In this article, I will cover the Best Bybit Alternatives Exchange in EU. Many platforms provide easy-to-use features for seamless trading and broader ranges for crypto assets which are very useful for traders in Europe.

From Binance to Coinbase, every exchange comes with its advantages that can fulfill a trader’s needs and likings throughout the European crypto market.

Key Point & Best Bybit Alternatives Exchange in Eu List

| Exchange | Key Point |

|---|---|

| Binance | Largest global exchange by volume; wide range of coins and trading features. |

| Kraken | Known for strong security and regulatory compliance, ideal for U.S. users. |

| OKX | Advanced trading tools and DeFi integration; low fees. |

| Bitstamp | One of the oldest exchanges; trusted and reliable fiat on-ramp. |

| KuCoin | Offers a vast altcoin selection and futures; not fully regulated. |

| Gate.io | Great for altcoins and new listings; offers copy trading and leveraged tokens. |

| Bitget | Fast-growing platform with strong focus on copy trading and derivatives. |

| Crypto.com | Offers crypto debit card; user-friendly mobile app and strong branding. |

| MEXC Global | High liquidity for small-cap coins; minimal KYC for quick access. |

| Coinbase | Highly regulated and beginner-friendly; strong U.S. presence and security. |

1.Binance

Binance ranks as the top alternative exchange to Bybit in the EU because it has the largest trading volume, deepest liquidity, and broadest selection of crypto assets. As with many other exchanges, Binance offers sophisticated trading software.

However, unlike most of his competitors, Binance’s interface is intuitive which makes it easier to use for both retail and institutional traders.

Its compliance with numerous EU regulations enhances its reputation as well as its availability. Best of all, however, is the relentless focus on innovation by Binance, such as offering Binance Earn and Launchpad, which gives users more diverse ways to engage with crypto aside from trading.

| Feature | Details |

|---|---|

| Exchange Name | Binance |

| KYC Requirement | Minimal for basic spot trading; full KYC for higher limits and fiat use |

| Headquarters | Registered in multiple jurisdictions including the EU (varies by region) |

| Key Strength | Largest global liquidity and asset variety |

| EU Access | Available in most EU countries |

| Unique Advantage | Advanced tools + optional services without full KYC |

| Trading Types Supported | Spot, Futures, Margin, P2P, Earn, Launchpad |

| Fiat Support (EU) | Yes – supports EUR deposits/withdrawals via SEPA and other methods |

2.Kraken

In the EU, Kraken is one of the best alternatives to Bybit owing to its compliance with European regulations. Its reputation as a safe trading platform makes Kraken one of the best exchanges to trade crypto for security-minded traders.

Different from most exchanges, Kraken has advanced margin trading, making it more appealing to both new and seasoned crypto traders. This is in addition to their strict risk controls which make them attractive for professional traders in need of a regulated exchange in Europe. What adds on to the trustworthiness of Kraken is transparency and robust fiat support, especially with several Euro trading pairs.

| Feature | Details |

|---|---|

| Exchange Name | Kraken |

| KYC Requirement | Minimal KYC for starter accounts (view & deposit only); full KYC for trading |

| Headquarters | United States, with strong EU regulatory presence |

| Key Strength | High security and regulatory compliance |

| EU Access | Fully available in most EU countries |

| Unique Advantage | Offers margin and futures with strong legal backing |

| Trading Types Supported | Spot, Margin, Futures, Staking |

| Fiat Support (EU) | Yes – supports EUR via SEPA transfers |

3.OKX

OKX is one of the top Bybit competitors in Europe. It has an appealing combination of advanced trading functionalities and DeFi integration for seasoned traders. Its most impressive feature is the combination of centralized exchange capabilities with the access to decentralized finance.

Users are able to perform all necessary operations including trading, staking, and asset management within a single ecosystem. OKX is known for its low fees, fast execution speed, and expanding brand presence in Europe which makes it a versatile and convenient trading platform for users from the EU who prefer something more complex than derivative trading.

| Feature | Details |

|---|---|

| Exchange Name | OKX |

| KYC Requirement | Minimal KYC for basic trading; advanced features require verification |

| Headquarters | Seychelles, with growing EU compliance |

| Key Strength | Advanced trading tools and DeFi integration |

| EU Access | Available in most EU countries |

| Unique Advantage | Unified account for CeFi and DeFi operations |

| Trading Types Supported | Spot, Futures, Options, Perpetuals, DeFi Services |

| Fiat Support (EU) | Limited direct support; crypto-first platform |

4.Bitstamp

In the EU, Bitstamp stands out as a top Bybit competitor, distinguished by its reputation and compliance history. Based in Europe, it has incorporated Euro fiat access for EU users with straightforward deposit and withdrawal systems.

