This article addresses Best Crypto Tools for Automated NFT Trading which provide traders the competitive advantage needed for the rapidly evolving NFT market.

They achieve this by automation, real-time analytics, and smart execution to capture low-priced and undervalued assets and maximize profits. Automated NFT tools are great tools for collectors and active traders as they simplify tasks and increase the efficiency of trading.

What is Crypto Tools for Automated NFT Trading?

Automated NFT trading crypto tools are applications and services that enable individuals to set predefined parameters, trading bots, and market signals to buy, sell, and manage NFTs automatically.

These tools quickly analyze and process real-time data on floor prices, rarity scores, listing trends, gas prices, and social sentiment to make execution decisions that are significantly quicker than manual trading.

Automation allows traders to construct and streamline strategies, management, and wallet balancing across several marketplaces focused on quickly sniping undervalued NFTs, rapidly flipping for profit, and trading.

These services optimize convenience, lower manual oversight, and increase profitability for professionals and novices alike engaged in dynamically changing NFT markets.

How To Choose Crypto Tools for Automated NFT Trading

Supported Marketplaces & Blockchains

- Check if the tool is compatible with the major NFT marketplaces (OpenSea, Blur, Magic Eden, etc.).

- Look for those supporting Ethereum, Solana, Polygon, and BNB Chain.

Automation Features & Bot Capabilities

- Identify trading bots with alerts, auto-buying, auto-selling, bulk bidding, and sniping.

- Seek out instruments with adaptable tactics and smart contract automation.

Rarity, Pricing & Quality of Analytics

- Tools should provide accurate rarity scores, price predictions, and floor price tracking.

- Market analytics showing changing volume and value of differentiated NFT attributes is a must.

Security & Wallet Protection

- Choose tools offering safe wallet integrations, as well as hardware wallet support.

- No custody of your keys must include strong encryption.

Gas Optimization & Trading Speed

- Bots must place transactions within the set time limits to seize profitable listings.

- Gas estimators, priority transactions, and transaction bundling add to efficiency.

User Interface & Ease of Use

- For instance, the dashboard should be beginner-friendly while powerful for advanced users.

- The ability to access a mobile app and browser extension increases the ease of use.

Key Point & Best Crypto Tools for Automated NFT Trading List

| Tool | Key point |

|---|---|

| Trait Sniper | Scans collections for rare trait combinations and alerts or places bids when matching NFTs appear. |

| NFTinit | Monitors new mints and project launches so you can snipe promising drops early. |

| SniperBot | General-purpose sniping bot that automates fast buys and bidding with customizable rules. |

| Genie | User-friendly sniping and marketplace tool that integrates with browser wallets for quick executions. |

| NFTGo Sniper | Combines NFTGo analytics with automated sniping to target undervalued listings using data signals. |

| Rarity Sniper Bot | Prioritizes rarity metrics—automatically targets high-rarity pieces within specified price ranges. |

| Alpha Sharks | Aggregates alpha (insider) signals and marketplace movements to trigger automated buys. |

| SorareData Bot | Focused on Sorare sports-card markets — automates card snipes and notifies on player-related moves. |

| Gem.xyz | Marketplace-focused tool that finds liquidity and executes rapid trades across supported marketplaces. |

1. Trait Sniper

Trait Sniper is recognized as one of the finest crypto tools available for automated NFT trading because it integrates real-time rarity detection with rapid execution functionalities, assisting traders in securing high-value NFTs before competitors.

Its main advantage is the immediate analytic capability on newly listed merchandise across multiple marketplaces and ranking items according to traits and pricing signals. Automated rules can be set to customize buy requests to be instant, to ultra fast gas p, and to execute sniper trades in the winner’s circle.

Trait Sniper provides early access to soon to be minted NFTs giving the user the ability to identify mintable NFTs as launch time hidden treasures. Combining intelligent automated trade functions with rapid execution creates significant advantages for NFT traders.

Pros & Cons Trait Sniper

Pros

- Rarity ranking and live alerts are speedy, ranking and alert systems are rapid and updated, and they bring to the forefront the rare items so that you are able to act promptly.

- It integrates with marketplaces (OpenSea + others) and has quick “snipe”/ buy shortcuts — cuts down on the clicks in between discovering an item and purchasing it.

- It is popular with a large user base and has API and data services for developers — this indicates there is a mature ecosystem and good community support.

Cons

- Browser-extension permissions — extensions that interact with wallets and are not safe can become a threat in the realm of security if they become compromised.

- Competition and latency — the user base is so large that many of them are using the same signals, and therefore the competition and lack of speed in processing can become a problem.

- New collection false positives — rarity scoring does not equal market demand. Price is determined by the market.

