This article examines the way stablecoins are changing the landscape of cross-border payments. While international transfers are slow, costly, complicated, and time-consuming, stablecoins provide a more secure, fast, and cheap option.

They are changing remittances, corporate payments, and global commerce through the use of blockchain technology, increasing the efficiency, transparency, and accessibility of international transactions by 2025.

What Are Stablecoins?

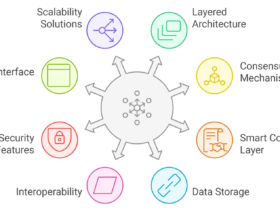

Stablecoins are a special type of cryptocurrency. They are designed to hold a consistent value since it is fixed to reserve assets. This includes pegging the value to fiat currencies such as the US dollar, gold, or a basket of commodities. To hold value, some free currencies like Bitcoin or Ethereum can be extremely volatile and valuable.

Stablecoins allow the use of a digital currency: fast, borderless, transparent, and versatile. The stablecoins are classed on different criteria. Fiat-backed currencies are stablecoins created from traditional money which is held as a reserve.

Crypto-backed stablecoins use cryptocurrency as collateral and to prevent losing value use over-collateralization which will also be losing value. Lastly, algo-stablecoins use designed computer programs, constraints, and algorithms to hold a predetermined stable value.

This includes USDT (Tether) and USDC (USD Coin) and are used when trading. Stablecoins have a high predictability which allows for to be adaptable. This allows use for digital items especially for and receiving digital currency. This allows use for lower volatile currencies which can be processed at high speed and for lower cost.

How Stablecoins Are Revolutionizing Cross-Border Payments

Example: Sending Remittances Using a Stablecoin (USDC) from the U.S. to the Philippines

Step 1: Sender Acquires Stablecoins

John in the U.S. wants to send $1,000 to his family in the Philippines. Instead of using a traditional bank or remittance service, he buys USDC, a US dollar-backed stablecoin, from a crypto exchange using his bank account.

Step 2: Initiate the Transaction

John transfers 1,000 USDC from his digital wallet to his family’s wallet in the Philippines. This transfer happens directly on the blockchain, eliminating intermediaries such as banks or payment processors.

Step 3: Transaction Confirmation

The blockchain validates the transaction in minutes (or even seconds). Unlike traditional cross-border payments that may take 2–5 business days, stablecoin transfers are near-instantaneous.

Step 4: Conversion to Local Currency

John’s family receives the 1,000 USDC in their digital wallet. Using a local crypto exchange, they convert USDC to Philippine Pesos (PHP) at a low conversion fee, avoiding high bank charges and unfavorable exchange rates.

Step 5: Use of Funds

The family uses their hold in local currency for everyday purposes, such as withdrawing cash, settling bills, or making online purchases.

Step 6: Benefits Realized

- Speed. Transfers are processed in minutes, not days.

- Low Cost. Both the remittance and currency conversion costs are considerably lower compared to remittance services.

- Safety & Security. Fraud is virtually impossible, and the blockchain’s audit trail records every step of the transaction.

- Financial Inclusion. Funds can be received and spent by families with no formal banking access.

Current Challenges in Cross-Border Payments

High Transaction Costs

Traditional banks transfer money internationally using correspondent banks and multiple payment processors. Each intermediary makes the process costly. For the customer, sending money abroad costs 5–10% of the amount sent.

Delays

Cross-border payments must pass through multiple banks in multiple countries. Each of the countries operates on their own working weeks. Different time zones can make 5 business days seem lenient, and verifications add time.

Market Fluctuations

Funds are sent in one currency, and the returned amount is in another. Exchange rates are constantly changing, and the recipient can lose a good amount. An unfavorable shift in the market can leave the recipient with less money than the market originally.

Transaction Status

Limited tracking options leave the sender and recipient blind to the intermediary actions until the process is fully complete. Each step can add a hidden cost and lose faith through poor exchange clarity.

Exclusion

Poor, underbanked people, especially in developing countries, can find it hard to receive or send payments internationally. Cross-border payments will be costly and inefficient without a proper banking solution.

Regulatory Issues

For cross-border transactions, diverse sets of regulations, including anti-money laundering (AML) and know-your-customer (KYC) regulations, must be adhered to. The navigation of these regulations leads to an increase in costs, complexity, and time.

Fraud and Security Risks

Fraud, identity theft, and unauthorized transactions are risks in any international transfer. Trust-based systems, wherein banks rely on each other to perform transactions, are outdated and wholly inefficient.

