The Best Crypto Wallets for EU-Regulated Crypto Businesses will be covered in this post. Institutions must select the appropriate wallet in order to manage digital assets securely and in accordance with EU legislation.

We will examine leading solutions, emphasizing their security, compliance features, and appropriateness for institutional cryptocurrency operations, including MetaMask Institutional, Ledger Enterprise, BitGo Europe, Fireblocks EU, and more.

How to Choose the Right Wallet for Your EU-Regulated Business

Security – wallets that protect your assets with ‘‘cold storage’’ or high level encryption; wallet options include multi-signature or MPC technology.

Compliance – with European regulations, ensure that the wallet provides appropriate AML/KYC, transaction monitoring, audit, and compliance controls for your business.

Compatibility – wallets that fit your organization’s business model and support the crypto currencies, stable coins, and tokenized assets, as well as the custom tokens your company uses.

Integration – assess if the wallet is able to integrate with various trading systems, treasury systems, DeFi tools, and accounting software.

User Access and Governance – for multi-user organization, consider the role-based access, policies, controls and approval processes.

Insurance and Risk Management – select wallets where the company offers risk mitigation and insure of the assets stored in the wallet.

Assistance and Usability – assess the usability of the interface, support provided, and the onboarding for large companies or institutions.

Benefits of Using EU-Compliant Crypto Wallets

Regulatory compliance: Minimizing legal and regulatory risk on the firm’s side, implications of EU’s AML, KYC, and GDPR are factored in.

Risk Mitigation: Institutions are shielded from losing custodial assets since many wallets provide insurance protection.

Operational Efficiency: Mistakes are less likely to happen when automating reports, and, combined with internal systems that mesh with trading desks, provide a time saving streamlining of workflows.

Auditability and Transparency: Internal governance and monitoring of transactions provide a clear auditable trail to regulators.

Access to Institutional DeFi and Tokenization: Regulated players can safely access modern digital asset ecosystems, including tokenized assets and decentralized finance.

Support of Multiple Assets: Viable control of a compliant crypto wallet platform with various tokens and different crypto assets.

Enhanced Security: Your asset are safer from hacks, internal and otherwise, with the use of cold storage, MPC technology, and multi-signature wallets.

Key Point & Best Crypto Wallets for EU-Regulated Crypto Businesses List

| Wallet / Platform | Key Points |

|---|---|

| MetaMask Institutional (MMI) | Enterprise-grade wallet with multi-signature support, advanced governance, and DeFi access; compliant with EU regulations for institutional clients. |

| Ledger Enterprise / Ledger Live | Hardware wallet with secure key management, offline storage, and multi-asset support; integrates Ledger Live for EU institutions with compliance tools. |

| BitGo Europe | Institutional custody with multi-sig security, insurance coverage, and compliance automation; EU-regulated services for digital asset custody. |

| Coinbase Wallet (EU version) | Self-custodial wallet with EU compliance, transaction monitoring, and integration with Coinbase Exchange; suitable for institutional investors. |

| Fireblocks EU | Secure digital asset transfer and custody platform with MPC (multi-party computation) security, compliance automation, and EU regulatory alignment. |

| Copper ClearLoop EU | Institutional custody with segregated accounts, compliance controls, and secure off-chain settlement; designed for EU-regulated entities. |

| Metaco Harmonize | Enterprise-grade custody and tokenization platform with workflow automation, compliance tools, and EU regulatory support for banks and institutions. |

| Qredo EU | Decentralized custody with multi-signature and MPC technology, instant settlement, and EU compliance for institutional clients. |

| Zengo Business EU | Cloud-based multi-asset wallet with MPC security, compliance monitoring, and EU-focused institutional features. |

| Matrixport Custody EU | Institutional-grade custody with cold and hot storage, insurance options, and EU compliance support for corporates and funds. |

1. MetaMask Institutional (MMI)

For institutional investors that require safe access to DeFi and digital assets, MetaMask Institutional (MMI) provides a strong solution.

It incorporates enterprise-level security features including granular permission management, policy enforcement, and multi-signature approval. Institutions can comply with regulations thanks to MMI’s real-time risk alerts and integration with top analytics platforms.

