In this post, I will discuss the How To Stake Bridging Aggregator Tokens for Extra APY. Earning passive income while enhancing cross-chain liquidity in DeFi can be achieved through the bridging of active tokens.

I will discuss the staking process, the perks, and the best strategies of earning the most rewards effortlessly, optimizing your crypto assets.

What is Bridging Aggregator Tokens?

Bridging aggregator tokens are bridging aggregator protocols yielding participants an asset. These tokens are bridging aggregator synthesizing protocols bridging two or more blockchains allowing fast and secure token swapping across blocks.

By staking, users will unlock rewards while enhancing the bridge’s liquidity and functionality. Bridging aggregator assigns great importance to multidimensional interoperability improvements within a Defy ecosystem or in short assists growth of new strands of ideas within Defy.

How To Stake Bridging Aggregator Tokens for Extra APY

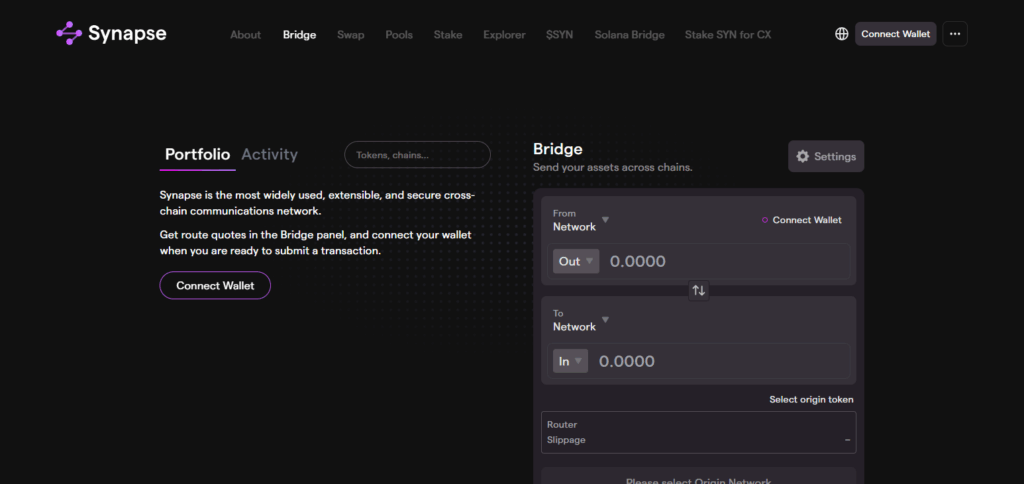

You can unlock further APY and maximize your returns by providing liquidity or locking tokens for rewards both with staking bridging aggregator tokens. Let’s use Synapse Protocol ($SYN) as an example.

Step-by-Step Guide to Staking SYN for Extra APY

Acquire SYN Tokens

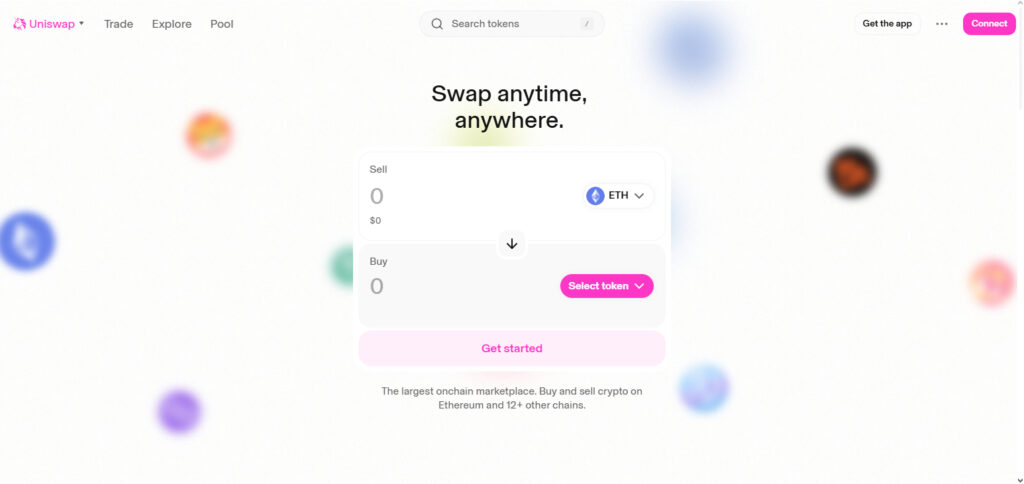

- $SYN can be purchased at Binance, Coinbase or Uniswap.

