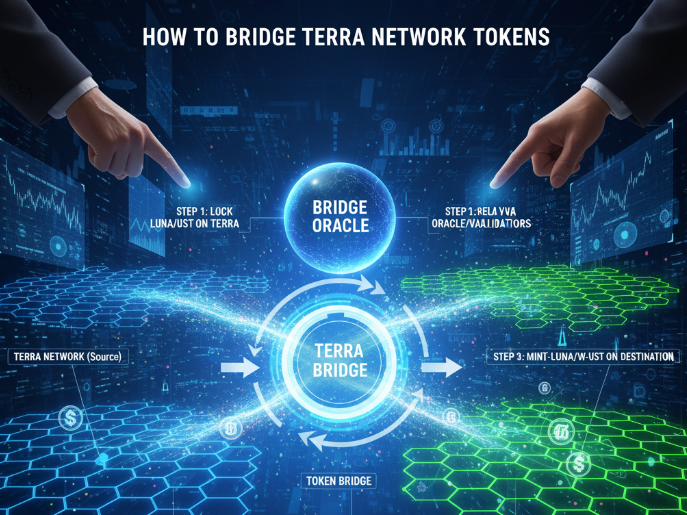

In this article, I will cover the How to Bridge Terra Network Tokens safely and efficiently. Bridging gives users the ability to send their Terra tokens to different blockchains, providing new opportunities in DeFi, trading, and liquidity.

I will cover the entire process of bridging along with the safety tips, and the problems users face to ensure the tokens move safely and fast across the networks.

What is Token Bridging?

Token bridging refers to the transfer of assets like cryptocurrencies/tokens from one blockchain network to another.

It enables users to transfer their tokens across various ecosystems to utilize decentralized applications, liquidity pools, or trading platforms located on different blockchains.

It usually entails the processes of simultaneously locking tokens on one chain and minting the same number of coins on another chain to ensure the supply on both chains is the same.

It is the key to blockchain interoperability and added flexibility, increased use cases, and upgraded decentralized finance utility.

How to Bridge Terra Network Tokens

Example: Moving LUNA from Terra to Ethereum

Step 1: Set Up Your Wallet

- Get the wallets Terra Station and MetaMask and follow the instructions to install and configure them.

- The wallets need to contain enough tokens to satisfy network fees.

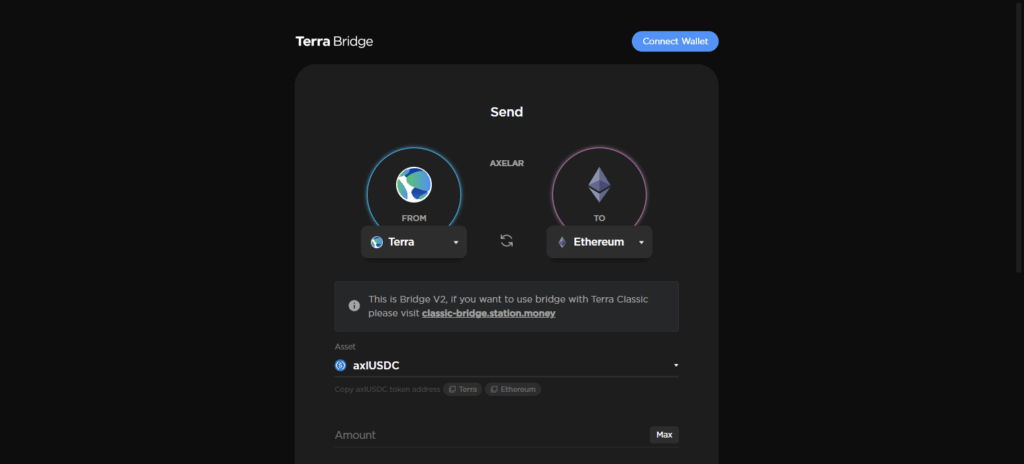

Step 2: Go to the Terra Bridge Website

- Visit the bridge website: https://bridge.terra.money.

- Always compare the URL in the address bar to verify and against potential phishing attacks.

Step 3: Link the Wallets

- For Terra Station, select the “Connect Wallet” button and link your Terra account.

- Your Ethereum wallet (MetaMask, for example) should also be connected.

Step 4: Pick Token and Target Network

- Select the token to bridge (i.e. LUNA).

- Choose the destination blockchain (i.e. Ethereum).

Step 5: Input the Amount

- Change the amount to the LUNA tokens you would like to bridge.

- The estimated fees and the overall total should be crossed checked.

Step 6: Approve and Begin the Transfer

- Press “Transfer” or “Bridge”.

- The approval will come from your Terra Station wallet.

Step 7: Confirmation

- The completion of the transaction may take a handful of minutes, contingent on the amount of congestion on the network.

- Transaction status can be monitored using the bridge interface or a blockchain explorer.