Bitstamp’s primary advantage is the combination of its institutional-grade infrastructure with a simple, secure interface used by retail traders. Users trust and depend on Bitstamp because of its transparent fee system, adherence to EU policies, and reputation as a trustworthy broker focused on regional financial alignment rather than high-leverage trading.

| Feature | Details |

|---|---|

| Exchange Name | Bitstamp |

| KYC Requirement | Minimal KYC for account creation; required for trading and withdrawals |

| Headquarters | Luxembourg (EU-based) |

| Key Strength | Long-standing reputation and regulatory compliance |

| EU Access | Fully operational across EU countries |

| Unique Advantage | Strong fiat integration with SEPA and EU-friendly services |

| Trading Types Supported | Spot trading, staking |

| Fiat Support (EU) | Yes – full EUR support with SEPA, card, and bank transfers |

5.KuCoin

KuCoin serves as a reliable alternative to Bybit for users in the EU who wish to access a diverse selection of altcoins as well as more sophisticated trading options. The platform’s competitive advantage is the listing of new tokens which other platforms have not listed yet.

This enables traders to take advantage of market movements before they become available on other platforms. Moreover, the platform caters to active traders as it offers crypto lending, automated trading, and leveraged tokens. Because of lack of regulation in the EU, KuCoin’s rich-feature platform appeals to users seeking diversification and early access to the market.

| Feature | Details |

|---|---|

| Exchange Name | KuCoin |

| KYC Requirement | No KYC required for basic trading and withdrawals (limited daily limits) |

| Headquarters | Seychelles |

| Key Strength | Wide selection of altcoins and early token listings |

| EU Access | Accessible in most EU regions |

| Unique Advantage | Full access to trading features with optional KYC |

| Trading Types Supported | Spot, Futures, Margin, Trading Bots, Lending |

| Fiat Support (EU) | Indirect via third-party services (e.g., Banxa, Simplex) |

6.Gate.io

Bybit alternatives for EU users are quite limited, but Gate.io stands out the most for users willing to explore and engage with newly launched crypto assets. The platform’s distinct edge is having one of the largest collections of lesser-known cryptocurrencies and new token listings, allowing users to trade on them before they become popular on major exchange platforms.

Gate.io caters to risk-taking traders from EU countries who appreciate diversity, innovation, and a first-mover advantage in the ever-changing crypto landscape, with features like copy trading, quantitative trading, and early-stage token sales.

| Feature | Details |

|---|---|

| Exchange Name | Gate.io |

| KYC Requirement | No KYC needed for basic deposits and spot trading (limited features) |

| Headquarters | Cayman Islands |

| Key Strength | Large selection of altcoins and early project listings |

| EU Access | Available across most EU regions |

| Unique Advantage | Offers spot, futures, and copy trading without mandatory KYC |

| Trading Types Supported | Spot, Futures, Margin, Copy Trading, Startup Sales |

| Fiat Support (EU) | Limited – crypto-first approach with third-party fiat options |

7.Bitget

For derivative and copy trading, Bitget is one of the top alternative options for Bybit for EU traders. Its most prominent feature is its advanced social trading system which enables users to follow and copy the real-time trades of successful traders.

This simplifies sophisticated trading for novices. Bitget provides alongside reasonable trading costs, platform security, and growing legal adherence in Europe, a protective environment where both beginners and veterans can leverage strong resources and community-driven trading analysis.

| Feature | Details |

|---|---|

| Exchange Name | Bitget |

| KYC Requirement | No KYC required for basic spot and futures trading (limited withdrawal) |

| Headquarters | Seychelles |

| Key Strength | Leading platform for copy trading and derivatives |

| EU Access | Available in most EU countries |

| Unique Advantage | Offers advanced trading features and copy trading without full KYC |

| Trading Types Supported | Spot, Futures, Copy Trading, Grid Bots |

| Fiat Support (EU) | Supported via third-party payment providers |

8.Crypto.com

As a Bybit alternative in the EU region, Crypto.com emerges as a prominent contender because they provide a complete crypto ecosystem that consists of trading, payments and other utilities. Their competitive advantage is the inclusion of a crypto debit card which permits access to spend digital currencies within Europe.

