In this article I will discuss the BTC Exchange Alternatives. I chose these because they are not mainstream platforms but they are secure, affordable, and offer flexible trading options.

These platforms ideal for beginners and professional traders alike because they have little to no KYC, low trading fees, diverse range of crypto assets, and expedited transactions. Safety, ease of use, and uncomplicated access to crypto trading around the globe are primary considerations when selecting a platform.

What is BTC Exchange Alternative?

A BTC exchange alternative is simply any exchange platform or service for cryptocurrency that lets users trade Bitcoin (BTC), buy or sell it without relying on Coinbase or Binance.

These includes decentralized exchanges (DEXs), peer-to-peer (P2P) systems, and smaller centralized exchanges which often provide reduced fees, increased privacy, and less stringent KYC regulations.

BTC exchange alternatives enhance user autonomy, facilitate quicker transactions, and allow access to distinctive trading pairs and cross-chain swaps.

They cater particularly well to traders needing anonymity, geographical availability, or rare crypto assets, which makes them crucial to the present crypto environment.

Why Use BTC Exchange Alternatives

Lower KYC Requirements: A lot of the alternatives let you trade without some verification steps and without revealing any personal information and This helps to keep your anonymity.

Lower Fees: They are usually more affordable than primary exchanges allowing you to keep more of your money during trading and saving your money on withdrawals.

Access to Unique Assets: A few provided platforms where you can trade for unique tokens and perform recommended cross-chain swaps that the common exchanges do not offer.

Faster Transactions: Peer to peer and decentralized exchanges do not require approval from a central authority and thus, can execute trades almost immediately.

Global Accessibility: They are handy for places where primary exchanges are more limited or have to offer lesser services.

Enhanced Privacy & Security: The absence of centralized control decreases the chances of hacking attempts on a decentralized platform and thus, increases security.

Best BTC Exchange Alternatives Points

- Kraken: Secure BTC exchange with advanced trading features and margin options.

- Binance: Large crypto exchange offering low fees, diverse trading pairs, and staking.

- KuCoin: User-friendly platform with spot, futures, and a wide range of altcoins.

- Coinbase: Beginner-friendly exchange with strong regulatory compliance and mobile app support.

- Bybit: Derivatives-focused exchange with leveraged trading and fast execution.

- PrimeXBT: Multi-asset platform for crypto, forex, and commodities trading.

- Crypto.com: All-in-one platform offering exchange, wallet, and crypto rewards.

- MEXC: Global exchange with margin trading, futures, and new token listings.

- OKX: Feature-rich platform with spot, derivatives, DeFi integrations, and staking.

- Uphold: Simple trading platform supporting crypto, stocks, and precious metals.

10 Best BTC Exchange Alternatives

1. Kraken

Kraken has been in business since 2011, and is one of the best alternatives to BTC exchanges, distinguished by its safety and dependability. It has a wide clientele since it accommodates various cryptocurrencies and traders, providing services in English and other key languages.

Kraken is also equipped with sophisticated margin trading, staking, and other advanced trading features. Due to trading fee promotions that run anywhere from 0-0.26% depending on the trading volume, Kraken is one of the most competitively priced services in the margin trading and staking business.

Kraken also has 24/7 support and allows almost free bank, crypto, and fiat gateways for Kraken and stake crypto deposits/withdrawals. For professional grade crypto trading anywhere in the world, Kraken is a secure all in one option.

| Feature | Details |

|---|---|

| Founded | 2011 |

| Supported Cryptocurrencies | Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and 50+ others |

| Local Languages | English, Spanish, French, German, Japanese, Chinese |

| Security | Two-factor authentication, cold storage, encryption, insurance fund |

