In this article,I will discuss the Best Crypto ETFs in Canada. Crypto ETFs allow investors to invest in popular digital currencies like Bitcoin and Ethereum directly and do not offer the luxury of holding the currency directly.

With all the professional management and ETFs provide, it is a great starting point for an experienced investor to enter the Canadian Cryptocurrency market.

What is Crypto ETFs in Canada?

In Canada, crypto ETFs are specialized investment funds that are listed and traded on stock exchanges and permit crypto ownership indirectly. These ETFs propel an investor in mainly one cryptocurrency and at times in a collection of them.

They allow ease of portfolio diversification and, thus, easier investing for an investor. They are crypto investments that are easy and regulated, and alongside traditional ETFs, provide easy investment in growing crypto; both are transparent and liquid.

How To Choose Crypto ETFs in Canada

Know the Type of Crypto ETF – Some ETFs focus on a single crypto asset, say Bitcoin, while others center on a collection of crypto assets. How much crypto concentration or exposure do you want to determine the selection?

Research the Fund’s Historical Performance – Performance evaluations over time trends and volatility in the market. Previous money made does not equate to future money made, however, understanding fund volatility and steadiness is critical.

Assess Cost and Expenditures – Management fees, trading commissions, and other costs must be minimized to maximize the long-term projected return on the fund.

Assess the ETF’s Market Activity – Greater trading activity allows the shareholder to buy or sell shares with more ease, and without the price moving in a significant way.

Research the ETF’s Owner – To minimize risk, only buy ETFs owned and managed by reputable, and legally operating financial institutions.

Check the ETF’s Regulatory Compliance – To ensure the ETF’s safety and legality, check for approval by the Canadian regulatory body, the Ontario Securities Commission (OSC).

Analyze the ETF’s Tax Treatment in Canada – Determine how the ETF is going to be taxed in Canada to prevent unplanned tax penalties.

Understand the Tracking Method – Different ETFs either physically hold the underlying cryptocurrency, or track it using futures contracts. Each approach carries its own risks and differs in performance.

Evaluate Your Risk Appetite – Cryptocurrencies can fluctuate wildly in value. Make sure the ETF corresponds with your investment objectives and risk threshold.

Key Point & Best Crypto ETFs in Canada List

| ETF Name | Purpose / Key Point |

|---|---|

| Purpose Bitcoin ETF | Provides exposure to Bitcoin, allowing investors to track its price without directly holding BTC. |

| CI Galaxy Bitcoin ETF | Offers regulated access to Bitcoin in Canada with the convenience of traditional ETFs. |

| CI Galaxy Ethereum ETF | Enables investors to gain exposure to Ethereum price movements through a managed ETF. |

| Evolve Bitcoin ETF | Allows investors to invest in Bitcoin easily with full regulatory compliance in Canada. |

| 3iQ CoinShares Bitcoin ETF | Combines the expertise of 3iQ and CoinShares to offer secure Bitcoin exposure. |

| Fidelity Advantage Bitcoin ETF | Provides a convenient way for Canadian investors to access Bitcoin with Fidelity’s backing. |

| Ninepoint Bitcoin ETF | Focused on long-term Bitcoin growth, offering investors a secure ETF structure. |

| CI Galaxy Multi-Crypto ETF | Diversifies across multiple cryptocurrencies, including Bitcoin and Ethereum, reducing single-asset risk. |

1. Purpose Bitcoin ETF

Widely regarded as the best crypto ETF in Canada, the Purpose Bitcoin ETF was the ETF to launch in Canada and remains Canada’s first Bitcoin ETF.

It permits Bitcoin ETF investors to gain economic exposure to Bitcoin’s price and functions without the hassle of digital wallets or private keys.

The Bitcoin ETF is extremely liquid and is recognized for its transparent and regulated structure, making it a safe and reliable way of investing in cryptocurrency.

Purpose Bitcoin ETF is made up of professional fund management, ease of access through traditional brokerage accounts, and tracks Bitcoin’s performance. This combination of features makes it a multi million CAD holding for both new and experienced investors.

Purpose Bitcoin ETF Features

- Direct Bitcoin Exposure: Grants Bitcoin investors regulated exposure to price movements without holding the coin.

- High Liquidity: Shares are easy to buy and sell since they are traded on the Canadian stock exchanges.

- Regulatory Compliance: Investment is completely approved by the Canadian government, thus keeping the investment risk-free and easily traceable.

