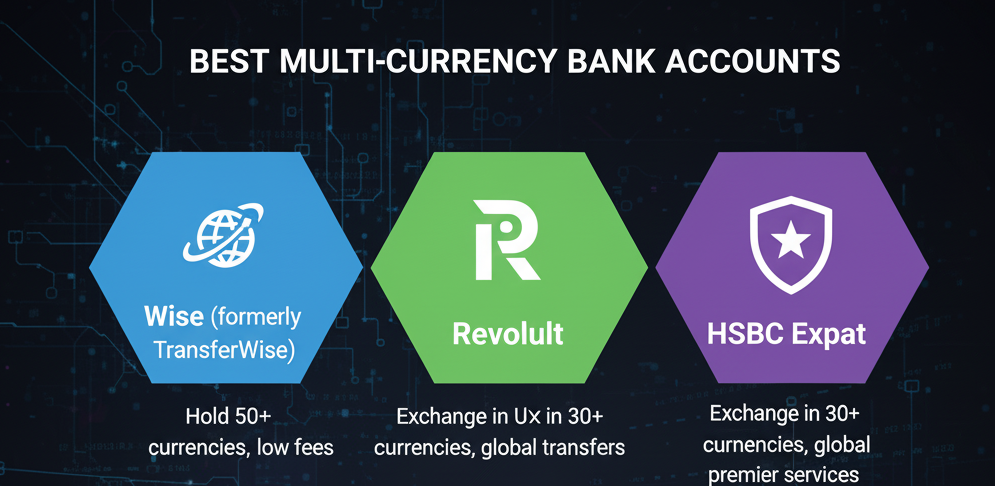

In this article, I will cover the Best Multi-currency Bank Accounts, covering the various features and advantages they provide for both individuals and businesses.

Multi-currency bank accounts empower account holders to store, transfer, and receive various currencies with ease, and this particular feature streamlines international expense tracking and management.

In this article, we review the main providers and the specific reasons they excel in international banking.

What is a Multi-currency Bank?

A multi-currency bank allows clients to manage multiple currencies in a single bank account–something a traditional bank can not do.

Multi-currency banks enable internal currency conversion, facilitate foreign currency transactions, and manage multiple currencies, making them ideal for global investors, businesses, and travelers.

Clients can receive and transfer foreign currency and pay foreign currency bills without maintaining multiple accounts, which is highly beneficial. This system avoids high transaction fees, eases account management, and simplifies management of foreign financial accounts.

Why Multi-currency Bank Accounts

Here are the reasons the multi-currency bank accounts are preferred:

Easy and Fast Transfers Globally: Send and receive funds in different currencies without the need for separate accounts.

Lower Currency Conversion Premiums: Reduce financial losses due to frequent interface charges in foreign currencies.

Limits Risks from Changes in Currency Values: Keeps funds in different currencies to guard against loss.

Supports Business Growth: Simplifies cross border payments and receipts for easier payments and receipts.

Freedom While Traveling: Travelers can spend without the need to convert currencies.

Less Complicated Accounting: Easier financial reporting by simplifying the tracking of multiple currencies consolidated in an account.

