In this article, I will talk about Best Auto Trading Platforms and their specific review. Automated trading has transformed the way traders handle their portfolios, allowing strategies to operate without requiring hands-on supervision.

Selection of a proper platform is critical for optimizing performance, precision, and revenue. In this summary, I have described the most remarkable platforms in regard to their functionality, user friendliness, as well as dependability.

Key Point & Best Auto Trading Platforms List

| Platform | Key Point |

|---|---|

| ProRealTime | Advanced technical analysis with extensive historical data |

| TradingView | User-friendly charting with strong social community and script sharing |

| TrendSpider | Automated technical analysis and dynamic trendline detection |

| MetaTrader 4 | Widely used for forex trading with strong support for custom indicators |

| SignalStack | Converts trading signals into real-time execution across brokers |

| AvaTrade | Regulated broker offering forex and CFD trading with fixed spreads |

| NinjaTrader | Powerful platform for futures and options with advanced charting tools |

| eToro | Leading social trading platform with copy trading functionality |

| Interactive Brokers | Professional-grade platform with access to global markets and low fees |

| QuantConnect | Cloud-based algorithmic trading with data and backtesting in C# and Python |

| AlgoTrader | Institutional-grade algo trading with support for multi-asset strategies |

| cTrader | Advanced forex platform with level II pricing and fast execution |

| ThinkorSwim | TD Ameritrade’s platform for active traders with rich analytics tools |

| TradeStation | Robust charting and strategy development for equities and options |

| HaasOnline | Customizable crypto trading bots with technical indicator integration |

| 3Commas | Smart crypto trading terminal with portfolio and bot management tools |

| Cryptohopper | Cloud-based crypto bot platform with marketplace for strategies |

| Bitsgap | Crypto trading automation with arbitrage and grid bot features |

| Coinrule | No-code rule-based crypto trading automation for beginners and pros |

1.ProRealTime

ProRealTime is one of the best platforms for automated trading due to the seamless combination of its advanced charting tools alongside strategy automation.

Its capability of backtesting complex trading strategies using high-quality historical data sets is what makes it unique. Traders can effortlessly build and operate automated systems through the platform’s user-friendly interface that does not require complex coding skills, as its architecture makes use of a native language.

ProRealTime offers real-time data, cloud-based infrastructure, and complex technical analysis tools which are great for advanced technical traders.

Features

- Superior charting construction along with real-time market information.

- Auxiliary trading system utilizing ProBuilder coding.

- Easy navigation with powerful backtesting functions.

2.TradingView

TradingView is one of the outstanding platforms for auto trading due to its powerful charting capabilities and community-based scripting with Pine Script. It stands out because it enables traders to create, test, and share proprietary strategies with a custom ecosystem of users around the world. Unlike other platforms,

TradingView offers browser-based automation and alerting systems which allows real-time execution of trades through integrated broker connections. This ease of use, customization, and collaboration in strategy formulation makes it ideal for collaborative traders.

Features

- Social trading in the cloud-enabled platforms.

- Automation with Pine Script through customizable scripts.

- Support for multiple assets with live data and notifications.

3.TrendSpider

TrendSpider qualifies as one of the best auto trading platforms because of its smart automation of technical analysis. Its standout attribute is the automatic adjustment of dynamic trendlines that respond to market shifts without the need for manual intervention.

This innovation not only cuts down the time spent on charting but also minimizes human error. Moreover, its multi-factor alert systems and strategy testers are favorable to traders looking to optimize automated decision making. TrendSpider smart algorithms with visualization as well enabling traders to make timely and precise moves.

Features

- Technical analysis of the AI with automated trendline drawing.

- Automated cross-analysis and backtesting for different time-periods.

- Dynamic price level custom alerts.

4.MetaTrader 4

MetaTrader 4 is regarded as one of the top auto trading platforms because of it’s exceptional support for Expert Advisors (EAs) which allows automation of trading strategies.

