This article focuses on the Best Solana Staking Platforms. Solana staking enables users to make passive income while helping to ensure the network is secure and running optimally.

With multiple platforms to select from, investors gain the freedom to choose ones that provide competitive returns, adaptable staking, robust safety, and easy-to-navigate designs. This is beneficial for all crypto users, whether they are novices or practiced investors, to optimize their holdings in SOL.

What is Solana Staking Platforms?

A staking platform is an online tool and crypto wallet where users can stake their Solana (SOL) tokens to help secure the Solana blockchain and get paid for it.

For every Solana (SOL) token there is network proof-of-stake (POS) consensus mechanism, users validate transactions, and provide blockchain security. Custom staking interface and staking rewards provide even the beginners and passive investors opportunities to get outstanding annual rewards.

In addition to competitive passive income in staking Solana (SOL) tokens, staking security, clarity in customer rewarded staking and comprehensive customer service all contribute for minimal risk in Solana (SOL) staking.

How To Choose Solana Staking Platforms

Security Measures: Verify the platform is using two-factor authentication, cold storage, and encryption to secure your SOL tokens.

Staking Rewards: Examine the annual percentage yields (APY) to ensure potential earnings.

Reputation & Reviews: Investigate user comments, ratings, and platform history regarding trustworthiness and reliability.

Fees & Commissions: Analyze platform fees or commission rates because excessive fees can eat into your staking earnings.

User-Friendly Interface: Target platforms that offer intuitive dashboards and uncomplicated staking procedures.

Flexible or Locked Staking: Decide if you prefer flexible staking withdrawals or if you’re fine with fixed lock-up periods.

Customer Support: Confirm support is responsive regarding potential problems or queries.

Key Point & Best Solana Staking Platforms List

| Platform | Key Points |

|---|---|

| Jito Network | High-performance validator, competitive staking rewards, secure network participation. |

| Marinade Finance | Decentralized staking, flexible withdrawals, community-governed platform. |

| Kraken | Regulated exchange, easy SOL staking, strong security and insurance coverage. |

| BlazeStake | User-friendly interface, reliable validator, competitive APY for SOL staking. |

| Lido Finance | Liquid staking solution, receive stSOL tokens, flexible and transparent rewards. |

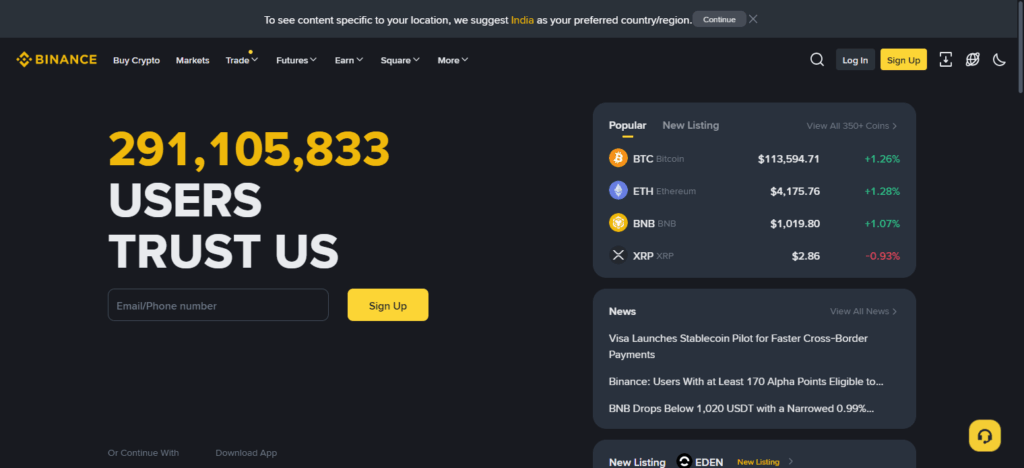

| Binance | Centralized platform, easy staking, high liquidity, multiple crypto services. |

| Coinbase | Beginner-friendly, regulated in Europe/US, secure SOL staking, transparent fees. |