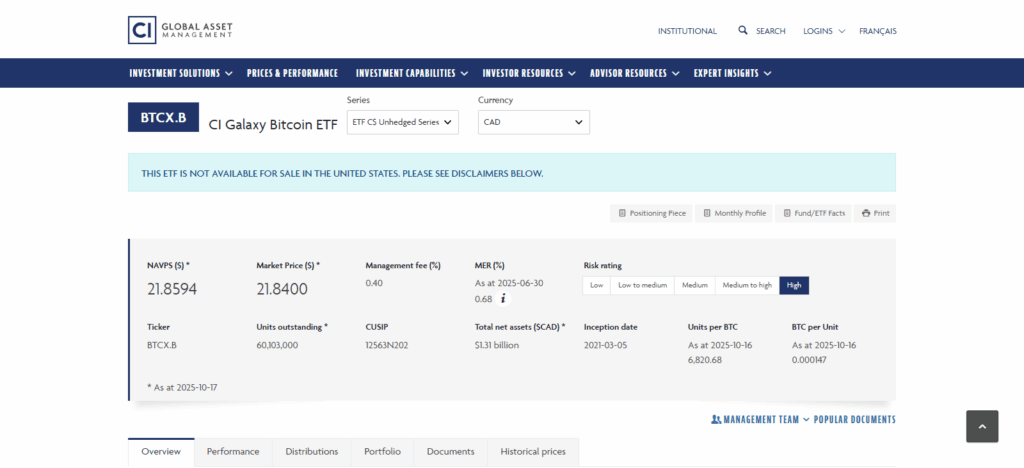

2. CI Galaxy Bitcoin ETF

One of the top crypto ETFs in Canada, the CI Galaxy Bitcoin ETF, has remains well regarded for its ease of entry, security, and astute management.

This ETF, for example, lets investors gain exposure to Bitcoin without the impracticalities of handling crypto wallets and private keys, thus remaining within a streamlined and highly regulated framework for crypto investing.

It’s strong institutional sponsorship from CI and Galaxy Digital sets it apart, providing uninterrupted, transparent, regulatory compliant, and reliable tethering to the Bitcoin market.

Offering competitive fees, high liquidity, and a strong ethical reputation, the CI Galaxy Bitcoin ETF has proven to be a versatile entry point for novice and seasoned investors eager to gain crypto exposure.

CI Galaxy Bitcoin ETF Features

- Institutional Backing: The ETF receives defense and credit from CI and Galaxy Digital with their management and professional control.

- Ease of Access: Available for purchase on standard brokerage accounts without the need for wallets or private keys.

- Accurate and Reliable Tracking: The ETF has strong operational management which ensures that the price of Bitcoin is tracked and governance is in place.

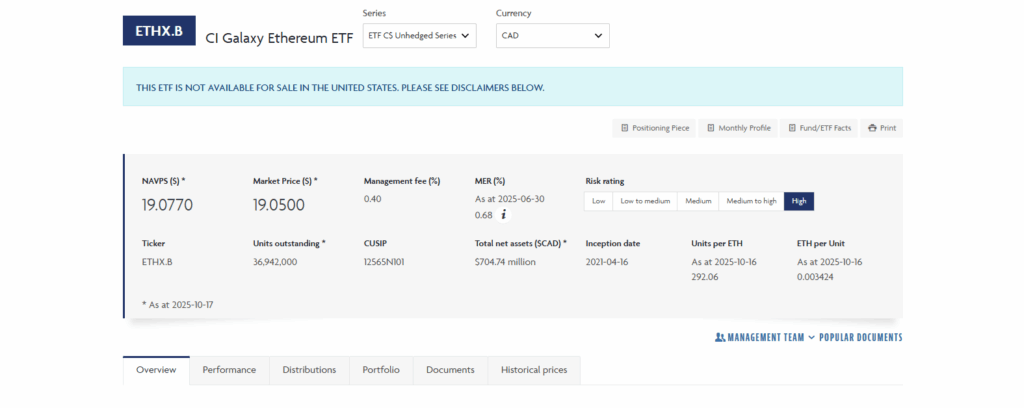

3. CI Galaxy Ethereum ETF

For Canadian buyers wanting regulated, easy access to Ethereum, the CI Galaxy Ethereum ETF is said to be one of the best crypto ETFs in Canada.

