This article explores the Best Staking Platform Alternatives. Staking your cryptocurrency is a simple way to earn a passive income, but picking a platform to earn your staking rewards from can be confusing given the number of platforms available.

Unlike other platforms, the alternatives discussed here have competitive liquidity, rewards, and most importantly, safety. These are the best options to consider if one is looking to earn passive income from staking.

What is Staking Platform Alternatives?

Unlike traditional staking, which has more limitations, staking-platform alternatives are services or crypto platforms that provide users flexible options regarding reward systems structure and earning potential. More flexible options include DeFi protocols, liquid staking services, and yield farming platforms instead of relying on a single centralized staking platform.

For network validation, liquidity provisioning, or governance, users mainly choose to use these platforms because they provide more control over the assets in question without the limitations of centralized exchanges.

Why Use Staking Platform Alternatives

Higher Rewards – Most staking alternatives provide better annual returns than centralized platforms which increases passive income opportunities.

Greater Control – Users own their private keys and their assets which reduces reliance on centralized exchanges.

Less Risk of Centralization – Staking decentralization offers control to multiple validators which enhanced network security and transparency.

Liquid Flexibility – Alternatives like liquid staking allow users to trade or otherwise utilize their tokens even while locked up and staked.

More Options – Stakers can mitigate ecosystem risk by choosing multiple tokens or different staking networks to participate in.

More Certainty – Staking in DeFi is done under autonomous smart contracts and users can maintain audit transactions to verify integrity.

DeFi Staked Tokens – Tokens may be used for other DeFi lending and borrowing staking to increase overall yield through a variety of cash flow strategies.

Key Point & Best Staking Platform Alternatives List

| Platform | Key Points |

|---|---|

| Lido Finance | Leading liquid staking platform supporting Ethereum and other networks; offers stETH tokens for liquidity while earning rewards. |

| Binance Earn | Centralized staking with flexible and locked options; easy to use for beginners with various crypto assets supported. |

| Coinbase Staking | Regulated and beginner-friendly; automatic staking rewards for select assets like Ethereum and Solana. |

| Kraken Staking | Offers on-chain and off-chain staking with competitive rewards; strong security and transparent reward distribution. |

| OKX Earn | Provides flexible staking and DeFi earning options; integrates with multiple blockchain networks. |

| Rocket Pool | Decentralized Ethereum staking protocol allowing users to run nodes or deposit ETH; offers rETH for liquidity. |

| StakeWise | Focuses on Ethereum staking with a dual-token system (sETH2, rETH2) for transparent reward tracking. |

| Ankr Staking | Multi-chain liquid staking service offering aTokens for liquidity and DeFi use cases. |

| Everstake | Trusted validator platform supporting 70+ networks; offers secure, non-custodial staking for institutions and individuals. |

| Figment | Users keep full control of their assets while Figment manages secure |

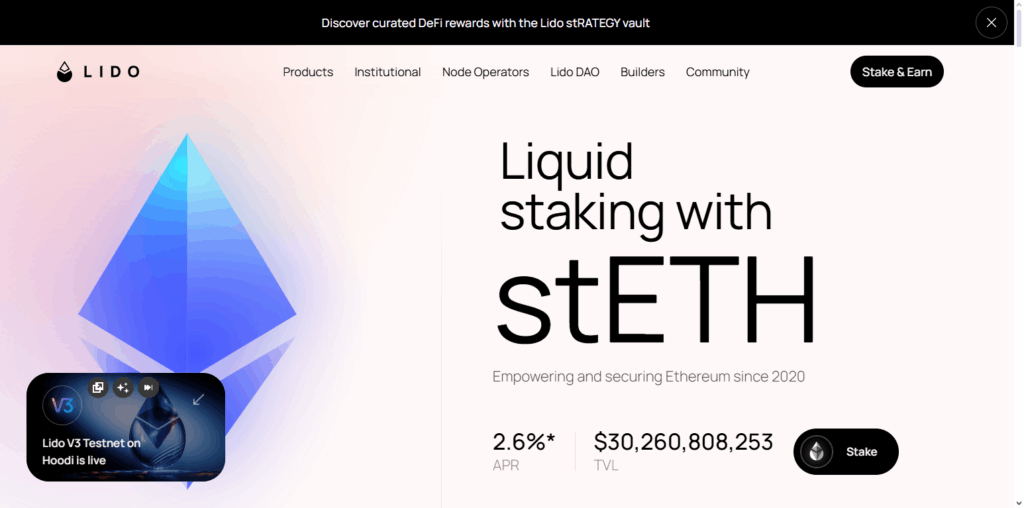

1. Lido Finance

Lido Finance provides one of the best alternative decentralized staking platforms. Lido Finance is the world’s first liquid staking solution with the ability to provide flexible staking. They provide liquid staking for Ethereum, Solana, and Polygon by issuing stETH which can be traded, used, and earned DeFi.

