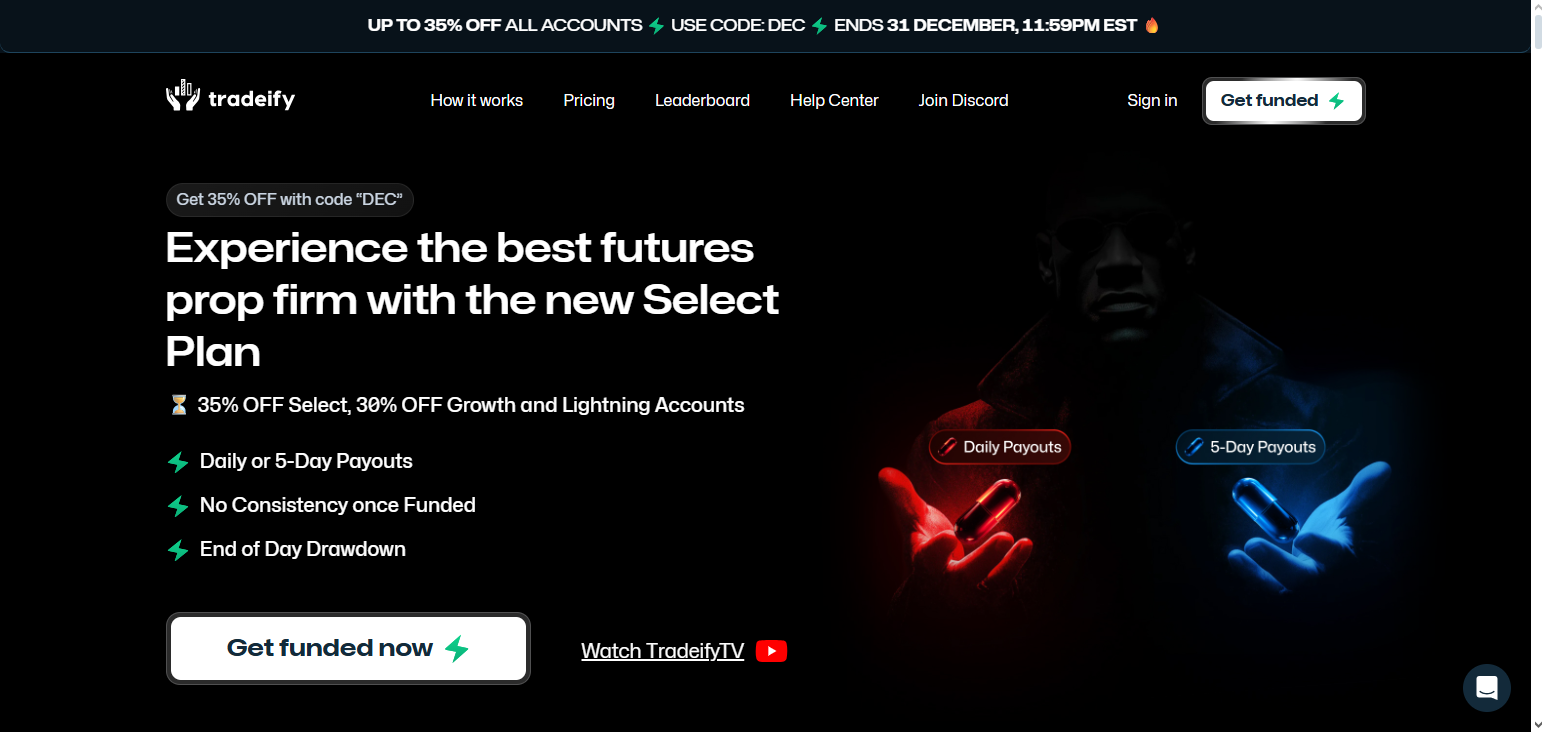

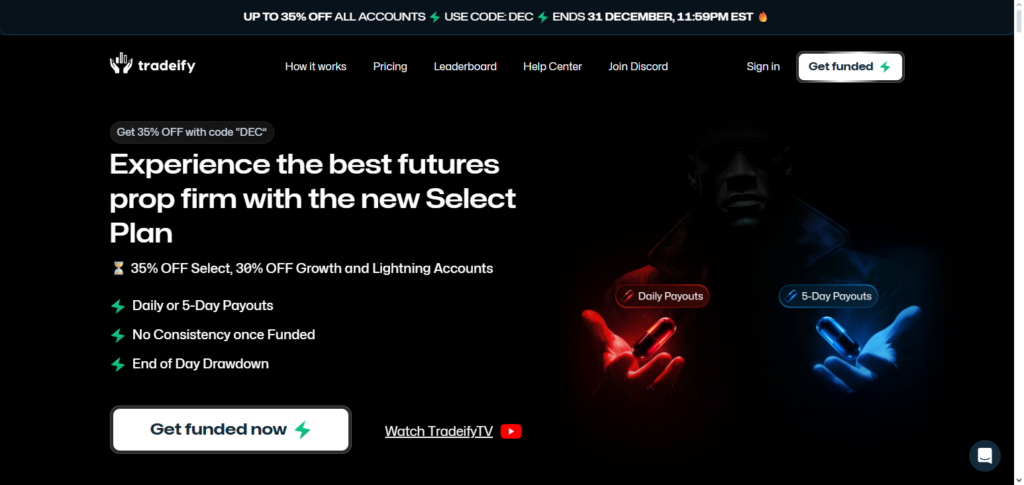

I’ll talk about Tradeify, a potent trading analytics and funded account platform, in this post. Tradeify provides risk management tools, prop firm challenge support, comprehensive performance metrics, and automatic trade tracking for traders of all skill levels.

Tradeify offers the resources and insights to boost consistency and trading performance, regardless of your level of experience—whether you are a novice, swing trader, or getting ready for a prop firm assessment.

What is Tradeify?

Tradeify is a contemporary trading analytics nad performance tracking platform meant to improve traders’ accuracy, discipline, and sustainable profitability. Operating as a smart trade journal and evaluation system, it records trades, assesses behaviors, and identifies and analyzes factors that contribute to traders’ success and shortcomings.

With support for many asset classes –forex, crypto, indices, and stocks– Tradeify is also apt for day traders, swing traders, and traders working for prop firms. Integrating seamlessly with trading terminals such as MT4, MT5, and cTrader, it offers users real time information on win rates, risk/reward ratios, equity curve, and psychological patterns.

In addition to trade journaling, Tradeify provides users with prop firm challenge tracking, trade replay, risk management tools, automated performance reports, and more.