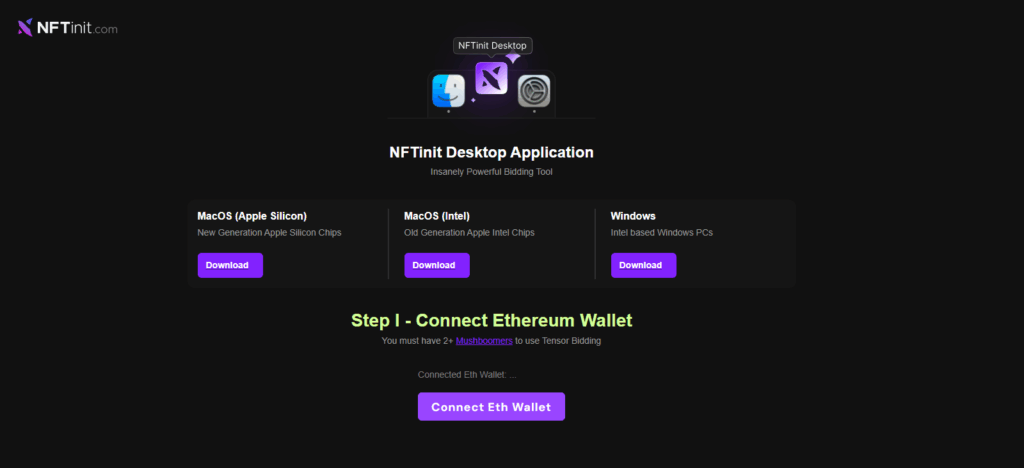

2. NFTinit

NFTinit is recognized for being among the most effective crypto tools for automated NFT trading due to its emphasis on early project discovery and mint sniping automation.

The service regularly reviews blockchain activity and identifies interesting upcoming collections before they appear on the mainstream marketplace, which gives NFTinit traders a significant head start.

The automated purchasing mechanism identifies sudden listing opportunities, monitors new wallet activity, and executes buy orders within seconds based on mint price, rarity, trait threshold, and demand surge preset filters.

NFTinit’s most remarkable feature is providing automated participation in real-time and providing traders uncomplicated early access to high-value assets for maximum extremum profit.

Pros & Cons NFTinit

Pros

- All-in-one sniping features (mass bidding, auto-purchase, reveal sniping) — useful for heavy bidders and power users.

- Desktop apps and integrations (some offer Mac/Apple Silicon builds) — more stable than simple extensions for high-frequency tasks.

- Automation for collection-wide strategies (trait filters, mass offers) — saves time when targeting many listings.

Cons

- Higher complexity and configuration — setup mistakes can lead to missed buys or accidental overspend.

- Risk of account/marketplace enforcement — automated mass bidding can trigger marketplace or wallet provider flags.

- Paid tiers / cost — advanced features often behind subscription or premium tiers.

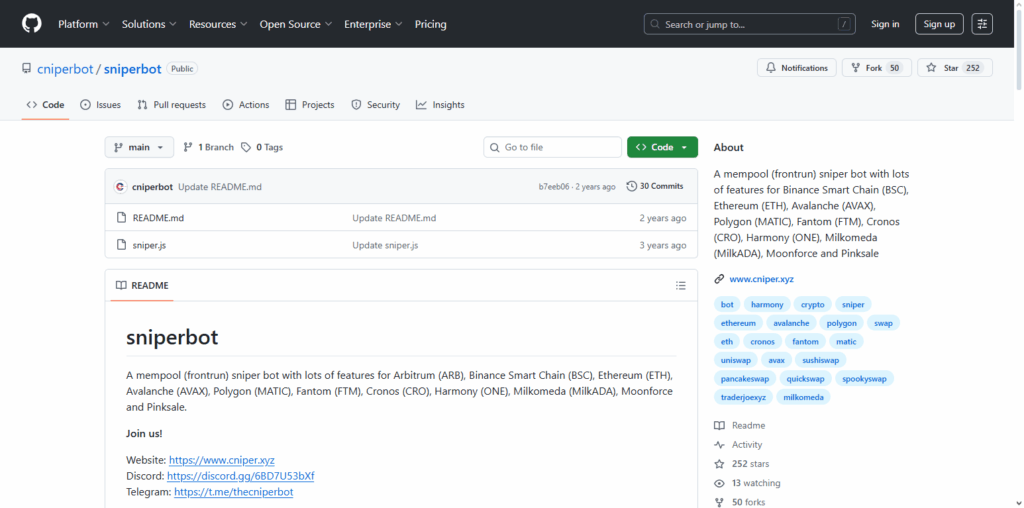

3. SniperBot

SniperBot stands out in the field of automated NFT trading tools because of its unique combination of strategy scripting automation and high-speed execution.