Regulatory and Compliance Landscape

Government Oversight

To ensure that stablecoins do not indefinitely impose threats to financial stability, governments are actively regulating stablecoins. Risks regarding issuance, reserve backing, and usage are being monitored to avoid systemic risks.

Anti-Money Laundering (AML) Requirements

In relation to anti-money laundering laws, stablecoins are also subject to compliance. Tainted and suspicious transactions are prevented within the system. It is the responsibility of the exchanges and wallets to monitor transactions.

Know Your Customer (KYC) Compliance

Those who send and receive stablecoins are more often than not obligated to have their identities verified. This makes transactions traceable, reducing the risk of fraud and aligning with the international financial system.

Reserve Audits and Transparency

To confirm that every token is backed fully by its reserve asset, regular audits are demanded by the regulators to be conducted by stablecoin issuers. This is for reserve transparency, which is needed to gain the trust of customers and regulators.

Cross-Border Coordination

Given their global nature, stablecoins’ laws and regulations are harmonized in different countries to reduce legal conflict and safe harbor regulations for consumers.

Taxation and Reporting

Governments require the reporting of transactions involving stablecoins for tax purposes. Crypto transactions are thus increasingly subject to tax and other reporting requirements. Businesses and users must document their transactions and conversions.

Real-World Use Cases in 2025

Cross-Border Remittances

Migrant workers can send money to their families instantly and at low cost using stablecoins, bypassing expensive traditional remittance services. This reduces fees, speeds up delivery, and ensures the full value is received.

Corporate International Payments

Businesses operating globally can use stablecoins to pay suppliers, partners, and employees across countries without delays or high bank charges, improving cash flow management and reducing currency conversion risks.

E-Commerce and Online Marketplaces

International buyers and sellers can transact seamlessly with stablecoins, eliminating currency exchange complications and offering faster settlement times for goods and services.

Integration with Fintech Platforms

Fintech apps increasingly integrate stablecoins to offer digital wallets, peer-to-peer transfers, and instant cross-border payments, enhancing user convenience and financial accessibility.

Decentralized Finance (DeFi) Applications

Stablecoins are used in DeFi platforms for lending, borrowing, and yield farming, providing global participants with stable, low-volatility assets for financial transactions and investments.

Future Outlook

The future of stablecoins in cross-border payments seems to be getting better. In 2025, stablecoins should be a popular option for international transfers, making cross border payments faster, cheaper, and less complicated.

As collaboration amongst regulators, financial institutions, and blockchain networks becomes more commonplace, stablecoins will likely merge with classic banking and fintech systems, making things easier for businesses and people.

Other developing technologies, like programmable money, multi-currency stablecoins, and interoperability between different blockchains, will strengthen the system. Also, stablecoins will enhance financial inclusion for the unbanked population.

Currently, cross-border payments, remittances, and global commerce are inaccessible to them. Limited regulatory compliance, security, and scalability will be challenges, but developing blockchain tech with global supportive policies will allow stablecoins to transform global payments.

Conclusion

Stablecoins are making it easier to send money across borders by tackling notorious issues like delays, high fees, lack of clarity, and difficulties in access. By 2025, they should help companies, people, and financial institutions move away from traditional banking networks and perform instantaneous, secure, and inexpensive cross-border transactions.

Whether it is remittances, corporate payments, e-commerce, or decentralized finance, stablecoins are proving their value in multiple use cases. With advancing technology and developing regulations, stablecoins will help make cross-border transactions more efficient, inclusive, reliable, and secure, transforming the future of international finance.

FAQ

Stablecoins are cryptocurrencies designed to maintain a stable value by being pegged to a reserve asset, such as fiat currency, commodities, or other cryptocurrencies. They combine the benefits of digital currencies with price stability, making them ideal for cross-border payments.

Stablecoins enable near-instant transactions, reduce fees by eliminating intermediaries, and provide transparency and security through blockchain technology. They also mitigate currency volatility risks in international transfers.

Yes. Individuals use stablecoins for remittances, online purchases, and travel payments, while businesses use them for global supplier payments, payroll, and e-commerce settlements.

Transactions on the blockchain are secure and transparent. Stablecoins rely on blockchain verification, reducing fraud risks, and providing a clear audit trail. However, users must ensure their wallets and exchanges are secure.

Most stablecoins follow regulations such as anti-money laundering (AML) and know-your-customer (KYC) requirements. Governments and regulators are increasingly implementing rules to ensure safe and legal use.