With such features, it is ideal for novice traders and those with more experience, as it offers a clean and intuitive interface, alongside tools to support fast analytics. With the aim of enhancing every part of the trading journey, Tradeify has a smooth trading experience.

Key Point

| Category | Details |

|---|---|

| Platform Name | Tradeify |

| Founder / Team | Created by a team of professional traders & fintech developers focused on analytics automation |

| Headquarters | Operates remotely with global user base |

| Platform Type | Trading Analytics & Trade Journaling Platform |

| Primary Purpose | To help traders track, analyze, and improve trading performance through automated insights |

| Supported Markets | Forex, Crypto, Indices, Commodities, Stocks |

| Supported Platforms | MT4, MT5, cTrader, TradingView (manual import), APIs |

| Core Features | Automated trade tracking, smart analytics, performance metrics, trade journaling, prop firm challenge tracking, risk analysis |

| Best For | Prop firm traders, day traders, scalpers, swing traders, beginners needing structured analysis |

| Data Security | Encrypted data storage with secure API connections |

| Subscription Type | Free plan + Premium monthly/annual plans |

| Mobile Availability | Web-based platform with mobile-responsive interface |

| Unique Selling Point (USP) | AI-driven insights & evaluation tools designed specifically for modern traders and prop firm challenges |

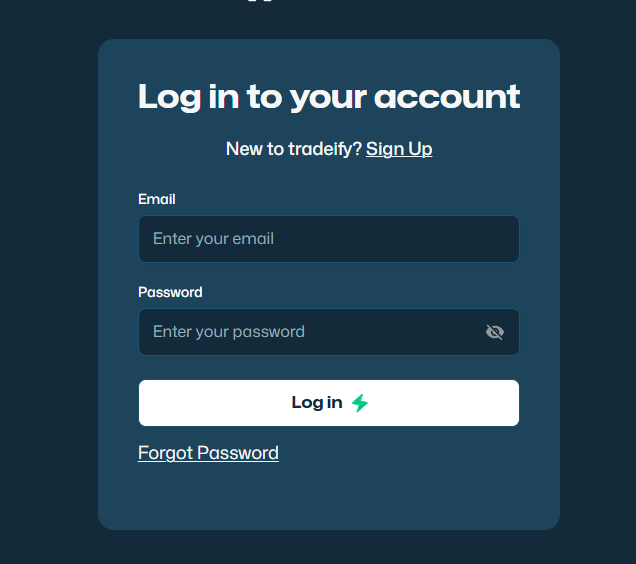

How to Get Started With Tradeify

Opening Account

- Go to the official website (Tradeify.com) click Sign Up to set up an account.

