality – Immediate finality without reversion risk is guaranteed for every transaction executed.

- Dynamic Fees & Live Rates – Bridging fee adjustment and token value quoting in real time offers accurate estimate.

4. Hop Protocol

As a bridging aggregator, Hop Protocol is notably recognized for its fast and scalable transfers between Layer 2 solutions and the Ethereum network.

Its strengths are evident through the use of liquidity pools on each network. Users can move assets instantly as no confirmation is required. This design mitigates delays and provides accurate quotes by reducing reliance on slow messaging.

With minimal focus on cross-chain communication, the protocol’s emphasis on real-time quoting makes it an optimal solution for users who demand speed and precision when transferring tokens.

Hop Protocol Features

- Batch Transfer Support – Provides support for batch token transfers, which help in gas reduction for large-scale operations.

- Optimized for Layer 2s – Caters to seamless Transfers of all types across L2s networks, such as Polygon and Optimism.

- Quote Visibility -Retrieval of important output information, such as transfer pricing and input dynamics, is done in real-time.

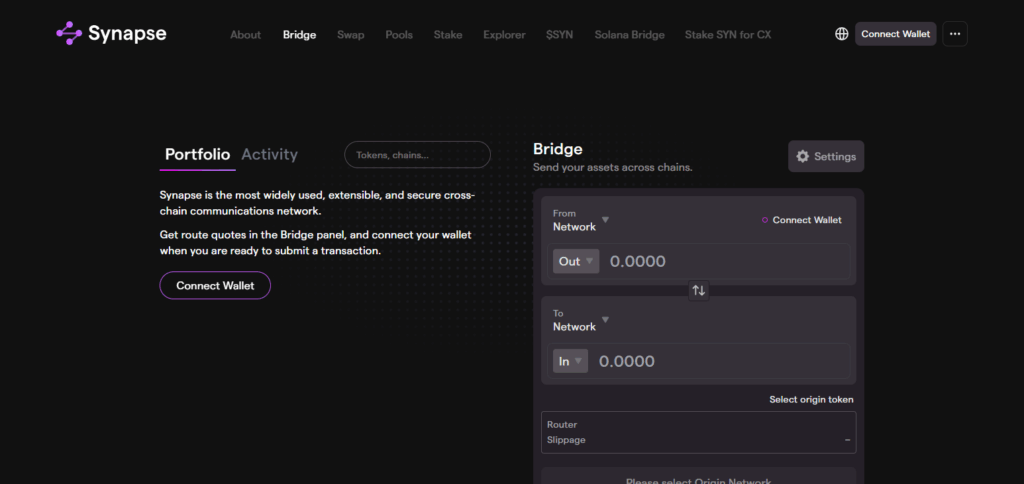

5. Synapse Bridge

Synapse Bridge is a leading bridging aggregator that provides real-time quotes with high accuracy across various blockchains.

Its unique edge comes from a decentralized network of validators that secure fast cross-chain transactions, ensuring both speed and trustlessness. Synapse’s sophisticated automated market maker (AMM) architecture enables thinner slippage and better prices than AMM-based DEXs in other blockchains.

This combination of security, speed, and liquidity makes Synapse Bridge a preferred choice for cross-chain transfers of digital assets.

Synapse Bridge Features

- Wide Asset Support -Able to bridge stablecoins, native tokens and NFTs across various chains and ecosystems.

- Real-Time AMM Pricing -Provided tokens to be casted and changed the SYNAPSE MARKER MODULE along with LIVE SYNAPSE units.

- Cross-Chain Messagin -Goes beyond the movement of assets by allowing applications to communicate over different chains.