| Trading Fees | 0% – 0.26% depending on trading volume |

| Deposit Methods | Bank transfer, crypto transfer |

| Withdrawal Methods | Bank transfer, crypto transfer |

| Customer Support | 24/7 via live chat, email |

| KYC Requirements | Minimal for basic accounts; enhanced for higher limits |

| Special Features | Margin trading, staking, futures trading |

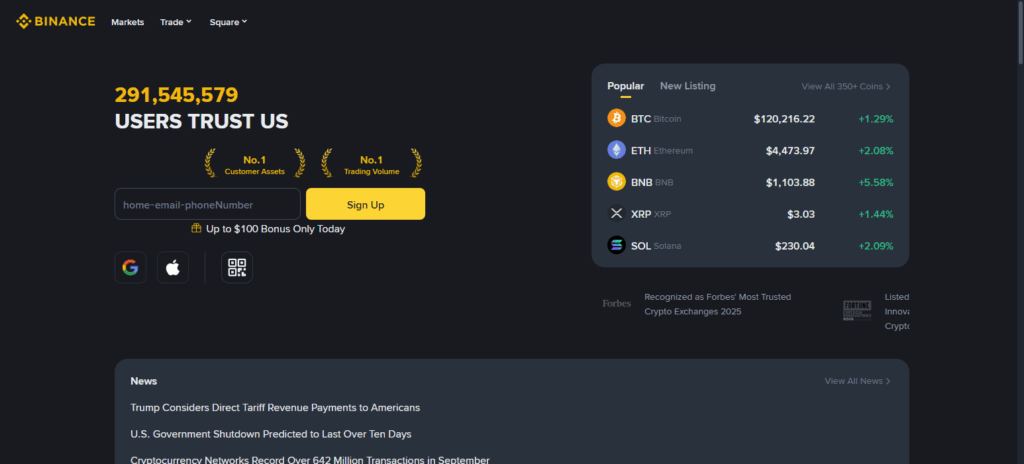

2. Binance

Established in 2017, Binance has grown to become one of the biggest alternatives to BTC exchanges in the world and it supports hundreds of other cryptocurrencies and over a dozen other local languages.

Binance has increasingly become the go to platform for spot, margin, and futures crypto trades and staking with very efficient security which includes a SAFU fund.

Trading on binance is very inexpensive with a 0.1% trade fee and the fee can even be reduced with the platform’s own crypto, BNB. Binance has the most accessible services in the world and supports dozens of deposit and withdrawal methods, available 24/7 multilingual.

This platform is very convenient and useful for traders who are looking for low fee trades on a wide variety of supported currencies and cryptocurrencies.

| Feature | Details |

|---|---|

| Founded | 2017 |

| Supported Cryptocurrencies | Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), 500+ others |

| Local Languages | English, Spanish, French, German, Chinese, Japanese, Korean |

| Security | Two-factor authentication, SAFU fund, cold storage, encryption |

| Trading Fees | 0.1% per trade (discounts with BNB) |

| Deposit Methods | Bank transfer, crypto transfer, credit/debit cards |

| Withdrawal Methods | Bank transfer, crypto transfer, cards |

| Customer Support | 24/7 via live chat and ticket system |

| KYC Requirements | Minimal for small limits; full verification for higher withdrawals |

| Special Features | Spot, futures, margin trading, staking, launchpad, savings products |

3. KuCoin

Founded in 2017, KuCoin is one of the popular alternatives to the BTC exchange, supporting hundreds of cryptocurrencies. With its multiple local site translations, it is also accessible to a vast range of international customers.

KuCoin places a focus on security, which includes risk reserve funds, multi-tiered encryption, and other security measures. KuCoin also has relatively low trading fees which start off at 0.1% with discounts for KCS (KuCoin token) holders.

For customer service, KuCoin is also accessible as it has a 24/7 support system which includes live chat and ticketing systems.

KuCoin’s services are also versatile, as they offer spot, margin, futures, and staking services. Overall, KuCoin is secure, cost-effective, and versatile for crypto-traders, whether they are beginners or professionals.

| Feature | Details |

|---|---|

| Founded | 2017 |

| Supported Cryptocurrencies | Bitcoin (BTC), Ethereum (ETH), USDT, 700+ others |

| Local Languages | English, Spanish, French, German, Chinese, Japanese, Russian |

| Security | Two-factor authentication, cold wallets, encryption, risk reserve fund |

| Trading Fees | 0.1% per trade (discounts with KCS) |

| Deposit Methods | Crypto transfer, bank transfer (via partners) |

| Withdrawal Methods | Crypto transfer, bank transfer |

| Customer Support | 24/7 via live chat and ticket system |

| KYC Requirements | Minimal for basic accounts; full verification for higher limits |

| Special Features | Spot, futures, margin trading, staking, P2P trading |

4. Coinbase

Since its inception in 2012, Coinbase has been recognized as a reputable alternative for BTC exchanges, offering services for buying, selling, and storing various cryptocurrencies.

