In this article, I will discuss the Best Aggregator for DeFi Interest Rates to assist you in maximizing yields throughout the various decentralized finance platforms.

From a novice to an investment expert, the right aggregator can streamline your approach, enhance efficiency, and elevate capital returns. Discover leading platforms that provide up-to-the-moment automation and advanced real-time comparison tools for income optimization in DeFi.

What is DeFi Interest Rates?

DeFi interest rates are the returns earned by the users for lending, staking, or providing liquidity on decentralized finance protocols. DeFi platforms, in contrast to traditional banks, operate on blockchain networks devoid of intermediaries.

As such, they offer real-time, competitive rates based on market demand and supply. There is a difference between assets as well as platforms, and hence these interest rates. It is, therefore, very important to make a proper comparison before making a decision. DeFi interest rates are a fundamental motivation for users to lock their assets in smart contracts, which facilitates decentralized lending and borrowing and yield farming throughout the crypto ecosystems.

Key Factors to Consider in a Good DeFi Aggregator

Accurate Real-Time Data: Interest rates must be reliable across various protocols to facilitate real-time updates.

Supported Protocols and Chains: The user’s cross-chain (Ethereum, BNB Chain, Polygon) and multi-platform DeFi needs should be met by the aggregator.

User Friendliness: Especially for beginners, navigation is made easier with a clean design.

Integration with Digital Wallets: Access and management of assets are simplified if the aggregator is compatible with popular wallets such as MetaMask and WalletConnect.

Audit Record and Security Risk: To reduce risks, carefully examine smart contracts and history to select platforms with audits.

Features for Yield Optimization: Better returns can result from automation of compounding and strategy execution provided by some aggregators.

Community & Support: Issues or questions can be solved with the help of strong community engagement and support channels.

Yield Calculation and Fee Transparency: There shouldn’t be incentives or fees that are hidden based on yield sourced and yield calculation methods used.

Top 5 Aggregators for DeFi Interest Rates

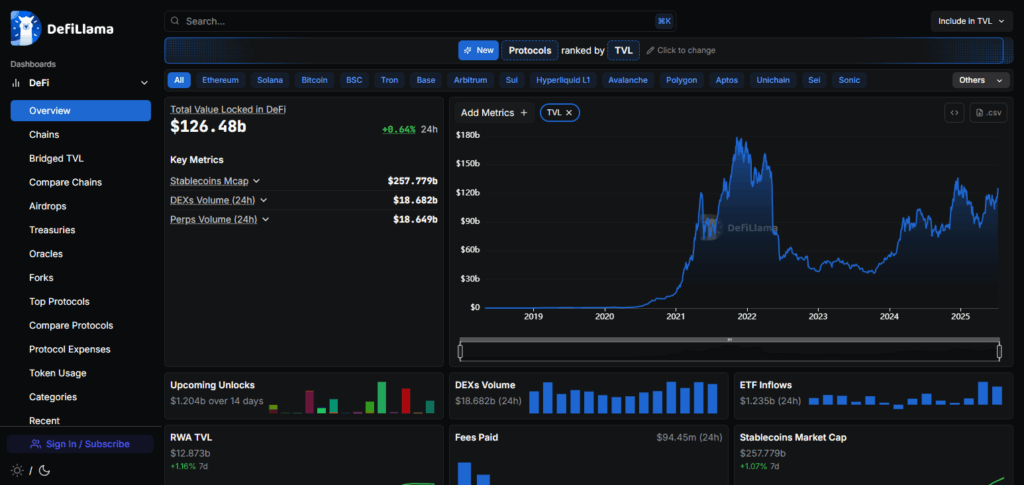

1.DeFi Llama

DeFi Llama is known as one of the best aggregators of interest rates on DeFi because of its unparalleled transparency, wide cross-protocol coverage, and multi-chain expansion. DeFi Llama is unique because of its open-sourced data and zero-token commitment which allows users to access real-time APY comparisons without biasing incentives.

DeFi Llama differs from other platforms because it tries to provide as many accurate metrics as possible which includes TVL and yield rates. This helps the platform achieve trust among serious yield farmers and institutional users.

2.Yearn Finance

Yearn Finance is arguably one of the best aggregators for DeFi interest rates since it automates the multicross yield optimization of its users’ funds. It saves time for users and maximizes returns. Its unique strength lies in its Vaults system, which dynamically reallocates user funds based on community-developed logic to maximize user returns.

Unlike traditional aggregators that only display rates, Yearn reallocates assets actively, offering a hassle-free compounding yield experience, which caters to long-term DeFi users who wish to earn passive income in a steady and sustainable manner.

3.Zapper

Zapper serves as a leading DeFi interest rate aggregator, distinguished by its portfolio management dashboard with real-time yield comparison features.

Its competitive edge comes from qualidade serviços offered from all-in-one interfaces to track and manage positions across multiple chains and protocols. Puesta en escena is a one-stop DeFer all-encompassing DeFi services such as swap, stake, yield farm, and track which serve the needs of both novice andlade and professional users.

