I will cover the best bridging aggregators for small trades. These services help traders seamlessly move assets across different blockchain networks. They do this with incredibly low fees and slippage.

These aggregators optimize the speed and security of blockchain transactions, deploying simple user interfaces for traders. They streamline small-scale cross-chain transactions, catering to novices and veterans in DeFi alike.

What is Bridging Aggregators ?

Bridging Aggregators streamlines the movement of assets across distinct blockchains. Rather than employing a single bridge or routing the asset one bridge at a time, the bridgers routing the assets through the most cost-effective, efficient, and secure method.

They like to save on tx cost, time and the chance of failure of the transaction. This is more prominent with traders and investors who want to transfer small and large amounts across chains. This and more sutdies show that cross chain bridging activities and investments will only be increasing in the future.

How To choose Bridging Aggregators for Small Trades

Low Fees: Pick aggregators that support small trades without incurring huge fees. Fees will always have a huge impact on small trades.

Speed & Efficiency: Transfers on the platform should happen without any loss of time. Delays can lead to loss of value or price slippage.

Security & Reputation: Transfers that fail or get lost can have a negative impact. Such transfers can be avoided with strong security on the platform.

Cross-Chain Compatibility: Having flexibility of multiple blockchain networks makes it easier to support aggregators.

User Friendly: Simple designs with clear guidelines will help in the proper execution of small trades without mistakes.

Top Bridging Aggregators for Small Trades Points

- Across Protocol: Fast, low-cost cross-chain transfers with strong security measures.

- Portal Bridge: Efficient asset bridging with wide multi-chain support and user-friendly interface.

- Squid Router: Aggregates multiple bridges to optimize speed and minimize fees for small trades.

- Rubic Exchange: All-in-one DeFi platform with secure, low-fee cross-chain swaps.

- MemeBridge: Simplified bridging solution focusing on small transactions and minimal slippage.

- Relay Chain: Reliable aggregator ensuring fast and secure asset transfers across chains.

- Matcha: Integrates multiple DEXs and bridges for optimized swap and transfer routes.

- 1inch: Aggregates liquidity and bridges to reduce fees and maximize transfer efficiency.

8 Top Bridging Aggregators for Small Trades

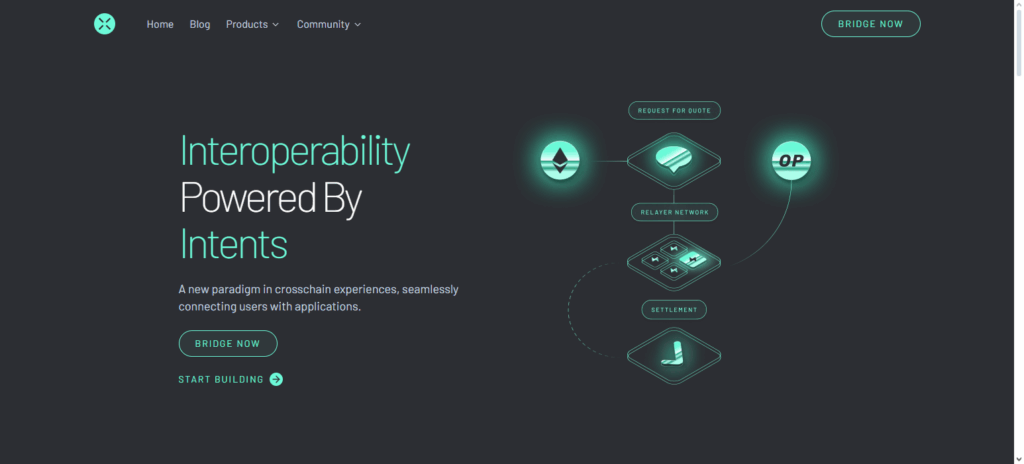

1. Across Protocol

Across Protocol is exceptional when it comes to bridging aggregator services for small trades. Its optimal speed in comparison to cost in addition to its secure nature makes it a frontrunner for small trade users who prioritize low transaction fees.

