I will discuss the Best Decentralized Exchanges DEX on Solana, talking about those that have enabled trading at tenth the cost, in a fraction of the time, and with maximum security.

Being high speed, Solana’s blockchain ensures that trading tokens can be done with little to no lags, virtually no cost, and optimum liquidity management. We will cover DEXs such as Jupiter, Raydium, Orca, and Saber, examining the Key Aspects and attributes that make them the best.

What is Decentralized Exchanges?

A Decentralized Exchange (DEX) is an example of a cryptocurrency exchange that does not have a middleman and lets users exchange digital assets directly from one person to another using blockchain-based smart contracts.

DEXs are more secure than centralized exchanges since they don’t hold user funds. This eliminates the risk of the funds being compromised, lost, or mishandled. DEXs allow peer to peer exchange allowing the users more privacy, freedom from middling control of assets, and less stringent KYC.

Trading on DEXs is supported by users who contribute to liquidity pools and earn transaction fee rewards tied to the pools. Uniswap, SushiSwap, and PancakeSwap are examples of DEXs.

While they DEXs provide censorship resistant, transparent, and globally accessible exchanges, they can have illiquid markets for less popular tokens, slow transaction speeds depending on the blockchain, and higher transaction fees during periods of network congestion.

Most importantly, DEXs are an important element of the entire DeFi ecosystem, embracing the pillars of autonomy, security, and financial inclusion.

Why use Decentralized Exchanges (DEX) on Solana

High-Speed Transactions: Every second, Solana can perform thousands of transactions. Therefore, on Solana, Dex trading is Done fast.

Cost Efficiency: Solana is less expensive than Ethereal and Bitcoin which enables bonuses and cheaper swaps in transactions.

Non-Custodial Modes: Users do not have to worry about hacking the exchange and mismanagement.

Access to DeFi Ecosystem: Solana DeFi DEXs can be easily integrated with other DeFi protocols for staking, yield farming, and lending.

High Scalability: Solana can grow its user demand and supports more users without increasing the amount of time it takes to perform the trades.

Wider Than Usual Global Accessibility: Dex trading on Solana has less KYC requirement than usual due to Demographics.

Diversified Token Availability: Users will find Solana projects on DEXs first compared to other DEXs.

Key Point & Best Decentralized Exchanges (DEX) on Solana List

| DEX Name | Key Points |

|---|---|

| Jupiter | Aggregator for best token swap rates across Solana DEXs; fast and low fees. |

| Raydium | AMM with liquidity pools; integrates with Serum order book for deep liquidity. |

| Meteora | Focused on yield farming and low-slippage swaps on Solana ecosystem. |

| PumpSwap | Decentralized token swap with community-driven governance and rewards. |

| Drift | Solana-based decentralized derivatives trading platform; margin and futures. |

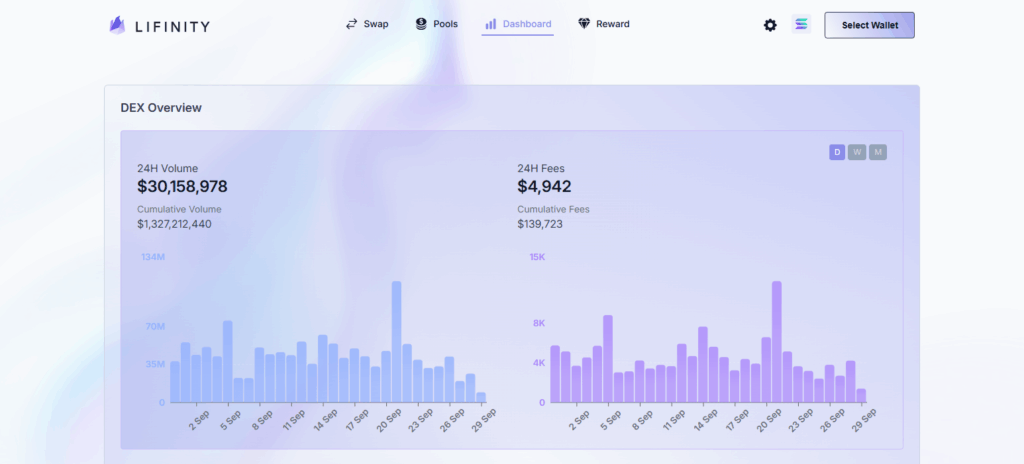

| Lifinity | Cross-chain DEX aggregator; supports multi-chain swaps and deep liquidity. |