- Enter the requested email to set up a password. Make sure to check your email afterwards.

- Optional fields include name, location (country/region), time zone, and experience (trading, marketplace).

Available Account Selection.

- Tradeify has multiple accounts available (Advanced, Growth, and Straight-to-Sim Funded)

- Each account has different features, risk rules, and pricing. Select the account with the risk rules and features for your best trading approach.

- Use the free option available for a trial account to experiment with no cost.

Trade Integration.

- Automated Connection: Use Tradeify Connector to link your accounts on MT4, MT5, Ctrader, and other frequently used brokers.

- Manual Import: If your broker is unsupported, you can upload your trade history via a CSV file or Excel Worksheet.

- Make sure the trade details are included such as: entry and exit of the trade, lot size, and the profit or loss.

Trades Organization and Data Validation.

- Make sure all imported trades have the correct displayed details such as: missing symbols, timestamps, profit, and loss.

- You can delete copies or testing/demo trades if needed.

- Correctly align symbols if your broker has suffixes or different changes in naming.

Set Account and Risk Preferences

- Put in your account balance and its currency.

- Set risk parameters such as maximum risk per trade and daily draw down cap.

- Set commission and swap parameters for proper Profit and Loss rounding.

Customize Your Dashboard

- Select the widgets you want to show: equity curve and P/L summary or trade heatmap and such.

- You can organize your dashboard to highlight information that aligns with the most important metrics for your trading style.

- You can save the layout for easy access in later sessions.

Tag Trades and Add Notes

- Organize trades by the strategy you used on that trade (breakout, swing, or scalping).

- Add a note describing the required trade logic as well as the emotions and market conditions, if needed.

- This aids in the refinement in strategy reviews.

Account Types and Pricing

Advanced Accounts

For those who prefer structure and high difficulty. You trade under an intraday trailing drawdown with no daily loss limit, enabling quick advancement. If good enough, the challenge could be completed in a day.

- $50,000 Advanced Account: $99/month

- Reset Fee: $45

- After passing: $125 activation fee

Growth Accounts

For those who prefer a calmer and slower approach. These accounts accrue drawdown at the end of the day, making this perhaps the best fit for those who prefer a swing trading style as well.

- $100,000 Growth Account: $339/month

- Reset Fee: $169

- Activation: none

Straight-to-Sim Funded

Perfect for those confident enough to trade immediately. The challenge isn’t needed to access and you get instant, simulated capital.

- $100,000 Account: $629 (one time payment)

Every account type comes with different target and risk rules, and the price point makes sense with the features and assistance available.

Profit Splits and Payouts

Tradeify emphasizes prompt and reliable payment to all its traders.

For the first $15,000, the traders keep 100\% of the profits. Afterward, Tradeify keeps 10\% of profits while the traders retain 90\% in profits.

To receive a payment, the trader must:

- Trade for a minimum of 10 days.

- Follow the 20\% consistency rule in which one day’s profit must not exceed 20\% of the total profits.

Once these requirements are satisfied, the payment systems process payments in a reliable and fast manner.

Also, Tradeify lets one trade from up to five accounts at the same time which are a combination of Advanced, Growth, and Sim Funded types which gives the trader access to over $750,000 total. This provides a lot of versatility and the ability to trade freely.

Tradeify Fees

| Account Type | Account Size | Monthly / One-Time Fee | Reset Fee | Activation Fee |

|---|---|---|---|---|

| Advanced | $50,000 | $99 / month | $45 | $125 (after passing) |

| Growth | $100,000 | $339 / month | $169 | None |

| Straight-to-Sim Funded | $100,000 | $629 (one-time) | N/A | N/A |

Who Should Use Tradeify?

Prop Firm Traders

- Especially beneficial for those with upcoming challenges or evaluations.

- Assists with monitoring daily drawdowns, profit targets, and rule adherence.

- Provides analytics tailored to strengthening consistency and discipline.

Forex, Crypto and Indices Day Traders

- Most suited for active traders who execute numerous trades on a daily basis.

- Offers real-time analysis on win rate, R:R ratio, peak drawdown and performance trends.

- Assists in quickly pinpointing areas of strength and weakness in the fast-paced market.

Beginners Who Need Structure

- Newly joined traders will appreciate the seamless interface which streamlines the journaling process.

- Performance reports provide guidance and pinpoint areas of mistakes on the traders part.

- Data-driven insights provide support to build trading discipline from day one.

Swing Traders & Position Traders

- Provides the ability to assess long-term performance at intervals of weeks or months.

- Assists in the analysis of risk exposure, position sizing and multi-day setups.

- Offers long-term equity curve analysis and insights of the market behavior.

