The Best AI Agents for Cross-Chain Asset Management will be covered in this article, with an emphasis on leading solutions that support the monitoring, analysis, and management of digital assets across several blockchains.

In today’s rapidly changing cryptocurrency ecosystem, these AI-driven technologies improve security, optimize portfolio strategies, identify dangers, and offer actionable insights, allowing investors and institutions to effectively handle cross-chain transactions.

What is Cross-Chain Asset Management?

The technique of simultaneously monitoring, evaluating, and maximizing digital assets across several blockchain networks is known as cross-chain asset management. It entails monitoring assets, liquidity, and transactions across several chains while guaranteeing security, effectiveness, and compliance, in contrast to single-chain management.

This strategy is crucial in today’s multi-chain cryptocurrency environment since it enables investors, fund managers, and institutions to diversify portfolios, lower risk, and take advantage of opportunities across decentralized ecosystems. Complex operations may be made simpler, anomalies can be found, and cross-chain asset performance can be optimized in real time with the use of sophisticated AI tools and analytics.

Why It Is AI Agents for Cross-Chain Asset Management Matter

Increased Security Across Chains: AI Agents provide security by monitoring a cross-chain environment for suspicious and fraudulent activities. This ensures the safety of assets against hacks, scams, and operational mishaps on a cross-chain environment.

Instant Analytics and Insights: These AI agents provide investors with real time insights and analytics of the buyer’s and seller’s wallets, liquidity, and the market’s liquidity.

Potential Portfolio Optimization: Investors can optimize their returns with reductions in their market exposure by receiving AI driven intelligence on their assets and the market’s cross-chain volatility.

Simplified Compliance: Institutions can simplify their compliance processes and avoid sanctions by using AI agents for Cross Chain Asset Management. These agents provide KYC, AML, and Compliance updates at regulatory checkpoints.

Increased Operational Efficiency: With the AI agents doing the monitoring and reporting, fund managers and traders can shift their focus on strategic activities instead of monitoring.

Key Point & Best AI Agents for Cross-Chain Asset Management List

| Platform | Key Point / Feature |

|---|---|

| Chainalysis Cross‑Chain Intel | Provides deep cross-chain transaction monitoring and risk assessment to track illicit activity across multiple blockchains. |

| Nansen AI | Offers on-chain analytics and wallet intelligence, identifying smart money flows and NFT/DeFi trends. |

| Messari Intelligence AI | Delivers comprehensive crypto market research, token metrics, and actionable insights for investors. |

| Gauntlet AI Simulation | Simulates protocol behavior under different market conditions to optimize risk management and strategy. |

| Token Terminal AI | Analyzes financial metrics of crypto projects, offering revenue, valuation, and performance insights. |

| Glassnode AI Metrics | Provides advanced on-chain metrics and network analytics for market health and activity monitoring. |

| Santiment AI | Tracks social sentiment, on-chain activity, and market indicators to predict potential price movements. |

| LayerZero AI Agents | Offers cross-chain messaging intelligence and smart contract monitoring for interoperability security. |

| AnChain.AI Behavioral Suite | Detects suspicious behavior, fraud, and compliance violations using AI-driven pattern recognition. |

| TRM Labs Intelligence | Focuses on crypto transaction monitoring, risk scoring, and regulatory compliance solutions. |

1. Chainalysis Cross‑Chain Intel

Chain analysis A leading blockchain analytics platform, Cross-Chain Intel offers in-depth understanding of transactions across several blockchains.

It assists regulators, exchanges, and institutions in monitoring asset flows, identifying illegal activity, and guaranteeing compliance. It finds trends that point to fraud, theft, or dangerous activity by utilizing cutting-edge AI and machine learning.

Its data-driven methodology enhances decentralized ecosystems’ transparency. It is regarded as one of the Best AI Agents for Cross-Chain Asset Management for businesses that manage assets across chains, guaranteeing safe and effective cross-chain activity monitoring while reducing operational and regulatory risks.