As a cross-chain transfer specialist, timeliness implemented Across Protocol’s proprietary routing system wherein assets are transferred in the most efficient manner possible to curb slippage. Users lacking in advanced trade experience are still able to easily perform cross-chain transfers thanks to the all-in-one system.

Most importantly, funds are safeguarded from possible exploits due to stringent Across Protocol frameworks. Overall, bridging small trades in DeFi is most easily done using Across Protocol for its highest balance efficiency and cost effectiveness.

Across Protocol Features

- Low Fees: Calculates optimal routes for small trades.

- Fast Transfers: Guarantees fast movement of cross-chain assets.

- Secure: Advanced security policies secure funds during transfers.

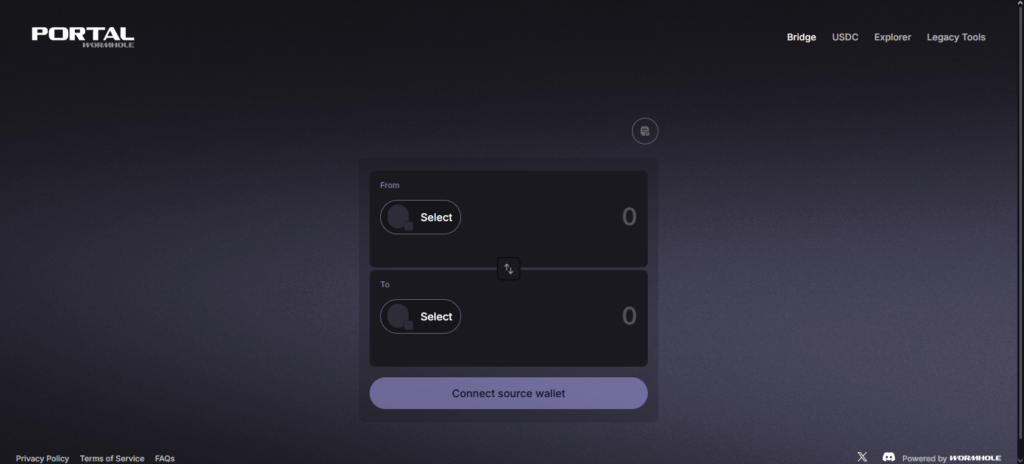

2. Portal Bridge

Portal Bridge stands out among the rest bridging aggregators for small trades due to its focus on instant, low-cost, secure transfers of assets across different blockchains.

Built for automation, it picks the most efficient routes for each transaction, ensuring small trades are not consumed by expensive transaction fees.

Portal Bridge also values the user experience through its streamlined process of fast target completion without complicated savvy steps. Traders can be assured of their peace of mind as smart-contract audits and other security measures called decentralized protocols put the system.

The speed, low-cost, and secure transfers of assets across different blockchains is how Portal Bridge designed it, and it is the reason why it is preferred for small-scale cross-chain DeFi transfers.

Portal Bridge Features

- Multi-Chain Support: Operates on numerous blockchain networks.

- Efficient Routing: Automatically selects the best option in terms of speed and cost.

- User-Friendly: Streamlined small trade processes through interfaces.

3. Squid Router

Router Squid is ranked first when it comes to bridging aggregators for small trades because of its advanced routing system that optimizes transfers over several blockchain networks.

It evaluates numerous bridges within seconds to determine the cheapest and fastest route. This makes it great for traders with small accounts who want to save on transfers.

Squid Router lowers the chance of transaction failures by avoiding unreliable transfers to enhance system reliability.

It has one of thme most simple user interface so even novices can complete small trades without any problems. With the right balance of speed and low costs, along with security, Squid Router has emerged as the DeFi go to solution for fast cross-chain transers.

Squid Router Features

- Smart Routing: Aggregates multiple bridges to optimize for cost and speed.

