The Best AI Systems for Web3 Business Intelligence that are revolutionizing blockchain projects, DeFi protocols, and cryptocurrency enterprises will be covered in this article.

These AI-powered solutions enable well-informed decision-making by offering sophisticated analytics, security monitoring, and market insights.

These technologies are crucial for companies managing the ever-changing Web3 ecosystem, from on-chain data insight to smart contract protection.

What is Web3 Business Intelligence?

Web3 Business Intelligence is the process of extracting useful insights from decentralized networks using blockchain technology, artificial intelligence, and advanced data analytics. It entails keeping an eye on on-chain activities, following token movements, assessing protocol performance, and studying market trends.

Web3 business intelligence helps investors, developers, and cryptocurrency projects make well-informed decisions, optimize strategy, improve security, and increase overall operational efficiency in the quickly changing decentralized ecosystem by fusing real-time data with predictive models.

Why Use AI Systems for Web3 Business Intelligence

Real-Time Data Evaluation – AI frameworks analyze large data sets based on Blockchain technology so companies can track and analyze data related to payments, customer wallets, and protocols in real-time.

Predictive Analytics – Tools powered by AI and machine learning can analyze and predict behavior in the marketplace, token valuations, and risks to create actionable insights for investors and developers.

Increased Security – AI Tools can ascertain the presence of anomalies, deficiencies in smart contracts, and fraudulent actions so the problems can be mitigated before they create a loss to the company.

Improved Operational Efficiency – When data monitoring and reporting are automated, less time is spent on these tasks, and focus can be shifted to strategy and growth.

Improved Strategic Decision-Making – AI meshes on-chain data, social data, and financial data to create insights to improve the management of a company’s portfolio, defy protocols, and NFT’s.

Key Point & Best AI Systems for Web3 Business Intelligence List

| AI Tool | Key Point |

|---|---|

| CertiK Skynet AI | Real-time smart contract security monitoring and threat detection. |

| PeckShield AI | On-chain security analytics and fraud detection for crypto projects. |

| Santiment AI | Market sentiment insights using on-chain, social, and development data. |

| Glassnode AI Metrics | Advanced on-chain metrics for tracking crypto asset movements and health. |

| Token Terminal AI | Fundamental analytics platform evaluating crypto projects’ financial performance. |

| Gauntlet AI Simulation | Simulates DeFi protocol risks and predicts outcomes of economic changes. |

| TRM Labs Intelligence | Provides compliance, risk scoring, and transaction monitoring for crypto. |

| Messari Intelligence AI | Market research and data-driven insights for informed crypto investment decisions. |

| Nansen AI | On-chain wallet analysis, token flows, and smart money tracking. |

| Dune AI (Analytics) | Customizable dashboards for on-chain data analytics and visual insights. |

1. CertiK Skynet AI

CertiK Skynet AI is a unique service that aids with monitoring blockchain networks and smart contracts for any possible threats in real time. It is the first of its kind to provide users with AI driven detection of risks and possible exploits and attempts to breach smart contracts as well as suspicious transactions.

CertiK Skynet AI offers an extensive ecosystem for monitoring events on chain and analyzing breaches in real time. It also offers automated dashboards that alert stakeholders to potential problems.

It is one of the Best AI Systems for Web3 Business Intelligence since it helps provide operational security and also helps manage the security of the investors providing confidence and security for the crypto projects.

CertiK Skynet AI Features, Pros & Cons

Features:

- Monitoring of smart contracts on a real-time basis.

- Threat detection powered by artificial intelligence.

- Alerts on vulnerabilities specific to DeFi protocols.

- Dashboards pertaining to blockchain security.

- Detection of anomalies automated.

Pros:

- Hacks and exploits are prevented in a proactive manner.

- Security reports are easy to read and understand.

- Multiple blockchain networks are supported.

- Trust of investors is enhanced.

- Notifications in real-time reduce the time taken to respond.

Cons:

- For small projects, it can be costly.

- Results require a technical understanding for accurate interpretation.

- Predictive modeling for trends in the market is limited.

- Primarily focuses on security, and not on financial analysis.

- At times, there may be too many alerts.