Chainalysis Cross-Chain Intel Features, Pros & Cons

Features

- Monitoring of cross-chain transactions

- Assess risks in real-time

- Detect patterns using artificial intelligence

- Aid in meeting compliance regulations

- Track fraudulent and other illicit activities

Pros

- Robust coverage of multiple chains

- Detecting suspicious activities with high accuracy

- Assists large institutions in meeting compliance requirements

- Offers multiple in-depth analytics dashboards

- Renowned and trusted by government regulators

Cons

- Can be pricey for small investors

- Complicated for persons new to the industry

- Analytics have limited predictability

- Predictive analytics are lacking

- Mostly focused on compliance instead of analytics

- Advanced tool usage may require significant training

2. Nansen AI

Nansen AI provides insights into smart money movements, DeFi patterns, and NFT activities by combining on-chain data analytics with AI-powered wallet labeling. It is used by traders and investors to study user behavior in real time and find winning techniques.

Cross-chain asset performance tracking and liquidity flow visualization are made possible by its user-friendly dashboards. Nansen aids in risk assessment and the creation of market strategies by identifying new trends and wallet clustering.

It provides asset managers and institutional traders with actionable intelligence for multi-chain portfolio optimization and risk-aware decision-making, making it one of the Best AI Agents for Cross-Chain Asset Management.

Nansen AI Features, Pros & Cons

Features

- Labeling of wallets on-chain

- Monitoring of smart money

- Analytics on DeFi and NFTs

- Monitoring of cross-chain portfolios

- Dashboards are updated in real-time

Pros

- Highly rated for its intuitive user interface

- Teams can quickly identify upcoming trends

- Supports analysis of multiple chains

- Beneficial for investors as well as traders

- Provide insight as to what the next steps should be

Cons

- Can be costly

- Some blockchains have a lack of past data

- Little to no analysis of compliance

- Advanced features can be confusing

- Primarily focused on Ethereum and other leading chains

3. Messari Intelligence AI

Messari Intelligence AI is a complete platform that provides market information, token analytics, and in-depth cryptocurrency research. It combines fundamental and technical data with AI-driven insights to inform trading and investment choices.

It provides analysts and portfolio managers with up-to-date information on network activity, project health, and token performance. Studies of asset correlation and multi-chain risk assessment are also made possible by its sophisticated analytics.

Messari, which is regarded as one of the Best AI Agents for Cross-Chain Asset Management, guarantees that investors may effectively manage cross-chain portfolios, lowering their exposure to market volatility while still making wise strategic choices.

Messari Intelligence AI Features, Pros & Cons

Features:

- Research on the market for crypto

- Analytics and metrics for tokens

- Tracking portfolios

- Insights on fundamentals as well as technical

- News and data feeds as per real time

Pros:

- Market coverage is exhaustive

- Insights from predictive AI

- Designed well for institutional investors

- Able to make assessments across multiple chains

- Merges analytics with research

- Integration of analytics and research

Cons:

- Starting from scratch will be rather difficult. Data and instructions are not meant for novices.

- Premium features do require a subscription to be unlocked

- NFT or DeFi focus is rather limited

- Data resides on servers with no designed for fraud

- Lagging data from time to time

4. Gauntlet AI Simulation

Gauntlet AI Simulation employs realistic simulations to stress-test financial systems and blockchain protocols. It forecasts protocol performance and risk exposure by simulating different market situations, liquidity scenarios, and user behavior.

It guarantees system stability while enabling developers and asset managers to maximize strategy and capital allocation.

Its AI-powered simulations improve cross-chain liquidity management and reduce losses during extreme market situations. Gauntlet, which is regarded as one of the Best AI Agents for Cross-Chain Asset Management, offers practical insights to protect assets across decentralized networks and uphold effective multi-chain operational strategies.

Gauntlet AI Simulation Features, Pros & Cons

Features:

- Risk simulation per protocol

- Modeling for market scenarios

- Optimization of liquidity and capital

- Stress testing on blockchain

- Insights on performance and stability

Pros:

- Financial risk mitigation

- Great for DeFi protocols

- Predictive AI simulations

- Multi-chain support

- Increases system stability

Cons:

- Complex technical setup

- Primarily for protocol use

- Limited for retail investors

- Complex and steep learning curve

- Expensive for small teams

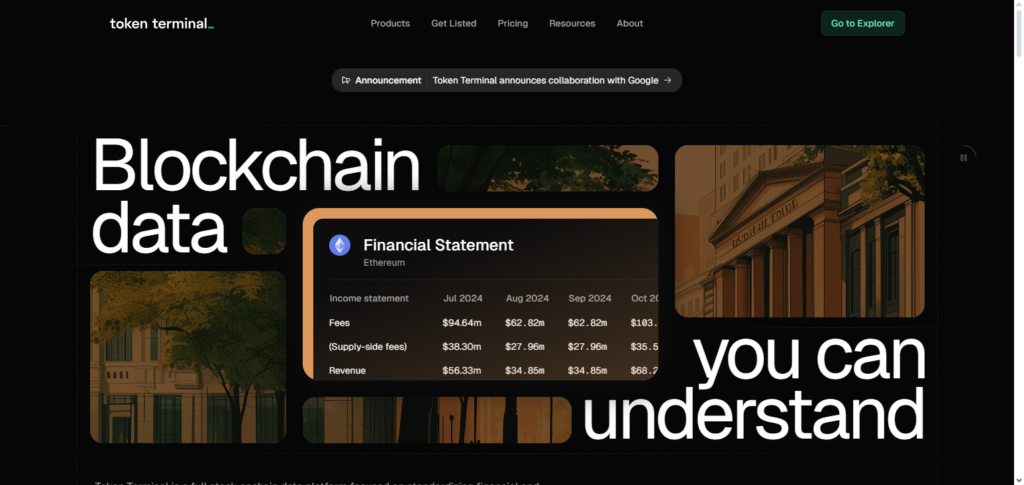

5. Token Terminal AI

Token Terminal AI evaluates income, growth data, and valuation patterns to determine the financial health of cryptocurrency enterprises. Asset managers and investors may monitor profitability, compare project performance across chains, and make well-informed investment choices. Its AI algorithms offer real-time dashboards and forecast insights for tracking cross-chain activity and liquidity movements.

It facilitates risk assessment and strategy allocation by providing a financial perspective on decentralized projects. Token Terminal AI, which is regarded as one of the Best AI Agents for Cross-Chain Asset Management, allows portfolio managers to maximize investments while preserving a thorough comprehension of multi-chain economic dynamics.

Token Terminal AI Features, Pros & Cons

Features:

- Financial analytics and revenue

- Revenue tracking of projects

- Financial analysis of tokens across chains

- Predictive analytics of performance

- Dashboard for portfolio tracking

Pros:

- Investment decisions are made easier due to clear financial focus

- Multi-chain analytics are clear

- Fund managers will find it useful

- Revenue and growth tracking

- Dashboards are simple to read

Cons:

- Not for monitoring securities

- Insufficient data regarding social sentiment

- Needs some knowledge of cryptocurrency

- Less predictive about market changes

- Primarily top-tier chains supported

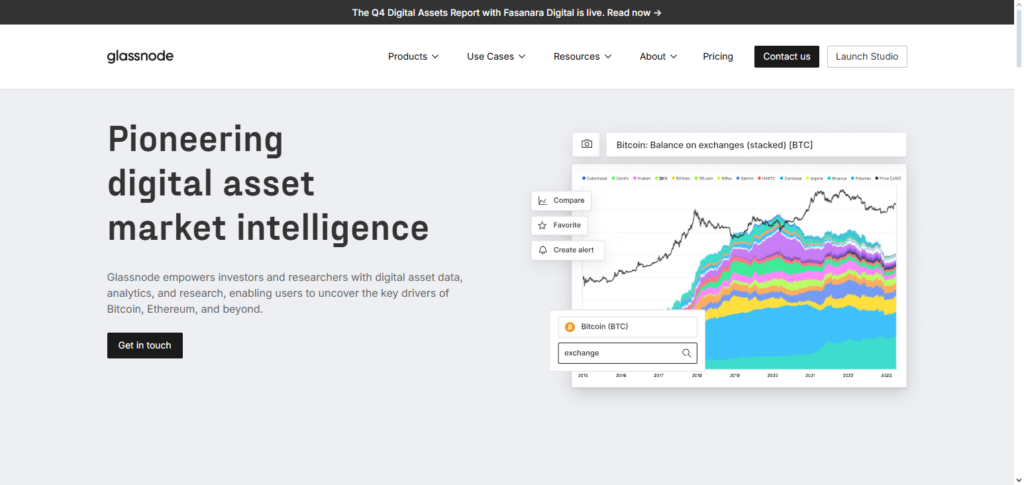

6. Glassnode AI Metrics

Glassnote AI Metrics offer thorough on-chain analytics that help assess the market, network, and capital flows. By utilizing AI analytics, investors and asset managers are able to analyze wallet dynamics, liquidity mappings, and the condition of tokens on various blockchains.