Through its app, compliance to EU regulations, streamlined user experience, and other features such as crypto staking rewards, Crypto.com prioritizes convenience for its users. It positions itself beyond being only a trading venue, transforming it into a gateway to the crypto lifestyle.

| Feature | Details |

|---|---|

| Exchange Name | Crypto.com |

| KYC Requirement | Basic app access without KYC; trading and fiat features require verification |

| Headquarters | Singapore |

| Key Strength | Integrated crypto ecosystem with DeFi, exchange, and Visa card |

| EU Access | Fully accessible in most EU countries |

| Unique Advantage | Crypto Visa card enabling real-world spending |

| Trading Types Supported | Spot, Derivatives, Staking, DeFi Wallet |

| Fiat Support (EU) | Yes – supports EUR deposits, withdrawals, and card payments |

9.MEXC Global

MEXC Global is one of the significant options for Bybit for EU users, especially those interested in newly launched tokens and altcoin markets with high liquidity. It was recognized for quickly listing new emerging crypto assets often before the leading exchanges.

Users get MEXC’s zero or low fee trading on some pairs, offer of minimal KYC for easier access. For EU traders focusing on fast execution, token variety, early trading opportunities, and execution speed, the agility and responsiveness of the platform were highly rated.

| Feature | Details |

|---|---|

| Exchange Name | MEXC Global |

| KYC Requirement | No KYC required for trading and withdrawals (daily limits apply) |

| Headquarters | Seychelles |

| Key Strength | Fast listing of new tokens and high liquidity for altcoins |

| EU Access | Available in most EU countries |

| Unique Advantage | Early access to emerging crypto assets with full trading features |

| Trading Types Supported | Spot, Futures, Margin, ETF, Launchpad |

| Fiat Support (EU) | Limited – fiat access via third-party providers |

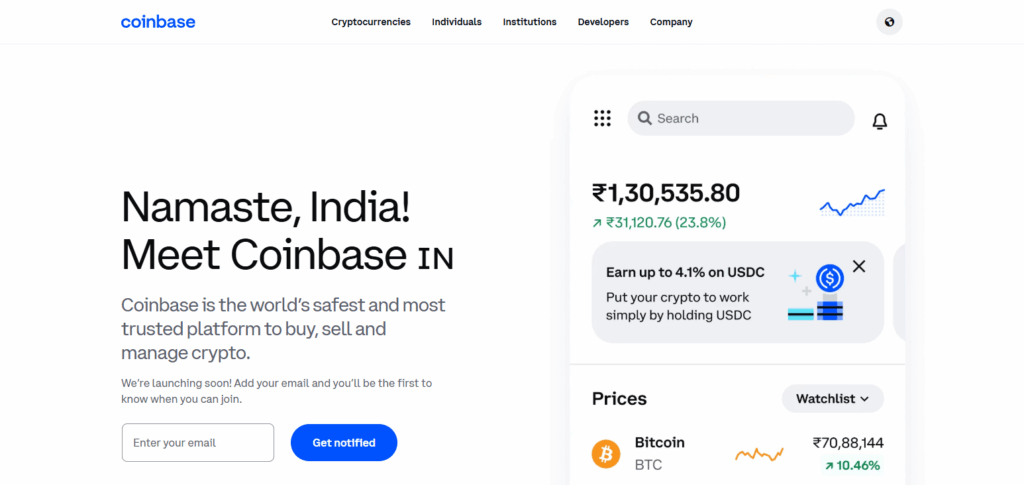

10.Coinbase

Bybit alternatives in the EU, especially for users who look for regulatory trust and ease of use, Coinbase is one of the best options. Noteworthy is its full compliance with European financial regulations which make it a safe and transparent platform for purchasing, selling, and holding crypto.

Coinbase caters to both novices and institutions, as it offers an easy to use user interface coupled with high level security. For users based in the EU who are looking for a compliant and easy to use exchange with effortless fiat currency integration, Coinbase serves as a dependable regulatory alternative to Bybit.

| Feature | Details |

|---|---|

| Exchange Name | Coinbase |

| KYC Requirement | Mandatory KYC for all trading and fiat services |

| Headquarters | United States |

| Key Strength | Fully regulated, beginner-friendly platform |

| EU Access | Fully operational across EU with local language and currency support |

| Unique Advantage | High trust and strong compliance with EU financial laws |

| Trading Types Supported | Spot, Staking, Advanced Trading |

| Fiat Support (EU) | Yes – supports EUR via SEPA, card, and bank transfers |

Conclusion

To sum up, the most prominent Bybit alternatives in the EU have distinct offerings suitable for a range of trading preferences. For liquidity and comprehensive features, Binance is unrivaled; for security, compliance, and overall reputation, Kraken is unmatched; while for advanced traders and copy traders, OKX and Bitget fill those needs.

For regulatory reputation, Bitstamp and Coinbase are unmatched. As for altcoin access and prioritization of innovation, KuCoin, Gate.io, and MEXC lead the pack. Real world utility is added by Crypto.com. Regardless of whether you prioritize regulation, diversity, or tools, there is a strong EU alternative tailored to your trading style.