Rather than purchasing Ethereum directly, this ETF is a more safe, compliant, and professionally managed option that grants exposure to Ethereum’s growth without the headaches of wallets and private keys.

Its unique strength lies in institutional backing by CI and Galaxy Digital, which enhances liquidity, transparency, and Ethereum market performance tracking.

The ETF’s reasonable expense ratio, focus on risk mitigation, and daily trades on Canadian exchanges make it a positive choice for crypto buyers, whether beginner or expert.

CI Galaxy Ethereum ETF Features

- Ethereum Exposure: Enables regulated exposure for investors to track and gain from Ethereum price movements.

- Professional Oversight: Managed by CI and Galaxy Digital for risk exposure and reliability.

- Simplified Ethereum Investment: Allows investment without the danger that comes with holding Ethereum directly.

4. Evolve Bitcoin ETF

Given its creative simplicity, it’s no wonder The Evolve Bitcoin ETF is considered one of Canada’s finest crypto ETFs for its ease of access, along with its innovative means of regulated custody.

This ETF lets investors track Bitcoin’s price in real time without the technical burden associated with buying and holding Bitcoin and other cryptocurrencies. What is truly remarkable is the ability to pay in CAD or USD, along with the great convenience these investors enjoy, while complying to other legal and tax obligations.

The Evolve Bitcoin ETF provides great liquidity and transparent market access, effective and satisfactory management, and compliance with strict regulations, making the investment experience seamless, safe, and appealing for all cryptocurrency investors, regardless of experience.

Evolve Bitcoin ETF Features

- Flexible Currency Options: Units are available in CAD and USD, thus appealing to both domestic and foreign investors.

- Product Structure: The managed fund removes the hassle of digital wallet or private key management.

- High Liquidity: Easily entered and exited on major Canadian exchanges.

5. 3iQ CoinShares Bitcoin ETF

One of the top crypto ETFs in Canada is the 3iQ CoinShares Bitcoin ETF since it merges professional management and institutional skill to provide secure access to Bitcoin.

There is no need to deal with the complexities of wallets and private keys since the ETFs offers direct access to Bitcoin without owning any cryptocurrency.

Its strength derives from the partnership between 3iQ and CoinShares due to the strong governance and precise tracking of Bitcoin’s price.

The 3iQ CoinShares Bitcoin ETF offers high crypto liquidity in Canada along with competitive fees and daily trading, making it easily available to all investors.

3iQ CoinShares Bitcoin ETF Features

- Institutional Partnership: 3iQ and CoinShares collaboration’s reputation adds to the credibility and governance of the partnership.

- Lifetime Bitcoin Exposure: In a secure ETF, managed format, tracks Bitcoin performance.

- Canadian-Based, Regulated, and Transparent: Fully regulated by Canadian financial authorities.

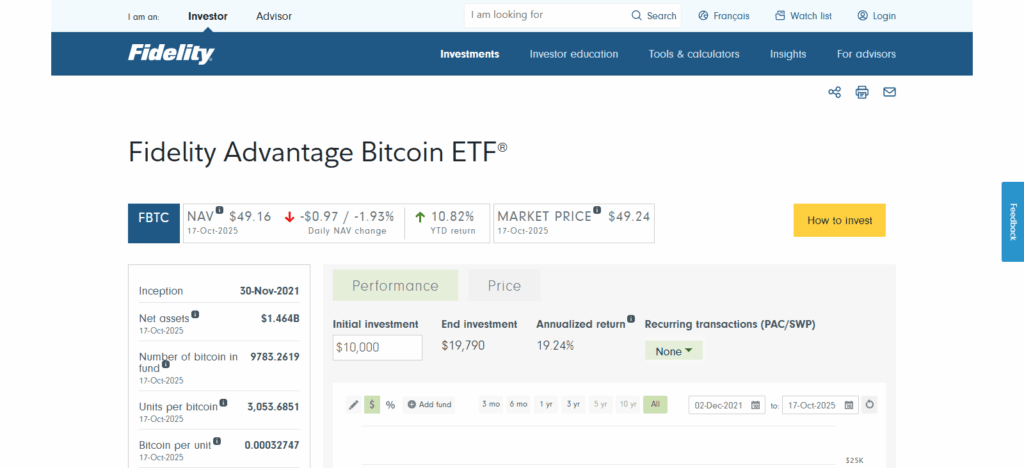

6. Fidelity Advantage Bitcoin ETF

The Fidelity Advantage Bitcoin ETF is also among the best crypto ETFs in Canada, and for good reason. It’s the fusion of regulatory compliance, ease of access for investors, and robust management.