It analyzes patterns to provide potential downside risks, anomalous market conditions, and strategic investment possibilities. With visual analytics and alert systems, users can make real-time decisions on DeFi and cross-chain assets.

Being recognized among the Best AI Agents for Cross-Chain Asset Management, Glassnode helps portfolio managers in risk management and performance optimization of multi-chain assets by providing clear, actionable, and transparent insights.

Glassnode AI Metrics Features, Pros & Cons

Features:

- Analytics of on-chain networks

- Tracking of wallet activities

- Metrics of flow and liquidity

- Indicators of market health

- Alerts driven by AI

Pros:

- Analytics on-chain are quite solid

- Monitoring in real-time

- Alerts that are actionable for the users

- Many chains supported

- Dashboards for data visualization

Cons:

- Metrics on-chain are the ones to focus the most on

- Some knowledge of the subject might be needed

- Monitoring of DeFi/NFT is limited

- Full data requires premium subscription

- Does not predict market trends

7. Santiment AI

Santiment AI integrates the analytics of social sentiment, on-chain metrics, and the market to predict price and trends. It outlines activities in various blockchains in real time such as token transfers, liquidity movement, and investor activities. It utilizes AI to study the relationship of sentiment to trends in the market to help in asset management.

Santiment is preferred by traders and fund managers to analyze potential market anomalies and execution of strategies. It is listed among the Best AI Agents for Cross-Chain Asset Management, offering actionable insights for asset managers to efficiently manage cross-chain assets with prompt reactions to active opportunities.

Santiment AI Features, Pros & Cons

Features:

- Analysis of social sentiment and activities on the chain

- Indicators of market trends

- Tracking the behavior of tokens

- Prediction driven by AI

Pros:

- Analyzing on-chain data and social data combined

- Useful for market timing

- Predictive insights on price movements

- Support for multiple chains

- Alerts for unusual activities

Cons

- Less of a focus on compliance

- Sentiment analysis might be subjective

- Financial metrics are limited

- Some features might need some knowledge of the subject

- Not ideal for institutional reporting

8. LayerZero AI Agents

LayerZero AI Agents simplify the secure messaging and monitoring of cross-chain smart contracts. Leveraging AI, the smart contracts provide safe, efficient, and clear asset transfers. Smart contracts mitigate operational failure and financial loss caused by malicious cross-chain protocol transactions.

LayerZero AI also aids in monitoring/optimizing performance, liquidity, and strategies across various networks. LayerZero has been ranked as one of the Top AI Agents Assisting with Cross-Chain Asset Management because the plug-in helps institutions and traders manage multi-chain portfolios with advanced AI operational and compliance efficiency.

LayerZero AI Agents Features, Pros & Cons

Features

- Intelligence for cross-chain messaging

- Monitoring smart contracts

- Detection of transfer anomalies

- Tracking across various networks

- Alerts

Pros:

- Safe cross-chain transactions

- Lower operational risk

- Watch multiple networks

- Automation

- Asset managers

Cons:

- Set up needs to be done

- Analytics are scarce

- Messaging focus, markets are ignored

- Community is smaller

- High premium

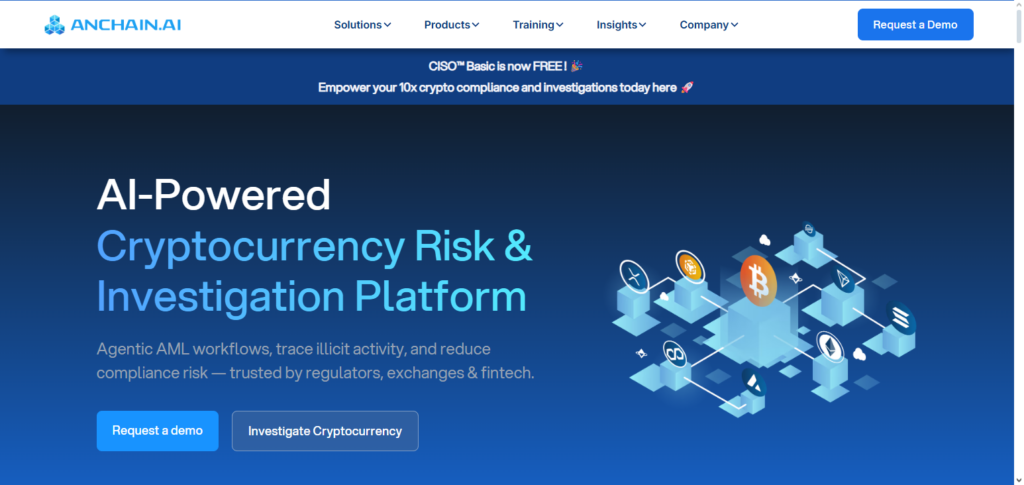

9. AnChain.AI Behavioral Suite

Advanced AI-driven monitoring of user behavior and transaction patterns across blockchain networks is offered by AnChain.AI Behavioral Suite. In real time, it detects fraud, suspicious behavior, and possible violations of compliance. Its behavioral analytics are crucial for upholding security and legal requirements in cross-chain asset management and decentralized finance.

Its insights help asset managers identify dangers before they affect portfolios. AnChain.AI, regarded as one of the Best AI Agents for Cross-Chain Asset Management, improves risk mitigation, operational transparency, and portfolio safety by providing actionable intelligence on multi-chain user activity and protocol behavior.

AnChain.AI Behavioral Suite Features, Pros & Cons

Features:

- AI-driven user behavior analytics

- Fraud detection

- Compliance monitoring

- Transaction pattern recognition

- Real-time risk alerts

Pros:

- Strong security focus

- Detects suspicious activity early

- Helps with AML/KYC compliance

- Real-time operational monitoring

- Supports multiple chains

Cons:

- Less focused on investment insights

- May require technical expertise

- Interface can be complex

- Premium plans are expensive

- Limited portfolio optimization tools

10. TRM Labs Intelligence

TRM Labs Intelligence is an expert in blockchain ecosystem compliance, risk assessment, and transaction monitoring. Its AI-powered analytics facilitate regulatory reporting across several chains, identify illegal conduct, and issue real-time notifications.

Institutions and asset managers depend on it to protect cross-chain portfolios and guarantee compliance with AML/KYC laws.

TRM Labs facilitates secure asset management and informed decision-making by fusing risk intelligence with operational strategy. It offers thorough visibility, practical risk insights, and regulatory assurance for managing intricate multi-chain digital asset portfolios, earning it recognition as one of the Best AI Agents for Cross-Chain Asset Management.

TRM Labs Intelligence Features, Pros & Cons

Features:

- Transaction monitoring

- Risk scoring and assessment

- Regulatory compliance support

- Multi-chain asset tracking

- AI-driven alerts

Pros:

- Excellent for institutional compliance

- Real-time fraud detection

- Multi-chain coverage

- Integrates with existing systems

- Reduces operational and regulatory risks

Cons:

- Less useful for market analysis

- Can be expensive

- Primarily compliance-oriented

- Limited predictive investment insights

- Learning curve for nontechnical users

Comparison Table

| Platform | Key Features | Pros | Cons |

|---|---|---|---|

| Chainalysis Cross‑Chain Intel | Cross-chain transaction monitoring, AI risk assessment, fraud detection, compliance support, pattern analytics | Strong multi-chain coverage, high accuracy, supports institutional compliance, detailed dashboards, trusted by regulators | Expensive for small investors, complex for beginners, limited predictive analytics, mainly compliance-focused, learning curve |

| Nansen AI | On-chain wallet labeling, smart money tracking, DeFi/NFT analytics, cross-chain portfolio monitoring, dashboards | User-friendly, identifies trends, multi-chain support, actionable insights, useful for investors & traders | High subscription cost, limited historical data for some chains, not compliance-focused, advanced features complex, mainly Ethereum-focused |

| Messari Intelligence AI | Market research, token metrics, portfolio tracking, fundamental & technical insights, real-time data | Comprehensive coverage, predictive insights, institutional-focused, multi-chain evaluation, integrates research & analytics | Complex for beginners, premium features require subscription, limited NFT/DeFi focus, occasional data lag, not for fraud detection |