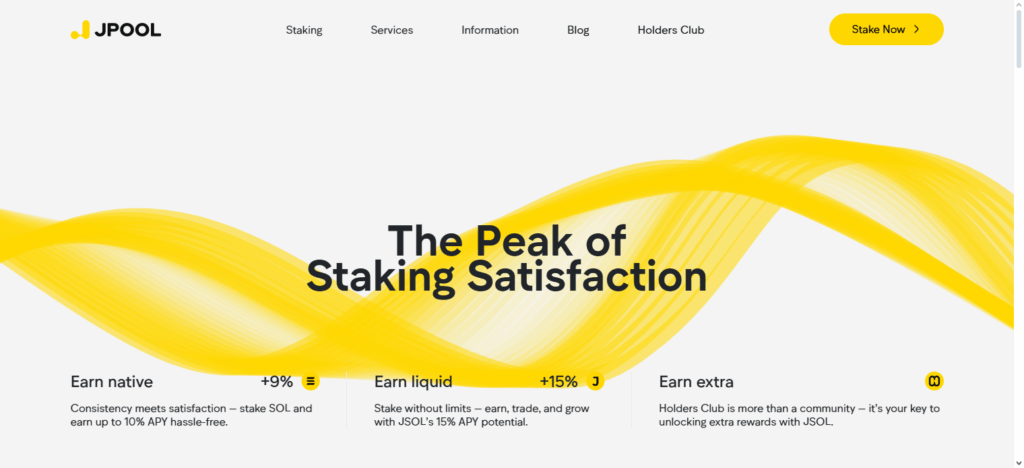

| JPool | Community-focused, supports multiple validators, flexible SOL staking options. |

| Socean | Decentralized liquid staking, receive tokens representing staked SOL, competitive rewards. |

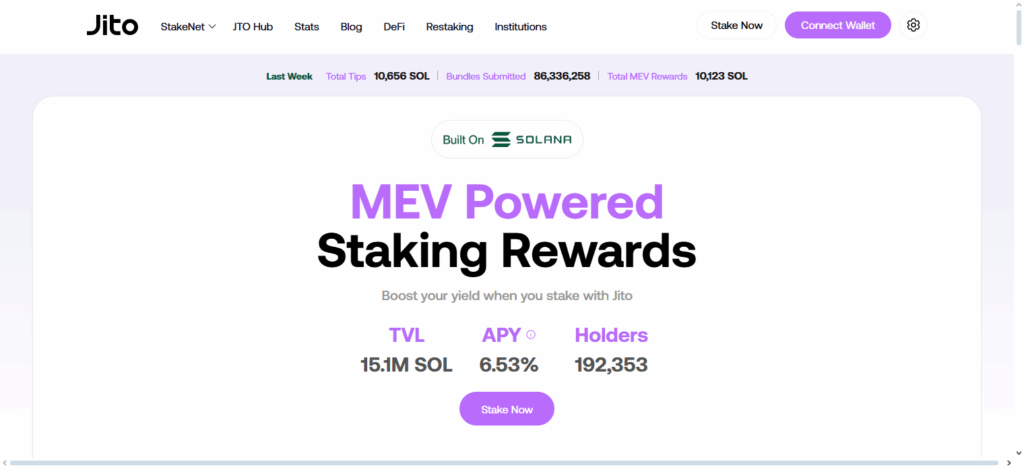

1. Jito Network

Jito Network also remains a first-rate Solana staking platform as a result of its validator infrastructure that guarantees the swiftest block confirmations through optimal transaction processing.

While reinforcing the network’s security, Jito Network staking guarantees competitive rewards from diversified staking efficiency from systems and infrastructure investment.

Besides, Jito bolsters community trust through decentralization, with self-governance and self-audit capabilities.

Jito’s low latency dependable staking infrastructure with community features offers great value from consistency expected in return by beginning staking participants as well as seasoned investors.

For Solana holders, Jito Network offers a dependable, optimal, and highly rewarding staking platform.

Jito Network Features

- High-Performance Validator: Optimizes transaction processing for faster rewards.

- Competitive Staking Yields: Efficient validator management maximizes SOL rewards.

- Transparent & Decentralized: Users can monitor validator performance and participate in governance.

2. Marinade Finance

Marinade Finance is a leading Solana staking platform with a decentralized and community-driven framework, letting users stake SOL without a single validator dependency.