- Low Slippage: Assists in minimizing the price differences in small transfers.

- Reliable: Protect against donations gone wrong through system trails.

4. Rubic Exchange

Rubic Exchange is the market leader as a bridging aggregator for small trades due to its unmatched unique selling points of versatility, affordability, and security all on a single platform.

It permits users to transfer assets across multiple blockchain networks at a minimal fee, which is a positive for small trades.

What makes Rubic Exchange unique is its all-in-one approach, combining swaps, bridges, and DeFi tools to ease transactions at all levels. It is simple and easy to use which is a positive for the first time users and also has strong security features to protect funds during transfers.

The combination of low costs and reliability, alongside the ease of use has made Rubic Exchange the market leader as a small scale DeFi cross chain trading platform.

Rubic Exchange Features

- All-in-One Platform: Swaps, bridges, and DeFi instruments.

- Affordable Transfers: Reduces charges for small trades.

- Easy to Use: Simplistic design for beginners.

5. MemeBridge

MemeBridge is easily among the top aggregators for bridging small trades due to its simplicity, speed, and minimal fees.

Specifically designed for users transferring small sums, it ensures that the fees are kept low while still providing fast and reliable cross-chain transfers.

MemeBridge is lightweight and easy to use, and even DeFi newcomers can make small trades with almost no effort. It also emphasizes security with its audited smart contracts, which ensures that funds are safe during every transaction.

By efficiency, affordability, and safety, MemeBridge has eliminated the common challenges associated with small-scale bridging. Since there is an unusual focus on micro-transactions, MemeBridge is perfect for traders who want quick and cheap cross-chain transfers.

MemeBridge Features

- Micro-Transaction Focus: Performs small trade under optimized conditions.

- Fast Execution: Transfers across chains with negligible delay.

- Secure Transfers: Transfers custody of money to smart contracts for safety.

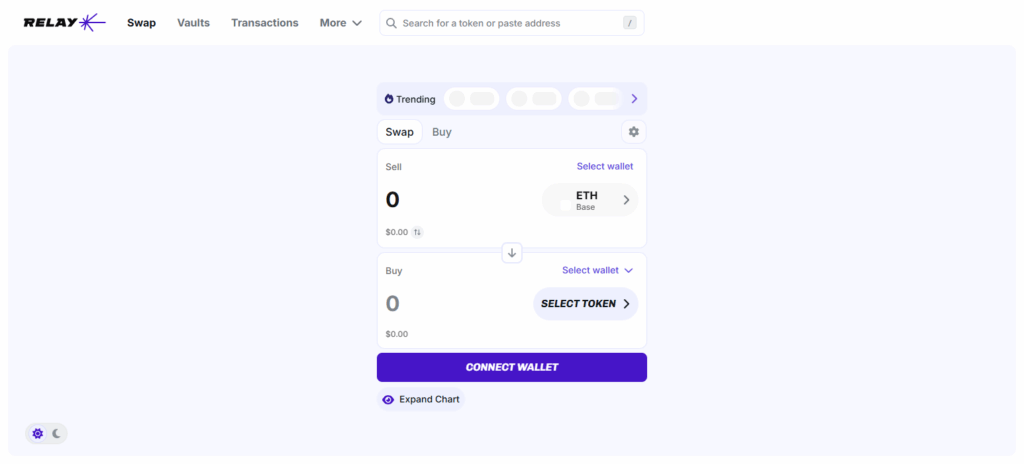

6. Relay Chain

Relay Chain is regarded as one of the top bridging aggregators for small trades due to its reliability, speed, and low accompanying fees.

It connects various blockchains and for every transactions, efficiently and autonomously detects the best possible route. It allows even novice DeFi users to transfer assets in a timely and secure manner due to its user-friendly interface.

Its decentralized verification, smart contract audit, and other standard security measures also provide real-time and continuous protection to funds in the course of transfer. These factors have made Relay Chain one of the most ever-growing preferred choices for users who want to trade small, seamless transactions across diverse blockchain networks.