Lido Finance solves the problem of immobility staking with their unique liquid staking model. Lido Finance is best known for their self-governed system, community transparency, and the reliability of their staking with professional validators.

Lido Finance is flexible with high liquidity and is the first to provide multi-chain capabilities. Lido Finance is user-friendly and the first to provide staking support for multiple chains making liquidity staking one of the best flexible staking solutions available.

Lido Finance Features

- Liquid Staking: Ethereum staked with Lido generates staked Ethereum tokens (stETH), staked assets earning liquidity.

- Decentralized Validators: Centralization risks are reduced with additional professional node operators and increasing network security.

- Seamless Integration: Staked assets can be used on other DeFi protocols and integrated other DeFi protocols.

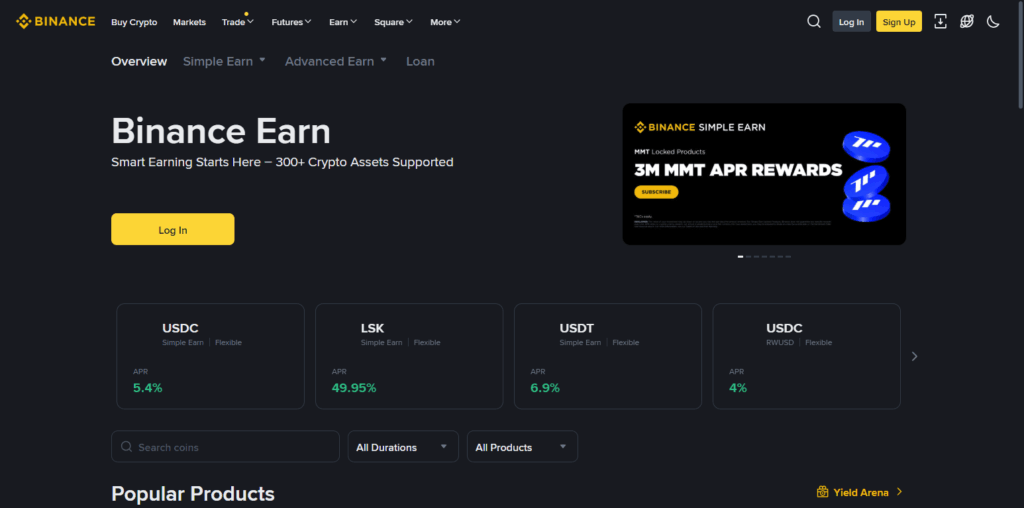

2. Binance Earn

One of the best staking platform alternatives has got to be Binance Earn because you earn in numerous ways, all under the same safe and easy-to-use platform! Here you can flexibly choose between staking in periods of 1-90 days, and locked staking for periods of 15 days, which means you can control the investment period and the liquidity for locked staking unlike most competitors.

Flexibility in investment periods makes locked staking far more appealing, especially in a volatile market. Other competitors restrict liquidity which can cause major inconvenience. Saving and earning DeFi products in the same ecosystem to avoid constant liquidity and diversified earning potential is genius! Most importantly, your security and consistency in yields provide an ease of mind.

Binance Earn Features

- Flexible Staking Options: In order to meet different risk appetites, Binance Earn provides flexible, locked, and high-yield staking for different crypto assets.

- High Liquidity: Users can access their funds for quick use due to easy deposit and withdrawal processes.

- User-Friendly Interface: Staking and backing features of the system is simplified for beginner users with intuitive dashboards and clear reward predictions.

3. Coinbase Staking

Coinbase Staking is an excellent choice for a staking platform for its regulatory compliance, simplicity, and transparent rewards system.

Designed for the beginner and the professional user, staking rewards can be earned on Ethereum, Solana, and Cardano and more assets directly from a Coinbase account. Coinbase Staking’s most valued strength is its offering of automatic staking with absolutely no technical management, enabling users to passively earn with absolutely no effort required on their part.

Coinbase Staking combines simplicity and security, and the passion for serving the accessible global crypto community is so apparent. Coinbase Staking is a highly reliable and low-risk staking platform.

Coinbase Staking Features

- Regulated & Secure: Users can trust the security risk environment of staking popular crypto assets as it is fully regulated and compliant with US laws.

- Automatic Rewards: Rewards are computed automatically and directly credited to the user’s account.

- Ease of Use: There is a very clear and easy staking process that is welcomed especially for beginners, and also is helpful for advanced users.