However, it’s optimum lightweight features fused with MQL 4 – a powerful scripting language – make it stand out further for enabling users to create flexible automated systems with ease. Its wide recognition guarantees an abundant collection of ready-made resources and community aid which makes it reliable for novice and proficient traders.

Features

- Commonly done in Forex trading with EA-enabled automated trading.

- Huge trading bot marketplace offers paid and free options from the strong community.

- Powerful tools for backtesting and optimizing trades.

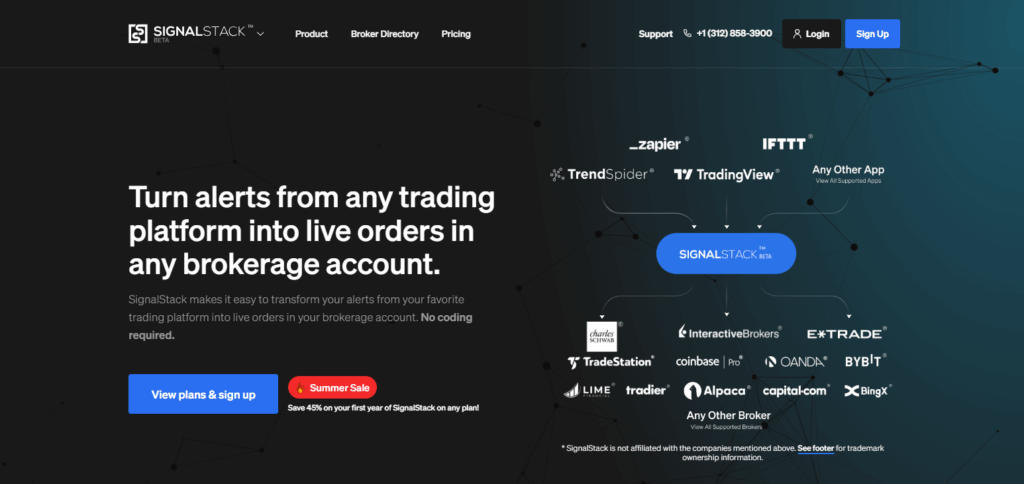

5.SignalStack

SignalStack is one of the best auto trading platforms since it provides unparalleled ease in transforming signals into actions. Moreover, its trading prowess stems from seamlessly integrating signals from TradingView, which are executed automatically, with no frameworks or specialized instructions required.

Such an environment permits traders to automate their strategies and utilize several brokers with little effort. Those wanting instant execution of strategy alerts will find SignalStack as the perfect candidate for reliable automation.

Features

- Multi-asset trade signals created by AI.

- Automated execution through connection with various brokers.

- Monitoring and risk prevention portfolio in real time.

6.AvaTrade

AvaTrade is at the top of the list for best auto trading platforms because of its seamless integration with automation services like DupliTrade and ZuluTrade. Copy trading is AvaTrade’s proprietary feature which provides regulated and simple access to mirror seasoned traders in real time.

This feature helps novice traders partake in automated trades without formulating their own strategies. Along with a wide range of assets offered and a robust trading environment, AvaTrade makes automation effortless for all users regardless of experience.

Features

- Trade with the use of EAs and through a computer interface can be done automatically.

- Wide range of instruments from Forex, crypto, stocks, etc.

- Broker which is regulated with low spreads, leverage and competitive rises.

7.NinjaTrader

NinjaTrader is among the best platforms for auto trading because of its sophisticated charting features and its custom strategy development capabilities. A related advantage is the C#-based scripting environment that allows full automation control.

With high-speed trade execution, comprehensive backtesting capabilities, and NinjaTrader customizability, it is tailored for futures traders and active day traders. Users can design, test, and execute complex strategies on NinjaTrader.

Features

- Accurate Charting with automated strategies of one’s choice.

- Wide range of third-party tool vendors and add-ons marketplace.

- Provides direct market access for futures, Forex, and stocks.