| Aldrin | Hybrid DEX offering AMM and order-book trading; beginner-friendly interface. |

| Saber | Stablecoin-focused AMM; optimized for low-slippage stablecoin swaps. |

| Orca | User-friendly AMM; simple swaps with intuitive interface and moderate fees. |

| Kamino Finance | Automated yield aggregator; optimizes staking and liquidity positions. |

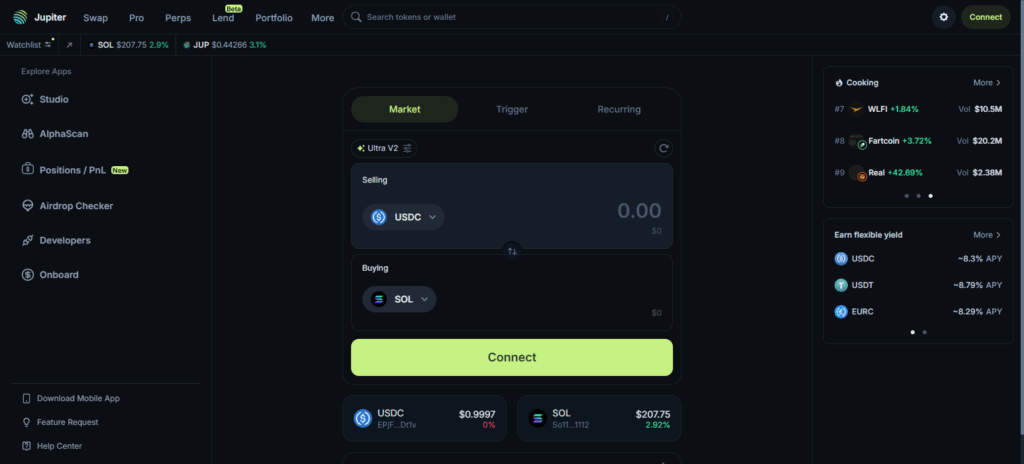

1. Jupiter

Jupiter is a top decentralized exchange (DEX) on Solana for its role as a dex aggregator and facilitates the best token swaps across the Solana-based DEXs.

Its competitive advantage is discovering the best prices and slippage by routing trades across the most liquid pools on Solana.

Transaction costs are a fraction of a cent, which is very advantageous for high volume traders.

It is a very user friendly and intuitive platform which facilitates for traders of all experience levels to swap tokens. Its liquidity and order execution are the best in the Solana ecosystem, which makes it a very attractive option for traders.

Jupiter Features

- Best Aggregator: Jupiter provides users with the best swap rates by consolidating liquidity from several Solana DEXs.

- High-Speed Transactions: Thanks to Solana’s extremely low latency network, Jupiter users enjoy the simultaneous swap transactions feature.

- Cross DEX Compatibility: Jupiter users do not have to leave the DEX to access the liquidity offered on different markets.