This allows traders set rules and automate responses to market changes. Market strategy execution does not require traders’ manual involvement.

The rule engines modularity and unique combination of multi-condition triggers such as, price, rarity, and time filters, as well as wallet activities, make it possible to execute intricate strategies.

With latency minimized and strategy testing possible in simulation with ‘dry runs’, SniperBot automation meets traders speed and precision requirements. SniperBot meets the necessity for market automation with programmable market strategies and extensive strategy evaluation provided by market automation.

Pros & Cons SniperBot

Pros

- Ultra-fast execution — custom sniper bots can beat manual traders on timing-critical buys.

- Customizable strategies — can program exact buy criteria (gas, slippage, trait thresholds).

- Multi-market support (with proper setup) — can target different chains/marketplaces in one workflow.

Cons

- Technical maintenance required — nodes, RPC endpoints and gas optimization need upkeep.

- Legal / marketplace policy risk — using bots can violate some marketplace TOS or be ethically controversial.

- Centralization risk — some public bots are not audited. Therefore, security gaps might lead to key exposure.

4. Genie

Genie provides the most automated NFT trading for rapid buying and portfolio management across different NFT marketplaces from one interface.

Its unique selling point is automated smart bulk trading, where the user can multiple bids or purchases in one transaction, with gas optimization and speedy execution. Genie’s automated systems find best listing prices and liquidity paths, helping users secure valuable NFTs faster than manual browsing.

There is also dynamic floor monitoring with instant buy triggers, ensuring you maximize profits. Genie provides streamlined simplicity for NFT traders that are cost and performance efficient with automated workflow.

Pros & Cons Genie

Pros

- Marketplace aggregation — checks several marketplaces to find better listings and optimize gas and time.

- Smooth User Experience (UX) for multi-market purchases — simplifies listing and route comparisons by bringing them together.

- Trust through partnerships/integrations — historically recognized across the NFT aggregator ecosystem.

Cons

- Complexity due to aggregator fee/routing — the best price is sometimes a matter of timing and liquidity in the marketplace, thus not guaranteed.

- Dependence on external marketplaces — changing an aggregator’s API will disrupt the aggregator’s functionality.

- Not a rarity sniper — more a trading tool than a trait-ranking engine. You will find trading and aggregation functionalities, but not sniping.

5. NFTGo Sniper

NFTGo Sniper merges advanced on-chain analysis with automatic execution for a sniper analytics advantage. The NFTGo rarity, liquidity, and market momentum signal suite are converted into rule-based bots that focus on priced listings with a price-to-rarity score.

The system allows for multiple thresholds and wallet management and includes simulated backtesting for refinements before going live. The system provides smart gas and batching based on timing to optimize transaction success, while alerts are provided for user control.

NFTGo Sniper integrates advanced analytics with automation and testing to speed up the high-risk, cross-chain, opportunistic entry acquisitions of high potential upside NFTs for collectors and traders.

Pros & Cons NFTGo Sniper

Pros

- Analytics based on actual data — several features focus on analyzing the market, detecting trends, and monitoring listings.

- Dashboards that identify price inconsistencies and quick resell opportunities.

- Sniping functionality is often paired with portfolio and alerting features, increasing utility.

Cons

- Compared to a tool designed explicitly for rarity sniping, NFTGo can feel sluggish when instant trait ranking for sniper functionality.

- Some of the advanced features are behind a paywall.

- Charts and signals require monitoring to generate profits, data will not provide the answer, and trading judgment is needed.

6. Rarity Sniper Bot

Rarity Sniper Bot specializes in automation driven by rarity, which is crucial for NFT collectors and traders who prioritize trait scarcity. Automating the process of indexing trait distributions and recalculating rarity scores, the bot identifies overlooked pieces that human watchers tend to miss.

Supplying Automation engines lets users define rigorous rarity and statistical edge criteria, including price ceilings, whitelisted wallets, and triggering purchases only after crossing a statistical threshold. Built-in backtesting, historical run comparisons, and simulated runs validate strategies, minimizing false positive rates.

With execution latency, multiple wallet management, and audit logging, Rarity Sniper Bot effectively captures price-quality rarified NFTs without hands on intervention.

Pros & Cons Rarity Sniper (Rarity Sniper Bot / Rarity Tools)

Pros

- Strong rarity-ranking across many collections – built specifically to surface rare traits and ranks.

- Clean UI for collection browsing and drop monitoring – makes manual discovery efficient.

- Covers multiple chains / many collections – broad coverage for collectors across ecosystems.

Cons

- Rarity != demand – a high rarity score doesn’t guarantee resale liquidity.

- Not primarily an automated execution bot – you may still need separate tooling to buy instantly.

- Popular signals attract competition – rare finds often get snapped up quickly once shown.