Strategy Developers & System Traders

- Ideal for verifying the historical performance of a trading strategy.

- Assists in the analysis of expectancy, consistency and the corresponding risk metrics.

- Offers optimization via tagging, note-keeping and pattern analysis.

Traders Looking For Improved Risk Management

- Monitors maximum risk per trade, drawdown periods, and emotional trading behaviors.

- Identifies oversized position and revenge trading behaviors.

- This is beneficial for traders aiming to improve self-discipline and minimize mistakes.

Traders With Multiple Accounts

- Perfect for people managing multiple funded accounts or trading in personal portfolios.

- Merges accounts in one dashboard for better data visualization and decision-making.

- Facilitates performance comparison across traded accounts, brokers, and strategies.

Anyone Interested in Fully Automated Trade Journaling

- Imports trades from MT4/MT5/cTrader and saves time.

- Prevents errors from manual logging.

- Provides charts, summaries, and insights for the week without any manual effort.

How Tradeify Works

Link a trading account

- Users link their accounts with MT4, MT5, cTrader or any of the supported brokers.

- Tradeify synchronously fetches current or past trades.

- Trade history can also be uploaded manually through CSV or Excel.

Automated Trade Tracking

- Tracking is done in real-time, detailing market entry, exit, volume, profit or loss, stop loss and take profit.

- Systematic trade categorizations are done by the system to log data without any input.

- This guarantees flawless and precise journal entries.

Smart Analytics & Performance Metrics

- The data is transformed into insights whereby Tradeify illustrates:

- Win rate

- Risk to reward ratio

- Profit factor

- Equity curve

- Drawdowns

- This assists the trader in pattern recognition, understanding their strengths and weaknesses.

Strategy tagging and Trade notes

- Users can categorize trades with specific tags per Strateg (Breakout, Scalping, Trend Pull-back)

- It enables distinct performance reporting for every strategy.

- Trade notes helps recollect emotions tied to the trade as well as reasoning.

Risk Management Analysis.

- Real-time risk management analytics are:

- Max risk per trade

- Daily/Weekly drawdown limits

- Quality of Position sizing

- It highlights dangerous patterns of excessive risk such as revenge trading or over-leveraging.

Prop Firm Challenge Tracking

- Tracking daily loss limits and drawdown, exact specifications, and completion criteria

- Designed for traders trying to obtain funded accounts

- Indicates whether your trading passes prop firm validator

Trade Replay & Chart Visualization

- Allows traders to rewatch their trades with chart visuals

- Assists in reviewing entry and exit points, timing, and overall market context

- Enhances future decision-making

Customizable Dashboard

- Users can create custom dashboards with widgets for

- P/L summary

- Equity graph

- Trade heatmap

- Performance by strategy

- All from one easy-to-read custom control panel

Automated Reports

- Reports for each week and month are generated automatically

- Best and worst days, top symbols, performance trends, and summary sent to users

- Reports can be found in the platform or sent as email notifications

Continuous Improvement Loop

- Tradeify can showcase traders their common mistakes

- Missed a clear entry, lacked the timing, or lost control of their strategy

- Assists users in systematically improving and approaching more advanced trading levels

Benefits of Using Tradeify

Improved Trading Discipline

- Structured journaling removes emotional decisions.

- Data-driven feedback encourages traders to stick to their plans.

- It helps reduce impulse and revenge trading.

Better Performance Insights

- Detailed metrics are provided such as: expectancy, win rate, profit factor, and equity curve.

- Assists in understanding behaviors and trading personalities.

- Illustrates what is working and what requires improvement.

Trade Tracking Automation

- Saves time by automatically importing trades from MT4, MT5, or cTrader.

- Everything is logged precisely without manual data entry.

- Trade logs are maintained without errors for record keeping.

Assists in Passing Prop Firm Evaluations

- Tracks target achievement, drawdowns, and maximum loss limits.

- Provided alerts notify users to close to rule violation.

- Increased consistency enhances the chance of funding.

Excellent Risk Management Options

- Recognizes oversized positions, dangerous setups, and loss patterns.

- Helps traders stick to risk-per-trade safety guidelines.

- Enhances the long-term stability and survival of the account.

Strategy Optimization

- Strategy comparison can be performed by tagging them to evaluate performance.

- Helps to hone in on the most successful strategies while getting rid of the least successful ones.

- ● Assists in the ongoing enhancement and adjustments of the system.

Tradeify Key Features

Automated Trade Import

- Connects to MT4, MT5, cTrader, and all the brokers we support.

- Automatically imports current and past trading records.

- No manual data entry to streamline and enhance accurate tracking.

