The Best Crypto Wallets for AML-Compliant Operations will be covered in this post. For organizations and companies, maintaining regulatory compliance is essential as digital assets increase.

To stop illegal conduct, AML-compliant wallets offer secure custody, transaction monitoring, and policy-driven controls. This article examines the best wallets that let businesses manage cryptocurrency assets while adhering to anti-money laundering regulations by combining robust security and transparency.

Why Use Crypto Wallets for AML-Compliant Operations

Regulatory Compliance: Adhere to anti-money laundering (AML) laws in all transactions to avoid legal and financial complications.

Transaction Tracking: Monitor and examine the transfer of digital assets in order to identify any suspicious or high-risk transactions.

Clear Audit Trail: Keep records of transactions and processes to assist with regulatory reporting, internal audits, and compliance checks.

Customizable Access Control: Secure operations with role assignments, whitelisting, and policy-based approvals.

Reputation and Asset Protection: Fraud, ML, and illicit transfer protection, and maintaining the institution’s reputation.

Regulatory Tool Integration: Utilize KYC, AML, and reporting tools for comprehensive supervision.

Key Point & Best Crypto Wallets for AML-Compliant Operations List

| Platform | Key Point |

|---|---|

| Anchorage Digital | Federally chartered crypto bank offering regulated, institutional-grade custody with integrated staking and governance. |

| BitGo Trust Company | Qualified custodian with multi-signature security, insurance coverage, and strong regulatory compliance for institutions. |

| Fireblocks | MPC-based wallet infrastructure enabling secure asset transfers, treasury management, and DeFi access at scale. |

| Gemini Custody | NYDFS-regulated custody platform emphasizing strong compliance, cold storage security, and institutional trust. |

| Coinbase Custody | SOC-compliant, insured custody solution with deep liquidity access and seamless integration with Coinbase ecosystem. |

| Kraken Custody | Institutional custody arm offering segregated cold storage, audited controls, and regulatory transparency. |

| Copper ClearLoop | Settlement network that reduces counterparty risk by enabling off-exchange trading without moving assets. |

| Qredo | Decentralized custody network using MPC and policy-based governance without reliance on private keys. |

| Ledger Enterprise | Hardware-backed enterprise wallet with role-based access control and secure key management. |

| Trezor Enterprise Solutions | Open-source, self-custody hardware wallets adapted for businesses prioritizing transparency and direct control. |

1. Anchorage Digital

Because Anchorage Digital is based on institutional-grade regulatory integrity, it stands out as one of the best cryptocurrency wallets for AML-compliant operations. In contrast to conventional self-custody systems, Anchorage integrates native compliance workflows that facilitate identity verification, transaction screening, and real-time monitoring to identify and stop illegal conduct with secure digital asset custody.

Its architecture helps organizations comply with strict AML and audit regulations by enforcing policy-based approvals and integrating easily with compliance teams. The platform is especially well-suited for businesses that need to manage digital assets while adhering to changing regulatory norms because of its combination of strong security, clear controls, and proactive compliance automation.

Anchorage Digital Features, Pros & Cons

Features

- Federally chartered bank offering crypto WITH integrated AML/KYC.

- Qualified custody that ensures compliance with US regulations.

- Governance and staking on-chain support.

- Audit logs and compliance-ready reporting.

- Enterprise risk systems APIs.

Pros

- Regulatory and AML control is strong.

- Compliance reporting is integrated.

- Audit support is institutional.

- Governance support includes staking.

- Layered custody ensures asset safety.

Cons

- Jurisdictional permits are limited.

- Service fees can be expensive.

- Self-custody is not available.

- There is time onboarding.

- DeFi automation is less flexible.

2. BitGo Trust Company

Because BitGo Trust Company combines enterprise-grade security with integrated compliance accountability designed for institutional demands, it is regarded as one of the best cryptocurrency wallets for AML-compliant operations.

Organizations may impose stringent controls on address whitelisting, transaction thresholds, and expenditure limits thanks to its multi-signature and policy-driven architecture, all of which are in line with AML risk management procedures.

BitGo’s strong auditability and open governance structure, which streamlines compliance reporting and facilitates regulatory inspections, are what make it unique. BitGo’s design guarantees robust risk mitigation and operational clarity in regulated contexts for institutions that need secure asset custody in addition to strict AML monitoring.

BitGo Trust Company Features, Pros & Cons

Features

- Qualified Custodian with strong AML/KYC blocking.

- Multi-signature security architecture.

- Tools for real time transaction monitoring.

- Insurance for digital assets.

- Reporting + Enterprise APIs.