2. PeckShield AI

PeckShield AI offers fraud detection and the analysis of blockchain security. It provides the most sophisticated AI-driven analytics in the area of decentralized networks. It examines blockchain transactions, smart contracts, and tokens in order to identify and record irregularities, fraud, and attacks.

PeckShield AI helps users in the Web 3.0 environment handle risks and protect user assets by using analytics that constructively predict future fraudulent scenarios.

Reporting and visualization tools assist users in analyzing sophisticated blockchain activities. PeckShield AI offers security and advanced AI services to the DeFi ecosystem and NFT (Non-fungible token) eco-systems and is awarded the Best AI Systems for Web3 Business Intelligence brokers.

PeckShield AI Features, Pros & Cons

Features:

- Detection of fraud on the blockchain.

- Monitoring and analysis of wallets.

- Anomaly detection that is predictive in nature.

- Assistance with auditing of smart contracts.

- Surveillance of security pertaining to DeFi and NFTs.

Pros:

- Detection of scams in the early stages protects the investors.

- Activity of suspicious wallets is tracked.

- It is compatible with multiple token standards.

- Dashboards with reports that are comprehensive.

- Provides DeFi protocols with a minimized level of risk.

Cons:

- The more advanced features may be difficult for novices.

- There is less emphasis on market sentiment or analytics.

- It is likely that the subscription fees are high.4. Alerts may need manual confirmation.

- Minimal integration with investing tools.

3. Santiment AI

Santiment AI offers a description of predicted sentiment of the market and offers services that encompass the analysis of blockchain, the social web, and the metrics of development.

Services offered are the analysis of blockchain, metrics of development, analysis of the social web, and the prediction of sentiment of the market. It provides investors with the prediction of the market, sentiment of the market, and analysis of the social web.

Services offered are the analysis of blockchain, metrics of development, analysis of the social web, and the prediction of sentiment of the market.

As a provider of the Best AI Systems for Web3 Business Intelligence held the most sophisticated means of diving into blockchain with no data (raw data) and offering data (processed) to use for the understanding of the market.

Santiment AI Features, Pros & Cons

Features:

- Analysis of market sentiments.

- Monitoring of on-chain metrics.

- Insights on trends in social media.

- Analysis of developer behavior.

- Predictive analytics of token movement.

Pros:

- Assists in predicting market trends.

- Sentiment-driven analytics are provided.

- Assists in trading and investing.

- Social data and blockchain data are fused.

- Streamlined dashboards for analysis.

Cons:

- Weak security analysis.

- Subscription is required for all functionalities.

- Data may be overwhelming and noisy.

- Not suited for smaller projects.

- Incomplete historical data.

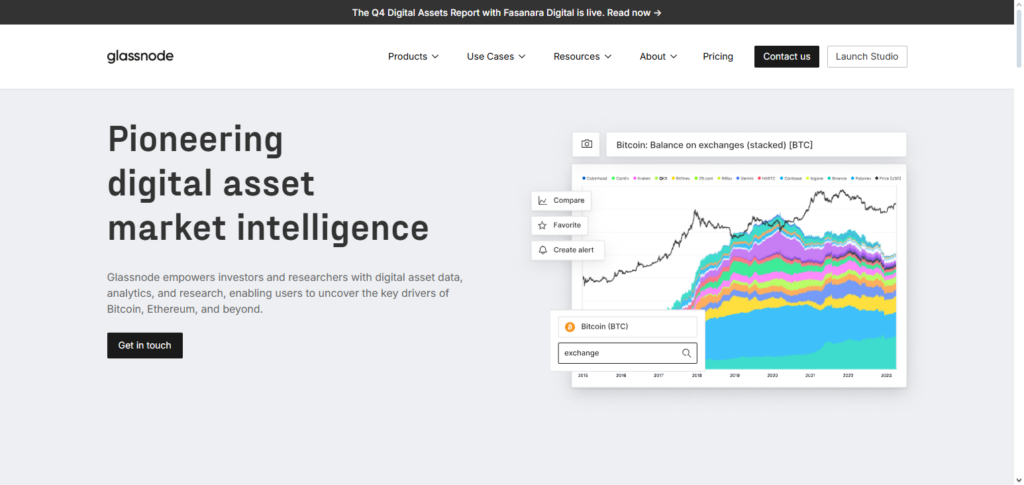

4. Glassnode AI Metrics

Glassnode AI Metrics is a leading supplier of advanced on-chain analysis and real-time monitoring of the blockchain’s assets, transaction volume, and the overall health of the network. It uses tools powered by Artificial Intelligence, so it can identify changes in trends, liquidity, and accumulation for various digital currencies.