7. Alpha Sharks

Alpha Sharks is one of the premier automated NFT trading crypto tools because it integrates advanced execution automation with real-time alpha intelligence.

Its unique advantage is monitoring smart-money wallet shifts, tracking community sentiment, and identifying sudden liquidity changes, and then translating those phenomena into automated buy or bid orders.

Competitive market tools, including gas-optimized auto sniping, wallet analytics, trait ranking systems, and comprehensive market tools, provide the necessary sniping resource. Automation with Alpha Sparks’ insider insights enables users to capitalize on NFT primary market profitable trading opportunities.

And competitively gas-optimized auto sniping. And competitive market tools like wallet analytics, trait ranking systems, and comprehensive market tools provide the necessary sniping resource.

Pros & Cons Alpha Sharks

Pros

- Community + tools combo — Usually combined with Discord communities that share snipes, charts, and mass-bidding tools.

- Advanced dashboards and reveal-sniping tools for members.

- Group intelligence — Group alpha can reveal opportunities that other individual users may overlook.

Cons

- Community reliance — Quality of signals depends on the honesty and expertise of the community.

- Paywall / tokenized access (some projects gate tools for holders) — Can be expensive.

- The risk of reputation and centralization — tool continuity can be affected by project or token issues.

8. SorareData Bot

SorareData Bot is highly regarded as one of the best cryptocurrency automated trading tools for NFTs, particularly for users within the Sorare sports-card ecosystem.

Its key strength is the automation of trading based on real-time data and performance metrics, which users utilize to snipe cards of players just before their worth increases.

The bot analyzes real-time data on the market, lineups, and injury reports, and then places or receives offers to exploit market opportunities. SorareData Bot analyzes athletes, evaluates pricing patterns, and automates responsive trading based on smart NFTs and sports event alerts.

The combination of real-time sports data responsiveness and automated trading marks SorareData Bot as superbly optimized for the competitive fantasy NFT markets.

Pros & Cons SorareData Bot

Pros

- Excellent for market analytics and for scouting and decision support thanks to the Sorare user sports/NFT data.

- Historical metrics provide great assistance in the selection of players and the optimization of offers.

- A freemium model is available, allowing a lot of users to benefit at a lower cost.

Cons

- No general NFT sniping capabilities for art or collectibles, as it is focused on the fantasy sports NFT ecosystem.

- Automation is limited, as buying automation is a separate tool and primarily analytics/scouting is handled.

- Inaccuracy results from dependence on external APIs and data quality.

9. Gem.xyz

Gem.xyz is one of the best tools in the market for automated NFT trading because it consolidates marketplace liquidity and streamlines optimum bulk execution into one convenient platform. “

Smart sweeping” is the platform’s most distinctive function; it lets traders select several listings across different marketplaces to execute one transaction with reduced gas fees and little to no slippage.

To automate instant purchases, Gem.xyz identifies profitable purchase opportunities by tracking floor changes and the speed of listings in order to adjust rarity weightings and values.

To automate instant purchases, Gem.xyz identifies profitable purchase opportunities by tracking floor changes and the speed of listings in order to adjust rarity weightings and values. With multi-market automation and efficient Gem.xyz bulk buying, NFT traders have increased the speed of acquisition and gained cost-saving benefits.

Pros & Cons Gem.xyz

Pros

- A marketplace aggregator that bundles cross-market purchases, saving gas and simplifying the process of buying multiple items.

- In flipping strategies, especially those involving batch purchases and gas cost savings, this is fantastic.

- Integrates broadly with marketplaces and frequently lists from OpenSea, LooksRare, X2Y2, Sudoswap, etc.

Cons

- The aggregator is complex, requiring users to check other marketplaces for the best price.

- Control can be an issue when users prefer native marketplaces as they experience different fees and UX.

- It is not a rarity sniper as the primary focus is on aggregation and trading.

Conclusion

In the rapidly changing Web3 environment, having automated NFT trading tools is necessary. Every platform has different competitive advantages, which can include bulk acquisition, early mint notifications, analytical sniping, or rarity identification.

Selecting the appropriate tool for your trading style, risk appetite, and marketplace ensures quicker execution, minimizes errors, and takes advantage of more opportunities. As the automated trading systems around NFTs advance, the technology allows for better, more responsive decision making at all hours of the day.

FAQ

No tool can guarantee profits because NFT markets are highly volatile. However, automation can increase your chances by improving reaction time and data accuracy.

Yes, if you choose reputable tools that support secure wallet integrations and never ask for private keys. Always review permissions and avoid untrusted platforms.

Automated NFT trading tools are platforms or bots that monitor NFT markets in real time and execute trades automatically based on rules like price, rarity, or volume changes — helping traders act faster than manual trading.