Pros

- Tools for compliance and AML are exhaustive.

- Cold storage is partnered with warm access.

- Support for institutions is broad.

- Custom alerts and tracking for risk.

- Insurance adds an extra layer of trust.

Cons

- Less flexibility than an MPC platform in the policy workflows.

- This may end up being expensive for smaller businesses.

- Less integration with DeFi.

- More work to implement.

- More work to onboard with compliance checks.

3. Fireblocks

Because it provides safe, institutional-grade infrastructure that integrates compliance controls directly into asset movement processes, Fireblocks is regarded as one of the finest cryptocurrency wallets for AML-compliant operations.

Organizations can implement AML-centric regulations like transaction limits, approved counterparty lists, and real-time risk checks thanks to its customized policy engines and multi-party computation (MPC) key management, which guarantees that there is no single point of compromise.

Additionally, Fireblocks connects with compliance tools and offers thorough audit trails, allowing compliance teams to see each movement. Fireblocks are particularly useful for organizations looking to manage digital assets under AML regulatory frameworks because of their excellent cryptographic security, flexible governance, and transparency.

Fireblocks Features, Pros & Cons

Features

- Wallet frameworks based on MPC

- Policy compliance and AML friendly policies

- Automated procedure workflows with compliance checks

- Support for multiple assets and blockchains

- Transaction governance logs

Pros

- Solid AML control on transactions

- Enterprise grade policies plus governance on approval workflows

- Good integration environment

- Support for DeFi and institutional trading

- MPC provides more security for the keys

Cons

- More challenging for smaller teams

- Not all jurisdictions operate with custodians

- More expensive

- More work to train on workflows

- Custody is done through service providers

4. Gemini Custody

Because Gemini Custody integrates regulatory compliance into every aspect of its service, from onboarding to transaction execution, it is among the top cryptocurrency wallets for AML-compliant operations.

In order to stop money laundering at its source, its governance system incorporates stringent identification verification and continuous surveillance that spots odd or dangerous conduct. Gemini’s unique blend of active compliance oversight and secure cold storage procedures guarantees that assets are maintained securely while adhering to stringent reporting and audit requirements.

Gemini Custody provides a dependable, legal solution that satisfies regulatory requirements for organizations that need to strike a balance between transparent, rules-based AML controls and secure custody.

Gemini Custody Features, Pros & Cons

Features

- Custody under NYDFS supervision with enforcement of AML

- Cold storage with insurance.

- Audit trails ready for compliance

- Integrations with the AML of exchanges

- Reporting tools for institutions

Pros

- NYDFS backed with strong AML/KYC supervision

- Insurance provides extra protection for the assets

- Great for regulated institutions and funds

- Compliance is easy to document

- Simple with trading operations

Cons

- Less automation of policies versus MPC

- Lag in asset support

- There is a fee for the service of custody

- Not intrinsic to DeFi

- Less done with workflows

5. Coinbase Custody

Because Coinbase Custody combines institutional-grade security with extensive compliance frameworks that assist firms in meeting regulatory obligations, it is often considered one of the best cryptocurrency wallets for AML-compliant operations.

Its infrastructure is designed to implement AML-centric standards including address whitelisting, counterparty screening, and real-time activity tracking in addition to supporting comprehensive transaction monitoring.

Compliance teams can effectively manage risk across asset movements thanks to Coinbase Custody’s smooth interaction with more comprehensive compliance tools and reporting systems. Institutions can operate with confidence in difficult regulatory contexts because to a mix of proactive AML measures, transparent auditing, and robust governance.

Coinbase Custody Features, Pros & Cons

Features

- KYC/AML fusion with Coinbase Compliance stack

- Cold Storage with Insurance

- Regulated Qualified Custodian (Multiple Jurisdictions).

- Enterprise Analytics & Audit Trails

- Institutional APIs

Pros

- Robust global regulatory compliance

- Integration with Coinbase Exchange AML services

- Extensive asset coverage

- Streamlined institutional onboarding

- Cold vault storage

Cons

- Workflow Policies are less Flexible than MPC-based

- Not Suitable for Decentralized DeFi

- Premium services can involve high costs

- Limited external integrations

- Workflows are not as defined

6. Kraken Custody

Because it combines safe asset storage with compliance-focused safeguards designed for institutional risk environments, Kraken Custody is regarded as one of the best cryptocurrency wallets for AML-compliant operations.

Its custody system places a strong emphasis on careful record-keeping and segregated asset holdings, providing compliance teams with clear access to transaction histories that are crucial for AML supervision.