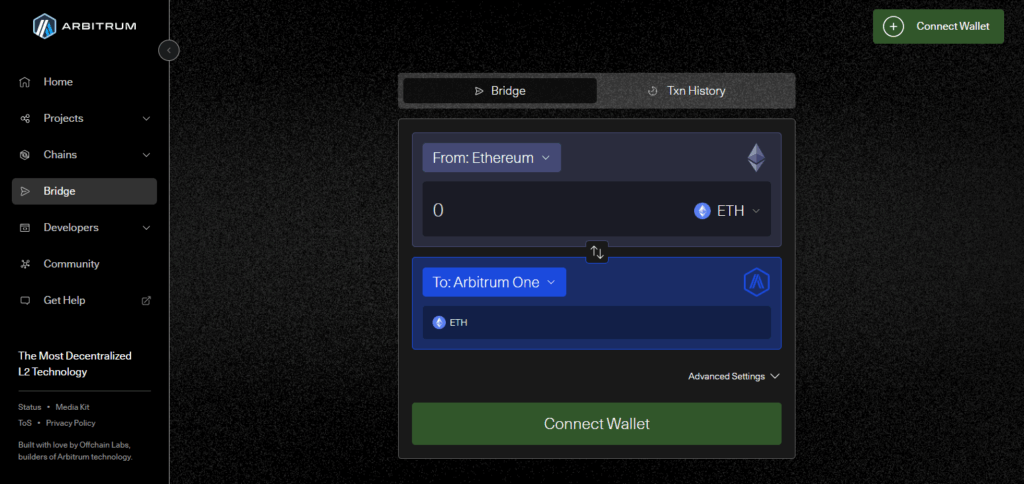

6. Arbitrum Bridge

Arbitrum Bridge is one of the top bridging aggregators, providing a connection between Ethereum and the Arbitrum Layer 2 network while delivering real-time quotes with low latency.

Its distinguishing advantage is the direct connection with Arbitrum’s optimistic Rollup technology, which allows for fast and secure transfers and a significant reduction in gas fees.

Arbitrum bridge’s integration provides instant price updates with adequate cross-chain liquidity, allowing users cost-efficient and dependable swaps, which makes The Arbitrum bridge one of the best options for seamless and precise token bridging between Ethereum and Layer 2.

Arbitrum Bridge Features

- Native L2 Bridge – Provides Ethereum to Arbitrum transfers instantly.

- Live Conversion Previews – Displays amount of tokens obtainable output prior to the bridging process based on current network situation.

- Secure Official Gateway – Transfers users funds from the Arbitrum network safely and reliably as maintained by Offchain Labs.

7.1inch

1inch is one of the leading bridging aggregators, providing real-time quotes by simultaneously fetching liquidity from multiple decentralized exchanges.

Its particular strength is the sophisticated pathfinding order-multi pricing strategy, which breaks orders into pieces ordered along different routes to optimize the price and reduce slippage.

This guarantees the best rate execution for users instantly, even in highly volatile markets. 1inch also combines broad accesses to liquidity with brilliant trade execution which makes trading fast, precise, and cheap, like all efficient cross-chain trades.

1inch Features

- DEX Aggregator Integration – Integrates bridge prices with best swap prices on global maps of the chains the user is connected to.

- Real-Time Bridge Quotes – Live pricing of cross-chain swaps is shown at the quoted price for real-time executions.

- Customizable Slippage Control – Allowing drag and drop settings while seeing changes to the final sum arranged for seamless execution.

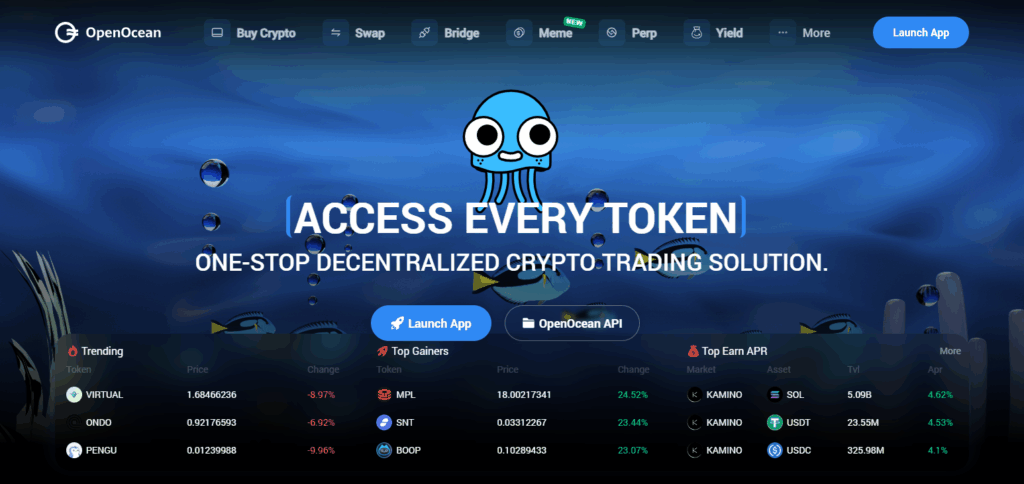

8.OpenOcean

OpenOcean stands out as a leading bridging aggregator, offering real-time quotes derived from a comprehensive aggregation of liquidity across a diverse array of decentralized exchanges and chains.