Its liquid staking provides users with mSOL token receipts, which can be employed in various DeFi protocols for additional earning opportunities.

To reinforce trust, Marinade prioritizes comprehensive audits of their smart contracts, and maintains public access to the validator’s performance, ensuring all users can evaluate the platform’s staking parameters and validator assignments.

The staking solution is augmented by the ability to pull in and restake SOL at any time. These unique features alongside Marinade’s commendable integration of liquidity and decentralization serve to firmly place Marinade Finance at the best possible position for all Solana staking.

Marinade Finance Features

- Liquid Staking: Receive mSOL tokens while staking SOL for added flexibility.

- Decentralized Governance: Community members actively shape validator and platform governance.

- Secure & Audited: Smart contracts undergo regular audits and other comprehensive risk assessment measures.

3. Kraken

As one of the most prominent staking platforms for Solana, Kraken is dependable, compliant, and easy to use, catering to all investor experience levels.

Among its many advantages, Kraken also has state-of-the-art custody security—insured and risk-free, users SOL tokens are cantilevers. Kraken also has automatic staking rewards that go directly into users accounts, making earning staking rewards passively easy.

With their clear pricing, dependable framework customer care, customers are guaranteed and trouble-free staking procedure.

With all the risk, staking Solana through Kraken easy to use for all investors, is one of the most efficient and fine staking platforms to use. Kraken provides the most balanced staking experience.

Kraken Features

- Regulated & Secure: Allheld assets are under custody and staking complies with international legislation.

- Automatic Rewards: Staking rewards are credited in real-time and directly in user accounts.

- User-Friendly Platform: Both beginners and advanced users benefit from the easy interface.

4. BlazeStake

BlazeStake is well regarded as a Solana staking platform because of its simplicity and ease of use, both for new and seasoned staking individuals. Its optimal resource and validator management is instrumental in ensuring maximum rewarded staking while securely maintaining the network.

Transparency and user trust is of utmost importance, which is why BlazeStake offers the ability for customers to view real-time statistics for validators and performance while staking.

The support team offers responsive and unstressed attention to customers. For Solana holders wanting a combination of optimal resource management, validator earned staking, and simple interface, BlazeStake is the best choice for profitable staking.

BlazeStake Features

- Intuitive Interface: Users find the staking dashboard simple and easy for streamlined access.

- Validator Efficiency: The team is committed toward delivering the highest possible staking rewards.

- Transparent Monitoring: Users can see performance metrics in real-time.

5. Lido Finance

Lido Finance is recognized as a top Solana staking platform due to its liquid staking solution, which permits users to stake SOL and earn stSOL tokens that can be utilized in various DeFi protocols.

This innovative feature allows users to earn staking rewards without needing to idle their assets, thus maintaining liquidity and earning other rewards.

As to security and decentralization, Lido works with reputable partners, trusted validators, and audited smart contracts.

With Lido Finance’s transparent fees, comprehensive rewards tracking, and smooth onboarding to Solana’s ecosystem, users get an innovative and effective staking solution, making Lido Finance perfect for users who want liquidity and steady rewards.

Lido Finance Features

- Liquid Staking with stSOL: Stake SOL and access funds for other DeFi activities.

- Validator Diversity: Works with many trusted validators to maintain security and performance.

- Clear Fees & APY: All reward movements and costs are visible.

6. Binance

Binance stands out as one of the most prominent platforms for Solana staking owing to its high liquidity and global reach. This allows users to stake their Solana (SOL) effortlessly and receive instant staking rewards.

The most obvious advantage of Binance is its completely centralized, beginner-friendly interface. This makes staking very accessible for complete novices, and it still provides advanced tools for professional traders.

Binance also boasts automated, preconfigured reward distribution which alleviates the need for manual monitoring.

Excellent security measures also contribute to Binance’s reputation. It also provides sufficient insurance, responsive customer service, and high liquidity. This makes Binance a spectacular and safe staking platform to reap maximum Solana staking benefits.

Binance Features

- High Liquidity: Global access makes SOL staking easy and is available in multiple regions.

- Staking Flexibility: Different staking terms with autocompounding rewards.