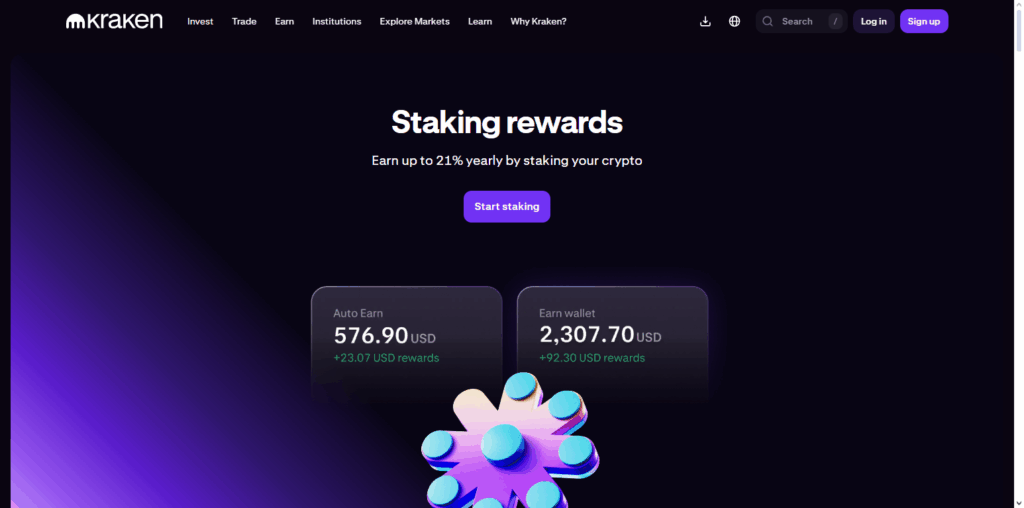

4. Kraken Staking

As an alternative, Kraken Staking is one of the best platforms on the market. It is safe, easy to understand, and offers great versatility for earning crypto rewards. Kraken provides quick access to rewards and flexible on-chain and off-chain rewards.

Kraken is known for its instant rewards Stolper and easy access to earning crypto which avoids the disappointment of rewards that are earned over extended periods. Kraken is highly regarded for its safe and dependable advanced security and regulatory infrastructure.

With adjustable earning opportunities, extensive supported assets, and a user-friendly staking platform, Kraken staking is a professional offering that is accessible to casual investors and seasoned crypto traders.

Kraken Staking Features

- Support for Multiple Assets: Staking for multiple cryptocurrencies, including ETH, DOT, and ADA, is supported.

- Instant Benefits: Staking benefits are spaced and distributed, and are almost instantaneous.

- No Minimum Stakes: Users are able to stake without having to make a large minimum investment.

5. OKX Earn

OKX Earn is a leading alternative in staking platforms. It is the only platform that offers multiple earning choices within one environment like staking, DeFi, and even savings products.

It is also unique in that it supports a number of different digital currencies which allows one to easily and effectively diversify and control one’s investments. It also offers a lot of flexibility in that users are able to opt for fixed-term or flexible staking, depending on the liquidity they desire.

There are also other unique features, for example the seamless, uncomplicated connection to reliable DeFi protocols for effortless yield generation and the ability to focus on the earning DeFi protocols without the technical aspects.

It also has robust security, clear and open rewards, and grants users a considerable control which makes the staking experience powerful and unique in its own, all-inclusive way.

OKX Earn Features

- Variety of Products: Offers a range of products and methods in DeFi, locked and flexible staking to serve varying investor needs.

- Competitive APY: Annual percentage yields are higher than other platforms.

- Integrated Platform: Staking is seamlessly integrated with trading, other financial services, and lending to create a one stop platform.

6. Rocket Pool

Rocket Pool offers one of the best alternatives, bringing complete accessibility and decentralization. It is the first fully decentralized Ethereum staking solution. For instance, competitors like centralized exchanges force you to stake and control a minimum of 1 ETH.

With Rocket Pool, you can stake a minimum of 0.01 ETH and fully control your assets. One innovative feature is the rETH token, a tradeable staking token which earns staking rewards and can be actively used in DeFi.

Rocket Pool is also one of the few decentralized staking solutions which allow users to run nodes while incorporating a simple technical setup. For these reasons and the community-based governance, transparent rewarding system, and decentralized parts, Rocket Pool is one of the most reliable open staking solutions.

Rocket Pool Features

- Decentralized Ethereum Staking: Small-scale ETH holders can stake through node operators.

- rETH Tokens: DeFi and other applications can use staked ETH through rETH tokens.

- Community Driven: Stakers govern and decide on the protocol’s development in a decentralized manner.

7. StakeWise

One of the most advanced alternatives to stake Ethereum is StakeWise. StakeWise offers a transparent and innovative dual-token model facility. Whenever a user stakes thier ETH, they receive both sETH2 , and rETH2 tokens.

While the former allows to claim the deposit, the latter allows rewards. StakeWise provides a clear and real-time evaluataion of stake performance. The innovative model allows rewards to be used independently in DeFi applications.

