The Best AI Agents for DeFi Strategy Execution will be covered in this article, with an emphasis on how cutting-edge AI-driven platforms automate trade, maximize yield strategies, and control risk in decentralized finance.

These AI agents improve decision-making, assist traders in effectively executing intricate DeFi strategies, and guarantee safe, data-driven success in rapidly evolving cryptocurrency markets.

What is AI Agents?

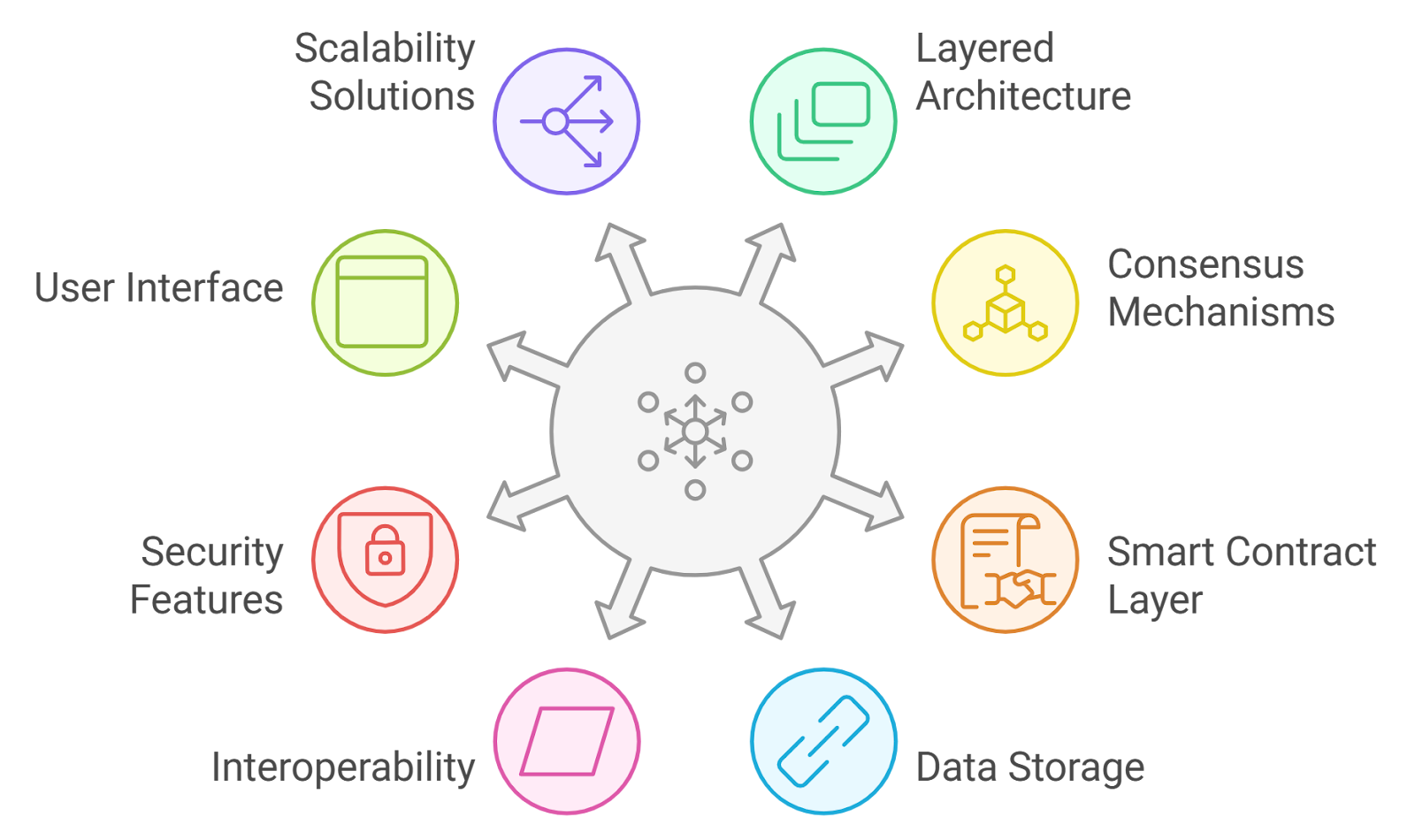

Artificial intelligence (AI) agents are intelligent software programs created to independently sense their surroundings, evaluate information, make judgments, and carry out actions to accomplish particular objectives.

To communicate with systems, users, or other agents, they employ technologies like machine learning, massive language models, and automation tools.

AI agents are very successful in fields like trading, customer service, robotics, and decentralized finance because they can plan tasks, adjust to changing situations, learn from feedback, and carry out complicated workflows with little human intervention.