8.eToro

eToro is arguably the best in the industry when it comes to auto trading platforms because of its copy trading system. Its one of a kind feature is that users can automatically copy the trades of highly successful investors in real time.

This enables people to benefit from sophisticated trading techniques even when they do not have the required skills. eToro performs analysis of the trade behavior of each trader and provides an easily accessible proven results database which allows users to make informed decisions.

This combines social and automated trading, making it perfect for novice traders and for investors who want to allocate their funds without spending too much time managing them.

Features

- Lets users engage with social trading and copy trading automation.

- Designed for beginners with user friendly interface.

- Variety of global markets and assets available.

9.Interactive Brokers

Interactive Brokers is listed amongst the auto trading platforms as one of the best due to its superb institutional-grade tools and immense market accessibility.

Its competitive edge is found in Trader Workstation (TWS) and API which enables users to develop individualized automation trading solutions using diverse global assets.

It is particularly ideal for professional traders and developer owing to the direct market access, low latency, and high fee competitiveneness. Interactive Brokers uses automation, precision, and scalability making it one of the preferred option for serious algorithmic and high-frequency trading.

Features

- Users can engage in advanced algorithmic trading with API support.

- Global exchanges access at low cost execution.

- Strong risk evaluation and portfolio analytics tools.

10.QuantConnect

QuantConnect is one of the leading auto trading platforms as it provides an exceptional cloud-based ecosystem for algorithmic trading along with a wide array of data.

An additional benefit offered by QuantConnect is that traders can C# and Python which enables them to construct complex strategies that can be backtested and executed across different markets without having to invest in local infrastructure.

It is flexible in the sense that individual quant developers as well as institutional developers who require sophisticated automation are able to work with it. Such access is aided further due to the open source nature of its Lean engine.

Features

- Offers cloud-based algorithmic trading system on multiple languages.

- Extensive historical market data available for backtesting.

- Provides trading options for equities, Forex, options, and crypto.

11.AlgoTrader

AlgoTrader is one of the best auto trading platforms because it has institutional grade automation and supports numerous asset classes. AlgoTrader’s algo trading software supports complex strategies execution over equities, forex, crypto, and derivatives which makes it very unique.

This auto trading software is one of the best because of its professional grade risk management and connectivity to thousands of brokers. So, professional traders and hedge funds who are looking for algo trading solutions will find AlgoTrader useful due to its comprehensiveness and scalability.

Features

- Provides institutional-grade algorithmic trading software.

- Automated trading and backtesting of multiple assets enabled.

- Executing venues and major data providers already integrated.

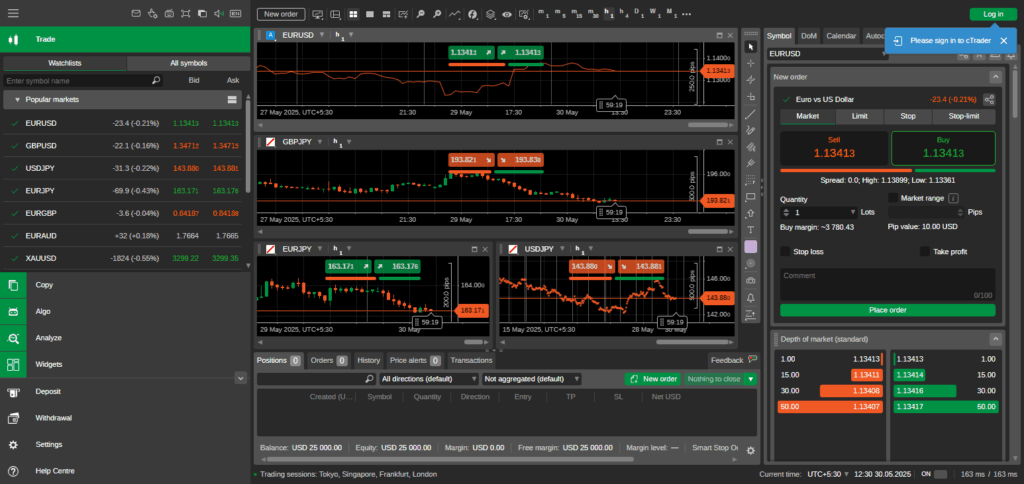

12.cTrader

cTrader is one of the premier auto trading platforms because of its cAlgo automation features. Its cTrader stands out for how well algorithmic trading is integrated with fast order execution, advanced level II pricing, and superior algorithmic trading.