It caters to a wide array of cryptocurrencies including BTC and ETH, and displays its services in many local languages.

Coinbase prioritizes safety, implementing two-factor authentication, insurance on accounts, and cold storage of digital assets. It charges a fee for transactions which vary from 0.5% to 4%. It provides round-the-clock assistance for customers through chat and email.

Bank transfers for deposits are free, while charges for withdrawals depend on the method used. For beginners wanting to trade cryptocurrencies, Coinbase provides a safe and secure platform.

| Feature | Details |

|---|---|

| Founded | 2012 |

| Supported Cryptocurrencies | Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), 100+ others |

| Local Languages | English, Spanish, French, German, Japanese, Portuguese |

| Security | Two-factor authentication, insurance coverage, cold storage |

| Trading Fees | 0.5% – 4% depending on transaction type |

| Deposit Methods | Bank transfer, debit/credit card, crypto transfer |

| Withdrawal Methods | Bank transfer, crypto transfer, PayPal (in some regions) |

| Customer Support | 24/7 via chat and email |

| KYC Requirements | Minimal for small transactions; full verification for higher limits |

| Special Features | Beginner-friendly interface, mobile app, staking, recurring buys |

5. Bybit

As a reputable derivative and crypto trading pioneer, Bybit became a strong BTC exchange alternative since its establishment in 2018. Bybit supports BTC, ETH and USDT along with many others, and services in a variety of local languages to support users across the globe.

Security is one of Bybit’s main priorities with the use of multi-signature wallets and cold storage, 2FA and more. In regard to trading fees, Bybit is competition with 0.01% for makers and 0.06% for takers.

Bybit offers 24/7 customer support in multiple languages and flexible options for deposits and withdrawals, which include crypto and fiat currencies with low to no fees. This makes the platform perfect for traders looking for quick, safe, and professional solutions for crypto trading.

| Feature | Details |

|---|---|

| Founded | 2018 |

| Supported Cryptocurrencies | Bitcoin (BTC), Ethereum (ETH), USDT, 50+ others |

| Local Languages | English, Chinese, Korean, Japanese, Russian |

| Security | Two-factor authentication, cold wallets, SSL encryption |

| Trading Fees | 0.01% (maker) / 0.06% (taker) |

| Deposit Methods | Crypto transfer, fiat via partners |

| Withdrawal Methods | Crypto transfer, bank transfer |

| Customer Support | 24/7 via live chat and ticket system |

| KYC Requirements | Minimal for small limits; full verification for higher limits |

| Special Features | Spot, futures, margin trading, derivatives, staking |

6. PrimeXBT

PrimeXBT was established in 2018 and has become quite a prominent BTC exchange alternative. It allows trading different cryptocurrencies alongside Bitcoin and Ethereum.

It is a global platform and offers a variety of local languages. With respect to safety and security of user funds, there is cold, two-factor, and SSL encrypted vaults.

Considering levels of active trading, PrimeXBT offers very low trading fees at 0.05% in a competitive environment.