Step 8. Confirm Tokens Within the Wallet

- Once the transaction is finished, withdraw your tokens directly into the MetaMask bridge tokens wallet.

- If it doesn’t show straight away, check the proper network is selected, and then add the token.

Step 9. Proceed

- LUNA tokens are bridged to Ethereum and can be used on DeFi apps, trading, and many more services.

Why Bridge Terra Network Tokens

Access to More Blockchains: Bridging makes it possible to use Terra tokens to ethereum, Binance Smart Chain and even Solana.

Defi opportunities: Users can stake, lend and even provide liquidity on various platforms outside the Terra ecosystem.

More Tokens: Bridging to more markets enables users to have more tokens, and better trading options to help maximize liquidity.

Transaction Fee: Sometimes it is cheaper to bridge to other networks than to transact on Terra Network directly.

Better Risk Management: Users can diversify their portfolios by holding tokens on various chains.

Expanded Utility: Bridges provide ecosystems with ease to help expand the use of tokens.

Safety Tips for Bridging Terra Tokens

Use Approved Bridges Only

Only use Terra Bridge or other well known platforms to avoid losing funds or falling for scams.

Scam URLs

Make sure you are on the correct website to avoid phishing schemes.

Select correct Destination Network

Make sure to choose the right destination blockchain to avoid losing your tokens.

Wallet Security

Never share your private keys and seed phrases with anyone.

Excessive Fees

Make sure to check your transaction fees prior to confirming the transaction.

Start Small

Before attempting large transfers, the bridge should be tested with small value transactions first.

Full Status Monitoring

Make sure you are tracking your bridging transaction to spot any abnormalities.

Be Cautious of 3rd Party Links

Links from untrusted sources offering bridging tokens should also be avoided.

Common Challenges and How to Solve Them

Failed Transactions: Some bridging transactions are unsuccessful because of an issue with network congestion or incorrectly entered values.

Solution: Conduct a cross-analysis of wallet addresses, the kind of token, and network, and attempt to process the transaction again with a minimal value, if required.

High Network Fees: Certain blockchains can see a spike in gas fees, leading to very expensive bridges.

Solution: Watch the fees and try to bridge at non-peak hours, or utilize a network with lower fees.

Tokens not appearing on the Destination Wallet: Sometimes, bridge tokens are in transit and take time to arrive.

Solution: Make sure your wallet is set to the appropriate network, and if necessary, add the token manually using the contract address.

Wrong Network Selection: Tokens can be sent to the wrong blockchain which can result in the tokens being lost.

Solution: Always verify the destination network for your tokens before starting the bridge process.

Security risks: Phishing sites and fake bridges can be used to steal and hold funds.

Solution: Stick to official, reputable bridge platforms and never share your private keys with anyone.

Delayed Confirmations: Transactions which take longer than anticipated can be regarded as delayed.

Solution: Stay calm and check the status of the transaction with the bridge or with a blockchain tracker.

Pros & Cons

Pros

- Cross-chain Transferability: It allows the usage of Terra Tokens on several blockchains including Ethereum and Solana.

- Extended DeFi Functions: Empower staked assets or lend on other platforms and provide liquidity

- Enhanced Market Reach: Able to trade or invest in diverse tokens.

- Cost-Effective: Bridging to a less dominant network can decrease transaction costs.

- Easier Asset Management: Dispersed assets of a user can be monitored in a single ecosystem.

- Wider Token Usage: Bridged tokens can be integrated into other Decentralized Finance (DeFi) applications.

Cons

- High Tx Fee: Bridging can cost a hefty amount of gas which will lose the intention of cost cutting.

- Token Loss: Tokens sent to the wrong network cannot be reversed can be sent to the wrong network.

- Chain congestion: Increased demand can lead to slowed network congestion.

- Bridging Phishing: Fake bridges can lead to fund bridges or stolen funds.

- KYC: Wallet Address and other info can be stolen.

- Unidirectional Support: Transfer cannot be made to blockchain bridges and holders of tokens.

Conclusion

To finish, Bridging Terra Network tokens provides users with endless possibilities such as cross-chain access, participation in DeFi, and increased token liquidity.

Tokens can be moved from one ecosystem to another in a secure and efficient manner using a step-by-step structured approach with official bridges, network verification, and transaction monitoring.

Although users may encounter obstructing factors such as service fees and delays, implementing best practices, safety measures, and defending these practices ensures a safe and unhindered bridging experience. Terra tokens can now be used to access various digital assets easily.

FAQ

No, once a token is bridged, it cannot be reversed. Always double-check the destination network and wallet address before confirming.

Yes, bridging involves network (gas) fees on both the source and destination chains. Fees vary by network and token type.

Transaction times vary depending on network congestion, but most bridges complete within a few minutes to an hour.

Popular wallets include Terra Station, MetaMask, and other wallets that support the destination blockchain.