Traders take advantage of powerful backtesting tools and easy C# coding for custom bot construction. This level of transparency and speed, coupled with cTrader’s developer-friendly tools, make it perfect for forex traders wanting to automate their strategies during active market hours and obtain real-time data.

Features

- Automated trading with cAlgo and intuitive interface.

- Supports multi-asset trading with advanced order types.

- Algorithms trading, fast execution and strong charting tools.

13.ThinkorSwim

ThinkorSwim is arguably one of the best auto trading platforms because of its wide ranging advanced trading tools along with its powerful automation features.

The comprehensive customization options offered through its proprietary scripting language, thinkScript, enables automation tailored to alert and design custom strategies.

ThinkorSwim also provides traders with extensive market data, execution, advanced charting capabilities, and brokerage automation making it possible to automate complex trading plans with market analysis.

Features

- Advanced automation with integrated paper and live transaction options.

- Comprehensive platform inclusive of thinkScript for automation.

- Advanced analysis and charting tools.

14.TradeStation

TradeStation is known as one of the best auto trading platforms because of its robust strategy development and execution environment.

EasyLanguage, TradeStation’s proprietary coding language that allows traders to formulate and automate intricate strategies with minimal programming expertise, is a major differentiating factor. With advanced charting, real-time market data, and powerful backtesting tools,

TradeStation provides a complete package for novices and professionals alike. This is especially important for dependable automated trading around the world since no other platform strikes such an ideal balance of accessibility and depth.

Features

- Offers an EasyLanguage scripting for a professional-grade trading platform.

- Comes with powerful backtesting and strategy optimization.

- Supports multiple assets with direct market access.

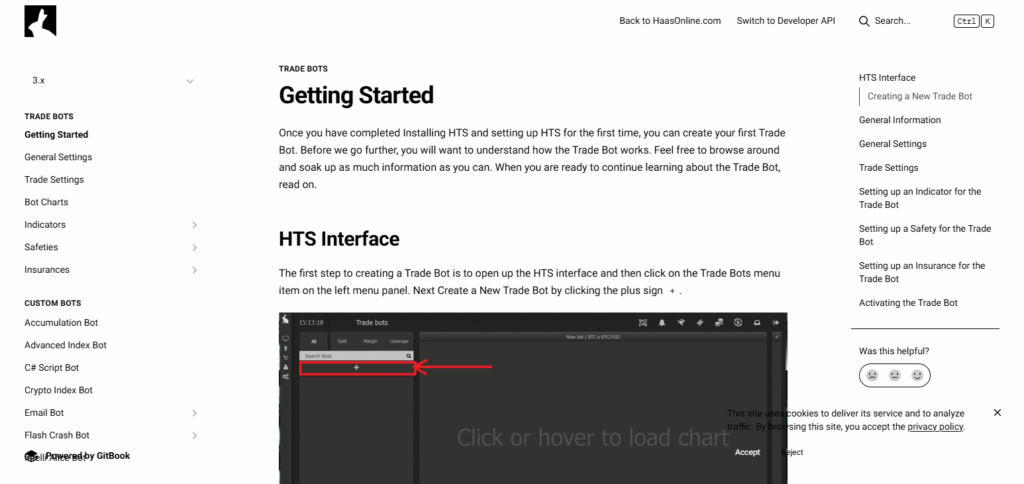

15.HaasOnline

HaasOnline is one of the best auto trading platforms. It stands out in the cryptocurrency trading sphere for its unparalleled support in bot building and bot user friendliness.