Key Point & Best Multi-Currency Bank Accounts List

1. Wise (Borderless)

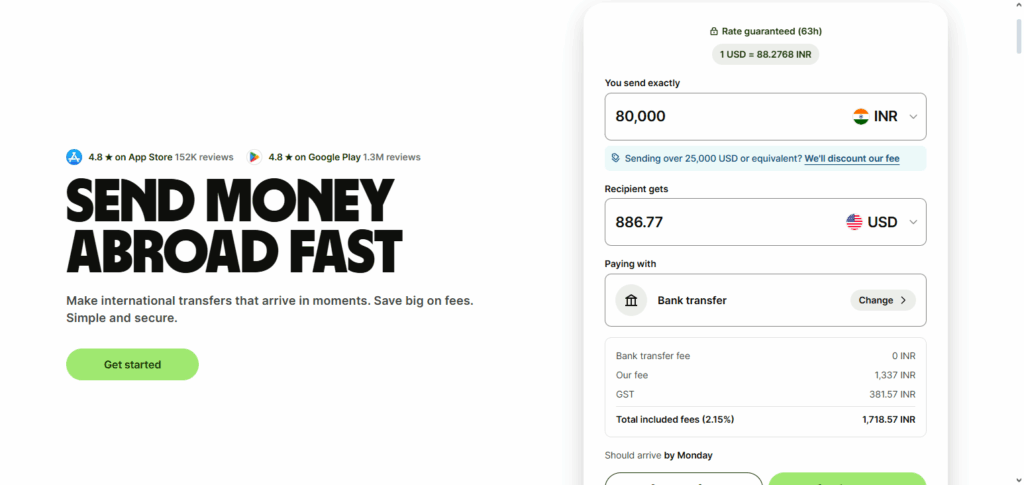

Wise (previously known as TransferWise) provides one of the best multi currency accounts in the world– the Wise multi currency account. This account enables users to manage 40+ currencies (USD, EUR, GBP, AUD, NZD, CAD, HUF, RON, TRY, SGD) and more, all on one account.

One of the best parts of the account is Wise provides users with local bank account details in 10 currencies. This enables the users to receive payments as though they possess a local bank account in those countries.

Wise is known for its transparent and set fees with low conversion fees starting at 0.35%. Additionally, Wise charges no monthly fees for account maintenance. Users with Wise accounts can withdraw up to $100 from ATMs monthly without a fee, and a 2% charge for any amount above that.

Through the Wise multi currency debit card, users can spend money in over 150 countries without any fees for foreign transactions. Wise has transformed international banking since 2011 by making the interaction and conversion of multiple currencies easier and cheaper.

This is possible due to Wise’s advanced and easy to use system that offers great prices, making it a preferred banking option for individuals and businesses with international transactions.

Wise (Borderless) Features

- Local Bank Details: Wise offers freeless accounts in multiple countries like the USA, the UK, France, to name a few, where the users can get paid in their local bank accounts.

- Real Exchange Rates: Wise has a transparent fee model where users can convert currency at the mid-market exchange rate.

- Global Accessibility: Wise can be accessed throughout the globe by the users through a website or a mobile app.

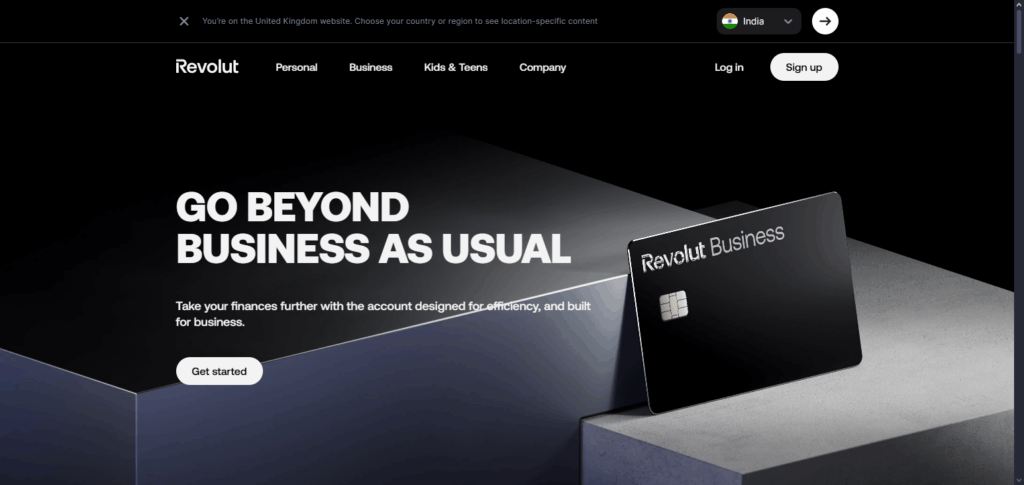

2. Revolut Business

Since 2017 comes the introduction of the multi-currency account from Revolut Business, which is specially designed for companies operating across the globe.