- Another option is to earn SYN by providing liquidity in Synapse pools.

Connect Your Wallet

- You can login using a Web3 wallet such as MetaMask or WalletConnect.

- Go to the Synapse staking page.

Choose Your Staking Method

- Direct Staking: This means locking SYN tokens for a fixed APY.

- LP Staking: This means you provide liquidity into the pools (e.g. ETH-SYN) and stake the LP tokens for additional rewards.

- Locking for veTokens: Some protocols reward long term lockers through boosted yields.

Stake Your Tokens

- Choose the option which matches your strategy.

- After that, approve the transaction in your wallet and finalize the stake.

Claim Rewards

- Rewards can be claimed in token form, stablecoins or even SYN.

- A number of platforms also self-compound rewards through advanced returns leading to higher yield returns.

Enhance Your APY Earning Potential

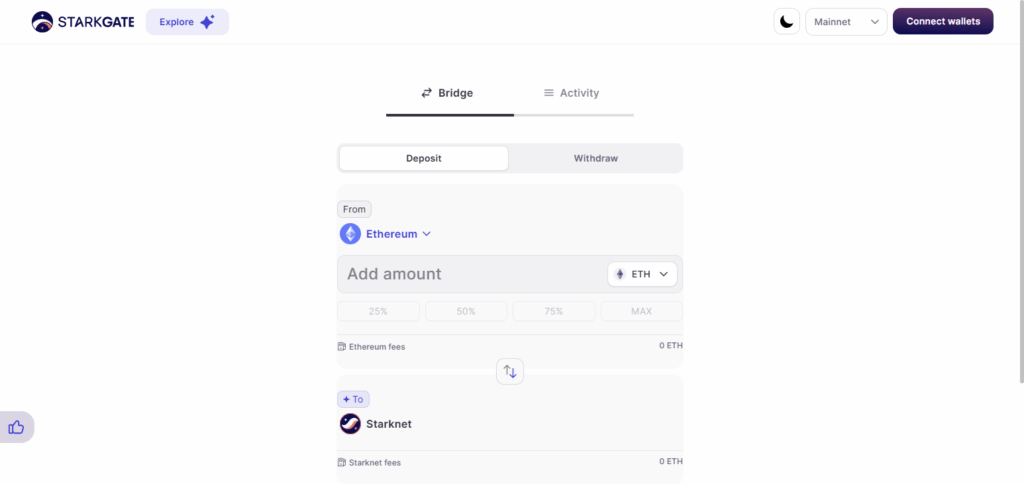

- Layer 2 Staking: Certain bridges provide elevated APY on Optimism or Arbitrum.

- Restaking: Use EigenLayer or other platforms to restake bridged assets.

- Liquidity Mining: Staking coupled with LPing may provide additional bonuses.

Track & Control Risk Factors

- If LPing, be on the lookout for impermanent loss.

- Confirm that the platform has undergone auditing to mitigate risks associated with smart contracts.

- Keep an eye on changes in token prices as they influence APY payout.

Other Place Where To Stake Bridging Aggregator Tokens for Extra APY

Stargate Finance

Stargate Finance is a top tier cross-chain liquidity protocol where users can earn extra APY by staking their bridging aggregator tokens. Stargate’s competitive advantage lies in offering fully composable liquidity across chains, facilitating borderless transfers of assets with very little slippage.

Users of Stargate’s native tokens compete for yield rewards and power the network’s liquid pooling, earning them strong returns. Stargate Finance is arguably the front runner when it comes to passive income from DeFi due to their yield farming opportunities combined with unparalleled cross-chain liquidity.

ChainPort

ChainPort is a new generation cross-chain port that allows users to stake its native PORTX tokens for higher yield.APY (Annual Percentage Yield). Through perpetual staking on ChainPort, users can garner rewards from several avenues: earning 10 percent of porting fees, 33 percent of transaction taxes, and extra special rewards through certain epochs.