Kraken Custody’s organized approach to compliance integration, which incorporates features like audit trails, counterparty verification, and transaction monitoring into the main service, is what sets it apart. Institutions may reliably manage digital assets while adhering to AML regulations thanks to this emphasis on accountability, transparency, and safe governance.

Kraken Custody Features, Pros & Cons

Features

- AML/KYC compliance for institutional clients

- MPC + HSM security

- Role‑based permissions and reporting

- Connected trading and staking services

- Audit‑ready logs

Pros

- Compliance‑focused custody with reporting

- Competitive pricing

- Strong security architecture

- Integrated trading paths

- Good for compliant funds

Cons

- AML tooling less advanced than exchange platforms

- Policy automations secondary to MPC

- Asset list more limited than some peers

- Requires compliance integration

- Less DeFi automation

7. Copper ClearLoop

Copper Because it combines secure custody with on-chain settlement restrictions that lower compliance risk across trading workflows, ClearLoop is regarded as one of the best options for AML-compliant cryptocurrency operations.

Although ClearLoop is a settlement network that links institutional custodians, its architecture supports AML control by enforcing stringent transaction governance, counterparty verification, and secure asset movement standards.

The capacity of ClearLoop to settle trades outside conventional exchanges with complete visibility into counterparty data and audit trails, allowing compliance teams to track and record each transfer, is what sets it apart. Institutions are able to maintain good AML compliance throughout digital asset operations because to this transparency and solid custody integration.

Copper Features, Pros & Cons

Features

- Professional custody with KYC/AML integration

- AML compliance Dashboards

- Key management via MPC (with integration of ClearLoop)

- Multi-approval parties

- APIs for enterprises

Pros

- Robust AML and reporting capabilities

- MPC and institutional security solutions

- Adaptable compliance processes

- Suitable for enterprise integration

- Treasury services with advanced capabilities

Cons

- Smaller ecosystem than leading providers

- Price may be on the higher side

- Can take time to onboard

- Limited DeFi integration

- Less recognized outside institutions

8. Qredo

Because it combines decentralized key management with enterprise-grade governance and compliance visibility, Qredo is regarded as one of the best cryptocurrency wallets for AML-compliant operations.

Single-point private key risk is eliminated via its distributed multi-party computation (dMPC) technology, which also allows enterprises to implement AML-aligned policies including role-based approvals, transaction whitelisting, and thorough audit logs.

Qredo’s mix of cross-chain functionality and policy enforcement, which provides compliance teams with organized control of asset transfers without compromising flexibility, is what makes it so effective. While managing digital assets across several blockchain ecosystems, this open, rule-driven method assists institutions in maintaining robust AML controls.

Qredo Features, Pros & Cons

Features

- Network of Decentralized MPC

- Compliance checks cross-chain

- Multi-sig & governance

- Audit and Monitor transactions

- Connectivity DeFi

Pros

- Custody decentralization with filtering of AML

- Govern workflows strong

- Support cross-chain

- Access DeFi under control of policy

- Logs transparency

Cons

- Bank-regulated not everywhere

- Tools of AML emerging

- Learning curve requires

- Network Dependence

- Less Traditional Custody Integration

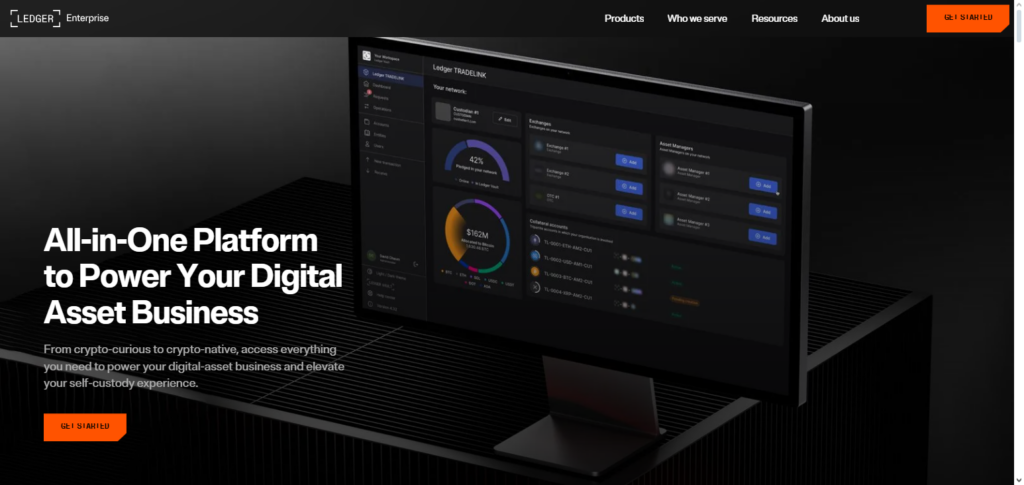

9. Ledger Enterprise

For companies and organizations seeking self-custody with governance controls and compliance tools, Ledger Enterprise is an enterprise-grade hardware-secured wallet infrastructure.