With this account, users can hold, send, and receive money in over 30 currencies, including but not limited to USD, EUR, GBP, JPY, and AUD, all from one platform.

Starting at just $10 a month, Revolut Business provides an all-in-one suite with local and international account capabilities, personal expense trackers, and Xero or FreeAgent accounting integrations.

With the expense account, users can physically and virtually pay using issued cards, automated bill payments, and analytic features. The platform allows for unlimited users and is unrestricted with international payments, making it the perfect solution for cross-border business operations.

Revolut Business Features

- Multi-Currency Support: A business can hold, exchange and transact with more than 30 currencies around the world with ease.

- Integrated Tools: Revolut Business has advanced features like hassle free invoicing and expense management.

- Global Payments: Revolut Business can be paid internationally at a lesser exchange and commission fee.

3. Airwallex

Airwallex is the best provider of multi-currency accounts with a sophisticated platform designed for global businesses. Companies can hold and manage funds of more than 20 currencies, including the USD, EUR, GBP, AUD, CNY, and HKD, which allows for smooth international operations without high currency conversion fees.

Airwallex provides local bank details to multiple regions, enabling easy payment and collection, similar to a local business. The platform offers foreign exchange rates that are 0.5% above interbank rates for major currencies and 1% above interbank rates for other currencies.

In addition, Airwallex has more than 120 countries that can receive local transfers and over 200 countries that can receive SWIFT payments, often free of charge.

The platform has $0 foreign transaction fees and other business foreign transaction free which is cost-effective. The US House of Representatives actively supports digital banking. Airwallex has streamlined account creation, which, along with a lack of foreign transaction fees and easy connection to Xero accounting software, is designed to give a perfect option for businesses who want to grow.

Airwallex Features

- Local Bank Accounts: Airwallex makes international bank transactions a lot easier by offering local bank accounts in certain countries.

- Real Time Currency Exchange: Airwallex has a great offering of providing realtime, international currency exchange at a low fee and exclusive offers.

- API Integration: Functions with a set of supportive APIs so companies can integrate Airwallex’s services within their financial infrastructures.

4. Monese

Monese provides an excellent solution with its multi-currency banking app, which is suited for individuals and businesses wishing to eliminate the hassle of border banking.

Monese offers instant and effortless currency exchange and cross-border transactions by allowing its users to hold and maintain accounts in GBP, EUR, and RON. Transfers to and from Monese accounts are instant and offered at a lower fee and competitive exchange rates abroad.

Monese ATM withdrawals come with generous free monthly limits, and the Premium account users enjoy unlimited withdrawals with no fees. Monese also provides users the freedom to make contactless payments via Apple Pay and Google Pay.

Monese prides itself in offering clear terms of use and pricing, along with an intuitive mobile app which simplifies banking for every customer’s individual needs.

Monese Features

- Instant Account Setup: Users can set up accounts without a credit check which broadens the scope of potential customers.

- Multi-Currency Wallet: Users can hold and manage funds in several different currencies in a single account.

- Global Spending: Users are able to spend anywhere due to the global acceptance of the prepaid Mastercard.

5. Payoneer

Payoneer is number one when it comes to multi-currency accounts. It serves businesses and freelancers with the facilities to manage funds in more than 70 currencies in more than 190 countries.

Its uniqueness lies in offering local receiving accounts in various parts of the world, enabling users to receive payments via bank transfers as if they had a local bank account in the respective countries.

This system greatly streamlines complex international payments by eliminating the complex hassle of converting currencies. Payoneer charges a 0 to 1% fee on Incoming payments, and cross-currency payments are free, whereby payments in other currencies are free.

Withdrawal fee pertains to local currency where a fixed fee applies of 1.50 USD whereby other cross currency may charge to the user a maximum of 3 percent fee. A user can also make payments from the local bank account, which is linked to the Payoneer MasterCard and allows payments worldwide.