StakeWise also minimizes fees and support both individual and corporation, appealing to a broader audience. The self-custody model, along with community governance and a network of reliable validators, proves StakeWise is an advanced and forward looking solution.

StakeWise Features

- Efficient Rewards: Staking rewards are automated and given on a daily basis.

- Low Fees: Compared to regular staking services, platform fees are low and more competitive.

- Tokenized Staking: Users are issued sETH2 and rETH2 tokens as a reward and for the staked asset, which increases liquidity.

8. Ankr Staking

Ankr Staking deserves recognition as one of the most effective alternatives to the widely used staking platforms. It simultaneously manages to makes decentralized, flexible, and hassle free liquid staking across multiple chains.

It is compatible with most important networks, including Ethereum, BNB, and Polygon, which makes diversification easy. Its most distinguished feature is the issuance of liquid staking tokens, aTokens, which allows users to earn staking rewards and spend them across various DeFi protocols for loans, trading, and other activities such as yield farming.

Ankr is designed to guarantee his performance coupled with low downtime which allows users to realize uninterrupted returns. Its intuitive design, low entry staking amounts, and focus on cross-chain staking makes Ankr Staking an effective and flexible service to optimize crypto rewards.

Ankr Staking Features

- Multi-Chain Support: Staking is available on Ethereum, BNB, and Polkadot, and many other blockchains.

- Liquid Staking Tokens: Receive liquid staking tokens that can be used in other DeFi applications.

- Easy Onboarding: Onboarding is easy for all level users, be it a beginner or an advanced user.

9. Everstake

Everstake is an excellent alternative for staking platforms because it merges top tier professionalism in validator services with user-friendliness for both individuals and institutions.

Encompassing over 70 networks in the cryptocurrency blockchain ecosystem offers users the ability to cryptocurrency stake and crypto blockchains across different staking networks while having complete control over your crypto blockchains and your cryptocurrency.

Its main non-custodial infrastructure is most important for protective crypto custody infrastructure for Everstake with ever stake system and staking interface. Everstake is the crypto blockchain staking system that fulfills your crypto staking demands and perfectly balances your crypto blockchains.

Everstake Features

- Professional Validator Network: Validators for several blockchains and secure staking.

- High Rewards: Competitive APY is offers on all supported assets.

- Advanced Dashboard: Stakers will find comprehensive analytics and a performance tracking system.

10. Figment

Figment is favored above all others in the industry due to its unique offering in the marketplace as an all-inclusive business. It is able to provide outstanding quality, unrivaled security, enterprise-level infrastructure, and custodial freedom to both institutions and individuals alike (Figment).

Its most notable feature is its ability to provide non custodial staking. You can keep all your crypto, and Figment will take care of all the infrastructure as a validator (Figment). Figment can service all stakeable Proof of Stake networks, including ETH, SOL, DOT, AVAX, and ATOM, amongst a lot of others, allowing added convenience and flexibility to stakers on all major blockchains (DIA).

Out of all competitors, Figment is the only option to offer a 99% validator uptime on Ethereum, and with its award winning admin dashboards and over 30 insights, staking returns are maximized with effortless order (Figment).

Figment Features

- Non-Custodial Staking – Stake while Figment takes care of our secure validator operations without any custody to the stakes.

- Broad Multi-Chain Availability – Stake with some of the most used PoS networks like ETH, SOL, DOT, AVAX, and several others.

- Business Level Excellence – Exceptional and consistent uptime with good reliability and reporting utilities for analytical and reward verification to streamline management.

Conclusion

To summarize, the most effective alternatives to centralized staking provide crypto holders with innovative and rewarding opportunities to grow their assets. For instance, Lido Finance, Rocket Pool, and Ankr focus on liquid staking and DeFi integration, whereas Coinbase, Binance Earn, and Kraken are geared more towards ease of use, compliance with regulations, and consistent reward generation.

Transparency, dual-token models, and extensive validator networks are the emphasis for StakeWise and Everstake. Risk multipliers and liquid staking opportunities, along with the ability to optimize staking rewards and reduce exposure, provide flexible and liquidity options for diversified staking opportunities.

FAQ

Staking platform alternatives are services or platforms—centralized or decentralized—that allow crypto holders to earn rewards by locking or delegating their assets. They often offer more flexibility, liquidity, and diverse reward options compared to traditional staking.

They provide higher potential rewards, greater control over assets, liquidity options, access to multiple networks, and opportunities to participate in DeFi while staking.

Popular choices include Lido Finance, Binance Earn, Coinbase Staking, Kraken Staking, OKX Earn, Rocket Pool, StakeWise, Ankr Staking, and Everstake.

Each platform has unique features: liquid staking tokens (Lido, Rocket Pool, Ankr), beginner-friendly interfaces (Coinbase, Binance), dual-token systems (StakeWise), or wide validator networks (Everstake, Kraken).