In this article, I will discuss the How To Stake Bridging Aggregator Tokens on Sidechains. Staking on sidechains comes with advantages such as cheaper fees, quicker transactions, and enhanced rewards.

You will discover the steps needed to successfully stake your tokens in a way that maximizes your earnings while effectively engaging with the distinct characteristics of sidechains in the crypto world.

What Are Bridging Aggregator Tokens?

Bridging aggregator tokens are a type of digital currency which provides users with the ability to easily move and interact with different currencies spanning across blockchains.

They operate as a single token, allowing users to traverse and transfer different assets across chains without the need for different tokens for each network.

By combining multiple bridging protocols into a single token, these tokens improve liquidity and interaction in decentralized finance (DeFi) services across different blockchains. Thus, increasing accessibility while reducing costs per transaction and other technical requirements.

How To Stake Bridging Aggregator Tokens on Sidechains

Staking bridging aggregator tokens on sidechains improve reward maximizations while lessening transaction cost. Here is an example with the use of Stargate Finance ($STG) on the Arbitrum.

Step-by-Step Guide to Staking STG on Arbitrum

Acquire STG Tokens

Purchase STG on Binance, Coinbase or Unswap.

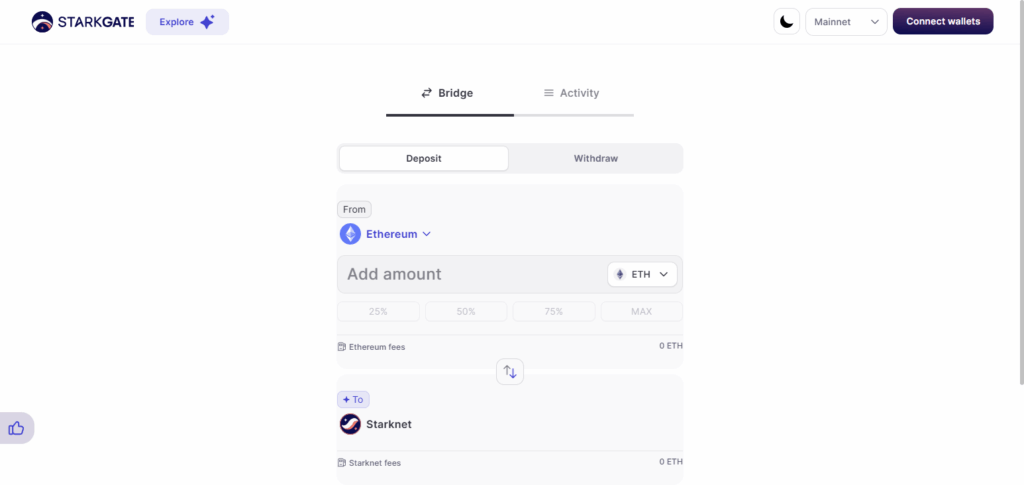

Or use Stargate’s official bridge to transfer STG from Ethereum to Arbitrum.

Connect Your Wallet

From a Web3 wallet such as MetaMask or WalletConnect.

Ensure you switch over to Arbitrum network via settings of your wallet.

Go to Stargate’s Staking Page

Proceed to the Stargate Finance staking portal.

Remember to select Arbitrum network.

Stake Your STG Tokens

Make a selection in LPing (e.g., STG-USDC LP or STG directo staking). Choose the pool.

Approve the transaction in your cardinal wallet and confirm the stake.

Claim Rewards

Ranging rewards will be rewarded through STG, some Stablecoins or other tokens.

Higher returns might be noticed through other platforms auto-compounding rewards.

Monitor & Manage Risks

Be mindful of impermanent loss while LPing.

Paranoia for no risks in smart contracts would need assurance for the platform being audited.

Be careful due to the token volatility impacting the outcoming APY returns.

Other Place Where To Stake Bridging Aggregator Tokens on Sidechains

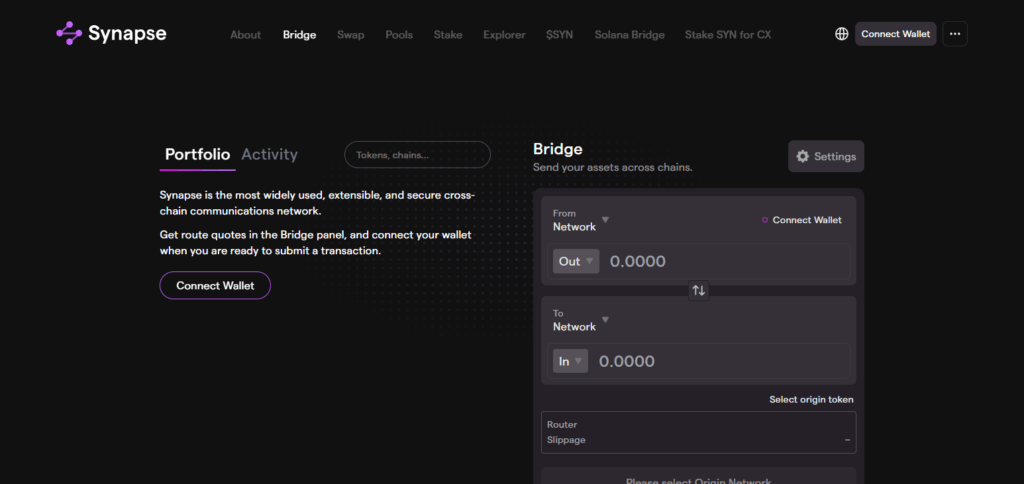

Synapse Protocol

Synapse Protocol is one of the most effective platforms for staking bridging aggregator tokens on sidechains because of its cross-chain interoperability. Synapse enables users to stake SYN tokens while maintaining fast, low-cost transaction processing on sidechains such as Arbitrum and Optimism.