This via ATM with a charge of 3.15 USD and applicable foreign currency transaction fees. Payoneer still remains the most reliable service for international payments, with a mobile application for better account management.

Payoneer Features

- Global Payment Solutions: Payoneer helps businesses receive payments from customers abroad with the local currency and bank details.

- Multi-Currency Holding: Users can manage and hold funds in multiple currencies, which makes international payments easier.

- Wide Network: There are thousands of partners and platforms within Payoneer’s network which makes it highly favorable to freelancers and businesses.

6. HSBC Global Money

HSBC Global Money Accounts are perfect for multi-currency digital banking for people abroad and international businesses. Users can seamlessly manage USD, EUR, GBP, JPY and any currencies of their choice, up to twenty all at once.

Sending money globally is done through the HSBC mobile banking app, while the user can spin currencies and can transfer money globally, fee-free of HSBC. Users can send money to over 200 regions with a maximum of $ 250,000 per day and can transfer $ 50,000 instantly to any HSBC account.

The account comes with a multi-currency contactless debit card and can withdraw money from any ATM, without any charges from HSBC.

The HSBC Global Money account is available at the USA, UK, UAE, and India for the fee-free banking experience and automates money top ups, Apple/Google Pay integrations and easy transfers currency exchanges.

HSBC Global Money Features

- Multi-Currency Management: Users can easily hold and manage multiple currencies within the same account for easier overseas transactions.

- Competitive Exchange Rates: Users can convert currency at a lower rate which allows for cost effective transactions.

- Global Access Benefits: Users can send and receive money easily without worrying about borders.

7. Lloyds International

Lloyds Bank provides a complete range of multi-currency accounts that fit the international banking requirements of their customers.

Their Premier International Account is unique because it provides a GBP, a EUR, and a USD option which customers can hold and manage without currency conversion fees. Each currency also comes with a Visa debit card which customers can use to access their funds from anywhere in the world.

Payments sent from and to Lloyds Bank accounts also come without fees, though there might be fees from the correspondent and recipient banks. This Lloyds account grants mobile and internet banking which provides 24-7 account access.

All Lloyds customers can use their accounts to travel, but Premier account holders also receive primary world travel insurance, which provides added security. They will also receive a qualified Premier Banking Relationship Manager.

The Premier Lloyds International Account is perfect for customers who want complete account access to their accounts without added international service fees.

Lloyds International Features

- Profitable Overdraft: Offers flexible overdraft facilities in many major currencies due to a partnership with other banks.

- Multi-Currency Accounts Access: Grants businesses access to accounts in various currencies, making international finance smoother and more efficient.

- Online Access: Automated access through online payments gives businesses instant access to online overdraft facilities.

8. Starling Bank

Starling Bank competes well in the UK each year in serving businesses and travelers with its versatile multi-currency accounts. For its Business Euro and USD accounts, users can hold, send, and receive funds in euros and the United States dollars.

The Euro account, which is £2 a month, can do SEPA payments. The USD account, which is £5 a month, can do ACH Transfers. Converting GBP and the accounts attracts a 0.4% fee and is subject to the mid-market exchange rate. Also, additional international payments are subject to extra fees depending on the payment network.

Internal Transfers are also subject to these fees. The Starling Bank mobile application includes features to manage different currencies, send real-time alerts for transactions, and enables users to link to digital payment providers like Apple Pay and Google Pay.

The Starling Bank has also a Travel Money Card, which enables users to receive fee-free Mastercard spending and fee-free ATM withdrawals abroad using the real exchange rate. Overall, Starling Bank has appealing fees, competitive features, and multi-currency financial management tools, which puts Starling Bank as a frontrunner in the market.

Starling Bank Features

- Standard User Account: Grants account holders the ability to file taxes, hold and transact in multiple currencies, and simplifies international business deals.

- Currency Exchange Regular Rates: Charges lower fees than other banks and offers real exchange rates with at least 3 transparent charges.