Relay Chain Features

- Reliable Transfers: Guarantees safe arrival of small trades at the target destination.

- Optimal Routes: Self-calculates the fastest and least expensive route.

- User-Friendly: Renders a streamlined process to facilitate rapid transactions.

7. Matcha

Matcha is one of the top aggregators for small trades because of its integration with multiple decentralized exchanges and bridges which optimizing transfers for speed and cost.

They let small users easily convert trades because of their slippage and fee strategies. Their customer service systems and style let even novices easily understand the maze of crosschain transactions.

Along with their strong security measures like audited smart contracts and transparent operations, Matcha is able to carry out safe transfers. Their combination of efficiency, low cost and reliability makes them one of the best options for small-scale DeFi bridging.

Matcha Features

- DEX Integration: Mashes together varying DEXes for the modification of rates.

- Smart Routing: Manages the obsession of fees and slippage.

- Secure Platform: Smart audits contracted safes.

8. 1inch

1inch offers one of the best bridging aggregators for small trades because of its liquidity aggregation and smart routing: it performs fast and inexpensive cross-chain transactions.

1inch has a unique approach where it scans multiple decentralized exchanges and bridges simultaneously to ensure small trades enjoy the best rates with minimal slippage.

This single-solution approach makes 1inch more user friendly as complex DeFi operations become easy to perform for even the novice users. Furthermore, 1inch offers users peace of mind with secured protocols and audited smart contracts which protect user funds at every stage of the transaction.

This balance of effectiveness, price, and security makes 1inch one of the best solutions for small cross-chain transfers in DeFi.

1inch Features

- Liquidity Aggregation: Looks over many DEXs and bridges to get the best rates.

- Small Fees: Has a low fee threshold to lessen the impact on tiny trades.

- Transfer Safely. Maintained security with audited and open contracts.

Pros & Cons Bridging Aggregators for Small Trades

Pros

- Low Fees Optimization: Routes small trades to the lowest cost alternatives to relieve high transaction burdens.

- Faster Transfers: Bridges are aggregated to take the fastest routes in the cross-chain transfer.

- User-Friendly: Offers simple steps for completing cross-chain transfers.

- Reduced Slippage: Narrowing price gaps of small trades to increase their value.

- Security Features: Uses smart contracts and decentralized verification to enhance the safety of transfers.

Cons

- Network Dependence: Transfers can become slower to execute during periods of high congestion on the coordinating blockchains.

- Smart Contract Risk: Unmanaged contracts can be subject to much more confusion and lack of control regarding their components.

- Limited Liquidity: Little to no liquidity for cross-chain trades on aggregators.

- Extra Fees: Some platforms add small service fees on top of the bridging costs.

- Learning Curve: Unfamiliar users may require more time to understand the cross-chain workings.

Conclusion

To sum up, bridging aggregators for little trades is among the most simple and affordable methods for transferring assets across various blockchain networks.

Some of the most helpful features are low fees, quick transfers, low slippage, easy-to-use dashboards, and strong security, which are all beneficial for small traders.

On the other hand, the disadvantages are network congestion, possible risks linked with smart contracts, low liquidity on niche tokens, slightly higher fees, and slow mastery for novices.

Ultimately, with the correct selection and approach, bridging aggregators are a practical and safe option for trading in DeFi ensuring small trades are adequately catered for at low cost.

FAQ

Bridging aggregators are platforms that combine multiple blockchain bridges to transfer assets across networks efficiently, finding the fastest and cheapest routes.

They minimize transaction fees, reduce slippage, and ensure faster transfers, making small trades more cost-effective and reliable.

Most top aggregators use audited smart contracts and decentralized protocols, but there is always a small risk if security vulnerabilities exist.

Limitations include network congestion, extra service fees, limited liquidity for niche tokens, and a learning curve for beginners.