I will explain how Central Bank Digital Currencies (CBDCs), by influencing the popularity of fiat currency cryptocurrencies, will affect the adoption of Bitcoin. CBDCs will incentivize the use of Bitcoin and help in the investment of Bitcoin.

We will analyze the incentives: the visible use of digital currencies, the extent of regulations and how centralized and decentralized systems will coexist in the future to provide systems economic infrastructure.

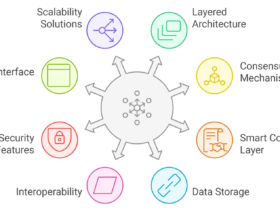

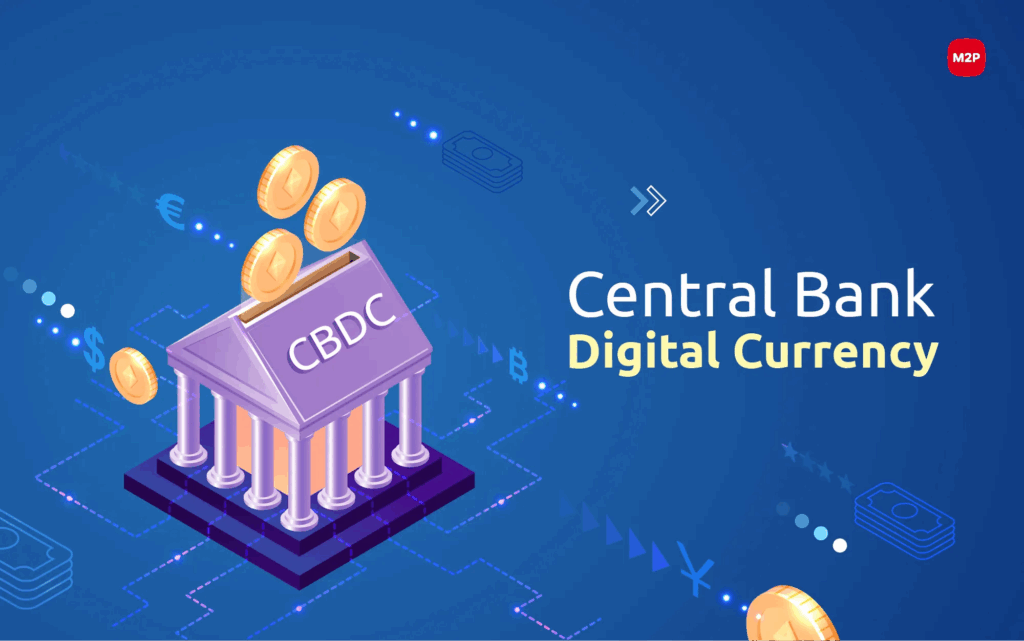

Understanding Central Bank Digital Currencies (CBDCs)

A Central Bank Digital Currency, or CBDC, is the digital version of a nation’s fiat currency, made available in digital form, regulated and overseen by the nation’s central bank. CBDCs are not like Bitcoin or other cryptocurrencies as they are not decentralized.

Based on the government’s digital currency CBDCs are fully legal tender and can be used for digital transactions assuring the user of a stable and reliable currency.

Their primary goal is to accommodate the most financially isolated communities by lowering the costs of transactions and payments. CBDCs have the ability to serve the “retail”. More popularly, China, Sweden and the Bahamas are focused on creating CBDCs.

How Central Bank Digital Currencies Could Influence Bitcoin Adoption

Example: China’s Digital Yuan (e-CNY) and Bitcoin Adoption

Step 1: Introduction of CBDC

- The People’s Bank of China issues the digital yuan (e-CNY) for retail payments.

- It is available for everyday transactions in mobile apps for quick and convenient digital payments.

Step 2: Increased Awareness of Digital Currencies

- People using the e-CNY drives awareness and understanding of digital currencies.

- It leads to interest in the decentralized counterparts of Bitcoin.

Step 3: Regulatory Clarity

- The introduction of a government-backed digital currency is likely to lead to unambiguous governance over the digital currency.

- This leads to a sense security for many who wish to invest in Bitcoin.

Step 4: Competitive Dynamics

- People may decide to use a CBDC over Bitcoin for payments because of its stability and legal status.

- Bitcoin is likely to attract those who wish to maintain privacy in transactions.

Step 5: Impact on Bitcoin Investment and Trading

- The tendency of the public to buy Bitcoin to revert in massive magnitude as a payment instrument is likely to increase.

- The result of this on crypto exchanges will be an increase in the volume of trades.