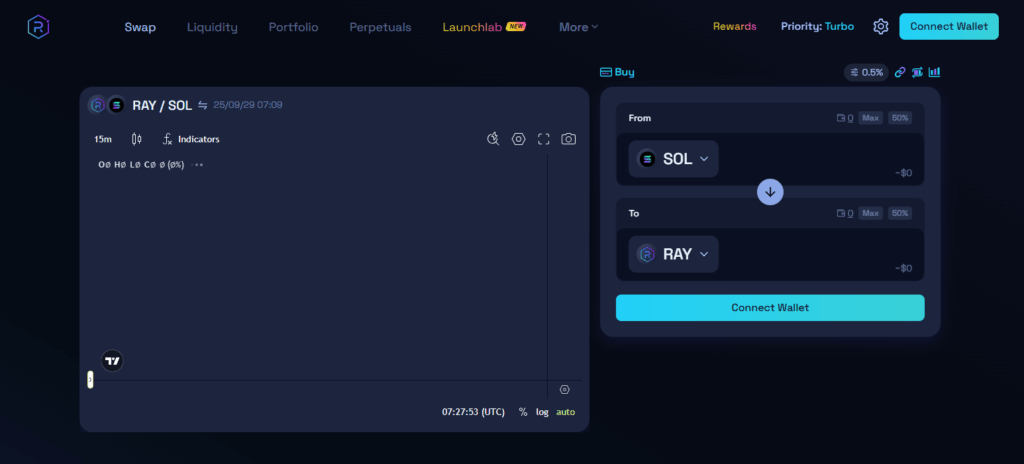

2. Raydium

Raydium is widely recognized as a top decentralized exchange (DEX) on Solana due to its unique model that integrates automated market maker (AMM) features with Serum’s central limit order book, allowing for extremely quick trade execution and high liquidity.

In addition to portability, its unique feature is the ability to provide near-zero slippage on all trades, even on large trades.

Transaction costs on Raydium also very low, typically under a cent, yielding a very favorable cost per transaction value. Users can earn passive income and rewards by yield farming or staking. Overall, its exceptional features place Raydium as one of top DEXs in the market.

Raydium Features

- AMM & Order Book Hybrid: To boost the liquidity in the markets, Raydium fuses automated market making with order book liquidity.

- Yield Farming: Users who stake tokens will earn rewards and elevated rates.

- Low Fees: Since Solana transactions are super low cost, users experience low trading fees.

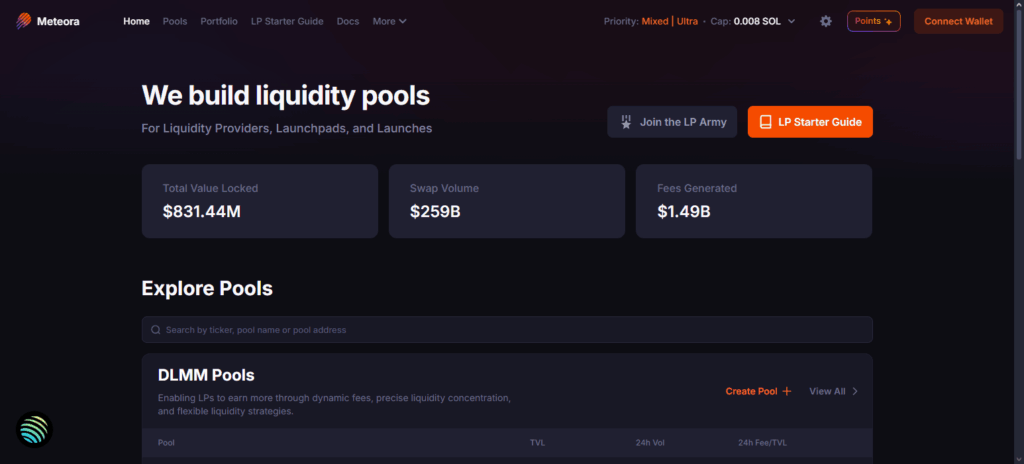

3. Meteora

Meteora represents one of the most efficient decentralized exchanges (DEXs) on Solana focusing on rapid, low-slippage token swaps and yield farming optimization.

Its primary differentiation is automated routing and trading through multiple liquidity pools, ensuring users get the best price with the least friction.

Meteora uses Solana’s ultra-cheap and hyper-scalable network to offer extremely low fees, often only a few cents.