| Gauntlet AI Simulation | Protocol risk simulations, market scenario modeling, liquidity optimization, stress-testing systems, performance insights | Reduces financial risk, excellent for DeFi, AI predictive simulations, multi-chain strategy support, improves system stability | Technical setup complex, mainly protocol-level use, less useful for retail investors, high learning curve, costly for small teams |

| Token Terminal AI | Revenue & financial analytics, project valuation, multi-chain token metrics, predictive insights, portfolio dashboards | Helps investment decisions, clear multi-chain analytics, useful for fund managers, tracks revenue & growth, easy dashboards | Limited social sentiment, not security-focused, requires crypto knowledge, less predictive on market trends, mainly top-tier chains |

| Glassnode AI Metrics | On-chain network analysis, wallet behavior, liquidity metrics, market health indicators, AI alerts | Strong on-chain analytics, real-time monitoring, actionable alerts, multi-chain support, visual dashboards | Mostly chain metrics, technical knowledge needed, limited DeFi/NFT tracking, premium plan needed, not predictive for market trends |

| Santiment AI | Social sentiment, on-chain activity, market indicators, token monitoring, AI predictions | Combines sentiment & on-chain data, market timing, predictive insights, multi-chain support, alerts for anomalies | Sentiment analysis subjective, less compliance focus, limited financial metrics, some features complex, not ideal for institutional reporting |

| LayerZero AI Agents | Cross-chain messaging intelligence, smart contract monitoring, anomaly detection, interoperability tracking, alerts | Ensures safe transfers, reduces operational risk, multi-network monitoring, AI-driven automation, supports asset managers | Technical setup required, limited financial analytics, focused on messaging not markets, smaller community support, premium features costly |

| AnChain.AI Behavioral Suite | AI-driven behavior analytics, fraud detection, compliance monitoring, transaction pattern recognition, real-time alerts | Strong security, early detection of suspicious activity, supports AML/KYC, real-time monitoring, multi-chain support | Less investment insights, requires technical expertise, complex interface, expensive premium plans, limited portfolio optimization |

| TRM Labs Intelligence | Transaction monitoring, risk scoring, regulatory compliance, multi-chain tracking, AI alerts | Excellent for compliance, real-time fraud detection, multi-chain coverage, system integration, reduces operational & regulatory risks | Less market analysis, expensive, compliance-focused, limited predictive investment insights, learning curve for non-technical users |

Conclusion

It is difficult to manage digital assets across several blockchains and calls for accuracy, security, and real-time intelligence.

Strong AI-driven tools for analytics, risk management, and operational optimization are provided by the platforms under discussion, including Chainalysis Cross-Chain Intel, Nansen AI, Messari Intelligence AI, Gauntlet AI Simulation, Token Terminal AI, Glassnode AI Metrics, Santiment AI, LayerZero AI Agents, AnChain.AI Behavioral Suite, and TRM Labs Intelligence.

Investors, fund managers, and institutions may monitor cross-chain transactions, identify risks, improve strategies, and uphold regulatory compliance with the help of these tools. In today’s changing cryptocurrency ecosystem, using these Best AI Agents for Cross-Chain Asset Management guarantees effective, safe, and knowledgeable multi-chain portfolio management.

FAQ

Cross-chain AI agents are advanced tools that use artificial intelligence to monitor, analyze, and manage digital assets across multiple blockchain networks. They help detect risks, optimize portfolios, and ensure secure and compliant asset transfers between chains.

AI improves efficiency by providing real-time analytics, predictive insights, and automated risk detection. It helps asset managers track liquidity flows, detect fraud, and optimize strategies across different blockchains, reducing manual effort and human error.

Top platforms include Chainalysis Cross‑Chain Intel, Nansen AI, Messari Intelligence AI, Gauntlet AI Simulation, Token Terminal AI, Glassnode AI Metrics, Santiment AI, LayerZero AI Agents, AnChain.AI Behavioral Suite, and TRM Labs Intelligence. Each offers specialized tools for monitoring, analytics, and risk management.

They detect suspicious transactions, monitor wallet behavior, analyze smart contract activity, and provide alerts for potential fraud or non-compliant actions. This ensures assets remain safe while navigating multiple blockchain networks.

Yes. They provide actionable insights on market trends, token performance, liquidity flows, and cross-chain opportunities, enabling portfolio managers to make informed, strategic decisions and improve returns.