This article will discuss why MMI is one of the Best Crypto Wallets for EU-Regulated Crypto Businesses, offering a smooth balance between accessibility and compliance while enabling businesses to effectively manage treasury assets and securely engage with decentralized finance ecosystems.

MetaMask Institutional (MMI) Features

- Enterprise-Grade Security: utilizes firm wallet access and approval controls through multi signature wallet access.

- DeFi & Web 3 Access: Provides institutional access to decentralized finance and smart contract programming.

- Governance & Permissions: Offers varied access through role assignment to reduce the risk of unapproved actions.

- Real-Time Alerts: Alerts for unusual activities to assist in maintaining compliance and operational awareness.

- Integration Support: Offers additional oversight through configuration with analytics and risk monitoring programs.

Pros & Cons MetaMask Institutional (MMI)

Pros

- Enterprise Security: Your assets are protected with an external multi-sig custody solution and policies.

- DeFi Access: Your enterprise can connect with decentralized protocols.

- Analytics: Access to integrated analytics and other risk management tools.

- Custom Roles: Different roles can be assigned to users.

- Regulatory Controls: Risk alerts help keep you compliant.

Cons

- Not Full Custody: Solutions for custody are external.

- DeFi Risks: Access to protocols can lead to smart-contract threats.

- Time Consuming: Setting up everything for an enterprise takes time.

- No Asset Insurance: Insurance on assets is available for purchasing.

- Difficult to Understand: New users face an overwhelming abundance of tools.

2. Ledger Enterprise / Ledger Live

With the Ledger Live and Ledger Enterprise combination, institutions have an option that provides security and compliance with hardware custody solutions. Live’s cold storage integrates with devices that keep the private keys offline, and provides features for portfolio management and transactions as well as controls for multiple users.

Apart from the EU regulatory compliant offline approvals and EU regulatory compliant secure signing, Ledger Enterprise also provides offline approvals and multi-asset storage.

For organizations looking for operational efficiency and maximum security, Ledger Enterprise is ideal, offering them and their regulators/insurers peace of mind that there is a robust governance, clear audit trail and safely stored assets for operational efficiency.

Ledger Enterprise / Ledger Live Features

- Cold Storage Security: Hardware wallet keeps the private keys to the crypto wallets offline, eliminating exposure to online security threats.

- Ledger Live Management: Provides the ability to manage the portfolio by tracking the transactions and controlling user access.

- Multi-Asset Support: Supports a broad variety of cryptocurrencies and tokens.

- Audit Trail: Supports compliance reviews by providing detailed records of the blockchain and logs in Ledger Live.

- Role-Based Approvals: Multi-user governance features allow teams to securely sign off transactions.

Pros & Cons Ledger Enterprise / Ledger Live

Pros

- Offline Key Storage: The hardware is secure, and you won’t get hacked.

- More than One Asset: There are many cryptos and tokens you can use.

- Audit Trails: Every transaction leaves a trace.

- User Controls: There are a few governance ways for multiple users.

- Strong Reputation: There is a lot of trust when it comes to hardware custody.

Cons

- Physical Devices Needed: The hardware has to be distributed in a secure way.

- Compliance not in Real Time: There are not a lot of tools for monitoring compliance and AML integrated.

- Manual Processes: Some tasks you have to sign manually.

- Team Collaboration Limits: For big groups, it is not very flexible.