Besides swapping, the platform also allows users to stake and earn, making Meteora a dual trading and yield platform. Clean platform design, rapid execution, and ample liquidity makes Meteor one of the best option across the Solana network.

Meteora Features

- Synthetic Assets Support: Users are able to trade synthetic assets and tokens with real world assets.

- Automated Liquidity Pools: Users earn passive income by supply liquidity to the pool.

- Fast Execution: With the optimization of the slippage promise, the application runs on Solana’s premium and super slippage.

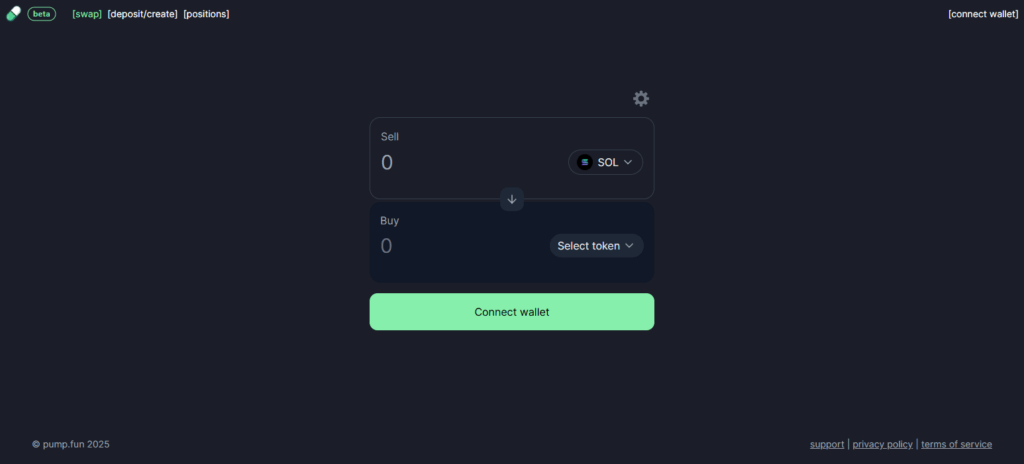

4. PumpSwap

PumpSwap is a remarkable decentralized exchange (DEX) on Solana for its one-of-a-kind and community-driven tokenomics. Its most unique characteristic is the inclusion of governance and reward systems within the swap so users get paid to trade.

Built on Solana’s blockchain, PumpSwap has lightning-fast transaction speeds and ultra-low transaction fees, mere cents, even during heavy traffic.

This makes frequent trades highly economical. In addition to governance token swaps, the platform facilitates rapid and low-slippage token swaps.

Users get actively involved in crucial governance activities, allowing the community to participate in the platform’s liquidity and other updates. These features make PumpSwap one of the top DEXs on Solana, considering the transaction speeds, low fees, and community engagement.

PumpSwap Features

- Community-Focused: Rewards programs are given to traders and liquidity providers who are considered active.

- Token Swaps: Allow users to swap Solana based tokens instantly.

- Simple UI: Has a straightforward design that is easy to understand.

5. Drift

Drift is one of the top decentralized exchanges (DEXs) on Solana that focuses on derivatives and decentralized perpetual futures trading.

Among the competition, its major advantage is offering on-chain margin and leverage trading, which is a rare feat because traders get to use sophisticated tools that are traditionally centralized while still being non-custodial.

Thanks to Solana’s unique blockchain technology, Drift’s transactions are extremely cheap (usually less than a cent) and executed in less than a second, even for high-volume traders. Drift is one of the most feature-rich and cheapest DEXs on Solana.

Drift Features

- Perpetual Futures: Allows low-fee, leveraged trading on Solana as the first perpetual futures DEX.

- Decentralized Risk Management: Smart contracts autonomously and securely manage positions with no third party involvement.

- Near-Instant Trade Execution: Completion of trades in seconds made possible by the Solana blockchain.