This ETF offers a digital Bitcoin exposure without the need to manage digital wallets or private keys, significantly simplifying the cryptocurrency investment process, and is secure. The ETF has secured a unique competitive advantage in the market because of Fidelity’s global asset management prowess.

This leads to strong governance, ample transparency, and solid price tracking of Bitcoin. The Fidelity Advantage Bitcoin ETF is, therefore, a highly accessible and well trusted Bitcoin ETF in Canada, owing to its reasonable management fees, ample liquidity, and trading ease via Canadian broker accounts. It’s an excellent option for novice and expert crypto investors alike.

Fidelity Advantage Bitcoin ETF Features

- International Fidelity Clout: Maintains and track record reputation oversight backed by Fidelity.

- Simple Participation: Investment accounts allow Canadian investors exposure to Bitcoin’s growth.

- Compliance and Clarity: Canadian law adherence maintained accurate ETF tracking.

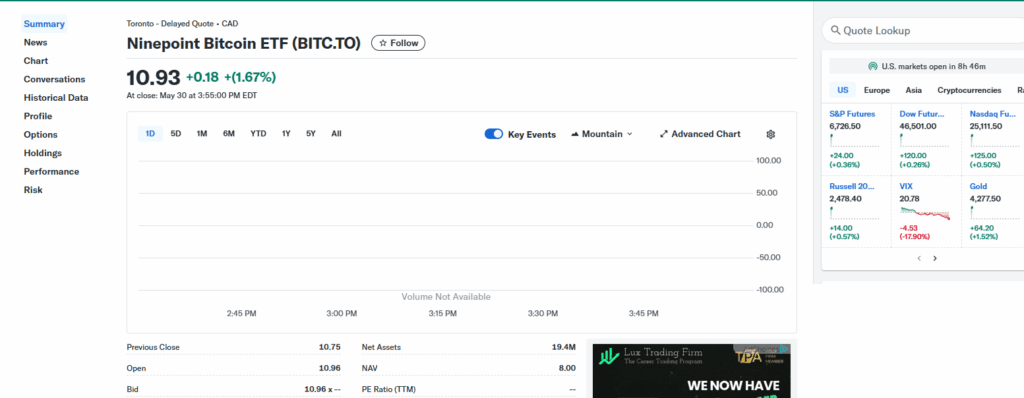

7. Ninepoint Bitcoin ETF

The Ninepoint Bitcoin ETF is highly regarded as one of the best crypto ETF in Canada since it offers investors direct, secure exposure to Bitcoin within a fully regulated structure.

This ETF averts the cumbersome and risk laden burdens of digital wallets and private keys, providing a simpler and safer mechanism to invest in crypto.

Its unique strength is in the long-term growth focus and risk discipline of the Ninepoint management, from which investors enjoy a dependable means to tap into the performance of Bitcoin.

With above average management fees, high liquidity, and clear business conduct, the Ninepoint Bitcoin ETF is regarded as a dependable and effective crypto investing option for Canada along with the other low cost ETF’s for Bitcoin.

Ninepoint Bitcoin ETF Features

- Balanced Investment Growth: Targets investors sensitive to Bitcoin price risk and exposure.

- Regulated Structure: No wallets or private keys to handle.

- Operational Transparency: Liquidity, fee competitiveness, and management professionalism are all commendable.