PrimeXBT offers customer assistance at all hours of the day with responsive emails and chats. The flexible deposit and withdrawal methods, with low to no fees, make it efficient and professional in trading.

| Feature | Details |

|---|---|

| Founded | 2018 |

| Supported Cryptocurrencies | Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), others |

| Local Languages | English, Spanish, French, Chinese, Russian, Japanese |

| Security | Two-factor authentication, SSL encryption, cold storage |

| Trading Fees | 0.05% per trade |

| Deposit Methods | Crypto transfer, fiat via partners |

| Withdrawal Methods | Crypto transfer, bank transfer |

| Customer Support | 24/7 via live chat and email |

| KYC Requirements | Minimal for basic accounts; full verification for higher limits |

| Special Features | Multi-asset trading, margin trading, derivatives, Forex, commodities |

7. Crypto.com

Crypto.com is a full-scale Bitcoin exchange alternative that became operational in 2016, also dealing in Ethereum, 250+ altcoins, and offering various native languages for clientele across the globe.

The platform emphasizes security, having equipped 2FA, cold storage of assets, and digital insurance on assets. At 0.04% for makers and 0.10% for takers, and additional discounts for CRO holders, Crypto.com, also provides competitive trading and taker fees.

All clientele get 24/7 support in multiple languages via live chat and email. The service is also convenient for trading in cryptos, as the deposits and withdrawals support crypto transfers, cards, and bank transfers often with very low/no fees.

| Feature | Details |

|---|---|

| Founded | 2016 |

| Supported Cryptocurrencies | Bitcoin (BTC), Ethereum (ETH), CRO, 250+ others |

| Local Languages | English, Spanish, French, German, Chinese, Japanese, Korean |

| Security | Two-factor authentication, cold storage, insurance coverage |

| Trading Fees | 0.04% (maker) / 0.10% (taker), discounts with CRO |

| Deposit Methods | Crypto transfer, bank transfer, credit/debit card |

| Withdrawal Methods | Crypto transfer, bank transfer, cards |

| Customer Support | 24/7 via live chat and email |

| KYC Requirements | Minimal for small transactions; full verification for higher limits |

| Special Features | Staking, mobile app, DeFi wallet, Visa card integration |

8. MEXC

Established in 2018, MEXC has become a top alternative for exchanges supporting BTC, Bitcoin, Ethereum, and numerous other altcoins while catering to users in different languages.

The platform has a firm emphasis on security, implementing 2FA, cold storage, and other encryption security measures.

MEXC has a price competitive trading fee structure starting at 0.2% with additional fee reduction for MX token holders. Customer support available 24/7 in different languages through live chat and email.

Most crypto deposits are free while withdrawals are crypto specific. MEXC is a versatile and cost-efficient exchange for crypto trading and offers spot, futures, and margin trading.

| Feature | Details |

|---|---|

| Founded | 2018 |

| Supported Cryptocurrencies | Bitcoin (BTC), Ethereum (ETH), USDT, 700+ others |

| Local Languages | English, Chinese, Korean, Russian, Spanish, Japanese |

| Security | Two-factor authentication, cold wallets, encryption |

| Trading Fees | 0.2% per trade, discounts for MX token holders |

| Deposit Methods | Crypto transfer, bank transfer (via partners) |

| Withdrawal Methods | Crypto transfer, bank transfer |

| Customer Support | 24/7 via live chat and ticket system |

| KYC Requirements | Minimal for small limits; full verification for higher limits |

| Special Features | Spot trading, futures, margin trading, new token listings |

9. OKX

Established in 2017, OKX is an alternative exchange for BTC, supporting Bitcoin, Ethereum, other cryptocurrencies, and a multitude of local languages for global coverage.

The exchange prioritizes user safety, implementing 2FA, cold wallet storage and other industry-standard encryption.

OKX has a very low fee structure compared to other exchanges, and even more so for OKB holders, charging 0.08% for makers and 0.10% for takers.

Support is 24/7 and offers chat and email in several languages. Users most likely will not pay for deposits, and withdrawal fees depend on the cryptocurrency. OKX is an exchange for professional and secure worldwide crypto trading.

| Feature | Details |

|---|---|

| Founded | 2017 |

| Supported Cryptocurrencies | Bitcoin (BTC), Ethereum (ETH), USDT, 300+ others |

| Local Languages | English, Chinese, Korean, Japanese, Russian, Spanish |

| Security | Two-factor authentication, cold storage, SSL encryption |

| Trading Fees | 0.08% (maker) / 0.10% (taker), discounts with OKB |

| Deposit Methods | Crypto transfer, bank transfer, card |

| Withdrawal Methods | Crypto transfer, bank transfer |

| Customer Support | 24/7 via live chat and ticket system |

| KYC Requirements | Minimal for small limits; full verification for higher withdrawals |

| Special Features | Spot, futures, margin trading, staking, DeFi integrations |

10. Uphold

Uphold was established in 2013 and is one of the great alternatives to a BTC exchange, as it is capable of handling a wider range of currencies including Bitcoin, Ethereum, and other cryptocurrencies, as well as fiat currencies and precious metals.