Synapse also has integrated liquidity pools that allow users to earn from providing liquidity for cross-chain swaps. This feature allows users to maximize their rewards efficiently through staking and earning from cross-chain operations, enhancing the rewards in the DeFi ecosystem.

PolygonPoS Bridge

Polygon Bridge PoS is based on staking bridging aggregator tokens on sidechains due to its low feesand Let me tell you, it has a very low fee for transactions. It also supports Ethereum and Polygon sidechain.

Users are able to stake tokens with low gas fees and low delay in comparison to other chains. The best feature of this system is the security, control with consistent reward that is provided under the Proof-of-Stake framework. This enables users to obtain extra rewards through cross chain transactions while still utilizing the Polygon infrastructure.

Rango Exchange

Rango Exchange offers cutting edge price-staking bridging aggregator of tokens on sidechains with the best in class cross-chain interoperability. Its distinguishing feature is sophisticated routing system which aggregates over a hundred DEXs and bridges across more than 70 blockchains—ranging from Ethereum and Solana to Cosmos and StarkNet.

This system determines the optimal and capital-efficient pathways for token swaps while reducing slippage and fees. Rango offers a non-custodial framework with an intuitive interface that eases cross-border transaction complexity for users seeking to earn maximally through seamless-sidechain staking.

Why Stake Bridging Aggregator Tokens on Sidechains?

Reduced Costs For Transactions

Compared to mainnets, gas fees on Other Chains like Polygon and Arbitrum are drastically cheaper, making it easier for users to stake.

Increased Speed of Transactions

Staking, rewarding, and withdrawing are done at a much faster rate on sidechains which greatly improves the ease of staking on the chains.

More AVY Possibilities

A lot of sidechain services have increased or at least comparable to main networks to encourage liquidity which makes it possible to gain much greater rewards than on the main networks.

Benefits of Stake Bridging Aggregator Tokens on Sidechains

Superior Performance

Sidechains manage congestion better, enabling the seamless processing of an increased volume of transactions. This guarantees much smoother staking operations during network surges.

Increased Earning Potential

As is widely observed by many users, returns tend to be larger because of the sidechain’s liquidity-attracting programs featuring focused liquidity incentive alignment

Inter-Chain Mobility

By staking bridging aggregator tokens, users gain the ability to engage with a variety of blockchain ecosystems which aids in improving access to liquidity while lowering the frequency of asset conversions.

Tips to Maximize Your Staking Rewards

Research Reliable Platforms

Opt for reputable platforms that have a history of reliability, use safe smart contracts, and consistently deliver steady rewards.

Compare APYs Across Sidechains

Explore sidechains with competitive and desirable APYs along with low fees detrimental for maximizing gains from your staked tokens.

Compound Your Earnings

To sustainably maximize yield, periodically reinvest your staking rewards instead of cashing them out.

Stake Early in Reward Cycles

Get into staking pools early to reap the benefits of higher reward rates before the earnings potential diminishes as more users join.

Monitor Network Activity

Keep track of changes in the network, new programs, protocol upgrades, or other opportunities that can enhance your staking rewards and.

Risks and Considerations

Flaws in Smart Contracts

Staking requires the implementation of smart contracts which may possess bugs and untested code. Those that are poorly audited will always be easy targets to be exploited.

Exploit or Bridge Failure

There will always be exploits, failures and vulnerabilities with the bridge. This is fully dependent on cross-chain operations.

Volatility in the Market

The market is prone to rapid changes that can, and likely will affect the prices of tokens. Staking rewards also depend on the base value of the token used, so will face fluctuations.

Staking Restriction Policies

Different protocols come with different stipulations. Some will impose restriction policies that will limit the ability to access funds, thus yielding less control over that.

Risk to Legality Compliance

Policies associated with cryptographic assets create an environment that faces rapid change. As such, any platform will face issues with compliance due to regulations on platforms or absolute legality faced.

Pros & Cons

| Pros | Cons |

|---|---|

| Low transaction fees on sidechains | Potential smart contract vulnerabilities |

| Faster transaction speeds | Risk of bridge exploits or downtime |

| Higher APY and bonus rewards | Token lock-up periods may reduce liquidity |

| Access to cross-chain DeFi opportunities | Market volatility can impact reward value |

| Scalable and efficient staking environment | Regulatory uncertainty in some regions |

Conclusion

In summary, staking bridging aggregator tokens on sidechains is a great way to earn additional rewards due to less costs, quicker transactions, and wider access around multi chains.

Users can maximize their staking potential by picking the right platforms, keeping up to date, and managing risks intelligently. With the evolution of DeFi, crypto yields are further enhanced with flexibility and scalability which sidechain staking efficiently provides.