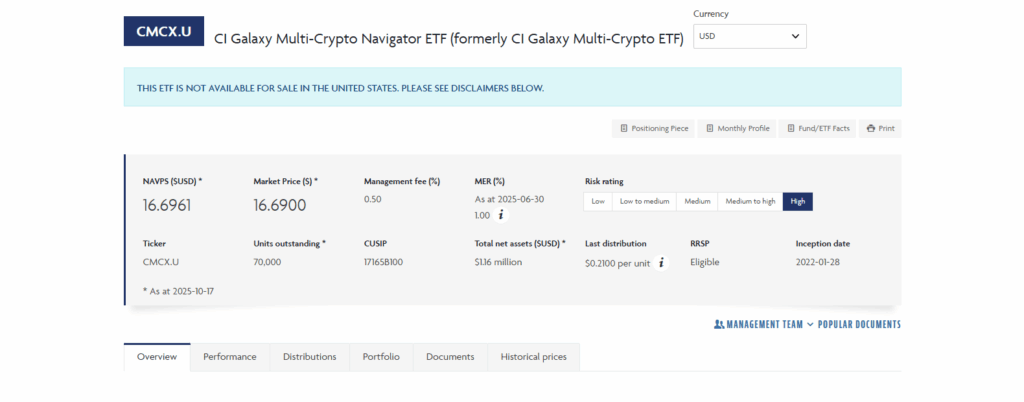

8. CI Galaxy Multi-Crypto ETF

Among many ETFs, the CI Galaxy Multi-Crypto ETF remains the ETF of choice within Canada as it provides various investments within a single, regulated fund as CI Galaxy Multi Crypto ETF offers exposure to multiple cryptocurrencies such as Bitcoin as well as Ethereum.

Unlike other single asset ETFs, the CI Galaxy Multi Crypto ETF is ideal for investors willing to invest in the broader crypto market as it mitigates the risks associated with volatility of single cryptocurrencies.

It is professionally managed by CI and Galaxy Digital which provides operational transparency, liquidity, and proper asset tracking. Because of its competitive fee structure and accessibility through Canadian brokerage accounts, it has is regarded as a secure, diversified, efficient, and affordable ETF to investors with various levels of experience.

CI Galaxy Multi-Crypto ETF Features

- Diversified Crypto Exposure: Invests in multiple cryptocurrencies, including Bitcoin and Ethereum.

- Risk Reduction: Spreads investment across several digital assets to lower volatility risk.

- Professional Oversight: Managed by CI and Galaxy Digital, offering transparent and secure operations.

Pros & Cons

Pros:

- Safer Investment – Ownership of crypto is far more risky than ETFs on crypto which are monitored and approved by the Canadian government.

- No Wallet Management – Traditional brokerage accounts allow investors to buy ETFs without worrying about wallets and private keys.

- Lower Single-Asset Risk – Certain ETFs allow investors to buy more than one digital currency, thereby lowering the risk of investing in one asset only.

- Quick conversion to Cash – Investors can easily buy and sell ETFs which are listed on stock exchnages.

- Lower Investment Risk – The possibility of risk is limited, and the crypto prices are accurately tracked by the capable hands which manage the fund.

Cons:

- Lower return on Investment – ETFs are designed to deliver Crypto returns but are charged an annual fee which can slightly reduce ROI.

- Volatility – ETFs are charged an undue which can cause extreme alterations in the value of an fund.

- No Investment Ante – Most cryptocurrency ETFs neglect ones like Ethereum and Bitcoin, thereby limiting investment to only these major ones.

- The difference in value – Operation costs and structures that are based on futures can cause grown ETFs to deviate heavily from the price of the underlying crypto.

- Tax Implications – Even in Canada, crypto ETFs jewelled with increasing values are taxable, and taxation for every investor, given their unique context, may vary.

Conclusion

In conclusion, Crypto ETFs in Canada allow investors to safely invest in the growing cryptocurrency market without sacrificing convenience or compliance with laws regarding crypto trading.

High-quality offerings like the Purpose Bitcoin ETF, CI Galaxy Bitcoin and Ethereum ETFs, Evolve Bitcoin ETF, 3iQ CoinShares Bitcoin ETF, Ninepoint ETFs, CI Galaxy Multi-Crypto ETF, and the CI Galaxy Multi-Crypto ETF are among the few in the market to offer proprietary active management, high management fee to performance value, and adequate liquidity which provide robust support to investors.

Regardless of the fee structure and volatility of these cryptos, the accessible, diverse, and legally compliant offerings of Canadian crypto ETFs make them ideal to manage risk effectively.

FAQ

Yes, many Canadian crypto ETFs can be held in registered accounts like RRSPs or TFSAs, allowing for tax-deferred or tax-free growth depending on the account type.

Crypto ETFs remove the need to store or secure digital assets personally, while offering regulated oversight, professional management, and easier access via traditional brokerage accounts.

Most crypto ETFs do not pay dividends because cryptocurrencies like Bitcoin and Ethereum do not generate interest or income. Returns come from price appreciation.

Consider factors like the type of crypto exposure (single vs. multi-asset), management fees, liquidity, regulatory compliance, fund provider reputation, and your own risk tolerance.