Key Point & Best AI Agents for DeFi Strategy Execution List

| AI Agent Platform | Key Point |

|---|---|

| LangGraph Agents | Focused on building modular, multi-agent workflows for complex tasks. |

| LlamaIndex Agents | Specializes in connecting LLMs to external data sources efficiently. |

| Semantic Kernel Agents | Enables semantic reasoning with AI, integrating knowledge graphs. |

| CrewAI Agents | Designed for collaborative AI workflows and task delegation. |

| AutoGen Agents | Automates AI agent creation and orchestration for multiple scenarios. |

| Agno Agents | Focused on secure, adaptive AI agents for data-driven decision-making. |

| Forta AI Agents | Security-oriented agents for real-time blockchain monitoring. |

| Gauntlet AI Agents | Simulates complex systems and stress-tests strategies using AI. |

| CertiK Skynet Agents | Blockchain security agents providing smart contract auditing and alerts. |

| PeckShield AI Agents | AI agents for threat detection and risk assessment in crypto networks. |

1. LangGraph Agents

LangGraph Agents are created to build modular, sophisticated, multi-agent workflows, and process complex DeFi functions. They integrate with different systems and APIs to trade, manage liquidity and execute arbitrage strategies.

LangGraph Agents is a candidate for the best AI agents for DeFi strategy execution due to his ability to create structured cooperation for the completion of several tasks automated by intelligence.

Users can design automated analysis, forecasts and executions, as well as adapt to the other elements of the market, making it one of the most flexible and modular tools for the reputable professional DeFi traders.

LangGraph Agents Features, Pros & Cons

Features

- Workflow of agents that is stateful and graph-based

- Integrated with LangChain ecosystem

- Coordination of multiple agents

- Control over memory & decisions

- Fits best with the advanced DeFi strategies

Pros

- Great for execution of multi-step DeFi processes

- High adaptability with the strategies

- Great handling of errors

- Adaptable with complicated logic

- Good for Developers

Cons

- Needs a lot of technical know-how

- High level of complexity

- Not for DeFi out of the box

- Lengthy development cycles

- Few development resources

2. LlamaIndex Agents

LlamaIndex Agents prove to be instrumental in modeling the intersection of large language models (LLMs) and external data sources by generating insightful actions in real-time. Agents process and analyze market data, on-chain data and historical trends during the execution of the DeFi strategy. Mid Paragraph, LlamaIndex Agents can be placed among the top AI agents for DeFi strategy execution, as they limit traders to make decisions in real time, based on contextual information.

Since they can process multiple data streams across different blockchains, they timely and optimally inform strategies. This enhances Automated Execution across sophisticated DeFi protocols and, in turn, reduces the risks and improves the efficiency of the strategies.

LlamaIndex Agents Features, Pros & Cons

Features

- Agents powered by AI and focused on Data

- Ability to ingest data on-chain and off-chain

- Execution driven by queries

- Advanced indexing and data retrieval

- Agnostic to LLM

Pros

- Great for making decisions on DeFi based on available data

- Quick retrieval of insights on-chain

- Simple to integrate with various blockchains

- Decentralized modular systems

- Good for strategies based on analytics

Cons

- Poor execution

- Custom building for DeFi is required

- Neglects security

- Needs optimization to scale

- Limited automated trading strategies

3. Semantic Kernel Agents

Semantic Kernel Agents utilize knowledge graphs and semantic reasoning to decipher intricacies in DeFi. They track market variables, associations, and risks that tend to go unnoticed by traditional approaches.

Mid-paragraph, Semantic Kernel Agents can be placed among the top AI agents for DeFi strategy execution, as they enable traders to make and automate decisions in a more accurate, seamless, and real-time manner.

They utilize semantic understanding and automated execution for strategy shifting in response to changing circumstances. These agents offer greater benefits to users to reduce adverse effects of incomplete data more effectively during portfolio optimization, yield farming, and protocol harvesting.

Semantic Kernel Agents Features, Pros & Cons

Features

- AI orchestration with Microsoft backing

- Execution based on Plugins

- Modules for memory and planning

- Architecture for the enterprise level

- Support for multiple languages

Pros

- Excellent planning and reasoning

- Great for institutional DeFi applications* Secure and organized

- Exceptional handling of long-term memory

- Nice API integrations

Cons

- Steeper learning curve

- Less crypto-native tooling

- Slower prototyping

- Infrastructure setup is required

- Not tailored for DeFi risks

4. CrewAI Agents

The crewAI Agents are built for collaboration, working with different AI agents to complete AI workflows. They have specializations in task allocation, risk evaluation, and the real-time tracking of trading protocols.