Glassnode illustrates complex analysis and assists traders, analysts, and institutions to make data-driven suggestions. It also gives a market cycle prediction and price movement forecast with attributed metrics.

Glassnode AI Metrics is recognized as one of the Best AI Systems for Web3 Business Intelligence solutions to help Crypto Professionals track blockchain ecosystems and develop a trading and strategy edge.

Glassnode AI Metrics Features, Pros & Cons

Features:

- Analysis of on-chain data in advanced form.

- Monitoring of the distributed network in real-time.

- Analysis of transactions and liquidity.

- Insights on the behavior of investors.

- Predictive analytics for market forecasting.

Pros:

- Offers actionable and premium data insights.

- Assists in portfolio management.

- Analysis of multiple cryptocurrencies trends.

- Tools for data visualization are intuitive.

- Analytics for real-time data assist in making decisions.

Cons:

- The high cost of subscription is unaffordable for newcomers.

- Weak security and compliance analysis.

- Advanced analysis does not need cryptocurrency knowledge.

- Largely focused on investment analytics.

- Minimal analysis of social sentiment.

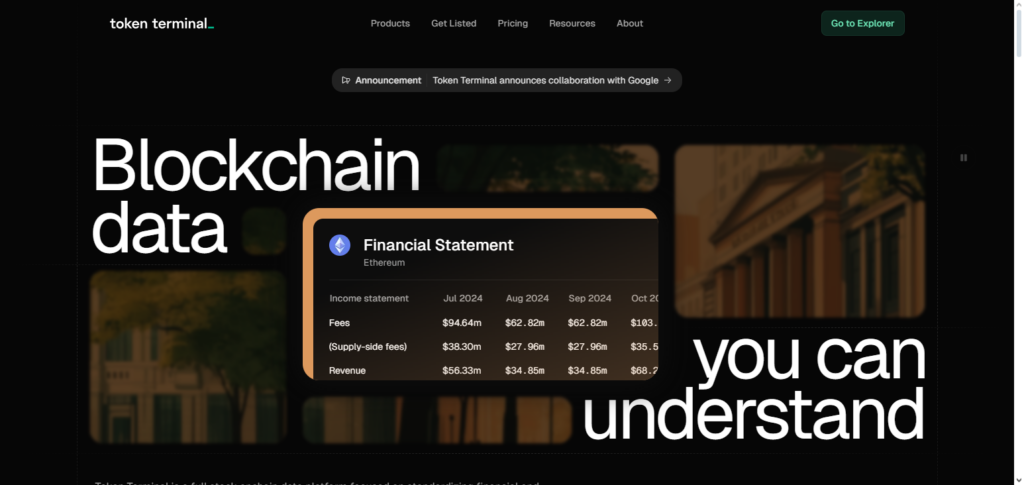

5. Token Terminal AI

Token Terminal AI provides fundamental financial analytics of the blockchain ecosystem with a focus on revenue, tokenomics, and economics. It simplifies complex on-chain and off-chain data to create actionable reports, which facilitate investors to benchmark projects on profitability and sustainability.

The AI models help predict in token performance and project growth. Token Terminal AI is recognized as one of the Best AI Systems for Web3 Business Intelligence solutions as it closes the distance between traditional financial analysis and Web3 assets. This makes it very dependable for investment research, portfolio management, and decision support systems in decentralized finance.

Token Terminal AI Features, Pros & Cons

Features:

- Financial analytics for blockchain projects.

- Tracking revenue and profitability.

- Analyzing tokenomics.

- Dashboards for project comparisons.

- Predictive insights on project growth.

Pros:

- Gives detailed revenue understanding.

- Valuable for data-driven funding.

- Assists in spotting long-lasting projects.

- Comparison of projects is straightforward.

- Combines fundamental and token metrics.

Cons:

- Little focus on protection or scams.

- Needs some level of crypto finance literacy.

- For long-term trading, less impactful.