- Less DeFi: Access to DeFi is limited

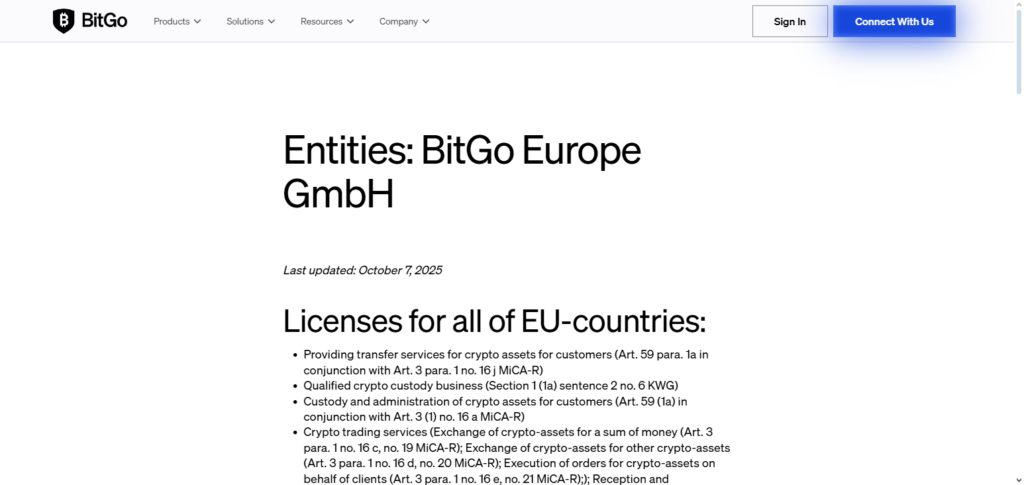

3. BitGo Europe

Institutional-grade digital asset custody with cutting-edge security, insurance coverage, and compliance automation customized to EU requirements is provided by BitGo Europe. To safeguard assets while adhering to legal requirements, it makes use of multi-signature wallets, policy controls, and real-time transaction monitoring.

For effective transfers, BitGo interfaces with trading platforms and offers a large variety of cryptocurrencies. Acknowledged as one of the Best Crypto Wallets for EU-Regulated Crypto Businesses, it enables organizations to guarantee transparent, auditable custody of digital assets, optimize compliance workflows, and lower operational risk. Banks, asset managers, and regulated trading companies all use its reliable platform extensively.

BitGo Europe Features

- Multi Signature Wallets: Extra protection by splitting control of key shares.

- Custody Insurance: Optional insurance to protect against external losses.

- Compliance Automation: Integrated features for automating AML/KYC collection and reporting.

- 24/7 Monitoring: Monitoring of transactions and risk on 24/7 basis.

- API Integrations: Easy connection to trading desks and other systems.

Pros & Cons BitGo Europe

Pros

- Multi-Signature Security: Excellent protection for user assets.

- Insurance Options: Users can secure their custody with insurance.

- Compliance Tools: Support for AML/KYC workflows.

- Institutional APIs: Straightforward integration with other trading systems.

- 24/7 Monitoring: Constant monitoring of all the risks.

Cons

- Costly Fees: High prcied enterprise pricing.

- Complex for Small Teams: Generally better for large businesses.

- Custody Only: A trade functionality with few integrated features.

- Onboarding Time: KYC/AML can take a while.

- User Interface: Users without expertise may find it complicated.

4. Coinbase Wallet (EU version)

Coinbase Wallet (EU version) is focused on self-custody solutions that emphasize compliance with European Union (EU) regulations. This solution enables institutions to manage private keys, execute on-chain transactions, and connect with Coinbase Exchange for asset management.

Identity verification, policy compliance, and transactional security features are integrated for alignment with EU regulations on digital assets. Coinbase Wallet is ranked among the Best Crypto Wallets for EU-Regulated Crypto Businesses because it gives custodial access to corporate treasury stakeholders and institutional investors, allowing them to manage and secure their digital asset holdings, control their private keys, and safely access blockchain networks.

Coinbase Wallet (EU Version) Features

- Self Custody Capability: Users lock their own private keys, which mitigates risks from external parties.

- EU Regulatory Alignment: Designed to help meet EU compliance needs.

- Smooth Exchange Integration: Seamless transfers from and to Coinbase institutional services.

- User Friendly Design: Custody and transactions are straightforward.

- Multi Asset Support: A broad range of cryptocurrencies and tokens are supported.

Pros & Cons Coinbase Wallet (EU version)

Pros

- Self-Custodial: Users manage the keys.

- Exchange Synergy: Excellent integration with Coinbase Exchange.

- Regulatory Compliance: Solution is tailored for EU regulations.

- User Experience: The design is user-friendly.