Uphold is the only platform of its kind to offer as many currencies, in as many local languages as it does. Uphold is exceptionally secure, employing 2FA, strong encryption, and other regulatory compliance measures.

They maintain reasonable trading costs which, in the absence of hidden fees, range from 0.5% to 1% per trade. Customer service is every day of the week and of the year, and is responsive via chat and email. Uphold is one of the safest options for trading, and is perfect for secure, multi-asset, and beginner-friendly trading.

| Feature | Details |

|---|---|

| Founded | 2013 |

| Supported Cryptocurrencies | Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), 50+ others |

| Local Languages | English, Spanish, French, German, Japanese, Portuguese |

| Security | Two-factor authentication, encryption, regulatory compliance |

| Trading Fees | 0.5% – 1% per transaction |

| Deposit Methods | Bank transfer, crypto transfer, debit/credit card |

| Withdrawal Methods | Bank transfer, crypto transfer |

| Customer Support | 24/7 via live chat and email |

| KYC Requirements | Minimal for small transactions; full verification for higher limits |

| Special Features | Multi-asset trading, mobile app, fiat and crypto integration |

Pros & Cons BTC Exchange Alternatives

Pros

- Less Comprehensive KYC Procedures: Numerous platforms permit trading without extensive identity checks or even confirmation.

- Reduced Fees: These platforms tend to be less expensive than the primary exchanges, leading to savings on the cost of trades and withdrawals.

- Variety of Assets: Provides access to rare tokens and cross-chain swaps that mainstream exchanges do not offer.

- Quick Transactions: Decentralized and P2P trading options have the capacity to execute trades in record time.

- Remove Regional Restrictions: Fulfills needs in areas where the larger exchanges are limited.

- Minimized Risk of Hacks: Decreased chances of hacks or personal information leaks on decentralized systems improve the overall safety and privacy of the user.

Cons

- Less Liquid Marketplace: There may be fewer participants compared to the primary exchanges.

- Greater Risk: There are fewer regulations. Consequently, the likelihood of scams, fraud, and overall risk increases.

- Confusing for Novice Users: New traders may find the absence of advanced system features perplexing.

- Limited Customer Service: Alternatives can have meager or delayed customer service.

- Limits on Withdrawals: Certain platforms restrict, or impose higher fees on extravagant withdrawals.

Conclusion

Alternative BTC exchanges offer traders versatility, safety, and affordability beyond the major platforms. They provide lower transaction costs, less extensive KYC, a wider range of cryptocurrencies, and quicker transactions, useful for novice and expert traders alike.

These exchanges offer great advantages, however, they do present certain risks, which include the potential for lower liquidity and weak regulation.

Picking trustworthy exchanges, such as the ones mentioned previously, can help alleviate these issues.

In conclusion, the BTC exchange alternatives offer the world of cryptocurrency a level of trading privacy, versatility, and potential that typical exchanges do not offer. These alternatives are a key part of the market.

FAQ

A BTC exchange alternative is a platform that allows users to trade Bitcoin and other cryptocurrencies outside mainstream exchanges, often with lower fees, enhanced privacy, and unique trading options.

They offer benefits like minimal KYC requirements, lower fees, access to rare assets, faster transactions, and global accessibility.

Yes, reputable platforms like Kraken, Binance, and Coinbase prioritize security with two-factor authentication, cold storage, and encryption.

Trading fees typically range from 0.01% to 0.5%, while deposit fees are often free, and withdrawal fees vary by asset.