Its intelligent routing systems, which determine the optimal swap paths to be taken alongside the availability of liquidity, deepen the user’s cost and slippage experience, further enhancing the user’s overall experience.

OpenOcean’s blend of real-time price feeds, deep liquidity, and cross-chain compatibility enables users to execute fast, reliable, and precise token swaps, positioning it at the forefront of multi-chain rate arbitrage.

OpenOcean Features

- Full Aggregation Engine – Brings together all quotes from various DEX and bridges for optimal execution.

- Live Multi-Chain Pricing – Gets up-to-date L1 and L2 prices for regions simultaneously.

- Cross-Chain Arbitrage Finder – Displays price discrepancies among different chains and suggests how trades can be done in a better way.

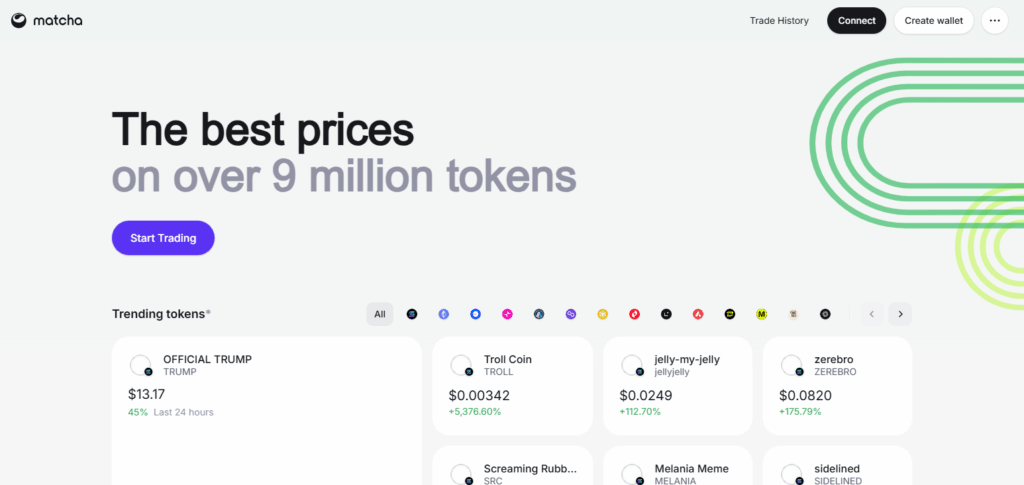

9. Matcha

Matcha is a well-known bridging aggregator as it provides real-time quotes by effortlessly aggregating liquidity from many cross-DEXs.

Its distinct competitive advantage comes from the ease of use of the platform matched by intelligent order routing (where trades are chopped into smaller pieces and exposed to multiple platforms for the best price).

This approach guarantees instant competitive prices and minimal slippage. As a streamlined bridging aggregator, Matcha focuses on transparency and efficiency, providing rapid response, reliable, and precise quotes that are optimal for users looking for fast and cheap cross-chain swaps.

Matcha Features

- Smart Order Routing – Picks the optimal route which may involve bridging.

- Clear Cost Breakdown – Gives token output and fees in a simple method before order execution.

- Real-Time Pricing – Provides live updates on borders and swaps to ensure timings.

10.ParaSwap

ParaSwap is well-known as a bridging aggregator for achieving accurate, real-time quotes of bridging and token swapping, thanks to its precise liquidity sourcing from numerous decentralized exchanges and marketplaces.

Most remarkable is the robust aggregation engine, which dynamically orders splits across various routes to minimize both price and slippage simultaneously.

Such adaptive fulfillment guarantees the most favorable trade rates available promptly, which is paramount for users. To reinforce speed, transparency, and lower overall fees, seamlessly switching cross-chain tokens provides confidence in selection.

ParaSwap Features

- Bridge and Swap Combined – Integrates token swap and cross-chain bridging into one transaction.

- Best Execution Engine – Ensures the highest returns from swaps by utilizing bridges and DEXes.

- Quote Comparison – Set the differencing, bridging, and show slippage and fees for them instantly.

Conclusion

Finally, real-time quotes from top bridging aggregators highlight their importance in the Innovation of cross-chain asset transfers.

These platforms utilize sophisticated algorithms and massive pools of liquidity interfaced with multiple chains to guarantee the highest precision of pricing within milliseconds.

Furthermore, Automated Market Makers (AMMs) with advanced slippage control and low fee structures heighten the efficiency of these aggregators. These features optimize the token swap experience across chains, providing cost-effectiveness and fast execution time.