Ledger Enterprise’s SOC-certified solutions and integration with compliance partners, like blockchain analytics providers, assist businesses in implementing AML/KYT procedures and audits while retaining ownership over private keys, even if it is not a custodial service.

It is one of the greatest cryptocurrency wallets for AML-compliant corporate and institutional self-custody where regulatory adherence is crucial because of features like role-based access, policy enforcement, and audit trails.

Ledger Enterprise Features, Pros & Cons

Features

- Isolation of keys that are hardware-based

- Enforcement of policies while offline

- Permissions based on role

- Connection to corporate AML systems

- Workflows for signing that are secure

Pros

- Maximum isolation from online threats.

- Strong internal policy control.

- No risk from third-party custodians.

- Reliability of hardware.

- Good for compliance on-premise.

Cons

- Not a regulated custodian.

- External AML systems.

- Overhead for integration.

- Support for DeFi is limited.

- An internal operations team is needed.

10. Trezor Enterprise Solutions

For companies that place a high priority on direct custody and compliance assurance, Trezor Enterprise Solutions provides open-source hardware wallet systems tailored for commercial use with transparent security and private key control.

Enterprise implementations of hardware wallets can interact with secure governance policies and compliance reporting systems to help fulfill organizational and regulatory needs, even if hardware wallets do not automatically perform AML/KYC monitoring.

Trezor’s enterprise strategy continues to be a fundamental choice among the top cryptocurrency wallets for AML-compliant self-custody environments for companies that prioritize control and transparency in addition to AML-aligned operating practices. (Note: for complete AML coverage, hardware wallets need additional compliance infrastructure.)

Trezor Enterprise Solutions Features, Pros & Cons

Features

- Control of offline hardware keys

- Workflows for enterprise of policy

- Partnerships for integration of AML processes

- Authorization of secure transactions

- Layering of corporate governance

Pros

- Custody of self and keys that are isolated

- Control of governance that is clear

- No risk from custodians

- Good for operations of treasury.

- Pathways for audits that are transparent.

Cons

- Support for AML dependent on external tools.

- No backing from a native regulator.

- Linkage to exchanges is limited.

- DeFi capabilities are limited.

- Not a complete solution for AML.

Conclusion

To choose the finest cryptocurrency wallet for AML-compliant operations, security, transparency, and regulatory compliance must be balanced. From advanced custody infrastructure and policy-driven transaction controls to decentralized key management and audit-ready workflows, institutional solutions such as Anchorage Digital,

BitGo Trust Company, Fireblocks, Gemini Custody, Coinbase Custody, Kraken Custody, Copper ClearLoop, Qredo, Ledger Enterprise, and Trezor Enterprise each offer distinct advantages. Their emphasis on stopping illegal conduct, facilitating transaction monitoring, and offering complete compliance visibility is what binds them together.

By utilizing virtual wallets, businesses may safely handle digital assets while adhering to strict AML regulations, protecting money and reputation in the rapidly changing cryptocurrency market.

FAQ

An AML-compliant crypto wallet integrates transaction monitoring, identity verification, counterparty checks, and audit trails to prevent money laundering and meet regulatory standards. It ensures all asset movements follow established rules and policies, giving institutions transparency and accountability.

Top wallets include Anchorage Digital, BitGo Trust Company, Fireblocks, Gemini Custody, Coinbase Custody, Kraken Custody, Copper ClearLoop, Qredo, Ledger Enterprise, and Trezor Enterprise Solutions due to their institutional-grade security, compliance controls, and regulatory alignment.

They provide tools like policy-driven approvals, transaction monitoring, role-based access, whitelisting, and detailed audit logs. These features allow organizations to detect suspicious activity, maintain compliance records, and report to regulators when required.

Yes, when integrated with enterprise governance and compliance systems. While they provide self-custody and secure key management, AML compliance is ensured through connected monitoring tools and structured transaction policies.

Yes. Platforms like BitGo, Fireblocks, and Coinbase Custody offer a combination of hot and cold storage with built-in compliance controls, while hardware wallets like Ledger Enterprise and Trezor Enterprise focus on secure cold storage with governance overlays.