6. Lifinity

Lifinity is an example of one of the top decentralized exchanges (DEXs) on Solana. Its decentralized cross-chain aggregation and deep liquidity routing gives users the opportunity to find the best price on multiple platforms within Solana.

Its unique addition is the capacity to split trades across multiple liquidity pools on the system which reduces slippage on trades while enhancing efficiency on large and small transactions.

Lifinity has delightful users’ sentiments and praise due to its very low fees which take the form of cents per swap on Solana’s speedy, low-cost blockchain. Lifinity users boast of enjoying fast and smooth swaps at low fees through an easy to use interface.

The easy interface allows users at all levels to fully engage and participate in trading activities. Out of all the DEXs on Solana, Lifinity has the best liquidity optimization combined with cost-effectiveness.

Lifinity Features

- Cross-Chain Asset Swaps: Enables interaction of Solana tokens with other blockchains.

- Slippage Minimization: Gathers liquidity from a number of pools to reduce slippage.

- Gas-Efficient Transactions: Economically priced swaps with a minimal gas fee, a boon for small and bulk traders.

7. Aldrin

Aldrin is distinguished as one of the most popular decentralized exchanges on the Solana blockchain and is praised for its combination of the AMM and order book trading models which allow users to choose how they may want to trade.

Aldrin’s key strength has to do with its ability to provide simple swaps to beginners and complex trading to experts and all flexible on a non custodial platform.

Aldrin earns from Solana’s ultra-fast and cheap network which keeps the trading fees at just a few cents. Aldrin is versatile and one of the fastest DEXs in the Solana ecosystem because of its combination of staking and yield farming, effective liquidity management, and its low transaction costs.

Aldrin Features

- Integrated DeFi Services: All-in-one ecosystem for trading, staking, and using the launchpad.

- Decentralized Order Book Exchange: Use of order books to enhance price discovery.

- Professional Trading Facility: Access to charts, sophisticated analytics, and limit order placements.

8. Saber

Saber is the preeminent DEX on Solana dedicated to stablecoin and wrapped token swaps with little slippage and precision execution.

Its core focus on optimization liquidities for comparably valued assets ensures stable and low risk exchanges for stablecoins and pegged tokens.

At the same time, Saber benefits from Solana’s network and offers low transaction costs (often a few cents per swap), enabling cost-efficient trading.

Active users can also provide liquidity and partake in yield farming to earn passive rewards while supporting the network. Saber demonstrates a topology of focus and is thus one of the most DEXes on Solana.

Saber Features

- Stablecoin and Wrapped Token Swaps: Stablecoin to stablecoin and wrapped tokens with minimal slippage.

- Liquidity Concentration: Focus on stablecoins leads to significant liquidity.

- Liquidity Provider Rewards: The system compensates liquidity providers with rewards.

9. Orca

Orca is a user-friendly decentralized exchange on Solana that is DEX whose user-friendly design and easy-to-do token swaps attracts both new and advanced crypto users.

Its major selling point is that it specializes in low-slippage trades using reliable liquidity pools with dependable slippage.

Due to Solana’s fast and inexpensive blockchain, Orca charges low transaction fees, usually a couple of cents per transaction. Users can also earn rewards by farming and providing liquidity. Their speed, affordability, and ease of use sets Orca apart from other DEXs on Solana.

Orca Features

- Liquidity Provider Rewards: Participants in liquidity pools and trading pairs are rewarded with easier gas fees.

- Staking Rewards: Users are able to stake Kamino tokens and earn other tokens in a transparent system.

- Instant Swaps: Users can effect swaps without loss of time, even in busy periods.