Step 6: Coexistence Scenario

- In this phase, CBDCs perform best in day-to-day transactions while Bitcoin holds value in speculative markets.

- In this case, a mixture of digital currencies nudging the prospective hybrid economy.

Current State of Bitcoin Adoption

Global Usage Growth

Adoption is growing around the world with millions of users holding and/or transacting in Bitcoin. The U.S., Germany, and Brazil are showing significant retail and institutional interest.

Institutional Investment

Bitcoin is becoming more legitimized as a digital asset as institutional interest grows, with large corporations, hedge funds and investment firms allocating portions of their investment to Bitcoin.

Payment Acceptance

The number of businesses and online platforms willing to accept Bitcoin payments is slowly increasing, but is dwarfed by the number of businesses that accept traditional fiat payments.

Regulatory Environment

The difference in uptake is how freely or restrictively governments choose to regulate or ban the use of Bitcoin as payment in their country.

Remittances & Financial Inclusion

Bitcoin is being more widely used to cross borders, make payments, and is being accessed by the unbanked in areas with weak financial institutions.

Technological Integration

The development and use of Bitcoin wallets, layer-2 solutions like the Lightning Network, and other tools are helping to make transactions quicker and more seamless.

Coexistence and Competition

Parallel Usage

CBDC’s stability and government backing will allow it to crown the everyday payments market. Bitcoin will retain its prominence as a store of value and investment as the payments crown.

Technological Integration

Settlements will be faster and more accessible as Bitcoin adopts CBDCs’ payment infrastructure.

Market Dynamics

Bitcoin is still relevant as the medium of exchange because its decentralized and borderless attributes will always keep it relevant.

Regulatory Balance

Governments encourage the complementary dodging of crypto regulations to encourage economically productive coexistence.

User Choice

Consumers will embrace CBDCs for security and everyday transactions while Bitcoin will be used for privacy, cross-border transfers, and as a hedge against inflation.

Competitive Pressure

CBDCs motivate Bitcoin to technologically and economically evolve and expand their adoption in economically decentralized industries.

Case Studies

Countries interested in Digital Currencies offer glimpses on how they influence the adoption of Bitcoin. China has restricted the use of crypto currency in the country, but the proliferation of the digital yuan in retail payments, and the testing e-CNY facilities, has heightened awareness of digital currency and has impact the use of Bitcoin in the country.

Sweden’s e-krona facilitates crypto adoption while the CBDC seeks to modernize payments, and focuses on the cashless society. The Sand Dollar issued by the Bahamas enhances access to inclusive finance, particularly in isolated regions.

Because of the value of Bitcoin, it can be used as an alternative digital asset. As these examples illustrate, the CBDCs are capable of competing with, and complementing, Bitcoin and the adoption of it in different regions.

Future Outlook

Innovation, regulatory frameworks, and coexistence will define the future of Bitcoin adoption in a world where CBDCs are prevalent.

Despite the potential for CBDCs to become the go-to medium for daily transactions because of their government stability, Bitcoin will continue to build upon its capabilities as a deflationary asset, a decentralized value holder, and an inflation hedge, and will facilitate cross-border payments. Bitcoin’s usability and attractiveness will most likely increase through technology, layer-2, and DeFi.

Governments are expected to formulate policies that integrate CBDCs and cryptocurrencies, fostering a hybrid financial system in which digital currencies and digital finance will drive economic behavior and its adoption.

Conclusion

In conclusion, Central Bank Digital Currencies (CBDCs) will most likely have a great impact, both great and small, on the adoption of Bitcoin.

While the stability and backing of the government may disincentivize the use of Bitcoin in everyday payments, the exposure and promotion of digital currency will spark interest in the use of Bitcoin and other decentralized options.

How these digital assets will coexist is a question of regulatory certainty, technological mergers, and changing market conditions. In all likelihood, CBDCs and Bitcoin will have and serve different, but also provide and serve, different components.

CBDCs will serve complete, safe transactions, while Bitcoin will serve as a decentralized Bitcoin store. This will enhance digital currency.

FAQ

CBDCs are digital forms of a country’s fiat currency, issued and regulated by the central bank. They are legal tender, centralized, and aim to modernize payments, reduce transaction costs, and enhance financial inclusion.

CBDCs may reduce Bitcoin’s role in everyday payments due to their stability and government backing. However, they can increase awareness of digital currencies, potentially encouraging Bitcoin adoption as an investment or hedge.

Yes. CBDCs can dominate daily transactions, while Bitcoin may continue as a decentralized store of value, cross-border payment tool, and speculative asset, creating a hybrid digital economy.