Its unique strength lies in its robust option for technical indicators, safeties, and insurances that allow precisions tailoring of automated strategies, enabling anything from easy bots to advanced multifunctional bots.

Furthermore, stringless affiliation with plenty of crypto exchange allows for seamless application of sophisticated arbirtage and market making bots. This level of constraining free form and compatability makes it a premier choice for traders looking for power in automationiddleware and crypto trading.

Features

- Advanced automation on crypto trading bots specialization.

- Drag and drop visual bot creation interface.

- Multi-exchange support along with custom script.

16.3Commas

3Commas is notably one of the best in the field of automatic trading services because of the simplicity of its design fused with robust smart trading functions.

It is particularly distinguished for its sophisticated trading bots which implement multi exchange automation for taking profits and trailing stops in a coordinated effort.

The platform has an all-in-one suite that has portfolio monitoring as well as social trading services, thereby catering to novice investors and advanced traders who want to have streamlined automation over their crypto holdings.

Features

- Bots that are cloud-based along with smart trading features.

- Automatic portfolio rebalancing and trailing stop features.

- Social trading and a marketplace for copying top traders.

17.Cryptohopper

Cryptohopper competes with the best of the auto trading platforms because of its innovative cloud based infrastructure that permits crypto trading round-the-clock and eliminates the need for a computer.

It provides a unique advantage with its sophisticated marketplace for pre-made strategies and templates where users can simply assign bots and modify them later.

Moreover, Cryptohopper offers social and paper trading which aids in strategy formulation for novices and experts alike. This combination of easy-to-use features, automated trading, and community involvement makes it an exceptional platform for trading cryptocurrency.

Features

- Strategy designer based cloud crypto trading bot.

- Associates external signals alongside technical indicators.

- Intuitive graphic interface featuring backtesting and paper trading.

18.Bitsgap

Bitsgap is at the top of the ladder when it comes to auto trading platforms, as they offer a fully automated cryptocurrency trading service along with integration of arbitrage and grid bot strategies.

One of its unique features is the ability to combine many exchanges into one account which enables single-window trade and portfolio tracking. Bitsgap’s smart bots constantly adjust to market shifts and execute optimized buying and selling decisions.

Their all-in-one technique eliminates the difficulty of complex trading strategies making it easier for traders to diversify their cryptocurrency automation systems.

Features

- Integrated platform for crypto arbitrage and bot trading.

- Unified interface for multiple exchanges.

- DCA and grid trading are automated bots.

19.Coinrule

Coinrule is a premier auto trading platform designed for cryptocurrency users looking for a no-code, user friendly automation solution. The platform’s greatest asset is its straightforward “If-This-Then-That” logic, which empowers users to design their own trading strategies without needing to code.

Users can immediately deploy bots on major exchanges like Binance and Coinbase Pro with over 250 pre-built templates available, including popular strategies such as “Buy the Dip” and “Trend Following.”

Moreover, advanced technical indicators alongside their seamless integration with TradingView allow seasoned traders to take full control, while demo mode lets all users test risk free, making Coinrule an effortless solution for automated crypto trading.

Features

- No-code crypto trading rules automation platform.

- Extensive template library for novice and expert traders.

- Universal exchange support and real-time monitoring.

Conclusion

Finally, the optimal auto trading platforms integrate sophisticated automation, simplicity of use, and strong customization options that serve various traders.

Whether it is advanced coding capabilities in MetaTrader 4 and NinjaTrader, effortless copy trading in eToro, or automation for cryptocurrencies from HaasOnline and 3Commas, each has its distinct advantages.

Depending on your experience, trading objectives, and preferred assets, you would select a platform best suited for you. Altogether, these platforms help traders design strategies and seize market opportunities 24/7.