- Assets Security & Insurance: Risk management through insurance and safety measures.

7. Coinbase

Coinbase ranks among the best platforms for staking Solana. This is down to its regulated environment and security and instills the best user trust.

Coinbase provides users the convenience of automatic staking rewards and no staking manual claim processes.

Coinbase has an easy to use interface that is designed to suit the novice and the expert alike and is made for flexible deposit and competitive APY offers.

Engaging Coinbase services is made with predictable fee structures so users can avoid unpleasant surprises and enjoy the peace of mind that comes with good security and responsive support.

For users who want to stake Solana for Coinbase, the claim convenience system is fully protective and operational.

Coinbase Features

- Regulated & Trusted: Safe and compliant staking environment.

- Automatic Reward Distribution: Simplifies reward collection.

- User-Friendly & Transparent: Numerous deposit options with straightforward pricing.

8. JPool

JPool stands out among Solana staking options for its community-oriented and decentralized model that lets users join in network validation and back many trusted validators at the same time.

One of its greatest advantages is flexible staking, which allows users to change and even remove staked SOL easily, with no lengthy lock-up periods involved.

It provides transparency and performance tracking with real-time access to validators’ performance records and staking rewards.

Designed for ease of use and investment, as well as for advanced users, it includes competitively priced APYs and secure infrastructure. Flexibility, transparency, and community governance make it no surprise JPool is a preferred choice for Solana holders.

JPool Features

- Community-Focused: The decentralized system collaborates with various validators.

- Flexible Staking: Easily adjust or fully withdraw SOL.

- Transparent Monitoring: Validator’s real-time performance can be tracked.

9. Socean

Socean is the best Solana staking platform utilizing decentralized liquid staking, enabling stake SOL and simultaneously receive scnSOL that can be used on DeFi protocols.

Such characteristics provide liquidity and flexibility, offering the opportunity to earn staking rewards while assets remain unlocked. Socean is robust and has diverse validators as it has partnership with several trustworthy validators.

The platform provides competitive APY, transparent fees, and performance tracking making it ideal for any investor. For Solana holders, Socean provides a seamless and reliable staking experience.

Socean Features

- Liquid Staking with scnSOL: Stake SOL and gain liquidity for your DeFi activities.

- Validator Diversity & Security: Collaborates with verified and safe validators.

- Competitive APY & Transparency: Performance and rewards are well distributed and clearly visible to users.

Pros & Cons

Pros:

- Earn Passive Income: SOL staking users receive rewards.

- Network Support: Stakers help secure Solana’s network during proof-of-stake.

- Flexible Options: Some platforms offer liquid staking and rewards.

- Low Entry Barriers: Sol can be staked in small amounts.

- Transparent Rewards: Most platforms state APY and performance in real time.

Cons:

- Validator Risks: Rewards may be lost with poorly performing validators.

- Lock-Up Periods: Some platforms require unmovable SOL.

- Platform Fees: Staking rewards may be lowered with fees.

- Market Volatility: Token devaluation results in net losses.

- Technical Knowledge: New users may find staking and validator selection complex.

Conclusion

Selecting a Solana staking platform comes down to various tradeoffs, whether it’s security, flexibility, liquidity, or rewards. Jito Network, Marinade Finance, Kraken, BlazeStake, Lido Finance, Binance, Coinbase, JPool, and Socean and several other staking services offers high-performance validators and liquid staking, as well as user-friendly interfaces.

By looking closely at APY rates, fees and platform security and considering validator reputation, Solana holders will best position themselves to reap staking rewards and provide support to network.

The best staking platform offers convenient and reliable access to staking rewards, and on top of that, a user will earn passive income and active rewards on the Solana network.

FAQ

Leading platforms include Jito Network, Marinade Finance, Kraken, BlazeStake, Lido Finance, Binance, Coinbase, JPool, and Socean, each offering unique features like liquid staking, high APY, and security.

A Solana staking platform allows users to lock up SOL tokens to help secure the Solana network while earning rewards through the proof-of-stake mechanism.

Rewards are typically based on the amount of SOL staked, validator performance, and platform fees, often expressed as an annual percentage yield (APY).