While some of the crewAI Agents are recognized for being the top agents in the execution of DeFi strategies, they also optimize the flow of the different stages of the strategies, execution, and simulation.

These agents, in addition to the unique sync of team-like AI collaboration, are able to complete assignment like arbitrage, liquidation, and yield farming with minimal human oversight to retain strategic control over complex, multi-step DeFi procedures.

CrewAI Agents Features, Pros & Cons

Features

- Role-based multi-agent framework

- Task delegation system

- Lightweight execution

- Easy configuration

- Human collaboration

Pros

- Seamless construction of multi-agent systems in DeFi

- Distinct task division

- Rapid testing

- Automation of DAOs

- Open-source compatible

Cons

- Limited complex planning

- Lack of a security focus

- Drives the need for custom DeFi connectors

- High-frequency strategies have less scalability

- Ecosystem is in the early stages

5. AutoGen Agents

AutoGen Agents primarily center around the automation of assembling and orchestrating the different AI agents for the varied scenarios in the world of DeFi. They have the ability to construct agents for trading, market surveillance, and loss mitigation with minimal hand-coded instructions.

Overall, AutoGen Agents are recognized as some of the top agents in the execution of DeFi strategies, as they also provide scalable automation and faster deployment. A major advantage for users is being able to have built-in templates combined with workflows that shift to adapt to current market conditions.

Due to their design, the execution of several strategies simultaneously is possible, which improves the speed of decision making and the overall active management of the DeFi strategies to increase the total DeFi returns .

AutoGen Agents Features, Pros & Cons

Features

- Conversations of autonomous multi-agents

- Supported by Microsoft

- Tool calling

- Self-optimizing agent loops

- High adaptability

Pros

- Remarkable autonomous reasoning

- Excellent for adaptive strategies in DeFi

- Research and execution of agents

- Large-scale multi-agent systems

- Versatile integration of tools

Cons

- Debugging is complicated

- Unstable behavior is a possibility

- Needs robust guardrails

- Not specific to DeFi

- Increased need for computing power

6. Agno Agents

Agno Agents focus on secure and adaptive AI-driven decision-making for data-heavy DeFi processes. They track and assess market signals, on-chain activities, and smart contract developments while adjusting to changes in the landscape. Mid-paragraph, Agno Agents are praised as best AI agents for DeFi strategy execution since they integrate security with performance.

Their adaptive algorithms lessen the risk of the turbulent market and unpredictable behavior of smart contracts. For traders automating advanced strategies, Agno Agents are invaluable: cross-chain arbitrage, liquidity provisioning, portfolio rebalancing, and strategy execution within the parameters of protocols.

Agno Agents Features, Pros & Cons

Features

- Accelerated execution

- Lightweight framework for AI agents

- Modularity

- Minimal Overhead

- API centric design

Pros

- Real-time monitoring

- Tailored alerts

- Security-focused

- Integrated with many chains

- Smart Contract Exploit Avoidance

- Decentralized Structure

Cons

- Non-trading focused

- AI limitations

- Integrated with hardly any def decentralized/AI

- Reactive alerts

7. Forta AI Agents

Forta AI Agents are security-oriented agents that track blockchain networks and DeFi protocols in real time. They notice deviations, potential exploits, and transaction risks to mitigate loss. Mid-paragraph,

Forta AI Agents are among the best AI agents for DeFi strategy execution as they offer efficient shielding for automated strategies. Once Forta is embedded, traders can fearlessly implement strategies, as the voids will be flagged in real time.

These agents merge threat detection with actionable insights to ensure that automated trading or liquidity operations done to evade pricey errors are done in alignment with the open protocols and blockchain security standards.

Forta AI Agents Features, Pros & Cons

Features

- Detection of on-chain threats

- Monitoring in real time

- Detection of DeFi exploits

- Decentralized architecture

- Alerts powered by AI

Pros

- Superb monitoring of DeFi security

- Prevention of exploits and attacks

- Used by many protocols

- Detection in real time

- Very DeFi-native

Cons

- Not focused on execution

- No automation of trading

- Some integration is needed

- Alerts only, no actions

- Limited strategy reasoning

8. Gauntlet AI Agents

Gauntlet AI Agents are risk management experts and use simulations to refine DeFi strategies. They model risk, liquidity, and protocol behavior to predict and improve outcomes prior to live execution.

Mid-paragraph, Gauntlet AI Agents are generally acknowledged as the best AI agents for DeFi strategy execution because of the heightened certainty they create and the performance enhancements they provide. Stress testing and predictive simulations allow traders to make informed position adjustments, risk exposure optimization, and return maximization.

These agents provide significant value to high-end protocols, liquidity providers, and advanced DeFi participants who value high levels of precision and automation for data-driven decision-making.