- Multi-Asset Support: Users can access many cryptocurrencies.

Cons

- Self-Custody Risk: Users losing their keys is a risk.

- Dependent on Coinbase Policies: Users may experience issues because of changes Coinbase makes.

- Limited Institutional Tools: Lack of enterprise-level governance tools.

- No Hardware Layer: Keys only exist in the software.

- Basic Reporting: Fewer tools for auditing.

5. Fireblocks EU

Fireblocks EU is focused on custody and transfer solutions for enterprises that apply multi-party computation (MPC) technology to secure digital assets.

It enables institutions to transfer assets to and from wallets and exchanges rapidly and securely, automating compliance and providing transfer insurance. For operational efficiency, Fireblocks interfaces with treasury management software and trading systems.

It is regarded among the Best Crypto Wallets for EU-Regulated Crypto Businesses because it allows institutions to maintain asset fungibility within the EU when it comes to the regulations on financial transparency, risk management, and digital assets compliance.

Fireblocks EU Features

- MPC Key Management: Multi Party Computation (MPC) secures keys without central repository.

- Fast Asset Transfer: Quick transfers between institutional accounts.

- Policy & Compliance Controls: Built-in compliance and monitoring for EU regulations.

- Insurance Available: Optional insurance for assets in custody.

- Treasury Integrations: Integrates with exchanges, liquidity providers, and reporting.

Pros & Cons Fireblocks EU

Pros

- MPC Security: Always distributed.

- Fast Transfers: Rapid intracompany transfers.

- Compliance Automation: Embedded monitoring.

- Integration-Ready: Connects with exchanges & liquidity providers.

- Insurance Available: Optional coverage on assets.

Cons

- Higher Price Tier: The enterprise expense can be substantial.

- Complex Onboarding: Integration can be a lengthy process.

- Tech‑Focused UI: More difficult for new users to grasp.

- Support Wait Times: Support for enterprise can be inconsistent.

- Overkill for Small Teams: More suitable for larger organizations.

6. Copper ClearLoop EU

Copper ClearLoop EU is designed with institutional clients in mind. It comes with a custody solution with segregated accounts, compliance workflows, and off-chain settlement features.

With multi-signature wallets and enhanced key custodianship, its platform prioritizes security, although it allows for rapid trade and transfer execution. With integrated risk and compliance reporting, it stands out among the Best Crypto Wallets for EU-Regulated Crypto Businesses.

For asset managers, hedge funds, and sanctioned trading companies, the unique blend of security, compliance, and operational effectiveness makes the Copper ClearLoop exceptional for primary custodial relationships. It enables regulated institutions to monitor the trade against the EU guidelines without losing liquidity and speed.

Copper ClearLoop EU Features

- Segregated Accounts: Retains the separation of client assets for audit and compliance purposes.

- Off-Chain Settlement: Efficient settlement without on chain fees for every transaction.

- Multi-Signature Security: Additional layers of authorizations for institutional transactions.

- Risk Monitoring Tools: Insights in real-time and compliance reporting.

- Trading Integration: Compatibility with trading desks and portfolio systems.

Pros & Cons Fireblocks EU

Pros

- MPC Security: Always distributed.

- Fast Transfers: Rapid intracompany transfers.

- Compliance Automation: Embedded monitoring.

- Integration-Ready: Connects with exchanges & liquidity providers.

- Insurance Available: Optional coverage on assets.

Cons

- Higher Price Tier: The enterprise expense can be substantial.

- Complex Onboarding: Integration can be a lengthy process.

- Tech‑Focused UI: More difficult for new users to grasp.

- Support Wait Times: Support for enterprise can be inconsistent.

- Overkill for Small Teams: More suitable for larger organizations.

7. Metaco Harmonize

A platform for tokenization and digital asset custody designed for regulated financial institutions is called Metaco Harmonize. It enables banks and asset managers to effectively manage cryptocurrency holdings by providing workflow automation, compliance tools, and secure key management.

With capabilities like transaction monitoring, audit reporting, and policy enforcement, Harmonize guarantees compliance with EU regulations.