- Not all blockchain networks may be included.

- Predictive models may be more off than on.

6. Gauntlet AI Simulation

Gauntlet AI Simulation applies state-of-the-art modeling technology to project the actions of DeFi protocols under different economic conditions. It helps projects address potential risks and fine-tune their risk management strategies by modeling possible scenarios involving liquidity events, governance shifts, and market turmoil.

The AI-driven simulation helps to steer crucial decision-making for the sustained stability and resilience of the protocols. Among other things, Gauntlet helps protocol developers anticipate user actions and to design and balance sustainable token incentives.

As one of the Best AI Systems for Web3 Business Intelligence Solutions, Gauntlet AI Simulation is highly beneficial to developers and investors for acquiring actionable and valuable insights into complex DeFi ecosystems while minimizing risk and maximizing efficiency for the protocols.

Gauntlet AI Simulation Features, Pros & Cons

Features:

- Simulations of DeFi protocols.

- Tokenomics risk modeling.

- Governance predictions.

- Liquidity shock simulation.

- Optimizations from AI.

Pros:

- Predicts outcome of protocols before use.

- Optimizes models of DeFi tokens.

- Lowers operational and financial risks.

- Assists in guiding governance.

- Offers comprehensive analysis of scenarios.

Cons:

- Some beginners may find the interface complicated.

- Primarily focuses on DeFi projects.

- Smaller protocols may find it costly.

- Needs integration with current protocol data.

- Quality of predictions relies on the quality of input.

7. TRM Labs Intelligence

TRM Labs Intelligence provides AI-powered blockchain risk management and compliance solutions. It enables organizations to successfully comply with regulatory obligations by offering transaction monitoring, wallet risk grading, and notifications for suspicious activity. To identify fraud, money laundering, and illegal activities, its software examines massive amounts of on-chain data.

TRM Labs improves security and reliability for financial institutions, exchanges, and DeFi projects. Acknowledged as one of the Best AI Systems for Web3 Business Intelligence, it integrates AI analytics with regulatory intelligence to assist businesses in maintaining compliance, safeguarding digital assets, and promoting safe blockchain usage.

TRM Labs Intelligence Features, Pros & Cons

Features:

- Monitoring transactions for compliance.

- Scoring risks of wallets.

- Detection for scams and money laundering.

- Reporting regulations with AI.

- Analytics cross chain.

Pros:

- Assists in following the regulations for compliance.

- Identifies and alerts users to potentially fraudulent activities quickly.

- Builds confidence in the activities of crypto businesses.

- Works with various DeFi protocols as well as exchanges.

- Gives detailed analytics in addition to comprehensive risk reports.

Cons:

- Sentiment analysis tools or market analysis are weak.

- Higher prices may be difficult for smaller companies to manage.

- There is a significant need for compliance expertise to get the most out of the system.

- Some alerts may require review or actions on the user’s part.

- Primarily risk and compliance oriented.

8. Messari Intelligence AI

Messari Intelligence AI offers a research and analytics platform for cryptocurrency market insights. Analyzing trends, prices, network stats, and fundamentals, Messari’s models support possible investment decisions. Messari includes reports, dashboards, and metrics for portfolio management and market research.

Participants and teams use Messari’s tools for high-value asset search, risk assessment, and industry evolution tracking. Messari is listed among the Best AI Systems for Web3 Business Intelligence for transforming raw information into actionable data and assisting professionals to confidently navigate the rapidly changing world of cryptocurrency.

Messari Intelligence AI Features, Pros & Cons

Features:

- Market analysis and research.

- Monitoring of asset price trends.

- Analysis of fundamentals for the project.

- Support for on-chain data.

- Monitoring of portfolio performance.

Pros:

- Provides the most actionable and presents relevant investment opportunities.

- Integration of on-chain data with market data.

- Helps in the management of developing trends in cryptocurrency.

- The dashboard is instrumental in the making of strategic decisions.

- Simplified interface for professionals.

Cons:

- Monitoring of security is limited.

- Complete access requires a subscription.

- Focus on the non-predictive simulations of protocols is lacking.

- For novices, there is a significant learning curve.

- There is a lack of insights focused on NFTs.