Smart Trade Journaling

- Captures each trade in detail: entry/exit points, position size, profit/loss, timestamp, and additional notes.

- Maintains a neat and orderly searchable record of all your trading activities.

- Provides possibilities for manual updates and additional notes.

Performance Metrics & Analytics

- Features performance metrics including win rate, profit factor, expectancy, and drawdown.

- Illustrates performance data in the form of graphs and other visual aids.

- Assists in identifying and analyzing areas for improvement.

Customizable Dashboard

- Assemble your desired configuration with widgets like equity curves, profit/loss summaries, and heatmaps.

- Personal your preferred layout with a drag and drop interface.

- Allows multiple different layouts to be saved.

Strategy Tagging & Notes

- Organize trades by strategy type (trend, breakout, scalping, etc.).

- Include notes to preserve trade rationale and to document the mental state at the time of trading.

- Evaluate and analyze the performance across multiple strategies.

Risk Management Tools

- Monitors risk exposure per trade, position size, and weekly drawdown limits.

- Alerts of risky patterns such as large lot sizes.

- Encourages sustainable risk management discipline.

Prop Firm Challenge Tracker

- Users can input requirements for specific prop firm evaluations.

- Monitors real-time compliance with drawdown limits and targets.

- Gets notified when limits are close to being reached.

Trade Replay & Chart Visualization

- Replay past trades on chart view for a more detailed review.

- Analyze the timing of your entry and exit, and price action context.

- Visual playback to learn from mistakes more effectively.

Automated Weekly/Monthly Reports

- Performance summaries are automatically generated and sent to your inbox.

- Reports include best and worst metrics, average R:R, and growth trends.

- Review results without having to manually assess your performance.

Multi-Account Support

- Connect and monitor several trading accounts in a single interface.

- Compare results and performance across multiple accounts.

- Extremely beneficial for portfolio traders and professionals.

Pros & Cons of Tradeify

| Pros | Cons |

|---|---|

| Automated trade import from MT4, MT5, cTrader, and supported brokers | Some advanced features require paid subscription |

| Smart trade journaling with notes and tagging | No direct trade execution—only analytics |

| Detailed performance metrics (win rate, expectancy, profit factor, drawdown) | Learning curve for beginners to use all analytics effectively |

| Customizable dashboard with widgets | Limited mobile app functionality compared to web platform |

| Prop firm challenge tracking for funded accounts | Manual import needed for unsupported brokers |

| Trade replay and chart visualization for review | Some integrations may require API keys or EA setup |

| Risk management tools to monitor position sizing & drawdown | Advanced reports may be overwhelming for new traders |

| Automated weekly/monthly performance reports | Primarily focused on analytics, not strategy development |

| Multi-account support for portfolio monitoring | Internet connection required for real-time updates |

| Alerts & notifications for limits, targets, and P/L events | Certain advanced customization only available on higher-tier plans |

| Secure, read-only data access ensuring safety | Occasional delay in importing very large trade histories |

Is Tradeify Legit & Safe?

Tradeify is certified given the reputation Tradeify has as a proprietary trading firm, the reviews on Trustpilot indicate reputable reviews, and the reviews indicate the firm pays out steadily and is easy to reach. Almost all reviews demonstrate the paying out profit is seamless.

Tradeify does not have a primary market regulator, meaning they have no control over trade rules, and has a few complaints over customer service which are not out of the norm for prop trading firms. As is the case with any prop firm, it is important to do your own research about the terms and conditions to fully understand the the firm.

Conclusion

Tradeify is an incredible analytics and funded account platform catered to every trader beginner to advanced. What automates tracking trades is the industry leading fully automated trade logging and analytics complete with advanced performance record evaluations, provisional risk tracking and trade performance forecasting support, and advanced prop firm challenge support.

Their account offerings are so unique, while the industry mostly offers just one account type Tradeify offers Growth, Advanced, and Straight to Sim Funded. Tradeify is trusted with industry leading prompt payouts, multiple account support, and arguably the best platform of its kind. Tradeify is not fully regulated and might lack the reliability certifications industry leaders have, but from our experience is still the best platform to use to sharpen trading skills and efficiently manage capital.

FAQ

Yes, Tradeify is considered legitimate, with many traders successfully receiving payouts. However, it is not regulated by major financial authorities, so users should understand the terms and risks before joining.

Tradeify is a trading analytics platform and prop firm that provides funded accounts, automated trade tracking, performance analytics, and risk management tools for traders of all levels.

Yes, traders can operate up to five accounts simultaneously, combining Advanced, Growth, and Sim Funded types, allowing access to over $750,000 in total capital.