Gauntlet AI Agents Features, Pros & Cons

Features

- Modeling and simulation of risk

- Optimization of protocol parameters

- Stress-testing framework

- Analytics of institutional quality

- Support for Governance

Pros

- Best in the area of DeFi risk management

- Real data driven strategy adjustments

- Trust by the best protocols

- Decreases the risk of liquidation

- Very trustworthy

Cons

- No autonomous execution

- Pricing for enterprise only

- Limited access for retail users

- Outputs are complex

- Expert level interpretation required

9. CertiK Skynet Agents

CertiK Skynet Agents operate within the blockchain ecosystem and provide automated auditing, vulnerability analysis, and transaction monitoring for DeFi protocols. Smart contracts and their respective transactions are guaranteed to be executed safely.

Mid-paragraph, CertiK Skynet Agents are recognized among the best AI agents for DeFi strategy execution due to the added value of combining security and automation. These agents defend automated trade execution, yield farming, and liquidity provision, as well as management activities, from unintended hacks and exploitation.

With the use of omnichannel real-time alerts and automated preventive measures, DeFi users achieve their strategies with minimized operational risk and improved confidence in the protocols.

CertiK Skynet Agents Features, Pros & Cons

Features

- Smart contracts monitoring

- AI-based alerts for risk

- Analysis of on-chain actions

- Scoring for security

- Tools for incident response

Pros

- Thick protocol-level reliability

- Reliable audit provider

- Real-time threat notifications

- Minimizes systemic risk

- Focused on DeFi

Cons

- No execution of trade

- System only for alerts

- Not strategy-driven

- More for protocols than for traders

- Overhead from integrations

10. PeckShield AI Agents

PeckShield AI Agents perform risk assessment, threat detection, and blockchain analytics to protect DeFi strategies. They constantly track smart contracts and transactions, as well as interactions with various protocols.

PeckShield AI Agents are considered some of the leading AI agents for DeFi strategy execution as they reduce the likelihood of losses due to exploits or other market irregularities.

Automated strategies are shielded by their AI compliance to protocols, and monitoring and reporting system. Traders receive notifications, actionable insights, and real-time reporting, which allows them to adjust their positions or stop what they’re doing before risks get out of hand.

PeckShield AI Agents Features, Pros & Cons

Features

- Detection AI of Exploits

- Risk-analysis of smart contracts

- Intelligence for DeFi threats

- Real-time alerts

- Forensics of incidents

Pros

- Exploit detection of high accuracy

- Extensive expertise in DeFi security

- Protection of funds and protocols

- Excellent background in research

- Early detection of threats

Cons

- No automated execution

- Only security oriented

- Targeted toward enterprise

- Less customization

- Not focused on traders

Conclusion

Using AI agents for strategy execution has become crucial for effectiveness, accuracy, and risk management in the quickly changing field of DeFi. From automated trading and multi-agent coordination to real-time security monitoring and risk modeling, platforms such as LangGraph, LlamaIndex, Semantic Kernel, CrewAI, AutoGen, Agno, Forta, Gauntlet, CertiK Skynet, and PeckShield offer a variety of features.

These platforms, which enable traders to automate intricate tactics, react quickly to market developments, and protect assets, are commonly regarded as the best AI agents for DeFi strategy execution. By utilizing these AI agents, decentralized finance may be fully realized, performance can be greatly improved, and errors can be decreased.

FAQ

AI agents for DeFi strategy execution are intelligent software systems that automate trading, portfolio management, and risk assessment in decentralized finance. They analyze market data, execute trades, monitor protocols, and optimize strategies without constant human intervention. These agents help traders save time, reduce errors, and respond quickly to changing market conditions.

DeFi markets are highly volatile and operate 24/7, making manual strategy execution inefficient and risky. AI agents enable automated decision-making, real-time monitoring, and predictive analysis. Mid-paragraph, the best AI agents for DeFi strategy execution enhance efficiency, security, and profitability, helping traders execute complex strategies with precision and speed.

Top AI agents include LangGraph Agents, LlamaIndex Agents, Semantic Kernel Agents, CrewAI Agents, AutoGen Agents, Agno Agents, Forta AI Agents, Gauntlet AI Agents, CertiK Skynet Agents, and PeckShield AI Agents. Each offers unique strengths such as modular workflows, real-time analytics, security monitoring, simulation, and risk mitigation for automated DeFi strategies.

AI agents analyze vast datasets, detect trends, simulate outcomes, and automatically execute trades or protocol interactions. They minimize human error, optimize timing, and help manage risk exposure. Using these tools allows traders to implement complex strategies like arbitrage, yield farming, and liquidity provision with greater accuracy and efficiency.