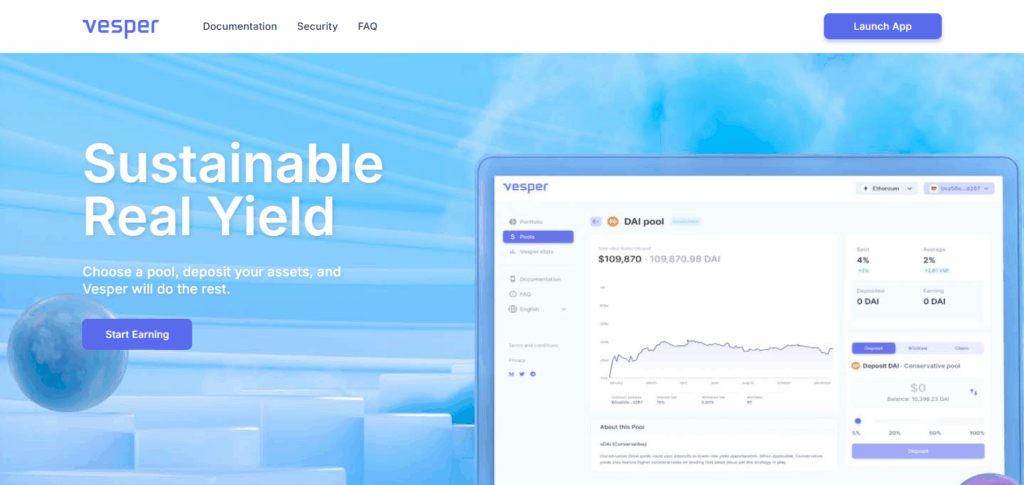

4.Vesper Finance

As one of the leading DeFi interest rate aggregators, Vesper Finance stands out because of its focus on sustainable, risk-adjusted yield accumulation strategies. What sets Vesper apart is its “set-and-forget” approach— vaults where users deposit their assets are continuously yield optimized using smart contracts which have been audited and follow conservative best practices.

This yield optimization is especially appealing for those users whose primary goal is capital preservation alongside return generation. Saved passive investors looking for consistent decentralized finance income have Vesper stand out for its unequaled security focus, transparency, and strategic long-term growth planning.

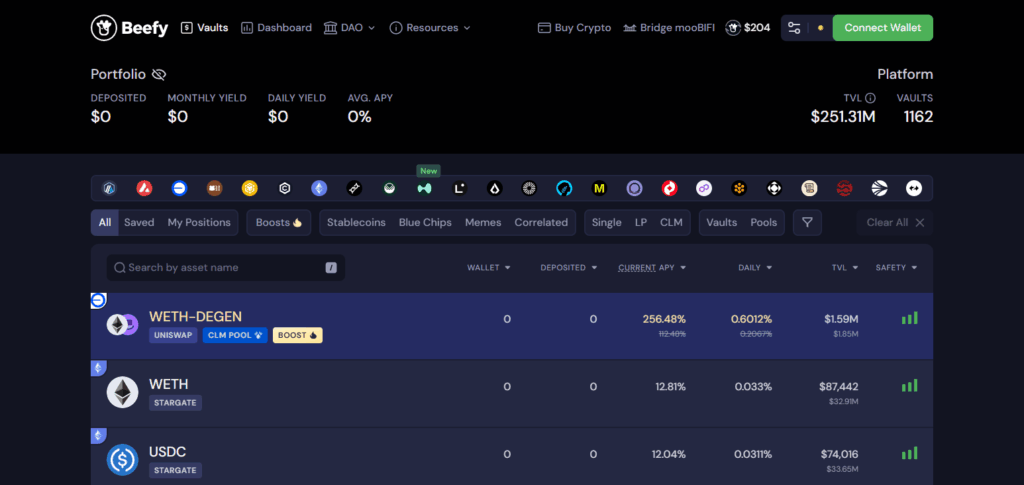

5.Beefy Finance

Beefy Finance is a prominent aggregator of interest rates in the DeFi industry, noted for its extensive multi-chain support as well as its auto-compounding vaults. Its greatest distinct advantage is the automation of earning reinvestment, which increases APY effortlessly.

Unlike most platforms that display yields, Beefy actively adapts and updates yield farming strategies throughout countless protocols, ensuring returns are maximized around the clock. Through active and strong community governance alongside reliable smart contract deployments, Beefy provides an exceptional yield generation solution across an array of blockchain infrastructures hands-free.

Risks & Considerations

Smart Contract Exploits

Weakly examined smart contracts are at risk of exploitation; this is especially relevant for aggregators.

Impermanent Loss

The opportunity cost of liquidity provision in volatile markets might yield substantially lower returns than simply holding.

Protocol Risk

Using an aggregator does not eliminate the risk of losing funds due to exploits of protocols integrated within the aggregator.

Produit KPI Gonfles

Certain platforms advertise unrealistic yields which are either unsustainable or manipulated.

Rug Pulls

DeFi projects lacking sufficient due diligence can abscond with user funds suddenly.

Absence of Coverage

Most DeFi platforms do not offer restitution for lost or stolen funds.

Regulatory Uncertainty

DeFi platforms exist in a legal gray area that might impact users’ access or security of their assets in the future.

Transaction Costs

Using aggregators might lead to lower overall returns due to high transaction costs on Ethereum.

Pros & Cons

| Pros | Cons |

|---|---|

| Simplifies yield comparison across multiple protocols | Smart contract vulnerabilities may lead to fund losses |

| Saves time by aggregating real-time interest rates | High gas fees can reduce net returns |

| Offers automated yield optimization in some platforms | Risk of fake or unsustainable APYs |

| Supports multi-chain DeFi access from one interface | Limited insurance or protection for user funds |

| Useful for both beginners and advanced users | Protocol failures can still impact user assets |

| Helps identify best opportunities for passive income | Regulatory uncertainty may impact aggregator platforms |

Conclusion

Selecting the optimal aggregator for DeFi interest rates relates to your investment strategy, risk appetite, and preferred platforms.

DeFi Llama, Yearn Finance, Zapper, Vesper, and Beefy Finance provides automated and risk-adjusted return features, supporting multiple chains and boasting user-friendly dashboards.

With these aggregators, users can make better and quicker choices, optimizing passive income potential. However, in the ever-evolving landscape of DeFi, always evaluate platform risks and conduct thorough due diligence prior to asset allocation.