Not only does this mechanism provide income while dormant through staking, it also lowers porting fees which increases the ROI for the users. Overall, this is a great tool to take advantage to expand income in the blown out DeFi system.

Benefits of Staking Bridging Aggregator Tokens

Earn Passively: Stakers passively earn an income due to high yield APY rewards offered on their tokens.

Increase Liquidity Across Blockchains: Enhances the efficiency of transactions by maintaining and increasing the liquidity accrued across multiple blockchains through staking.

Contribution to Network: The activity of stakers helps ensure the security and proper functioning of the bridging protocols.

Reduced Bridging Fees: Stakers receive additional benefits such as lowered transaction or bridging fees.

Participate in Decision Making: Voting power granted through staked tokens allows decision-making regarding the governance of protocols.

Value of Platforms Increases: There is value appreciation from holding and staking tokens and therefore increases value if adopted to further utilise the platform.

Prerequisites Before Staking

Create a Compatible Wallet: As a primary step, it is mandatory to create a crypto wallet such as MetaMask, or Trust Wallet which is one of the wallets that can link into the staking platform.

Connect to the Correct Blockchain Network: Select the appropriate blockchain network corresponding to the token’s blockchain, like Ethereum or Binance Smart Chain.

Acquire Bridging Aggregator Tokens: Make sure to stake only the native tokens you possess aiming to stake on.

Understand Staking Terms: Educate yourself about the distribution of seal periods, minimum staking amounts, reward payouts, and time.

Have Worth of Tokens for Fees: Hold a residue of native tokens to meet the transaction costs and gas expenditures.

Research Platform Security: Conduct a background check of the staking platform to skirt over the possible associated risks and scrutinize if they have third party auditing.

Tips to Maximize Your APY

Research

Spend time looking for good staking platforms that reliably pay rewards and have higher APY rates.

Increase Staking Duration

Increasing the duration for token locking translates to increment in interest rate.

Increase Compounding Frequency

You may also increase your earnings by regularly compounding your staking rewards which will lead to a boost in overall returns.

Token Bridging

Allocate chunks of your stake to different bridging tokens to make sure you handle risk properly while still maximizing gains.

Keep Track of Protocol Announcements

Bonus incentives, special staking events and new reward programs for stakeholders are usually announced by the protocol.

Minimize Transaction Costs

The net return will be greater if you perform staking actions when gas fees are at their lowest.

Risk & Considerations

Smart Contract Risks

Gaining access to funds is possible through sophisticated hacking methods. This happens if there are gaps in the staking protocol’s code.

Market Volatility

Staked assets rewards and their respective values may diminish due to drastic reductions in token prices.

Lock-Up Restrictions

Locked tokens cease to be accessible during intense periods of volatility in the stock market, curtailing ones breadth of action.

Liquidity Risks

If liquidity is meager, there may be a pronounced absence of funds, thus slowing down the speed at which tokens can be unstaked.

Platform Reliability

Operational risk exposure tends to be large for unaudited platforms which are new.

Regulatory Uncertainty

Verification alteration could modify the nature of some activities as they relate to staking or tokens.

Gas Fees Impact

Reduced profit margins due to elevated transaction costs may occur, particularly on congested networks.

Pros & Cons

| Pros | Cons |

|---|---|

| Earn passive income with attractive APY | Exposure to token price volatility |

| Support cross-chain liquidity and DeFi growth | Potential lock-up periods limiting access |

| Possible governance voting rights | Smart contract and platform security risks |

| Discounts on transaction or bridging fees | High gas fees can reduce net rewards |

| Opportunity for token appreciation | Complexity of managing cross-chain assets |

| Helps strengthen blockchain interoperability | Risk of low liquidity when unstaking |

Conclusion

To sum it up, bridging staking aggregator tokens helps earn additional APY whilst enabling important cross-chain liquidity in DeFi. By learning the intricacies of the process, picking reliable platforms, and mitigating risks, one can increase their passive income.

These tokens can be staked at virtually any level of competency within the cryptocurrency space and actively help in furthering the development of the blockchain system while capitalizing on the opportunity.