9. Nansen AI

Nansen AI marries blockchain analytics and wallet intelligence to track token movement, smart money movement, and on-chain activity. His AI-based insights identify smart money movements and on-chain activities, giving investors the ability to track investment movements, liquidity, and the adoption of protocols.

Nansen also covers analytics in the areas of DeFi and NFTs, which provides support for the optimization of strategic decisions in several others. Nansen AI is listed among the Best AI Systems for Web3 Business Intelligence and provides actionable insights to traders, analysts, and projects to help them optimize strategies for greater returns.

Nansen AI Features, Pros & Cons

Features:

- Wallet intelligence and tracking of smart money.

- Analysis of token flow.

- Monitoring of activities on-chain.

- Analysis of DeFi and NFTs.

- Alerts for various market trends.

Pros:

- Monitoring of smart money wallets and trends in the market is interconnected.

- Provides tools for decision making when investing strategically.

- Analytics for NFTs and DeFi.

- Alerts and dashboards that are easy to understand.

- Assists in detecting new trends.

Cons:

- A few compliance features.

- Need a subscription for advanced analytics.

- New users may find it a bit overwhelming.

- Primarily focuses on wallet-level insights.

- Gaps may be present in historical data.

10. Dune AI (Analytics)

Users may gain insights from intricate blockchain activity with Dune AI’s configurable dashboards and sophisticated analytics for on-chain data. With customizable SQL queries, it enables developers, analysts, and investors to see user behavior, transaction patterns, and protocol performance.

Its AI integration makes data interpretation easier, producing trend analysis and forecast insights. Dune AI, widely regarded as one of the Best AI Systems for Web3 Business Intelligence, enables companies to monitor ecosystem health, convey transparent metrics, and make well-informed decisions, promoting improved governance and strategic planning in the Web3 domain.

Dune AI (Analytics) Features, Pros & Cons

Features:

- On-chain data dashboards are customizable.

- Analytics with SQL-based query.

- Tools for visualization of trends.

- AI-driven insights for predictions.

- Performance tracking of protocols.

Pros:

- Analytics dashboards are customizable to the full extent.

- Supports detailed exploration of on-chain data.

- Queries on data driven by the community (at no cost) are available.

- Excellent for analytics on DeFi and NFTs.

- Reporting transparency and governance analytics are provided.

Cons:

- For advanced queries, SQL knowledge is a prerequisite.

- Financial compliance metrics or regulations are less emphasized.

- Predictive AI usage is limited.

- Dashboard configurations may take some time.

- Some metrics depend on the quality of external data.

Conclusion

Strong tools that can evaluate intricate blockchain data, forecast trends, and reduce risks are necessary for the developing Web3 ecosystem.

CertiK Skynet AI, PeckShield AI, Santiment AI, Glassnode AI Metrics, Token Terminal AI, Gauntlet AI Simulation, TRM Labs Intelligence, Messari Intelligence AI, Nansen AI, and Dune AI are just a few of the top AI systems for Web3 Business Intelligence that provide complete solutions for security, financial analytics, market insights, and protocol optimization.

Businesses, investors, and developers can make well-informed decisions, improve operational efficiency, and keep a competitive edge in the quickly growing decentralized economy by utilizing these AI-driven platforms.

FAQ

AI systems for Web3 business intelligence are platforms that use artificial intelligence to analyze blockchain data, track market trends, monitor security, and provide actionable insights for decentralized applications, DeFi protocols, and crypto projects.

They help businesses detect fraud, optimize protocols, predict market movements, and make data-driven decisions, ensuring security, efficiency, and competitive advantage in the rapidly evolving crypto ecosystem.

The leading platforms include CertiK Skynet AI, PeckShield AI, Santiment AI, Glassnode AI Metrics, Token Terminal AI, Gauntlet AI Simulation, TRM Labs Intelligence, Messari Intelligence AI, Nansen AI, and Dune AI.

Tools like CertiK Skynet AI and PeckShield AI monitor smart contracts and on-chain activity in real-time, detecting vulnerabilities, anomalies, and potential threats before they impact users.

Yes, platforms like Santiment AI, Glassnode AI Metrics, Messari Intelligence AI, and Nansen AI provide market analytics, sentiment insights, and token tracking, helping investors make informed and timely decisions.