- Mobile Banking: Immediate access through a mobile banking app allows customers to control their finances through their phone.

9. Bank of Ireland

The Bank of Ireland offers multi-currency accounts, which include accounts for people and companies that manage international transactions.

These accounts support GBP, USD, AUD, CAD, CHF, and PLN, among others, enabling smooth transactions from any part of the world. The account has a monthly maintenance fee of €6 which includes basic banking services.

For each payment that has been made using the foreign currency debit card, a fee of €11.43 per transaction will be charged which will not exceed a 2% fee.

For each ATM withdrawal wit foreign currency that leads to payment of transaction fees, the account will be charged 3.5% with transaction fees of a lowest of €3.17 and a highest of €11.43.

There is also a cross border and foreign currency fee that may apply. Bank of Ireland is highly reputable for foreign currency transactions.

Bank of Ireland Features

- Multi-Currency Accounts: Offers accounts in various currencies, allowing businesses to manage their international finances more effectively.

- Attractive Exchange Rates: Provides attractive exchange rates and borders to ease currency swapping, bringing multiple currencies viable.

- Payments Globally: Bank of Ireland enhances global business synergy through the ability of physical payments.

10. Handelsbanken

Handelsbanken excels at providing multi-currency banking services for individuals and businesses. Customers can open multiple currency accounts on the Global Gateway and it makes international transactions a breeze.

The bank has reasonable foreign exchange rates and it provides flexible hedging to reduce currency exposure. There is a 1.65% charge for card transactions on personal cards while the corporate cards are charged 2%.

Other cross-border payments can be done with a fee and there are faster options too. These factors make automatic multi-currency account management a top choice at Handelsbanken.

Handelsbanken Features

- Multi-Currency Support: Provides multi-currency accounts to businesses for efficient management of international finances.

- Customer Care: Tailors banking services to clients on a one-on-one basis, providing businesses with specialized financial services.

- International Presence: Supplies a worldwide network, helping businesses to handle international transactions easily.

Pros & Cons Best Multi-currency Bank Accounts

Pros

Simplified Global Transactions: Manage multiple currencies within a single account, streamlining international business and personal finances.

Cost Savings: Reducing transaction and overall monthly fees by holding currencies to required currencies.

Competitive Exchange Rates: Unlike the conventional bank, more attractive rates are available.

Local Payment Capabilities: Making it seem as though you own a bank account in different countries.

Improved Financial Control: Deciding the best times to hold and convert currencies enhances control over the financial assets.

Cons

Limited Currency Support: Less favorable multi-currency account options than others.

Potential Fees: With some providers, the monthly charge may be more than the total of interest earned.

Interest Rates: Hers, the interest rates are relatively lower than conventional savings accounts.

Lack of Currency Management Skills: Quoting different currencies and studying the fluctuations of exchange rates is a challenge to some.

Conclusion

To sum up, the most efficient multi-currency accounts are of great value to both individuals and corporations coordinating their finances across borders.

They allow for the accommodation of holding, sending and receiving numerous currencies on one account without high exchange fees and ease in sending and receiving payments globally.

Local receiving bank details, exchange rate margins, and connectivity to payment tools, as well as accounting software provide users with optimal financial control. This helps reach users and targeted markets across the globe.

A bank account may charge some fees and possess a few currencies but in the end, the overwhelming majority of the clients will appreciate the account’s practicality, value for money, and simplified approach to overseas payments.

FAQ

Fees vary by provider. Common charges include currency conversion fees, ATM withdrawals, and monthly maintenance, though many accounts offer competitive or low-cost options.

Top providers like Wise, Revolut, Payoneer, and Airwallex support 20–50+ currencies, depending on the platform.

Yes, leading accounts provide local bank details in major currencies, enabling you to receive payments as if you had a domestic account.

Yes, reputable providers are regulated and use encryption and security protocols to protect funds and transactions.

Most accounts allow ATM withdrawals worldwide, with some free limits per month and a small fee beyond that.