Acknowledged as one of the Best Crypto Wallets for EU-Regulated Crypto Businesses, it connects blockchain ecosystems with traditional finance, offering a safe environment for digital assets and allowing institutions to create, store, and trade tokens while complying with strict regulations.

Metaco Harmonize Features

- Custody with Tokenization: Supports custody and token issuance functions.

- Workflow Automation: Manual compliance processes are considerably lessened through built in automations.

- Regulatory Reporting: Customized reporting tools assist in meeting legal obligations of the EU.

- Secure Key Management: Enterprise level protections for keys of high sensitivity.

- Institutional Focus: Tailored for banks and other regulated financial institutions.

Pros & Cons Metaco Harmonize

Pros

- Workflow Automation: Less manual work for compliance.

- Tokenization Support: Tools for tokenized assets are built in.

- Secure Custody: Key controls for enterprise.

- Audit & Reporting: Advanced reporting for compliance.

- Bank Integration: Tailored for banks.

Cons

- Enterprise Complexity: Not friendly for beginners.

- Higher Implementation Cost: Substantial service configuration expense.

- Niche Focus: Primarily for large banks and institutions.

- Limited DeFi Access: Custody focus, not market access.

- Lengthy Onboarding: Extensive regulatory requirements.

8. Qredo EU

Qredo EU offers a differentiated solution in custody with instant settlement capability based on decentralization and multi party computation (MPC). With the platform’s custody solution, clients are able to operate with the safety of a multi-signature wallet and the efficiency of a decentralized network.

This enables institutions to self-custody asset management. Qredo’s suite of tools, including monitoring, regulation, and reporting, ensures compliance to EU standards.

Ranked among the Best Crypto Wallets for EU-Regulated Crypto Businesses, Qredo provides a custody solution that addresses concerns pertaining to scalability, transparency, and custody along with rapid decentralized processes to corporate treasury along with funds the ability to store, transfer, and settle their assets in a safe and rapid manner.

Qredo EU Features

- Decentralized MPC Custody: Private key management that is distributed on a decentralized basis.

- Instant Settlement: Qredo provides a real-time transaction settlement in the network.

- Compliant Reporting Tools: Tools integrated within for AML audit assistance and compliance reporting.

- Multi-Asset Support: Supports a wide variety of cryptocurrencies and other tokens.

- API Connectivity: Connects with institutional trading and reporting systems, and treasury systems.

Pros & Cons Qredo EU

Pros

- Decentralized Custody: Uses MPC + layered distribution.

- Instant Settlement: Rapid transfer capabilities.

- Compliance Tools: Integrated monitoring and compliance reports.

- Multi-Asset Support: Variety of digital assets available.

- Institutional API: API access is straightforward.

Cons

- Emerging Tech Risks: New technology that requires adjustment over time.

- Complexity: Advanced decentralized structures can be hard to understand.

- Limited Awareness: Less market penetration than old school competitors.

- Varying Support Availability: Support Altered by region.

- Pricing: Pricing for enterprises can be high.

9. Zengo Business EU

The Zengo Business EU multi asset wallet is also cloud based, with security based on MPC, fully eliminating single point of key compromise. It has features such as compliance monitoring, transaction approval, and role based access control, all of which provide it with the capability to cater to EU regulated institutions.

Zengo Business has also, deservedly, been recognized among the Best Crypto Wallets for EU-Regulated Crypto Businesses. Zengo Business offers enterprises the ability to seamlessly manage digital assets, along with the peace of mind that all access policies are fully compliant, auditable, and protected keyed assets.

Zengo Business EU Features

- Cloud MPC Security: Multi-factor authentication and keyless signing provide asset protection.

- User Management: Team access is role based with approval levels.

- Compliance Monitoring: Tools integrated report on compliance and monitor activity that is suspicious.

- Streamlined Onboarding: Seamless interface and configuration for business users.

- Multi-Asset Management: Compatible with all major crypto and tokens.

Pros & Cons Zengo Business EU

Pros

- MPC Cloud Security: Signing without keys, a model.

- User Experience: Adoption is simple for the organization.

- Risk Monitoring: Risk assessments included.