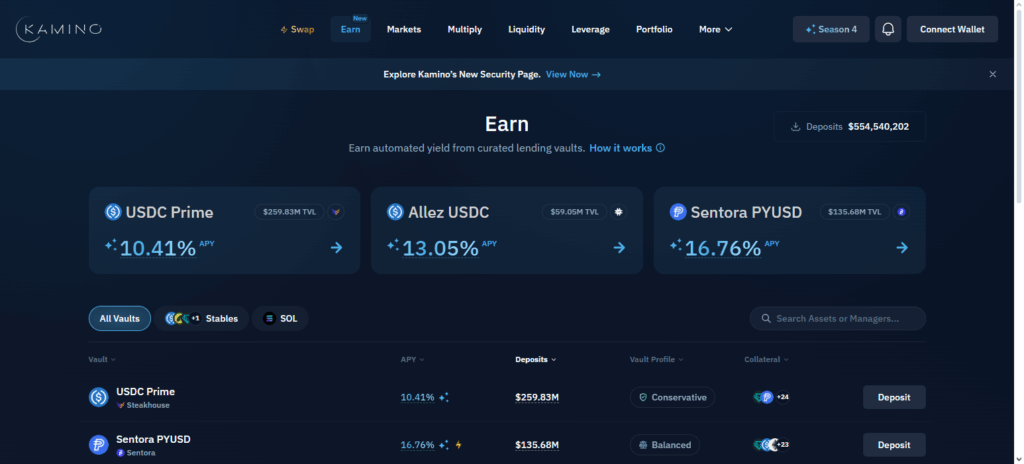

10. Kamino Finance

Kamino Finance is one of the first decentralized exchanges (DEXs) on Solana and is well-regarded for automating yield maximization during the staking and liquidity provisioning processes.

Profitability is achieved effortlessly and efficiently by automatically compounding rewards and managing liquidity positions. Kamino Finance operates on Solana’s blockchain a and offers some of the lowest transaction fees, often a few cents, tailoring to both retail and institutional investors.

Kamino Finance is a yield automation specialist and is designed for rapid execution with high security, making it a preferred DEX for traders and liquidity providers on Solana.

Kamino Finance Features

- Users’ Vaults: Smart contracts multiply and boost the LP tokens’ yield.

- Strategic Return Focused: Maximizing LP return strategies from Solana pools.

- Low-Risk Yield Farming: Automated strategies limit the amount of work & effort users have to put in.

Pros & Cons Decentralized Exchanges (DEX) on Solana

Pros:

- Non-Custodial Control: Having custody over assets eliminates risks related to hacks.

- Fast and Cheap: Solana’s decentralized network charges a few cents and allows rapid trades.

- Fast Transactions: Solana charges minimal gas fees to execute complex computations quickly.

- Privacy Friendly: Most DEXs ask for minimal verification.

- Accessible Anywhere: Trades can be done from any location using a crypto wallet.

Cons:

- Some Projects Have Smaller Pools: Smaller tokens that are more nascent may be lacking.

- High Entry Barrier: Yield farming and complex staking are difficult for novices.

- Intricate DEX Protocols: DEX Protocols can be compromised.

- Community Based: A lot of DEXs don’t have any real customer service.

- Unlikely But Possible: A lot of activity on the network can delay or stop transactions.

Conclusion

In conclusion, Solana DEXs offer incredible speed and low cost, low risk and secure trading, all while being feature rich, ensuring trading is always quick and easy.

In particular, Jupiter, Raydium, Saber, Orca, and Kamino Finance are all leaders on the DEX market for their optimized liquidity and automated yield strategies.

As with all DEXs, some issues remain, such as lower liquidity on niche tokens and some contracts, but the focus on user empowerment makes token swaps and earning through Defi effortless.

All considered, DEXs on Solana are indispensable to the rest of the growing Solana ecosystem.

FAQ

DEXs reduce risks of centralized hacks since users retain control of funds. However, smart contract vulnerabilities can still pose risks.

Solana DEXs offer low fees, fast execution, non-custodial control, and access to DeFi features like staking, yield farming, and liquidity provision.

A DEX on Solana is a platform that allows users to trade cryptocurrencies directly from their wallets without a central authority. It leverages Solana’s high-speed blockchain for fast, low-cost transactions.