- Role-Based Access Control: Administrative controls for teams.

- Multi-Asset Support: Support for many cryptocurrencies.

Cons

- Cloud Signing: Digital signing requires an internet connection.

- Limited Insurance: Patrol not as robust as some custodians.

- Reduced Ecosystem: Integrated services are not as diverse as smaller competitors.

- Enterprise Features: Less than the best of the top competitors for enterprises.

- Support Maturity: Enterprise support needs to be enhanced.

10. Matrixport Custody EU

Matrixport Custody EU provides insurance-backed compliant custody services to enterprises, offering both cold and hot storage options. Institutional players such as corporates, funds, and banks can take advantage of custodial services across a variety of digital assets.

Performing custodial services within the outlined regulations for EU institutions, Matrixport provides compliant payment gateways and transaction monitoring.

As one of the Best Crypto Wallets for EU-Regulated Crypto Businesses, Matrixport Custody balances accessible and fortified EU regulatory custodial services, audit requirements, and industry best practice adherence, enabling institutions to operate large portfolios efficiently.

Matrixport Custody EU Features

- Hybrid Storage: Integration of both cold and hot wallets for a balance of security and access.

- Insurance Coverage: Provides optional insurance on assets held in custody.

- Risk & Compliance Tools: Includes features like compliance audit logs and reports.

- Broad Asset Support: Custody of various tokens and institutional assets.

- Institutional Integrations: Compatible with enterprise reporting and risk management systems.

Pros & Cons Matrixport Custody EU

Pros

- Cold + Hot Storage: Custody service offers a choice of security methods.

- Insurance Coverage: Custody insurance protection is available.

- Regulatory Fit: Built for compliance with EU regulations.

- Broad Asset Support: A wide variety of coins.

- Institutional Tools: Governance and reporting tools.

Cons

- Fees: Custody fees can be quite high.

- Platform Familiarity: Not as widely used as some competitors.

- Onboarding Requirements: Compliance checks from the EU prolong the onboarding process.

- Fewer DeFi Integrations: Custody is their primary focus.

- Support Limitations: Support options can be limited based on your location.

Conclusion

For organizations subject to EU regulation, selecting the best cryptocurrency wallet is essential since security, compliance, and operational effectiveness cannot be compromised.

Because they combine strong security features, regulatory compliance, and easy-to-use management tools, platforms like MetaMask Institutional, Ledger Enterprise, BitGo Europe, Coinbase Wallet EU, Fireblocks EU, Copper ClearLoop EU, Metaco Harmonize, Qredo EU, Zengo Business EU, and Matrixport Custody EU stand out as the Best Crypto Wallets for EU-Regulated Crypto Businesses.

In today’s changing cryptocurrency economy, these wallets enable institutions to safely store, transfer, and manage digital assets while adhering to stringent EU rules, guaranteeing transparency, auditability, and risk mitigation.

FAQ

A wallet suitable for EU-regulated businesses must offer enterprise-grade security, regulatory compliance tools, transaction monitoring, and auditable reporting. It should support multi-signature or MPC key management, insurance coverage, and seamless integration with trading or treasury systems to meet EU standards.

The top options include MetaMask Institutional (MMI), Ledger Enterprise, BitGo Europe, Coinbase Wallet EU, Fireblocks EU, Copper ClearLoop EU, Metaco Harmonize, Qredo EU, Zengo Business EU, and Matrixport Custody EU. These wallets balance security, compliance, and operational efficiency.

They provide transaction screening, policy enforcement, risk monitoring, and audit-ready reporting. Many also integrate with compliance platforms to detect suspicious activity, maintain segregation of accounts, and follow EU anti-money laundering (AML) and Know Your Customer (KYC) requirements.

Yes. Most use multi-party computation (MPC), multi-signature wallets, or offline hardware storage, ensuring private keys are never exposed. Additionally, many offer insurance coverage and continuous monitoring to protect against internal and external threats.

Wallets like MetaMask Institutional, Coinbase Wallet EU, and Qredo EU allow regulated institutions to securely interact with DeFi, tokenized assets, and blockchain networks while maintaining compliance controls.